Development Economics – Econ 682

... Monetary policy affects the supply of money & the rate of interest. Fiscal policy includes the rate of taxation & level of government spending. Incomes policy consists of anti-inflation measures that depend on income & price limitations, such as moderated wage increases. ...

... Monetary policy affects the supply of money & the rate of interest. Fiscal policy includes the rate of taxation & level of government spending. Incomes policy consists of anti-inflation measures that depend on income & price limitations, such as moderated wage increases. ...

Trinidad and Tobago Trinidad and Tobago`s economy is projected to

... abolished. The budgeted deficit will be financed through borrowing, about three quarters of which Trinidad and Tobago: GDP and Inflation, 2014-2016 will come from domestic sources. ...

... abolished. The budgeted deficit will be financed through borrowing, about three quarters of which Trinidad and Tobago: GDP and Inflation, 2014-2016 will come from domestic sources. ...

Slide 1

... These perceptions about the future affect all types of economic activities. How do these expectations affect macroeconomic behaviour? It is obvious from what we see in the markets. Prosperity follows from good expectations. Recession arises with dim expectations. Confidence of consumers and producer ...

... These perceptions about the future affect all types of economic activities. How do these expectations affect macroeconomic behaviour? It is obvious from what we see in the markets. Prosperity follows from good expectations. Recession arises with dim expectations. Confidence of consumers and producer ...

12-Real

... • All prices and contracts were slowly converted to multiples of URVs • Once all contracts were converted to URV the government would start issuing a new currency: the real • The goal of the URV was to index completely the Brazilian economy to the URV: keep relative prices stable – Worked as a Nomin ...

... • All prices and contracts were slowly converted to multiples of URVs • Once all contracts were converted to URV the government would start issuing a new currency: the real • The goal of the URV was to index completely the Brazilian economy to the URV: keep relative prices stable – Worked as a Nomin ...

FinalExamReviewGuide

... Open Economy, Closed Economy, Current Account, Capital Account, Official Reserves, Net Capital Outflow, Exchange Rates, Purchasing Power Parity, Trade Deficit, Trade Surplus, appreciation, depreciation, NX = NCO ...

... Open Economy, Closed Economy, Current Account, Capital Account, Official Reserves, Net Capital Outflow, Exchange Rates, Purchasing Power Parity, Trade Deficit, Trade Surplus, appreciation, depreciation, NX = NCO ...

Document

... an increase in B will lead to higher interest rates and an increase in M will lead to lower interest rates in the short run. b. In an open economy with flexible exchange rates, and no government spending or taxes (G=T=0), the level of consumption expenditure is given by C = 100 + .75 Y while inves ...

... an increase in B will lead to higher interest rates and an increase in M will lead to lower interest rates in the short run. b. In an open economy with flexible exchange rates, and no government spending or taxes (G=T=0), the level of consumption expenditure is given by C = 100 + .75 Y while inves ...

Interdependence, Exchange Rate Flexibility, And National Economies

... and a gain in international reserves. The latter reserve inflow will more than offset any tendency for reserves to decline due to the trade account deficit. That is because, if imports are a reasonably stable proportion of income, the trade deficit would be limited by the size of the rise in income. ...

... and a gain in international reserves. The latter reserve inflow will more than offset any tendency for reserves to decline due to the trade account deficit. That is because, if imports are a reasonably stable proportion of income, the trade deficit would be limited by the size of the rise in income. ...

ISMP_2012_L1_post

... μ = simple Keynesian multiplier = 1/[(1 - b(1- τ)] which we graph as the IS curve. Note that changes in fiscal policy, investment “animal spirits,” consumption wealth effect SHIFT IS CURVE ...

... μ = simple Keynesian multiplier = 1/[(1 - b(1- τ)] which we graph as the IS curve. Note that changes in fiscal policy, investment “animal spirits,” consumption wealth effect SHIFT IS CURVE ...

Finance and the Real Economy: Session Two

... Net new flows into emerging-economy mutual funds rose in 2009 (though cross-border bank lending had not recovered) Inflationary pressures are more likely to build up in emerging economies where, for example, high real estate prices in certain areas have not undergone any correction ...

... Net new flows into emerging-economy mutual funds rose in 2009 (though cross-border bank lending had not recovered) Inflationary pressures are more likely to build up in emerging economies where, for example, high real estate prices in certain areas have not undergone any correction ...

PDF Download

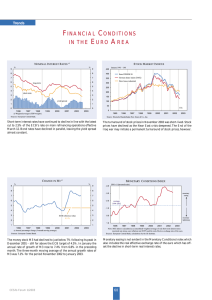

... The turnaround of stock prices in November 2002 was short-lived. Stock prices have declined as the Near East crisis deepened. The End of the Iraq war may initiate a permanent turnaround of stock prices, however. ...

... The turnaround of stock prices in November 2002 was short-lived. Stock prices have declined as the Near East crisis deepened. The End of the Iraq war may initiate a permanent turnaround of stock prices, however. ...

... compared with 3.1%). Inflation to December 2014 was 5.8%, within the target range —of 5.5% to 7.5%— set by the Central Bank of Honduras and well below initial projections under the monetary programme. This performance was attributable chiefly to the drop in the oil price late in the year, which offs ...

Macroeconomics

... Attendance: Three-strike policy - absence from more than 25 percent of the classes for each semester results in automatic failure. If you arrive late to the class, it is your responsibility to let me know at the end of class so that I can check off your name. Participation: Your quality participatio ...

