DOES HIGH INFLATION AFFECT GROWTH IN THE LONG

... of our paper is to estimate the long-run response of output to a permanent inflation shock. In sum, the Blanchard and Quah decomposition allows one to assess the effects of temporary and permanent shocks on a variable in a bivariate VAR. They construct this decomposition by assuming that one type of ...

... of our paper is to estimate the long-run response of output to a permanent inflation shock. In sum, the Blanchard and Quah decomposition allows one to assess the effects of temporary and permanent shocks on a variable in a bivariate VAR. They construct this decomposition by assuming that one type of ...

Working Paper 142

... shift in growth rates for some of the variables, e.g. inflation, money growth and asset price inflation, observed in the "Great Inflation" and "Great Moderation" periods which would otherwise affect the identified shocks.5 Another problem we encountered during the analysis, especially for the specif ...

... shift in growth rates for some of the variables, e.g. inflation, money growth and asset price inflation, observed in the "Great Inflation" and "Great Moderation" periods which would otherwise affect the identified shocks.5 Another problem we encountered during the analysis, especially for the specif ...

Chap 23

... Devoting about a week of lecture time to the AS-AD model is worthwhile. At this point the students don’t yet have the background to appreciate all the details that go into the aggregate demand and aggregate supply curves. But they are able to grasp the basic purpose of the model. Your goal at this p ...

... Devoting about a week of lecture time to the AS-AD model is worthwhile. At this point the students don’t yet have the background to appreciate all the details that go into the aggregate demand and aggregate supply curves. But they are able to grasp the basic purpose of the model. Your goal at this p ...

Aggregate Supply

... data for the U.S. economy from 1960 to 2000. If Keynes’s prediction were correct, the dots in this figure would show a downward-sloping pattern, indicating a negative relationship.Yet the figure shows only a weak correlation between the real wage and output, and it is the opposite of what Keynes pre ...

... data for the U.S. economy from 1960 to 2000. If Keynes’s prediction were correct, the dots in this figure would show a downward-sloping pattern, indicating a negative relationship.Yet the figure shows only a weak correlation between the real wage and output, and it is the opposite of what Keynes pre ...

Term 2 Week 6 to 9 - Singapore A Level Notes

... Money supply increase – interest rate falls – C/I increase – AD increase – N/ NY increase Japan in 1990s: liquidity trap (draw diagram seen in ‘What is liquidity trap’ notes) – increase money supply – interest rate unchanged because opportunity cost of holding cash balances (earn 0 interest) very lo ...

... Money supply increase – interest rate falls – C/I increase – AD increase – N/ NY increase Japan in 1990s: liquidity trap (draw diagram seen in ‘What is liquidity trap’ notes) – increase money supply – interest rate unchanged because opportunity cost of holding cash balances (earn 0 interest) very lo ...

Bank of England Inflation Report February 2015

... increases have not been offset by cuts by other producers, such as OPEC members. The decision by OPEC members not to cut production has, according to market contacts, led to a reassessment by market participants of the outlook for OPEC supply. But weakening demand for oil (Chart 4.5), reflecting sub ...

... increases have not been offset by cuts by other producers, such as OPEC members. The decision by OPEC members not to cut production has, according to market contacts, led to a reassessment by market participants of the outlook for OPEC supply. But weakening demand for oil (Chart 4.5), reflecting sub ...

romewp2013-01 - Research on Money in the Economy” ROME

... the dawn of the financial crisis in 2007. Since central banks around the world conduct quantitative easing in order to counteract the negative consequences of the financial market tensions for the real economy, money re-gained prominence on the monetary policy agenda. At the same time, with central ...

... the dawn of the financial crisis in 2007. Since central banks around the world conduct quantitative easing in order to counteract the negative consequences of the financial market tensions for the real economy, money re-gained prominence on the monetary policy agenda. At the same time, with central ...

