Lesson 1

... U is separable in c and m: same utility out of money whatever the level of consumption ...

... U is separable in c and m: same utility out of money whatever the level of consumption ...

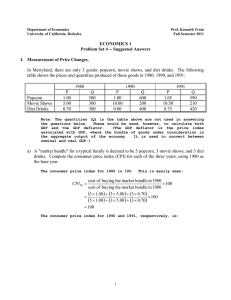

Answers. - University of California, Berkeley

... This differs from the inflation rate calculated in (b) because the “market bundle” is different. The rate of inflation is the percentage increase in the cost of buying a specific bundle of goods. Therefore it may be different for different bundles. Why might we want to change the bundle of goods use ...

... This differs from the inflation rate calculated in (b) because the “market bundle” is different. The rate of inflation is the percentage increase in the cost of buying a specific bundle of goods. Therefore it may be different for different bundles. Why might we want to change the bundle of goods use ...

HUD Priority News Briefing (12-17-15)

... health care. “Research shows that moving children to more prosperous neighborhoods improves their life outcomes, but it is unrealistic to move every family currently living in underinvested areas. Further, being able to afford to live in a good neighborhood shouldn’t be tantamount to winning the lo ...

... health care. “Research shows that moving children to more prosperous neighborhoods improves their life outcomes, but it is unrealistic to move every family currently living in underinvested areas. Further, being able to afford to live in a good neighborhood shouldn’t be tantamount to winning the lo ...

- Strathprints - University of Strathclyde

... the analysis. Sraffa argued that Hayek’s account of the working of a monetary economy was fundamentally inadequate because, having introduced hidden assumptions that effectively neutralised money, Hayek had so confused himself that he failed to recognise the real source of the disturbances he was d ...

... the analysis. Sraffa argued that Hayek’s account of the working of a monetary economy was fundamentally inadequate because, having introduced hidden assumptions that effectively neutralised money, Hayek had so confused himself that he failed to recognise the real source of the disturbances he was d ...

Equity Returns and Business Cycles in Small Open Economies Mohammad R. Jahan-Parvar

... these observed long-run equity premia. Our analysis shows that, for a small open economy with production, to replicate equity premia it is not sufficient to use GHH preferences and impose investment adjustment costs. We need to also assume borrowing and lending costs. This is due to the behavior of ...

... these observed long-run equity premia. Our analysis shows that, for a small open economy with production, to replicate equity premia it is not sufficient to use GHH preferences and impose investment adjustment costs. We need to also assume borrowing and lending costs. This is due to the behavior of ...

Dollars - Sites@UCI

... rate affect investment flows? What would this do to the BoP and the exchange rate? ANSWER: The US will increase investment in Mexico (maybe buy a Mexican company or lend to Mexican government). This will add to Mexico’s capital account, which will return the BoP to 0. Dollar stronger at new equilibr ...

... rate affect investment flows? What would this do to the BoP and the exchange rate? ANSWER: The US will increase investment in Mexico (maybe buy a Mexican company or lend to Mexican government). This will add to Mexico’s capital account, which will return the BoP to 0. Dollar stronger at new equilibr ...

Choices and Best Practice in Corporate Risk Management Disclosure

... Sensitivity Analysis. The sensitivity analysis method expresses the potential loss in future earnings, fair values, or cash flows that could result from selected hypothetical changes in market rates and prices. Companies are required to provide a description of the model, assumptions, and parameters ...

... Sensitivity Analysis. The sensitivity analysis method expresses the potential loss in future earnings, fair values, or cash flows that could result from selected hypothetical changes in market rates and prices. Companies are required to provide a description of the model, assumptions, and parameters ...

The Economic Consequences of Mr Osborne

... In this paper we investigate, by means of a century of UK data, the possibility of improving the government’s fiscal position by cutting expenditure. The period before the second world war provides examples of genuine ‘fiscal consolidations’, that is, episodes when government spending actually fell ...

... In this paper we investigate, by means of a century of UK data, the possibility of improving the government’s fiscal position by cutting expenditure. The period before the second world war provides examples of genuine ‘fiscal consolidations’, that is, episodes when government spending actually fell ...

Chapter 8 Money, Inflation, Growth, and Cycles

... system. The ability of the private banking system to create monetary assets depends in part on the amount of “base money” provided by the central bank, which is usually an agency of the national government. In the short run, imbalances between the demand for money and its supply are likely to be res ...

... system. The ability of the private banking system to create monetary assets depends in part on the amount of “base money” provided by the central bank, which is usually an agency of the national government. In the short run, imbalances between the demand for money and its supply are likely to be res ...

Woodford and Wicksell: a Cashless Economy or a Moneyless

... framework that central banks should use. This recent monetary literature labelled under different flag -such as "Post Modern monetary policy", "New monetary policy "or "New Consensus"-refers directly as a quite identical framework. The latter is featured not only by its neglect of monetary agregrate ...

... framework that central banks should use. This recent monetary literature labelled under different flag -such as "Post Modern monetary policy", "New monetary policy "or "New Consensus"-refers directly as a quite identical framework. The latter is featured not only by its neglect of monetary agregrate ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... in the Great Contraction, although evidence of contemporaneous correlation between money and income has been interpreted as supporting significant feedback from nonmonetary to monetary forces. However, evidence of endogeneity of the money supply or of feedback from real forces to the money supply be ...

