Document

... But a government that relies too much on seigniorage to raise real resources risks “killing the goose that lays the golden egg.” • High money growth eventually gets built into expected inflation; and so the public reduces money demand – whether because πe is built into i (Fisher effect) – or becaus ...

... But a government that relies too much on seigniorage to raise real resources risks “killing the goose that lays the golden egg.” • High money growth eventually gets built into expected inflation; and so the public reduces money demand – whether because πe is built into i (Fisher effect) – or becaus ...

How do resource-driven economies cope with the oil price

... of an oil-exporting country and its capacity to balance its external accounts if the share of its non-oil and non-resource sectors (whose competitiveness would benefit from the depreciation) in GDP is very low. Moreover, such exporting or import-competing industries may be reliant on imported inputs ...

... of an oil-exporting country and its capacity to balance its external accounts if the share of its non-oil and non-resource sectors (whose competitiveness would benefit from the depreciation) in GDP is very low. Moreover, such exporting or import-competing industries may be reliant on imported inputs ...

Exchange Rates

... rate, think first about a simple case in which all countries produce the same goods, which are freely traded • If there were no transportation costs, the real exchange rate would have to be e = 1, or else everyone would buy goods where they were cheaper ...

... rate, think first about a simple case in which all countries produce the same goods, which are freely traded • If there were no transportation costs, the real exchange rate would have to be e = 1, or else everyone would buy goods where they were cheaper ...

Cornell Notes: Dividing Decimals

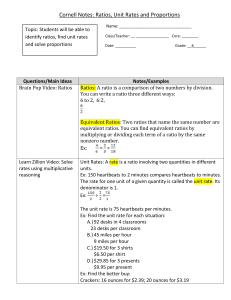

... Ratios: A ratio is a comparison of two numbers by division. You can write a ratio three different ways: 6 to 2, 6:2, ...

... Ratios: A ratio is a comparison of two numbers by division. You can write a ratio three different ways: 6 to 2, 6:2, ...

ECONOMIC POLICY AND THE REAL EXCHANGE RATE: RUSSIA

... stipulated nominal rate. But they cannot fix the real exchange rate in a similar fashion. A oneline explanation of this “policy impotence” is that one cannot in the final analysis determine a real variable through the use of purely nominal policy instruments. To have impact on the equilibrium real e ...

... stipulated nominal rate. But they cannot fix the real exchange rate in a similar fashion. A oneline explanation of this “policy impotence” is that one cannot in the final analysis determine a real variable through the use of purely nominal policy instruments. To have impact on the equilibrium real e ...

Problem 1. Use the money market to explain the interest

... Answer 12: (a). Crowding out happens when government purchases increases the interest rate. The Federal Reserve could increase the money supply by buying bonds to bring the interest rate back down. Answer 13: (d). (Stolen from the textbook.) The primary argument against active monetary and fiscal po ...

... Answer 12: (a). Crowding out happens when government purchases increases the interest rate. The Federal Reserve could increase the money supply by buying bonds to bring the interest rate back down. Answer 13: (d). (Stolen from the textbook.) The primary argument against active monetary and fiscal po ...

Chapter 12

... excess supply of money. Individuals will use up their excess money holdings by buying bonds, driving bond prices up and the interest rate down toward equilibrium. At a nominal interest rate of 4%, the quantity of money demanded is greater than the quantity of money supplied, i.e., there is an excess ...

... excess supply of money. Individuals will use up their excess money holdings by buying bonds, driving bond prices up and the interest rate down toward equilibrium. At a nominal interest rate of 4%, the quantity of money demanded is greater than the quantity of money supplied, i.e., there is an excess ...

ERDEM BAŞÇI, CENTRAL BANKER OF THE YEAR

... experimental measures designed to curb hot money while maintaining a free-floating currency regime.” The article went on to say that the CBRT delivered a series of interest rate cuts to reduce the appreciation of the Turkish lira, as well as setting a corridor around its policy rate which meant that ...

... experimental measures designed to curb hot money while maintaining a free-floating currency regime.” The article went on to say that the CBRT delivered a series of interest rate cuts to reduce the appreciation of the Turkish lira, as well as setting a corridor around its policy rate which meant that ...

Monetary Policy

... •The Fed can’t control unemployment or inflation rates directly •The Fed uses monetary policy targets, that it can control, that in turn, affect variables closely related to its policy goals—real GDP, employment, and the price level. •These monetary policy targets include the growth rate of the mone ...

... •The Fed can’t control unemployment or inflation rates directly •The Fed uses monetary policy targets, that it can control, that in turn, affect variables closely related to its policy goals—real GDP, employment, and the price level. •These monetary policy targets include the growth rate of the mone ...

NBER WORKING PAPER SERIES HONG KONG’S CURRENCY BOARD AND CHANGING MONETARY

... little or no uncertainty ...

... little or no uncertainty ...