QUIZ 5: Macro – Fall 2014 Name: _ANSWERS____ Section

... All consumers are non-liquidity constrained, non-Ricardian PIH (as developed in class) Expected inflation has no effect on money demand; NX = 0 . All changes are permanent and unexpected unless told otherwise The economy is initially in long run equilibrium at Y* TFP, taxes, consumer confidence, val ...

... All consumers are non-liquidity constrained, non-Ricardian PIH (as developed in class) Expected inflation has no effect on money demand; NX = 0 . All changes are permanent and unexpected unless told otherwise The economy is initially in long run equilibrium at Y* TFP, taxes, consumer confidence, val ...

The Economics of Money, Banking, and Financial

... C) the monetary base D) GDP Answer: A Ques Status: Previous Edition 2) During the years 1979 to 1982, the Federal Reserve's announced policy was monetary targeting. During this time period the Federal Reserve A) hit all of their monetary targets. B) did not hit any of their monetary targets because ...

... C) the monetary base D) GDP Answer: A Ques Status: Previous Edition 2) During the years 1979 to 1982, the Federal Reserve's announced policy was monetary targeting. During this time period the Federal Reserve A) hit all of their monetary targets. B) did not hit any of their monetary targets because ...

Chapter 1: Introduction

... Y means that the equilibrium nominal interest rate varies whenever real GDP Y varies. At each possible level of total income Y, there is a different curve showing money demand as a function of the nominal interest rate, as Figure 11.2 shows. With a fixed money supply, each of these money demand curv ...

... Y means that the equilibrium nominal interest rate varies whenever real GDP Y varies. At each possible level of total income Y, there is a different curve showing money demand as a function of the nominal interest rate, as Figure 11.2 shows. With a fixed money supply, each of these money demand curv ...

Preparing for inflation - Charles Schwab Bank Collective Trust Funds

... As shown below, inflation hasn’t always risen slowly and steadily, and it can be caused by a variety of catalysts. Moreover, the performance of an asset class can vary depending upon the underlying catalyst for inflation. This has led us to the conclusion that adopting a well-diversified investment ...

... As shown below, inflation hasn’t always risen slowly and steadily, and it can be caused by a variety of catalysts. Moreover, the performance of an asset class can vary depending upon the underlying catalyst for inflation. This has led us to the conclusion that adopting a well-diversified investment ...

Aggregate Demand and Aggregate Supply

... • Increases in oil prices shift the aggregate supply curve. However, they also have an adverse effect on aggregate demand. • Because the United States is a net importer of foreign oil, an increase in oil prices is just like a tax that decreases the income of consumers. • An increase in taxes will sh ...

... • Increases in oil prices shift the aggregate supply curve. However, they also have an adverse effect on aggregate demand. • Because the United States is a net importer of foreign oil, an increase in oil prices is just like a tax that decreases the income of consumers. • An increase in taxes will sh ...

Business Economics – II (MB1B4): January 2009

... 20.During recession, there is unexpected reduction in the general level of demand for goods and services. This is an important cause of (a) Frictional unemployment (b) Structural unemployment (c) Cyclical unemplo yment (d) Seasonal unemployment (e) Disguised unemployment. ...

... 20.During recession, there is unexpected reduction in the general level of demand for goods and services. This is an important cause of (a) Frictional unemployment (b) Structural unemployment (c) Cyclical unemplo yment (d) Seasonal unemployment (e) Disguised unemployment. ...

Fiscal Stimulus and Potential Inflationary Risks

... If the debt will be paid off by higher future tax rates, the economy can be set up for a decade or more of high-tax and low-growth stagnation. If the Fed’s kitty and the Treasury’s taxing power or spending-reduction ability are gone, then we are set up for inflation.” It may be worth recognising tha ...

... If the debt will be paid off by higher future tax rates, the economy can be set up for a decade or more of high-tax and low-growth stagnation. If the Fed’s kitty and the Treasury’s taxing power or spending-reduction ability are gone, then we are set up for inflation.” It may be worth recognising tha ...

