PDF

... authority led to increasing by NBRM the reserve requirement obligations ratio. The National Bank of Republic of Macedonia increased the rate from 10 to 13% for all the credits denominated in foreign currency. Therefore, implementing this direct monetary instrument provided necessary tightening of mo ...

... authority led to increasing by NBRM the reserve requirement obligations ratio. The National Bank of Republic of Macedonia increased the rate from 10 to 13% for all the credits denominated in foreign currency. Therefore, implementing this direct monetary instrument provided necessary tightening of mo ...

M. Chatib Basri Institute for Economic and Social Research Faculty

... banking sector: closed 16 banks Focus on strutural reform Exchange rate regime: fixed ...

... banking sector: closed 16 banks Focus on strutural reform Exchange rate regime: fixed ...

Two-Country Stock-Flow-Consistent Macroeconomics

... central bank of our model is “sterilizing” foreign reserves, by selling domestic Treasury bills on the open market. In a way, it is true. But this is not the result of any intentional policy, where central bankers are actively intervening in financial markets. The UK (Chinese) central bank, just lik ...

... central bank of our model is “sterilizing” foreign reserves, by selling domestic Treasury bills on the open market. In a way, it is true. But this is not the result of any intentional policy, where central bankers are actively intervening in financial markets. The UK (Chinese) central bank, just lik ...

Asian Currency Crisis 1997-1998

... Hardest-hit countries were those running deficits; depreciation against dollar of up to 151% (Indonesia)! Solvency: Deficits could persist so long as trade surpluses could be generated at some point in the future GDP growth rates averaged 7 to 10% annually ...

... Hardest-hit countries were those running deficits; depreciation against dollar of up to 151% (Indonesia)! Solvency: Deficits could persist so long as trade surpluses could be generated at some point in the future GDP growth rates averaged 7 to 10% annually ...

Currency Boards

... around parity, but adjust the parity value regularly. That is, periodically devalue or revalue according to circumstances. In principle, the ceilings and floors may instill some monetary discipline. However, a major change in the BOP position due to an external or external shock may require ma ...

... around parity, but adjust the parity value regularly. That is, periodically devalue or revalue according to circumstances. In principle, the ceilings and floors may instill some monetary discipline. However, a major change in the BOP position due to an external or external shock may require ma ...

Macro2003 Free Response

... you identified in part (d) will affect each of the following. (i) International value of the dollar relative to other currencies ...

... you identified in part (d) will affect each of the following. (i) International value of the dollar relative to other currencies ...

Homework Quiz 7

... list 3 richest and 3 poorest economies in the world (per capita GDP), include numbers ...

... list 3 richest and 3 poorest economies in the world (per capita GDP), include numbers ...

Chapter 5.2 Read More Online

... their prices, we might observe a positive relationship between prices and sales, even though demand curves slope downward. The dollar-yen exchange rate qualifies as an “instrumental variable” because it shifts the U.S. supply curve of Japanese auto makers (since it alters the number of yen they rece ...

... their prices, we might observe a positive relationship between prices and sales, even though demand curves slope downward. The dollar-yen exchange rate qualifies as an “instrumental variable” because it shifts the U.S. supply curve of Japanese auto makers (since it alters the number of yen they rece ...

... ended on 2 February and a managed float was established. Under this arrangement, the colón will now float freely, but the central bank will intervene on the foreign-exchange market in the event of major exchange-rate fluctuations. The central bank is maintaining the foreign-exchange purchase program ...

the Purchasing Power Parity (PPP)Exchange Rate.

... exchange rate adjusts for the fact that prices are much lower in China than in the U.S. and equalizes the purchasing power of the currencies in the 2 countries. This makes comparisons of GDP using a PPP valuation meaningful. ...

... exchange rate adjusts for the fact that prices are much lower in China than in the U.S. and equalizes the purchasing power of the currencies in the 2 countries. This makes comparisons of GDP using a PPP valuation meaningful. ...

WELFARE ANALYSIS

... People will buy more items that require loans, like cars, houses, appliances, and furniture – durable goods ...

... People will buy more items that require loans, like cars, houses, appliances, and furniture – durable goods ...

South East Asia before the Crisis

... South East Asia before the Crisis The countries which witnessed the crisis had shown a spectacular economic growth for the last two decades before the currency crisis. These countries namely Korea, Singapore, the Hong Kong Special Administrative Region (SAR), Taiwan, Thailand, Indonesia, Malaysia an ...

... South East Asia before the Crisis The countries which witnessed the crisis had shown a spectacular economic growth for the last two decades before the currency crisis. These countries namely Korea, Singapore, the Hong Kong Special Administrative Region (SAR), Taiwan, Thailand, Indonesia, Malaysia an ...

The G-20 Calls a Truce in the Currency War

... flowing into emerging economies could lead to “exchange-rate overshooting, credit booms, asset-price bubbles and financial instability.” And emerging economies may have to adopt capital controls to help moderate the vast flows. To manage the two-speed recovery and promote “strong, sustainable and ba ...