... Attendance: Three-strike policy - absence from more than 25 percent of the classes for each semester results in automatic failure. If you arrive late to the class, it is your responsibility to let me know at the end of class so that I can check off your name. Participation: Your quality participatio ...

Macroeconomics 6

... This is the sixth and final part of the required macroeconomic sequence at NES. The goal of the sixth module is to utilize the methodology and knowledge obtained in the previous five modules and consider questions relevant for policy makers. Specifically, the course will cover fiscal and monetary po ...

... This is the sixth and final part of the required macroeconomic sequence at NES. The goal of the sixth module is to utilize the methodology and knowledge obtained in the previous five modules and consider questions relevant for policy makers. Specifically, the course will cover fiscal and monetary po ...

The Asian Financial Crisis 1997-1998 and Malaysian Response: An

... the non-performing loans began the era of banking crisis as banks’ balance sheet had been deteriorated. In international trade, Thailand had become less competitive in the existence of an emerging trader like China together with a constantly increasing trend of dollar currency (i.e. an appreciation ...

... the non-performing loans began the era of banking crisis as banks’ balance sheet had been deteriorated. In international trade, Thailand had become less competitive in the existence of an emerging trader like China together with a constantly increasing trend of dollar currency (i.e. an appreciation ...

How Germany Benefits from the Euro in Economic Terms

... rency, interest rates would be lower than those in the eurozone. Falling interest rates reduce manufacturing costs, and act as an incentive when it comes to making investments. Thus a separate currency can have an impact in a number of different ways. Of the four listed above, the first three can ha ...

... rency, interest rates would be lower than those in the eurozone. Falling interest rates reduce manufacturing costs, and act as an incentive when it comes to making investments. Thus a separate currency can have an impact in a number of different ways. Of the four listed above, the first three can ha ...

kennedy

... 4. Forecasting i rate relies mainly on forecasting inflation and central bank reactions 5. Reduce i rate by reducing money growth 6. Beware using nominal i rate as a policy target 7. Bad economic news increases bond prices 8. International roles to be discussed later. ...

... 4. Forecasting i rate relies mainly on forecasting inflation and central bank reactions 5. Reduce i rate by reducing money growth 6. Beware using nominal i rate as a policy target 7. Bad economic news increases bond prices 8. International roles to be discussed later. ...

The Economics of Monetary Unions

... them. This policy switch is consistent with the widespread reinstatement of the basic Fleming-Mundell theorem that fixed exchange rates are incompatible with national monetary sovereignty in a world of high international capital mobility. During all of these developments a separate strain of thinkin ...

... them. This policy switch is consistent with the widespread reinstatement of the basic Fleming-Mundell theorem that fixed exchange rates are incompatible with national monetary sovereignty in a world of high international capital mobility. During all of these developments a separate strain of thinkin ...

PDF

... and how, with the current exchange rate and trade regimes, the free international movement of short-term capital undermines the ability of countries to induce economic development by robbing them of even the minimal economic instruments they retain. II-1. Governments’ Role in Initiating Development ...

... and how, with the current exchange rate and trade regimes, the free international movement of short-term capital undermines the ability of countries to induce economic development by robbing them of even the minimal economic instruments they retain. II-1. Governments’ Role in Initiating Development ...

Some sample pages from the toolkit can be downloaded here

... of “hot money” will cause an outward shift in demand for the currency and an appreciation of the exchange rate – helping to maintain the currency peg. 2. Direct intervention: The central may also go into the currency market and intervene directly by buying up their own currency (e.g. the Latvian ...

... of “hot money” will cause an outward shift in demand for the currency and an appreciation of the exchange rate – helping to maintain the currency peg. 2. Direct intervention: The central may also go into the currency market and intervene directly by buying up their own currency (e.g. the Latvian ...

2.2.

... Can occur quickly or slowly Consumer confidence increases Returns the country to the prosperity phase. ...

... Can occur quickly or slowly Consumer confidence increases Returns the country to the prosperity phase. ...

Lecture 19: From Stability to Inflation: 1950-1980

... Collapse of Bretton Woods and Restraint on Inflation • If all foreign central banks tried to convert their holdings at once, the United States would not be able to honor its obligations to convert $ into gold at $35 an ounce. • Instead: a slow run on the dollar. But U.S. does not respond by tighten ...

... Collapse of Bretton Woods and Restraint on Inflation • If all foreign central banks tried to convert their holdings at once, the United States would not be able to honor its obligations to convert $ into gold at $35 an ounce. • Instead: a slow run on the dollar. But U.S. does not respond by tighten ...

ECO 212 Principles of Macroeconomics List of Formulas

... BLS assumes the composition of the basket remains unchanged over time. 2. The inflation rate is the percentage change in price index from one year to the next. It is normally calculated using CPI. For example, the inflation in year t can be computed as: CPI Inflationt = ...

... BLS assumes the composition of the basket remains unchanged over time. 2. The inflation rate is the percentage change in price index from one year to the next. It is normally calculated using CPI. For example, the inflation in year t can be computed as: CPI Inflationt = ...

By dint of railing at fools, we risk becoming fools

... Whilst information contained in Roger Nightingale’s articles is based on sources believed to be reliable, neither the accuracy nor the completeness can be guaranteed. Any judgments articulated are Roger Nightingale’s as at the date appearing on the material. They are subject to change without notice ...

... Whilst information contained in Roger Nightingale’s articles is based on sources believed to be reliable, neither the accuracy nor the completeness can be guaranteed. Any judgments articulated are Roger Nightingale’s as at the date appearing on the material. They are subject to change without notice ...