Ch21 - 山东大学课程中心

... Chapter 21 Monetary and Fiscal Policy in the ISLM Model 1. If taxes and government spending rise by equal amounts. what will happen to the position of the IS curve? Explain this outcome with a Keynesian cross diagram. 2. What happened to the IS curve during the Great Depression when investment spend ...

... Chapter 21 Monetary and Fiscal Policy in the ISLM Model 1. If taxes and government spending rise by equal amounts. what will happen to the position of the IS curve? Explain this outcome with a Keynesian cross diagram. 2. What happened to the IS curve during the Great Depression when investment spend ...

ExamView Pro - sgch20

... a. the money supply of a given increase in government purchases. b. tax revenues of a given increase in government purchases. c. investment of a given increase in interest rates. d. aggregate demand of a given increase in government purchases. 6. The government purchases multiplier is defined as a. ...

... a. the money supply of a given increase in government purchases. b. tax revenues of a given increase in government purchases. c. investment of a given increase in interest rates. d. aggregate demand of a given increase in government purchases. 6. The government purchases multiplier is defined as a. ...

ECON 111-01A Dr. John F. Olson Introduction to Economics Spring

... deficit (-netX). What are the likely macroeconomic consequences or effects of these policies? Can these economic goals all be achieved? The tax cuts (T) and increased government spending (G) are likely to increase the budget deficit (T-G becomes more negative). Thus, one of two things (or a combinat ...

... deficit (-netX). What are the likely macroeconomic consequences or effects of these policies? Can these economic goals all be achieved? The tax cuts (T) and increased government spending (G) are likely to increase the budget deficit (T-G becomes more negative). Thus, one of two things (or a combinat ...

Lecture 1

... because of illness, vacation, bad weather, strike, or various personal reasons Who is “unemployed”? 1. Everyone who is at least 16 years old, not institutionalized or on active duty in the armed forces, and who did not have a job at all during the survey week but made specific active efforts to find ...

... because of illness, vacation, bad weather, strike, or various personal reasons Who is “unemployed”? 1. Everyone who is at least 16 years old, not institutionalized or on active duty in the armed forces, and who did not have a job at all during the survey week but made specific active efforts to find ...

Answer Key - uob.edu.bh

... 1. According to the Monetarists, the aggregate demand curve slopes downward because an increase in the price level means a(n) _____ in the real money supply and therefore a _____ level of real spending. a. increase; higher b. increase; lower c. decrease; higher * d. decrease; lower 2. Keynesians and ...

... 1. According to the Monetarists, the aggregate demand curve slopes downward because an increase in the price level means a(n) _____ in the real money supply and therefore a _____ level of real spending. a. increase; higher b. increase; lower c. decrease; higher * d. decrease; lower 2. Keynesians and ...

Quantitative Easing and the Fed: Ghost Story II

... critically on what is in banks and ready to be loaned out. Other measures include successful in keeping inflation under bank money but they depend more on what has been successfully loaned out, as control. Can it continue to make the right moves after the full implementain Figure 2. The measure of m ...

... critically on what is in banks and ready to be loaned out. Other measures include successful in keeping inflation under bank money but they depend more on what has been successfully loaned out, as control. Can it continue to make the right moves after the full implementain Figure 2. The measure of m ...

Ch12

... Any sign of inflation makes Fed increase interest rates. Higher real interest rates slow down the economy and lower future profits. Higher real interest rates lower the price of bonds and shift the demand away from stocks to bonds, lowering stock prices. If there is no inflation but there is an asse ...

... Any sign of inflation makes Fed increase interest rates. Higher real interest rates slow down the economy and lower future profits. Higher real interest rates lower the price of bonds and shift the demand away from stocks to bonds, lowering stock prices. If there is no inflation but there is an asse ...

Chapter 27 - Money and Banking

... M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. ...

... M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. ...

AP Macroeconomics Unit 4 Review Session Money Market

... b. The government reduces the government deficit. Demand for LF from the government has diminished. This will cause Dlf curve to shift to the left, resulting in a decrease in both interest rate and quantity. But because interest rate is now lower, the quantity of LF for private investment spending w ...

... b. The government reduces the government deficit. Demand for LF from the government has diminished. This will cause Dlf curve to shift to the left, resulting in a decrease in both interest rate and quantity. But because interest rate is now lower, the quantity of LF for private investment spending w ...

eurozone and the low inflation risk - SEA

... understood: the zero lower bound, the liquidity trap and the secular stagnation. The zero lower bound defines a macroeconomic problem that occurs when the short-term nominal interest rate is at or near zero, causing a liquidity trap and limiting the capacity that the central bank has to stimulate ec ...

