The macroeconomic effects of fiscal policy in Spain

... explanation could be the lack of necessary data at high enough frequency. However, some recent pieces of empirical research on this field, mainly for the US economy, can be found. Edelberg et al. (1998), Ramey and Shapiro (1998) and Burnside et al. (1999) argue against using VAR based innovations as ...

... explanation could be the lack of necessary data at high enough frequency. However, some recent pieces of empirical research on this field, mainly for the US economy, can be found. Edelberg et al. (1998), Ramey and Shapiro (1998) and Burnside et al. (1999) argue against using VAR based innovations as ...

MONETARY POLICY REPORT CENTRAL BANK OF THE REPUBLIC OF TURKEY APRIL 2003

... Data until 25 April 2003 have been used in this report. ...

... Data until 25 April 2003 have been used in this report. ...

Exchange rate valuation and its impact on the real economy

... Economics, employs a similar underlying balance method as in the partial equilibrium models (ie, internal and external balance) but is calculated using a large macro model in which international relationships within the model are endogenous. This helps to ensure consistency. 2.3 Other concepts of ex ...

... Economics, employs a similar underlying balance method as in the partial equilibrium models (ie, internal and external balance) but is calculated using a large macro model in which international relationships within the model are endogenous. This helps to ensure consistency. 2.3 Other concepts of ex ...

united states securities and exchange commission

... assumptions could prove inaccurate. The forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond Piedmont’s ability to control or predict. Such factor ...

... assumptions could prove inaccurate. The forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond Piedmont’s ability to control or predict. Such factor ...

NBER WORKING PAPER SERIES Christopher J. Erceg Christopher Gust

... to appreciate. Private absorption falls in response to the higher interest rates, and exports also decline due to the induced appreciation of the real exchange rate. Both domestic and consumer price inflation fall, and roughly converge to their new target level after two years. Perhaps somewhat rema ...

... to appreciate. Private absorption falls in response to the higher interest rates, and exports also decline due to the induced appreciation of the real exchange rate. Both domestic and consumer price inflation fall, and roughly converge to their new target level after two years. Perhaps somewhat rema ...

Textbook of Economics

... machines, you need some staff to service the machines, you need to rent some area where the machine is placed, and you need the machines. If you operate u bus from Prague to Brno, you need a driver, you need to pay for the road and terminals, and you need the bus. If you produce software, you need t ...

... machines, you need some staff to service the machines, you need to rent some area where the machine is placed, and you need the machines. If you operate u bus from Prague to Brno, you need a driver, you need to pay for the road and terminals, and you need the bus. If you produce software, you need t ...

Lesson 4: The Impact of Inflation

... investors use the CPI as a benchmark for their investments to outpace by a certain percentage. Inflation risk is very common with cash equivalent assets such as savings accounts, money market funds, and certificates of deposit (CDs). The two enemies of anyone trying to accumulate money for future fi ...

... investors use the CPI as a benchmark for their investments to outpace by a certain percentage. Inflation risk is very common with cash equivalent assets such as savings accounts, money market funds, and certificates of deposit (CDs). The two enemies of anyone trying to accumulate money for future fi ...

Effectiveness of devaluation in achieving Internal and External

... fall of Derg in 1991, Transitional government of Ethiopia took control over the whole economy. The government started to accept the aids and supports the financial institutions, who generally were backed by the western ideology, an ideology which was clearly reflected on SAP. SAP included the previo ...

... fall of Derg in 1991, Transitional government of Ethiopia took control over the whole economy. The government started to accept the aids and supports the financial institutions, who generally were backed by the western ideology, an ideology which was clearly reflected on SAP. SAP included the previo ...

Surprising Similarities: Recent Monetary Regimes of Small Economies Andrew K. Rose

... was also the first truly global recession in decades. Historically, recessions have frequently caused monetary upheaval; change in monetary regime has been strongly countercyclical. Yet this time was different, at least for the two monetary regimes of concern here. Most countries with hard fixed exc ...

... was also the first truly global recession in decades. Historically, recessions have frequently caused monetary upheaval; change in monetary regime has been strongly countercyclical. Yet this time was different, at least for the two monetary regimes of concern here. Most countries with hard fixed exc ...

What is the Shape of the American Economy

... Before digging into the concepts and numbers, it must be recognized that “profits” are a most elusive concept. There are at least four important definitions – profits for accounting purposes, profits for tax purposes, profits as measured in the NIPA, and economic profits. The first three are widely ...

... Before digging into the concepts and numbers, it must be recognized that “profits” are a most elusive concept. There are at least four important definitions – profits for accounting purposes, profits for tax purposes, profits as measured in the NIPA, and economic profits. The first three are widely ...

Comments on “When Do TIPS Prices Adjust to

... => For flexibility concerns, high growth firms tend to retain more earnings when they face higher risk. ...

... => For flexibility concerns, high growth firms tend to retain more earnings when they face higher risk. ...

Stock Market Response to Monetary and Fiscal Policy Shocks: Multi

... economic stabilisation and a potential source of destabilisation it is increasingly important to gain a better understanding of the effects of fiscal policy on the economy, in general, and the stock market, in particular. This gap in understanding remains despite the fact that the theoretical effec ...

... economic stabilisation and a potential source of destabilisation it is increasingly important to gain a better understanding of the effects of fiscal policy on the economy, in general, and the stock market, in particular. This gap in understanding remains despite the fact that the theoretical effec ...

Notes Solow Growth Model

... Korea was able to achieve a much faster long-run rate of growth than Nicragua. Why does GDP per worker increase? It would seem that it has a lot to do with the amount of capital that each worker in the economy gets to use, as we can see in the following graph: Pretty obviously, having more capital- ...

... Korea was able to achieve a much faster long-run rate of growth than Nicragua. Why does GDP per worker increase? It would seem that it has a lot to do with the amount of capital that each worker in the economy gets to use, as we can see in the following graph: Pretty obviously, having more capital- ...

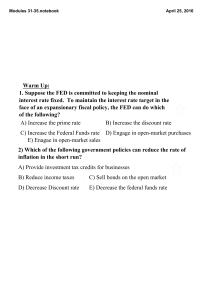

Chapter 9 Chapter Outline Figure 9.1 The FE line

... – Keynesian economists see slow adjustment of the price level ...

... – Keynesian economists see slow adjustment of the price level ...

CH 9 PDF

... • The equality of money demanded and money supplied – Equilibrium in the asset market requires that the real money supply equal the real quantity of money demanded – Real money supply is determined by the central bank and isn’t affected by the real interest rate – Real money demand falls as the real ...

... • The equality of money demanded and money supplied – Equilibrium in the asset market requires that the real money supply equal the real quantity of money demanded – Real money supply is determined by the central bank and isn’t affected by the real interest rate – Real money demand falls as the real ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.