8 AM – May 17 th , 2012 AP Macroeconomics Test

... Both are price indices but they have different market baskets. The CPI includes consumer goods whereas the GDP deflator contains all items that are produced domestically. RMCE/HWRHS ...

... Both are price indices but they have different market baskets. The CPI includes consumer goods whereas the GDP deflator contains all items that are produced domestically. RMCE/HWRHS ...

CHAPTER 12

... decreases, the purchasing power of currency and checking account balances increases; therefore, households feel less need to save and are likely to buy a greater quantity of goods and services. Second, a lower price level decreases interest rates, which results in additional spending on investment g ...

... decreases, the purchasing power of currency and checking account balances increases; therefore, households feel less need to save and are likely to buy a greater quantity of goods and services. Second, a lower price level decreases interest rates, which results in additional spending on investment g ...

CHALLENGING MERCANTILISM: THE IMPACT OF DAVID HUME ON THE EVOLUTION OF A

... with a passage from Hume, Friedman concludes that the short-run effect of a change in the money supply is primarily on output, but that the long-run effect is on the price level. It can be argued that Friedman’s conclusions quite clearly resemble Hume’s own pivotal notion that the inflationary effec ...

... with a passage from Hume, Friedman concludes that the short-run effect of a change in the money supply is primarily on output, but that the long-run effect is on the price level. It can be argued that Friedman’s conclusions quite clearly resemble Hume’s own pivotal notion that the inflationary effec ...

Document

... Assumption: The short-run supply curve is horizontal (= P is fixed), which implies that aggregate demand alone determines output. The model also assumes that the real interest rate is fixed; and that planned investment is an exogenous variable. The money market plays no explicit role here. The model ...

... Assumption: The short-run supply curve is horizontal (= P is fixed), which implies that aggregate demand alone determines output. The model also assumes that the real interest rate is fixed; and that planned investment is an exogenous variable. The money market plays no explicit role here. The model ...

as a PDF

... came to a standstill while at the same time the real economy stagnated and was seen at the brink of recession by some commentators in early 2003. Against this backround, there is widespread concern in policy circles that with a weak economy and a monetary policy guided to a structurally higher euro ...

... came to a standstill while at the same time the real economy stagnated and was seen at the brink of recession by some commentators in early 2003. Against this backround, there is widespread concern in policy circles that with a weak economy and a monetary policy guided to a structurally higher euro ...

Charles I. Plosser Robert G. King Working Paper No. 853 1050

... drive economic activity through central bank policy response. For example, Tobin (1970) provides an earlier analysis of a model with endogenous money ...

... drive economic activity through central bank policy response. For example, Tobin (1970) provides an earlier analysis of a model with endogenous money ...

Question No: 2 ( M - 1 )

... ► Decrease money supply to increase interest rate and increase aggregate demand. ► Increase money supply to increase interest rate and increase aggregate demand. ► Decrease money supply to decrease interest rate and increase aggregate demand. ► Increase money supply to decrease interest rate and in ...

... ► Decrease money supply to increase interest rate and increase aggregate demand. ► Increase money supply to increase interest rate and increase aggregate demand. ► Decrease money supply to decrease interest rate and increase aggregate demand. ► Increase money supply to decrease interest rate and in ...

How the Consumer Price Index Is Calculated

... • fiscal drag may have unintended effects on tax liabilities • capital and profits taxes may be distorted ...

... • fiscal drag may have unintended effects on tax liabilities • capital and profits taxes may be distorted ...

demand S. 1

... –When the ________ goes up, quantity demanded goes down. –When the price goes down, ___________ demanded goes up. Foundations for the Law of Demand •Price is an _____________, which discourages consumers from buying. •The higher this obstacle, the less of a ___________ they will buy; the lower the o ...

... –When the ________ goes up, quantity demanded goes down. –When the price goes down, ___________ demanded goes up. Foundations for the Law of Demand •Price is an _____________, which discourages consumers from buying. •The higher this obstacle, the less of a ___________ they will buy; the lower the o ...

money affects real gdp - Choose your book for Principles of

... of Money Velocity How might the use of credit cards have explained the change in M1 velocity from the 1950s to the 1980s? • Increased use of credit cards during this period allowed people to buy more goods and services with less cash and lower demand deposit balances relative to nominal GDP. ...

... of Money Velocity How might the use of credit cards have explained the change in M1 velocity from the 1950s to the 1980s? • Increased use of credit cards during this period allowed people to buy more goods and services with less cash and lower demand deposit balances relative to nominal GDP. ...

ECON00 Chapter 3

... – inflation reduces purchasing power of people with fixed (unchanged dollar) income or savings – nominal interest rate observed interest rate; dollars per year in interest as percentage of dollars saved – realized real interest rate is nominal interest rate adjusted for inflation = nominal interest ...

