Monetary Policy - Maria Jose Rodriguez

... the interest rate, which increases investment and GDP. Contractionary Monetary Policy: Decreasing the money supply to increase the interest rate, which decreases investment and GDP. ...

... the interest rate, which increases investment and GDP. Contractionary Monetary Policy: Decreasing the money supply to increase the interest rate, which decreases investment and GDP. ...

A Framework for Analyzing Large Scale Asset

... the Treasury. Shortly thereafter, it made use of its recently acquired power to pay interest on reserves. It funded subsequent expansion of its balance sheet by issuing interest bearing reserves, which can be thought of as overnight government debt. Seen from this vantage, it is clear that LSAPs can ...

... the Treasury. Shortly thereafter, it made use of its recently acquired power to pay interest on reserves. It funded subsequent expansion of its balance sheet by issuing interest bearing reserves, which can be thought of as overnight government debt. Seen from this vantage, it is clear that LSAPs can ...

Monetary Policy in a Changing Economic Environment

... time. Econometric theory has spent decades devising sophisticated identifying restrictions to isolate different types of shocks from the tangle that appears in the data. The purpose of these exercises is to trace the propagation profile of exogenous impulses through the economic system. But nothing ...

... time. Econometric theory has spent decades devising sophisticated identifying restrictions to isolate different types of shocks from the tangle that appears in the data. The purpose of these exercises is to trace the propagation profile of exogenous impulses through the economic system. But nothing ...

How can emerging market economies best cope with the current

... Consistent with expectations of a gradual normalisation of monetary policy in major currency areas, financial market participants expect only a very modest increase in core bond yields in the coming years (Graph 2, left-hand panel). In five years’ time, market prices point to US 10-year yields at ju ...

... Consistent with expectations of a gradual normalisation of monetary policy in major currency areas, financial market participants expect only a very modest increase in core bond yields in the coming years (Graph 2, left-hand panel). In five years’ time, market prices point to US 10-year yields at ju ...

Document

... • If inflation is fully anticipated, and if both parties take it into account, then inflation will not redistribute purchasing power • When inflation is not correctly anticipated, however, our conclusion is very different • Nominal interest rate – Annual percent increase in a lender’s dollars from m ...

... • If inflation is fully anticipated, and if both parties take it into account, then inflation will not redistribute purchasing power • When inflation is not correctly anticipated, however, our conclusion is very different • Nominal interest rate – Annual percent increase in a lender’s dollars from m ...

Chap11_12q_for print..

... C) expansionary shift in the LM curve. D) contractionary shift in the LM curve. 7. An increase in the money supply shifts the ______ curve to the right, and the aggregate demand curve ______ ______. A) IS; shifts to the right B) IS; does not shift C) LM: shifts to the right D) LM; does not ...

... C) expansionary shift in the LM curve. D) contractionary shift in the LM curve. 7. An increase in the money supply shifts the ______ curve to the right, and the aggregate demand curve ______ ______. A) IS; shifts to the right B) IS; does not shift C) LM: shifts to the right D) LM; does not ...

NBER WORKING PAPER SERIES USING MONETARY CONTROL 10 DAMPEN THE

... postwar business cycles. These involve (1) the volatility of velocity growth in comparison with that of money growth, (2) the inertia of inflation, (3) the natural rate of unemployment as a dividing line between Conditions of accelerating and decelerating inflation, and (4) the role of supply shocks ...

... postwar business cycles. These involve (1) the volatility of velocity growth in comparison with that of money growth, (2) the inertia of inflation, (3) the natural rate of unemployment as a dividing line between Conditions of accelerating and decelerating inflation, and (4) the role of supply shocks ...

Methodology and results of the calculation of weighted average cost

... Explanations: Rf – risk free rate of return in the market; Rm – average market rate of return; Rm- Rf – equity risk premium, showing the required rate of interest premium compared to risk free rate of return; – beta, relative risk indicator, showing company’s risk compared to all companies in the ...