... in the Great Contraction, although evidence of contemporaneous correlation between money and income has been interpreted as supporting significant feedback from nonmonetary to monetary forces. However, evidence of endogeneity of the money supply or of feedback from real forces to the money supply be ...

If GT =0, Debt/GDP increases if the r > growth rate of GDP

... investment. Monetary policy: A higher money supply decreases the interest rate and thereby private investment, aggregate demand and output. 9.1.2B. The small open economy with its own currency. The interest rate is fixed but the exchange rate is flexible. Main lesson: Fiscal policy is less effectiv ...

... investment. Monetary policy: A higher money supply decreases the interest rate and thereby private investment, aggregate demand and output. 9.1.2B. The small open economy with its own currency. The interest rate is fixed but the exchange rate is flexible. Main lesson: Fiscal policy is less effectiv ...

When It Rains, It Pours: Procyclical Capital Flows and

... (see Lane, 2003), but systematic empirical work is scant.2 This is probably due to the notorious difficulties (present even for advanced countries) in empirically characterizing the stance of monetary policy.3 Relying on data for 104 countries for the period 1960-2003, this paper revisits the eviden ...

... (see Lane, 2003), but systematic empirical work is scant.2 This is probably due to the notorious difficulties (present even for advanced countries) in empirically characterizing the stance of monetary policy.3 Relying on data for 104 countries for the period 1960-2003, this paper revisits the eviden ...

Hisse Senetleri 2015 Görünümü

... geçeceğini duyurmasını bekliyoruz. Buradan doğacak atıl likiditenin yüksek getiri arayışından, Avrupa’daki periferi ülkeleri gibi gelişen piyasalar da payını alacaklardır. Ayrıca şirketlerimizin Avrupa’dan dış borç bulması da kolaylaşacaktır. ...

... geçeceğini duyurmasını bekliyoruz. Buradan doğacak atıl likiditenin yüksek getiri arayışından, Avrupa’daki periferi ülkeleri gibi gelişen piyasalar da payını alacaklardır. Ayrıca şirketlerimizin Avrupa’dan dış borç bulması da kolaylaşacaktır. ...

Productivity and economic profits of banks

... differentiation (τ). Since the unit costs decrease with the TFP (measured by parameter A), the higher the productivity of banks, the lower the interest rates of loans and deposits in the equilibrium. The loans and deposits per bank branch in the equilibrium depend on the aggregate number of branches ...

... differentiation (τ). Since the unit costs decrease with the TFP (measured by parameter A), the higher the productivity of banks, the lower the interest rates of loans and deposits in the equilibrium. The loans and deposits per bank branch in the equilibrium depend on the aggregate number of branches ...

DP2010/14 Monetary Policy, In‡ation and Unemployment Nicolas Groshenny December 2010

... 6; impliying a steady-state markup of 20 percent as in Rotemberg and Woodford (1995). The vacancy-…lling rate q is set equal to 0:70: This is just a normalization as q is not identi…ed. The steady-state government spending/output ratio G=Y is set equal to 0:20. Finally, the steady-state values of th ...

... 6; impliying a steady-state markup of 20 percent as in Rotemberg and Woodford (1995). The vacancy-…lling rate q is set equal to 0:70: This is just a normalization as q is not identi…ed. The steady-state government spending/output ratio G=Y is set equal to 0:20. Finally, the steady-state values of th ...

Phillips Curve - Webarchiv ETHZ / Webarchive ETH

... changes in expectations. • The short-run Phillips curve also shifts because of shocks to aggregate supply. • Adverse changes in aggregate supply can worsen the short-run trade-off between unemployment and inflation. • An adverse supply shock gives policymakers a less favorable trade-off between infl ...

... changes in expectations. • The short-run Phillips curve also shifts because of shocks to aggregate supply. • Adverse changes in aggregate supply can worsen the short-run trade-off between unemployment and inflation. • An adverse supply shock gives policymakers a less favorable trade-off between infl ...

Powerpoint Chapter 14 - The Federal Reserve and Monetary Policy

... • If actual reserves (RD) are less than Required Reserves (RR), the excess Reserves (ER) are negative – If a bank does find itself short, it will usually borrow reserves from another bank that does have excess reserves. These are called federal funds and the interest rate charge is called the federa ...

... • If actual reserves (RD) are less than Required Reserves (RR), the excess Reserves (ER) are negative – If a bank does find itself short, it will usually borrow reserves from another bank that does have excess reserves. These are called federal funds and the interest rate charge is called the federa ...

Presentation before the Council of Ministers Erdem Başçı Governor

... required to hold at the CBRT against the deposits and other liabilities. ...

... required to hold at the CBRT against the deposits and other liabilities. ...

Monetary Policy Statement March 2016

... New Zealand output growth has continued to recover from the weakness over the first half of 2015, but the global outlook has worsened and survey measures of inflation expectations have fallen. Annual CPI inflation for the December quarter was 0.1 percent – lower than our December Statement estimate ...

... New Zealand output growth has continued to recover from the weakness over the first half of 2015, but the global outlook has worsened and survey measures of inflation expectations have fallen. Annual CPI inflation for the December quarter was 0.1 percent – lower than our December Statement estimate ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.