Homework 1

... grosses into 2004 dollars (i.e. use 2004 as the reference year) and rank the films by their grosses in 2004 dollars. ...

... grosses into 2004 dollars (i.e. use 2004 as the reference year) and rank the films by their grosses in 2004 dollars. ...

Economic Barometer

... willing to sacrifice yield to hold such debt. This can be seen in the chart below, which presents an estimate of the term premium embedded in the ten-year Treasury note—the amount of yield required by investors to hold such price-sensitive debt over and above the expected average of short-term inter ...

... willing to sacrifice yield to hold such debt. This can be seen in the chart below, which presents an estimate of the term premium embedded in the ten-year Treasury note—the amount of yield required by investors to hold such price-sensitive debt over and above the expected average of short-term inter ...

Learning from the Past to Invest for the Future

... • Vs. real bond return of 3 to 4. Less risk in stocks the longer you hold them ...

... • Vs. real bond return of 3 to 4. Less risk in stocks the longer you hold them ...

Lecture 2 PPT - Kleykamp in Taiwan

... financed by the money creation. Governments can borrow at extremely low interest rates and don’t need to raise taxes. If that sounds inflationary...well a little inflation can be good for the economy. The cost is low compared to the social cost of continued recession. ...

... financed by the money creation. Governments can borrow at extremely low interest rates and don’t need to raise taxes. If that sounds inflationary...well a little inflation can be good for the economy. The cost is low compared to the social cost of continued recession. ...

The Icelandic Economy

... The Central Bank of Iceland is on inflation targeting and has expressed a determination to keep inflation down. The Central bank has indicated that development on the asset markets will be crucial for time ahead. ...

... The Central Bank of Iceland is on inflation targeting and has expressed a determination to keep inflation down. The Central bank has indicated that development on the asset markets will be crucial for time ahead. ...

NBER WORKING PAPER SERIES U.S. MACROECONOMIC POLICY AND PERFORMANCE IN THE 198Os:

... These estimates were obtained using procedures outlined in Mishkin (1981) which eaki use of the rational expectations assumption. SpecifIcally, the real rates in Figure 5 are fitted value; from regressions of the ex—po;t real rate; on the three—month bill rate, the three—month Inflation rate end a s ...

... These estimates were obtained using procedures outlined in Mishkin (1981) which eaki use of the rational expectations assumption. SpecifIcally, the real rates in Figure 5 are fitted value; from regressions of the ex—po;t real rate; on the three—month bill rate, the three—month Inflation rate end a s ...

Name: Answer Key - University of Colorado Boulder

... demand for money to rise. C. A rise in the average value of transactions carried out by a household or a firm causes its demand for money to rise. D. A rise in the average value of transactions carried out by a household or a firm causes its demand for nominal money to rise. E. A rise in the average ...

... demand for money to rise. C. A rise in the average value of transactions carried out by a household or a firm causes its demand for money to rise. D. A rise in the average value of transactions carried out by a household or a firm causes its demand for nominal money to rise. E. A rise in the average ...

Aggregate Supply & Demand

... • Aggregate-demand curve (AD)- how demand for the entire economy changes with inflation (price level) – demand from households, firms, exports & government at each price level ...

... • Aggregate-demand curve (AD)- how demand for the entire economy changes with inflation (price level) – demand from households, firms, exports & government at each price level ...

PDF Download

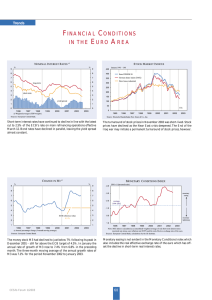

... In the fourth quarter of 2002 real GDP continued on its gradual upward trend. The 12 euro area countries recorded growth of 1.3% over the fourth quarter 2001, topped slightly by the 1.4% growth of all 15 EU countries. Compared with the third quarter of 2002, growth in both areas amounted to 0.2%. Wh ...

... In the fourth quarter of 2002 real GDP continued on its gradual upward trend. The 12 euro area countries recorded growth of 1.3% over the fourth quarter 2001, topped slightly by the 1.4% growth of all 15 EU countries. Compared with the third quarter of 2002, growth in both areas amounted to 0.2%. Wh ...

European Commission

... These two decisions relate to the sector of interest rate derivatives in the Swiss Franc currency. These financial products allow companies to hedge the risk of interest rate fluctuations, as a kind of insurance mechanism. We have uncovered two separate infringements of EU competition rules in this ...

... These two decisions relate to the sector of interest rate derivatives in the Swiss Franc currency. These financial products allow companies to hedge the risk of interest rate fluctuations, as a kind of insurance mechanism. We have uncovered two separate infringements of EU competition rules in this ...

CSC Volume 1, Section 2 (Chapter 4, 5) Total score: 11/14 = 78

... General Feedback: Deflation occurs when the price level is steadily falling resulting in a negative Consumer Price Index (CPI). Although lower prices are generally considered good for the economy in the short-run, there are negative longer term implications. Faced with lower prices, corporate profit ...

... General Feedback: Deflation occurs when the price level is steadily falling resulting in a negative Consumer Price Index (CPI). Although lower prices are generally considered good for the economy in the short-run, there are negative longer term implications. Faced with lower prices, corporate profit ...