... – inflation reduces purchasing power of people with fixed (unchanged dollar) income or savings – nominal interest rate observed interest rate; dollars per year in interest as percentage of dollars saved – realized real interest rate is nominal interest rate adjusted for inflation = nominal interest ...

Tax-Driven Money: Additional Evidence from the History of Thought

... to a certain extent that promise performs the functions of the gold itself, and a certain volume of notes can be floated as long as the credit of the bank is good. Because bank promises to pay are found to be convenient, as a means of conducting exchanges. After this number has been floated the note ...

... to a certain extent that promise performs the functions of the gold itself, and a certain volume of notes can be floated as long as the credit of the bank is good. Because bank promises to pay are found to be convenient, as a means of conducting exchanges. After this number has been floated the note ...

Money and Its Role of Income Stabilization: An Econometric Diagnosis

... hold bonds as well as other assets in their wealth portfolio, increment in the value of bonds brought about by increase in the monetary impulses will affect net worth of the consumers and they start to make more expenses on various goods and services. Permanent income hypothesis of Milton Friedman ( ...

... hold bonds as well as other assets in their wealth portfolio, increment in the value of bonds brought about by increase in the monetary impulses will affect net worth of the consumers and they start to make more expenses on various goods and services. Permanent income hypothesis of Milton Friedman ( ...

PPT

... typically gold, on demand. • In modern economies, paper money is generally issued by a central bank run by the government. • The Federal Reserve is the central bank of the United States. However, money issued by the Federal Reserve is no longer exchangeable for gold; nor is any current world currenc ...

... typically gold, on demand. • In modern economies, paper money is generally issued by a central bank run by the government. • The Federal Reserve is the central bank of the United States. However, money issued by the Federal Reserve is no longer exchangeable for gold; nor is any current world currenc ...

Mankiw SM Chap13 correct size:chap13.qxd.qxd

... Beginning in long-run equilibrium, where output is at the natural level, if the Federal Reserve increases the money supply, this will cause the economy to go through an expansionary phase. Starting with the IS-LM model in Figure 13-2A, an increase in the money supply will shift the LM curve to the r ...

... Beginning in long-run equilibrium, where output is at the natural level, if the Federal Reserve increases the money supply, this will cause the economy to go through an expansionary phase. Starting with the IS-LM model in Figure 13-2A, an increase in the money supply will shift the LM curve to the r ...

Which of the following would cause the production possibilities

... government spending is increased b. Increase the money supply when government spending is decreased c. Decrease the money supply when government spending is increased d. Increase interest rates when government spending is increased e. Decrease interest rates when government spending is decreased 27. ...

... government spending is increased b. Increase the money supply when government spending is decreased c. Decrease the money supply when government spending is increased d. Increase interest rates when government spending is increased e. Decrease interest rates when government spending is decreased 27. ...

Inflacja - E-SGH

... Two possible reactions of government: a) increase of M (easy monetary policy) to avoid the decrease in M/P and in AD. Unemployment does not grow, but the rate of inflation goes up; b) no change in M (restrictive monetary policy). Higher inflation means lower M/P, higher interest rate and the recessi ...

... Two possible reactions of government: a) increase of M (easy monetary policy) to avoid the decrease in M/P and in AD. Unemployment does not grow, but the rate of inflation goes up; b) no change in M (restrictive monetary policy). Higher inflation means lower M/P, higher interest rate and the recessi ...

active learning

... T … the total number of transactions during some period of time P … price of a typical transaction PT … number of dollars exchanged in a year M … quantity of money VT … transactions velocity of money The ...

... T … the total number of transactions during some period of time P … price of a typical transaction PT … number of dollars exchanged in a year M … quantity of money VT … transactions velocity of money The ...

Economics Exit Exam Preparation

... this is possible depends on the elasticities of demand and supply. Generally, the more elastic (inelastic) demand is, the more difficult (easier) it is for the firm to pass the tax burden to the consumer. In contrast, the more inelastic (elastic) supply is, the more difficult (easier) it is to pass ...

... this is possible depends on the elasticities of demand and supply. Generally, the more elastic (inelastic) demand is, the more difficult (easier) it is for the firm to pass the tax burden to the consumer. In contrast, the more inelastic (elastic) supply is, the more difficult (easier) it is to pass ...

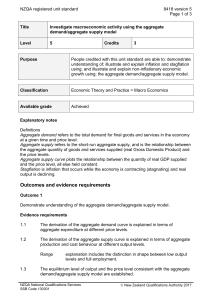

8418 Investigate macroeconomic activity using the

... of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are asses ...

... of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are asses ...