Factor income shares and the current account of the New... balance of payments

... profits are retained in New Zealand and reinvested into productive enterprises here, the transfer of ownership of a large part of the economy’s capital stock into foreign hands should make little difference to economic performance (except to the extent that there are wealth effects flowing from the ...

... profits are retained in New Zealand and reinvested into productive enterprises here, the transfer of ownership of a large part of the economy’s capital stock into foreign hands should make little difference to economic performance (except to the extent that there are wealth effects flowing from the ...

Triangular Relation Foreign Direct Investments - Exchange Rate – Capital Market for the CEE Countries:

... the cointegration tests which revealed important findings. The analysis focused on foreign direct investments both in the position of determinant factor for the dynamic of the other macroeconomic indicators, as well as in the position of a receptor of the effects exerted by the other variables. The ...

... the cointegration tests which revealed important findings. The analysis focused on foreign direct investments both in the position of determinant factor for the dynamic of the other macroeconomic indicators, as well as in the position of a receptor of the effects exerted by the other variables. The ...

What are Interest Rates?

... Real interest rate compensates for delayed consumption. The higher the desire for current consumption, the higher the real interest rate. The real interest rate is the long-term base of nominal interest rate. It is determined by real factors in the economy such as preferences for consumption over ti ...

... Real interest rate compensates for delayed consumption. The higher the desire for current consumption, the higher the real interest rate. The real interest rate is the long-term base of nominal interest rate. It is determined by real factors in the economy such as preferences for consumption over ti ...

NBER WORKING PAPER SERIES MONETARY POLICY: DOMESTIC TARGETS AND INTERNATIONAL CONSTRAINTS

... involving specific pairs of assets. In evaluating these transactions it might be useful to explore the broader spectrum of possible policies. Figure 1 summarizes the various patrerns of domestic and foreign monetary policies and foreign ...

... involving specific pairs of assets. In evaluating these transactions it might be useful to explore the broader spectrum of possible policies. Figure 1 summarizes the various patrerns of domestic and foreign monetary policies and foreign ...

ON THE IMF-DIRECTED DISINFLATION PROGRAM IN TURKEY:

... expanding fiscal deficits; marginalization of the industrial relations; and the severe erosion of moral values with increased public corruption. Following a series of ill-founded and poorly focused set of stabilization attempts through the decade, the government initiated a comprehensive disinflati ...

... expanding fiscal deficits; marginalization of the industrial relations; and the severe erosion of moral values with increased public corruption. Following a series of ill-founded and poorly focused set of stabilization attempts through the decade, the government initiated a comprehensive disinflati ...

Chapter 1: An Introduction to Corporate Finance

... • A total return swap exchanges an interest rate return for the total return on an equity index plus or minus a spread. For example, first an investor could enter into an interest rate swap to convert fixed rate bond payments into payments that vary with a float rate, such as LIBOR. Then, the invest ...

... • A total return swap exchanges an interest rate return for the total return on an equity index plus or minus a spread. For example, first an investor could enter into an interest rate swap to convert fixed rate bond payments into payments that vary with a float rate, such as LIBOR. Then, the invest ...

Contemporary Logistics Currency Internationalization and

... When a country’s economy developing into a certain extent, and its external trade scale being large enough, to promote its sovereign currency internationalizing is inevitable for an open economy. With the increase of currency internationalization degree and influence, it can bring extra income for i ...

... When a country’s economy developing into a certain extent, and its external trade scale being large enough, to promote its sovereign currency internationalizing is inevitable for an open economy. With the increase of currency internationalization degree and influence, it can bring extra income for i ...

NBER WORKING PAPER SERIES REAL-FINANCIAL LINKAGES AMONG OPEN ECONOMIES Sven W. Arndt

... This paper integrates the contributions to a forthcoming volume of the same title by the authors. The volume analyzes and empirically examines linkages between the real and financial variables that themselves link open economies-- "linkage" thus has a double meaning. Two types of linkages are discus ...

... This paper integrates the contributions to a forthcoming volume of the same title by the authors. The volume analyzes and empirically examines linkages between the real and financial variables that themselves link open economies-- "linkage" thus has a double meaning. Two types of linkages are discus ...

Q3 GDP_IMF_PPP https://thinkingquantitatively.wordpress.com/ 1

... b. The graphic above says the “output fell because the dollar rose”. How does the graphic below show the dollar “rising”? ...

... b. The graphic above says the “output fell because the dollar rose”. How does the graphic below show the dollar “rising”? ...

The Yen and Japan`s Economy, 1985-2007

... nontradables causes higher productivity growth in that sector – the traditional supply effect of relatively low NT growth seems to be trumped. • Measured nontradables productivity growth in Japan has generally been lower after the early 1990s than before. Related to post-1995 depreciation of yen (wh ...

... nontradables causes higher productivity growth in that sector – the traditional supply effect of relatively low NT growth seems to be trumped. • Measured nontradables productivity growth in Japan has generally been lower after the early 1990s than before. Related to post-1995 depreciation of yen (wh ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.