14.02 Quiz 1 Solutions Fall 2004 Multiple-Choice Questions (30/100 points)

... A tax cut is represented in this model by a reduction in t. Smaller t increases C. But note that the IS curve does not shift out in a parallel fashion in this case. This is because t enters into the slope of the IS equation. A smaller t tilts the curve, making it flatter. (Recall from part 1 that, o ...

... A tax cut is represented in this model by a reduction in t. Smaller t increases C. But note that the IS curve does not shift out in a parallel fashion in this case. This is because t enters into the slope of the IS equation. A smaller t tilts the curve, making it flatter. (Recall from part 1 that, o ...

Accelerated Macro Spring 2015 Solutions to HW #4 1

... b. A financial crisis prompts households to sell off some of their stock market portfolio and deposit the proceeds into bank accounts covered by deposit insurance. Solution: As people sell their stocks and increase their deposits, the currency-deposit ratio will decline. This causes the money multip ...

... b. A financial crisis prompts households to sell off some of their stock market portfolio and deposit the proceeds into bank accounts covered by deposit insurance. Solution: As people sell their stocks and increase their deposits, the currency-deposit ratio will decline. This causes the money multip ...

HW02

... fund with a guaranteed return of 10% per year. Assuming that your only other investment alternative is a savings account, should you buy? Yes. 4.27 Suppose a young newlywed couple is planning to buy a home two years from now. To save the down payment required at the time of purchasing a home worth $ ...

... fund with a guaranteed return of 10% per year. Assuming that your only other investment alternative is a savings account, should you buy? Yes. 4.27 Suppose a young newlywed couple is planning to buy a home two years from now. To save the down payment required at the time of purchasing a home worth $ ...

Deflation, Globalization and the New Paradigm of Monetary

... Credit rationing and equity rationing (imperfections of capital markets limit use of equity markets in raising new funds) mean that: ...

... Credit rationing and equity rationing (imperfections of capital markets limit use of equity markets in raising new funds) mean that: ...

Economic Growth and Fluctuations Macroeconomics tries to explain

... B. Helps policymakers assess various government spending and tax proposals to increase long-term economic growth. C. Helps policymakers keep inflation low and stable without causing unnecessary economic fluctuations. D. Tells us how broad policy changes affect the types of goods produced. ...

... B. Helps policymakers assess various government spending and tax proposals to increase long-term economic growth. C. Helps policymakers keep inflation low and stable without causing unnecessary economic fluctuations. D. Tells us how broad policy changes affect the types of goods produced. ...

FedViews

... pickup won’t be enough to bring down the unemployment rate quickly. At the end of 2014, we expect the rate to still be about 1½ percentage points above its inflation-neutral equilibrium level. ...

... pickup won’t be enough to bring down the unemployment rate quickly. At the end of 2014, we expect the rate to still be about 1½ percentage points above its inflation-neutral equilibrium level. ...

Robert T. Parry President and Chief Executive Officer

... While the reasons for raising interest rates in response to a demand shock are obvious, it may be less obvious that the Fed still would have had to do so even if we were dealing mainly with a technology shock. A. ...

... While the reasons for raising interest rates in response to a demand shock are obvious, it may be less obvious that the Fed still would have had to do so even if we were dealing mainly with a technology shock. A. ...

Nicaragua ECLAC expects Nicaragua`s economic growth to come in

... Central government revenue grew by 11.8% in real terms year-on-year in the period up to August 2016, more than the 7.9% seen in the prior-year period thanks to a rise in tax revenues, which are expected to be equivalent to 16.1% of GDP by the end of 2016. While income tax collection maintained growt ...

... Central government revenue grew by 11.8% in real terms year-on-year in the period up to August 2016, more than the 7.9% seen in the prior-year period thanks to a rise in tax revenues, which are expected to be equivalent to 16.1% of GDP by the end of 2016. While income tax collection maintained growt ...

The Global Financial Crisis: A Re

... Interventions, either through the acceptance of assets as collateral, or through their straight purchase by the central bank, can affect the rates on different classes of assets, for a given policy rate. In this sense, wholesale funding is not fundamentally different from demand deposits, and the de ...

... Interventions, either through the acceptance of assets as collateral, or through their straight purchase by the central bank, can affect the rates on different classes of assets, for a given policy rate. In this sense, wholesale funding is not fundamentally different from demand deposits, and the de ...

Chapter 14

... the U.S. Explain the meaning of a personal health insurance mandate. Describe increases of unauthorized immigrants and the effects of this increased population. Explain the attempts of the U.S. House and Senate to pass bills controlling the flow of unauthorized immigrants and the companies who ...

... the U.S. Explain the meaning of a personal health insurance mandate. Describe increases of unauthorized immigrants and the effects of this increased population. Explain the attempts of the U.S. House and Senate to pass bills controlling the flow of unauthorized immigrants and the companies who ...

Chapter 14 - Department of Agricultural Economics

... for inflation. In the above example, real GDP grew over the 1992-1999 period, but not at the rate implied by comparisons in nominal terms. Page 347 ...

... for inflation. In the above example, real GDP grew over the 1992-1999 period, but not at the rate implied by comparisons in nominal terms. Page 347 ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.