Chapter 02 Money and the Payments System

... A. Greenbacks are still legal tender in the U.S B. Greenbacks were tied to the value of gold and silver C. The South used "greenbacks" to pay for salaries and supplies D. Greenbacks are a historical example of commodity money ...

... A. Greenbacks are still legal tender in the U.S B. Greenbacks were tied to the value of gold and silver C. The South used "greenbacks" to pay for salaries and supplies D. Greenbacks are a historical example of commodity money ...

Monetary policy and supply shocks - Hans-Böckler

... Figure 1 shows how the interest rate, headline and core inflation, and the output gap react to a temporary but persistent oil price shock given the three Taylor rules introduced above. 7 The simulations show that stabilizing core inflation is the superior monetary strategy: both output in the core ...

... Figure 1 shows how the interest rate, headline and core inflation, and the output gap react to a temporary but persistent oil price shock given the three Taylor rules introduced above. 7 The simulations show that stabilizing core inflation is the superior monetary strategy: both output in the core ...

Measuring Inflation

... and services they buy within the category, bars when the relative prices of those goods and 3 fruits services change. 4 frozen desserts (c) 2000,2001, 2002 Claudia Garcia - Szekely ...

... and services they buy within the category, bars when the relative prices of those goods and 3 fruits services change. 4 frozen desserts (c) 2000,2001, 2002 Claudia Garcia - Szekely ...

A Dynamic Model of Aggregate Demand and Aggregate Supply

... • When either the previous period’s inflation or the current period’s inflation shock increases (decreases), the DAS curve shifts up (down) by the same amount • When natural GDP increases (decreases), the DAS curve shifts right (left) by the same amount ...

... • When either the previous period’s inflation or the current period’s inflation shock increases (decreases), the DAS curve shifts up (down) by the same amount • When natural GDP increases (decreases), the DAS curve shifts right (left) by the same amount ...

Money, Banking, and the Financial System

... Topic: functions of money Objective: Discuss the four key functions of money AACSB: Reflective Thinking 8) The difference between money and income is that whereas income is an individual's A) flow of earnings over a period of time, money is an individual's stock of currency and currency substitutes. ...

... Topic: functions of money Objective: Discuss the four key functions of money AACSB: Reflective Thinking 8) The difference between money and income is that whereas income is an individual's A) flow of earnings over a period of time, money is an individual's stock of currency and currency substitutes. ...

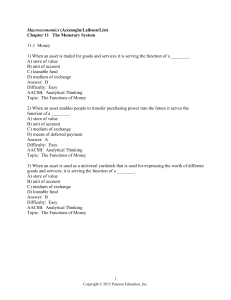

chapter 11

... 4) Which of the following statements is true? A) One of the limitations of using money is that it does not allow for the transfer of purchasing power into the future. B) The necessary condition required for money to function as a medium of exchange is that it also needs to be a store of value. C) H ...

... 4) Which of the following statements is true? A) One of the limitations of using money is that it does not allow for the transfer of purchasing power into the future. B) The necessary condition required for money to function as a medium of exchange is that it also needs to be a store of value. C) H ...

Sample

... Diff: 2 Page Ref: 29 Topic: functions of money Objective: Discuss the four key functions of money AACSB: Reflective Thinking 12) When economists refer to the role of money as a standard of deferred payment, they mean that A) payments by checks are usually deferred until the checks clear the bank. B) ...

... Diff: 2 Page Ref: 29 Topic: functions of money Objective: Discuss the four key functions of money AACSB: Reflective Thinking 12) When economists refer to the role of money as a standard of deferred payment, they mean that A) payments by checks are usually deferred until the checks clear the bank. B) ...

the aggregate demand curve

... is on the steep part of the AS curve, they can not increase their output very much • There is a substantial increase in price level • The increase in price level increases the demand for money, which leads to an increase in the interest rate, decreasing ...

... is on the steep part of the AS curve, they can not increase their output very much • There is a substantial increase in price level • The increase in price level increases the demand for money, which leads to an increase in the interest rate, decreasing ...