... flowing into emerging economies could lead to “exchange-rate overshooting, credit booms, asset-price bubbles and financial instability.” And emerging economies may have to adopt capital controls to help moderate the vast flows. To manage the two-speed recovery and promote “strong, sustainable and ba ...

Document

... 4. Jack and Jill both obey the two-period model of consumption. Jack earns $200 in the first period and $200 in the second period. Jill earns nothing in the first period and $420 in the second period. Both of them can borrow or lend at the interest rate. r? a. You observe both Jack and Jill consumin ...

... 4. Jack and Jill both obey the two-period model of consumption. Jack earns $200 in the first period and $200 in the second period. Jill earns nothing in the first period and $420 in the second period. Both of them can borrow or lend at the interest rate. r? a. You observe both Jack and Jill consumin ...

Problem Set 1 Econometria - MFEE - FGV Cecilia

... South region, calculate the mean and sample standard deviation. b Use the appropriate test to determine whether or not average hourly earnings in the Northeast region the same as in the South region. c Find the 1%, 5%, and 10% confidence interval for the differences between the two population means. ...

... South region, calculate the mean and sample standard deviation. b Use the appropriate test to determine whether or not average hourly earnings in the Northeast region the same as in the South region. c Find the 1%, 5%, and 10% confidence interval for the differences between the two population means. ...

Guatemala_en.pdf

... GDP). Those inflows went some way towards financing the country’s large trade deficit (about 17% of GDP). The current-account deficit (5% of GDP) was more than covered by foreign direct investment and other capital inflows. The yearly inflation figure to November was 9.1%, mostly owing to supply fac ...

... GDP). Those inflows went some way towards financing the country’s large trade deficit (about 17% of GDP). The current-account deficit (5% of GDP) was more than covered by foreign direct investment and other capital inflows. The yearly inflation figure to November was 9.1%, mostly owing to supply fac ...

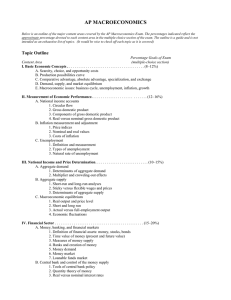

APMACROECONOMICSTopicOutline

... Below is an outline of the major content areas covered by the AP Macroeconomics Exam. The percentages indicated reflect the approximate percentage devoted to each content area in the multiple-choice section of the exam. The outline is a guide and is not intended as an exhaustive list of topics. (It ...

... Below is an outline of the major content areas covered by the AP Macroeconomics Exam. The percentages indicated reflect the approximate percentage devoted to each content area in the multiple-choice section of the exam. The outline is a guide and is not intended as an exhaustive list of topics. (It ...

Midterm answers

... and the long-term financial account has debits exceeding credits by $30, then the country’s balance on current account is (a) $-120. (b) $-90. (c) $-75. (d) $-60. 19. The multiplier (∆Y /∆I) is smaller in a model with imports and exports because ...

... and the long-term financial account has debits exceeding credits by $30, then the country’s balance on current account is (a) $-120. (b) $-90. (c) $-75. (d) $-60. 19. The multiplier (∆Y /∆I) is smaller in a model with imports and exports because ...

Why Study Money, Banking, and Financial Markets?

... bond, stock and foreign exchange markets work • To examine how financial institutions such as banks and insurance companies work • To examine the role of money in the economy ...

... bond, stock and foreign exchange markets work • To examine how financial institutions such as banks and insurance companies work • To examine the role of money in the economy ...

Single currency - IS MU

... world war. Many countries issued exceed amount of banknotes. Change for gold has been stopped by laws or in practice. • Several European currencies collapsed in ...

... world war. Many countries issued exceed amount of banknotes. Change for gold has been stopped by laws or in practice. • Several European currencies collapsed in ...

International Adjustment and Interdependence

... Devaluation moves the NX=0 curve up and to the right This helps reduce the current-account deficit Lower prices of home-country exports AD shifts up and to the right Devaluation also lowers unemployment Note: inability to devalue is one of the main costs of giving up independent currency and parti ...

... Devaluation moves the NX=0 curve up and to the right This helps reduce the current-account deficit Lower prices of home-country exports AD shifts up and to the right Devaluation also lowers unemployment Note: inability to devalue is one of the main costs of giving up independent currency and parti ...

Week 5 Lecture Notes

... managed floating rates • Governments intervene in the market by buying and selling their own currency (and those of other countries) • Maintaining a fixed exchange rate when there is a deficit on the current account of the balance of payments can rapidly run down government reserves ...

... managed floating rates • Governments intervene in the market by buying and selling their own currency (and those of other countries) • Maintaining a fixed exchange rate when there is a deficit on the current account of the balance of payments can rapidly run down government reserves ...

THE CONTINENTAL ECONOMICS INSTITUTE The world economy

... that are scheduled in Europe in 2017, particularly in Germany and France. Concerns are on the rise that the European Union will not be sufficiently resilient to wither the storms while at the same time a deep split divides the United States. Protectionism The greatest concern for the world economy r ...

... that are scheduled in Europe in 2017, particularly in Germany and France. Concerns are on the rise that the European Union will not be sufficiently resilient to wither the storms while at the same time a deep split divides the United States. Protectionism The greatest concern for the world economy r ...