... Explanations: Rf – risk free rate of return in the market; Rm – average market rate of return; Rm- Rf – equity risk premium, showing the required rate of interest premium compared to risk free rate of return; – beta, relative risk indicator, showing company’s risk compared to all companies in the ...

Rudiger Dornbusch Working Paper No. i66

... rendered largely impotent by the complete collapse of any legitimacy the ...

... rendered largely impotent by the complete collapse of any legitimacy the ...

Adopting Inflation Targeting in Pakistan

... As a regime, the following set of conditions must be fulfilled before IT is introduced into an economy: (i) a strong commitment to price stability, (ii) a numerical target for inflation, (iii) a time horizon for achieving that target, and (iv) an autonomous, transparent, and accountable central bank ...

... As a regime, the following set of conditions must be fulfilled before IT is introduced into an economy: (i) a strong commitment to price stability, (ii) a numerical target for inflation, (iii) a time horizon for achieving that target, and (iv) an autonomous, transparent, and accountable central bank ...

unemployment

... • The rate of unemployment that just keeps inflation constant is called the “non-accelerating inflation rate of unemployment” or NAIRU. ...

... • The rate of unemployment that just keeps inflation constant is called the “non-accelerating inflation rate of unemployment” or NAIRU. ...

Review Questions - Leon County Schools

... scarcity, choices and opportunity costs. The slope of a production possibilities curve shows the opportunity cost of producing one more unit of one good in terms of the amount of the other good that must be given up. The law of comparative advantage shows how everyone can gain through trade by speci ...

... scarcity, choices and opportunity costs. The slope of a production possibilities curve shows the opportunity cost of producing one more unit of one good in terms of the amount of the other good that must be given up. The law of comparative advantage shows how everyone can gain through trade by speci ...

IOSR Journal Of Humanities And Social Science (JHSS)

... determine exchange rates in the long run. Accordingly, the nominal exchange rate between the currencies of two countries must reflect the different prices level in those countries. PPP, which forms a strong building block of the theory of exchange rate determination, maintains that there exists a pr ...

... determine exchange rates in the long run. Accordingly, the nominal exchange rate between the currencies of two countries must reflect the different prices level in those countries. PPP, which forms a strong building block of the theory of exchange rate determination, maintains that there exists a pr ...

exemplars and commentary

... The business confidence index is decreasing at an alarming rate. It began at 33 in Dec‘10 and continued to decrease, ending at 22 in Mar’13. I extrapolated a continual decreasing trend due to these observations. A decrease in business confidence means that firms are uncertain about the future, so th ...

... The business confidence index is decreasing at an alarming rate. It began at 33 in Dec‘10 and continued to decrease, ending at 22 in Mar’13. I extrapolated a continual decreasing trend due to these observations. A decrease in business confidence means that firms are uncertain about the future, so th ...

True, False, or Uncertain? Explain with words and graphs Study

... pass on smaller price increases to consumers: inflation will be below expected inflation . Eventually, expected inflation will fall as workers revise their expectations. As expected inflation falls, workers accept smaller raises (of their wages and salaries), which allows firms to lower the inf ...

... pass on smaller price increases to consumers: inflation will be below expected inflation . Eventually, expected inflation will fall as workers revise their expectations. As expected inflation falls, workers accept smaller raises (of their wages and salaries), which allows firms to lower the inf ...

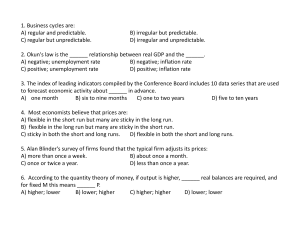

File: ch10 Type: Multiple Choice 1. Which are the two major

... reasonable estimates for earnings. Section: The Target Price and Relative Valuation Approach. ...

... reasonable estimates for earnings. Section: The Target Price and Relative Valuation Approach. ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.