... understood: the zero lower bound, the liquidity trap and the secular stagnation. The zero lower bound defines a macroeconomic problem that occurs when the short-term nominal interest rate is at or near zero, causing a liquidity trap and limiting the capacity that the central bank has to stimulate ec ...

ecn211-team-assessment-fall-2011-students

... 20. (LO18) Which of the following factors will NOT increase the production capacity of the economy (i.e., what will NOT shift the Long-run aggregate supply curve to the right)? a. Discovery of new natural resources b. improvement in technology c. change in exchange rate d. improvement in human capi ...

... 20. (LO18) Which of the following factors will NOT increase the production capacity of the economy (i.e., what will NOT shift the Long-run aggregate supply curve to the right)? a. Discovery of new natural resources b. improvement in technology c. change in exchange rate d. improvement in human capi ...

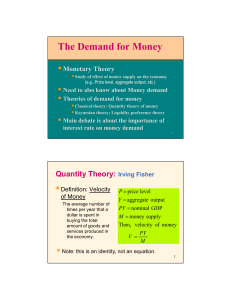

The Demand for Money - Spears School of Business

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

Monetary Accounts: Analysis and Forecasting

... supply Money demand, like the demand for goods and services, depends on Income, i.e., GNP Price, i.e., the opportunity cost of holding money Inflation rate in developing countries Interest rate in industrial countries ...

... supply Money demand, like the demand for goods and services, depends on Income, i.e., GNP Price, i.e., the opportunity cost of holding money Inflation rate in developing countries Interest rate in industrial countries ...

Course - TYWLS Economics

... Increased population will not increase GDP unless capital deepening also increases. (Think of countries like India who have a large population but a lower GDP per capita.) Increased human capital (skills and knowledge) will increase aggregate supply. Increased savings and investment will incre ...

... Increased population will not increase GDP unless capital deepening also increases. (Think of countries like India who have a large population but a lower GDP per capita.) Increased human capital (skills and knowledge) will increase aggregate supply. Increased savings and investment will incre ...

14.02 Solutions Quiz II Spring 03

... 8. The modified Phillips curve tell us that the only way to reduce inflation is through a) unemployment rates higher than the natural rate b) expansionary fiscal policy c) unemployment rates lower than the natural rate d) contractionary fiscal policy 9. Stock prices increase if: a) Money supply incr ...

... 8. The modified Phillips curve tell us that the only way to reduce inflation is through a) unemployment rates higher than the natural rate b) expansionary fiscal policy c) unemployment rates lower than the natural rate d) contractionary fiscal policy 9. Stock prices increase if: a) Money supply incr ...

C 1-5

... 1.b. Supply-side economics includes any policy measure that will increase potential GDP by shifting the long-run (vertical) AS-curve to the right. Supply-side economists put forth the view that a cut in income tax rates will increase the incentive to work, save, and invest. Some economists claimed t ...

... 1.b. Supply-side economics includes any policy measure that will increase potential GDP by shifting the long-run (vertical) AS-curve to the right. Supply-side economists put forth the view that a cut in income tax rates will increase the incentive to work, save, and invest. Some economists claimed t ...

Chapter 9 (6 spp) - N. Meltem Daysal

... from full-employment. • An example of a demand shock: exogenous decrease in velocity • If the money supply is held constant, then a decrease in V means people will be using their money in fewer transactions, causing a decrease in demand for goods and services: ...

... from full-employment. • An example of a demand shock: exogenous decrease in velocity • If the money supply is held constant, then a decrease in V means people will be using their money in fewer transactions, causing a decrease in demand for goods and services: ...

chapter 12 questions

... c. The higher interest rates associated with expansionary fiscal policy attract foreign investors. To buy U.S. financial assets, foreigners bid up the real exchange rate, which in turn causes net exports to fall. d. The cut in taxes associated with expansionary fiscal policy stimulates aggregate sup ...

... c. The higher interest rates associated with expansionary fiscal policy attract foreign investors. To buy U.S. financial assets, foreigners bid up the real exchange rate, which in turn causes net exports to fall. d. The cut in taxes associated with expansionary fiscal policy stimulates aggregate sup ...