quiz 9

... university education. For Roberto, money was functioning primarily as a a. unit of account. b. store of value. c. means of payment. d. type of short-term loan. 4. Which one of the following is not included in the M1 money stock? a. Deposits with maturity up to two years. b. Overnight deposits. c. Cu ...

... university education. For Roberto, money was functioning primarily as a a. unit of account. b. store of value. c. means of payment. d. type of short-term loan. 4. Which one of the following is not included in the M1 money stock? a. Deposits with maturity up to two years. b. Overnight deposits. c. Cu ...

Chapter 11 Money and Monetary Policy

... a. The Fed raises the interest rate, which leads to a decrease in intended investment spending and a decrease in the supply of federal funds, which decreases aggregate demand and output. b. The Fed decreases intended investment spending, which leads to a decrease in aggregate demand and output, and ...

... a. The Fed raises the interest rate, which leads to a decrease in intended investment spending and a decrease in the supply of federal funds, which decreases aggregate demand and output. b. The Fed decreases intended investment spending, which leads to a decrease in aggregate demand and output, and ...

Additional Help

... A change in the bank rate is one form of monetary policy. 7. B Response: Contractionary monetary policy increases interest rates which reduces investment, a component of aggregate expenditures. The AD curve shifts to the left by a multiple of the decline in investment. 8. B Response: The interest ra ...

... A change in the bank rate is one form of monetary policy. 7. B Response: Contractionary monetary policy increases interest rates which reduces investment, a component of aggregate expenditures. The AD curve shifts to the left by a multiple of the decline in investment. 8. B Response: The interest ra ...

Economics 514

... with 50% probability. Calculate the expected value of income in period 1. Calculate the expected value of marginal utility in period 1 when c0 = 100 as in 1c under the three different utility functions in 1d. Is this greater than or less than the marginal utility in period 0. Under which of the util ...

... with 50% probability. Calculate the expected value of income in period 1. Calculate the expected value of marginal utility in period 1 when c0 = 100 as in 1c under the three different utility functions in 1d. Is this greater than or less than the marginal utility in period 0. Under which of the util ...

multiple choice

... (A) you must be eating the same number of hot dogs and hamburgers. (B) the price of a hot dog and the price of a hamburger must be the same. (C) your total utility from all previous hot dogs eaten must be the same as your total utility from all previous hamburgers eaten. (D) Both answers B and C are ...

... (A) you must be eating the same number of hot dogs and hamburgers. (B) the price of a hot dog and the price of a hamburger must be the same. (C) your total utility from all previous hot dogs eaten must be the same as your total utility from all previous hamburgers eaten. (D) Both answers B and C are ...

1 The original Phillips curve and its Policy Implications Phillips

... expectations in line with reality, there is no trade-off between rates of inflation and rate of unemployment. In the long-run, economy moves along the Long-Run Phillips Curve. However, some new Keynesians have come up with a different idea from their empirical observation of some European countries ...

... expectations in line with reality, there is no trade-off between rates of inflation and rate of unemployment. In the long-run, economy moves along the Long-Run Phillips Curve. However, some new Keynesians have come up with a different idea from their empirical observation of some European countries ...

multiple choice

... (A) you must be eating the same number of hot dogs and hamburgers. (B) the price of a hot dog and the price of a hamburger must be the same. (C) your total utility from all previous hot dogs eaten must be the same as your total utility from all previous hamburgers eaten. (D) Both answers B and C are ...

... (A) you must be eating the same number of hot dogs and hamburgers. (B) the price of a hot dog and the price of a hamburger must be the same. (C) your total utility from all previous hot dogs eaten must be the same as your total utility from all previous hamburgers eaten. (D) Both answers B and C are ...

Federal Reserve and Monetary Policy

... and more accurately than, individuals making decisions by themselves. Moreover, it was not the performance of the individual committee members that contributed to the superiority of committee decisions—the actual process of having meetings and discussions appears to have improved the group’s overall ...

... and more accurately than, individuals making decisions by themselves. Moreover, it was not the performance of the individual committee members that contributed to the superiority of committee decisions—the actual process of having meetings and discussions appears to have improved the group’s overall ...

country spreads in emerging countries: who drives whom?

... Until this point, I have used intuitive arguments to claim that the impulse response functions implied by the estimated VAR system make sense. I now would like to show that those impulse response functions are sensible in terms of a fully fledged dynamic general equilibrium model of an emerging coun ...

... Until this point, I have used intuitive arguments to claim that the impulse response functions implied by the estimated VAR system make sense. I now would like to show that those impulse response functions are sensible in terms of a fully fledged dynamic general equilibrium model of an emerging coun ...

MM`s dividend irrelevance theory says that dividend policy does not

... distributions in the form of dividends). Gaza forecasts that its net income will be $12 million this year. The company has no depreciation expense so its net cash flow is $12 million, and its target capital structure consists of 70 percent equity and 30 percent debt. Gaza capital budget is $10 milli ...

... distributions in the form of dividends). Gaza forecasts that its net income will be $12 million this year. The company has no depreciation expense so its net cash flow is $12 million, and its target capital structure consists of 70 percent equity and 30 percent debt. Gaza capital budget is $10 milli ...

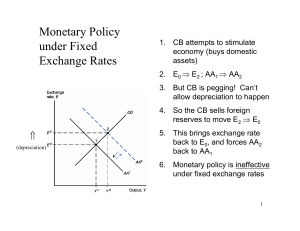

Fixed Exchange Rates and Macroeconomic Policy

... the exchange rate for which the output market is in short-run equilibrium (aggregate demand = aggregate output). • It slopes upward because a rise in the exchange rate (depreciation) causes output, Y, to rise – If P and P* are fixed in the short run, a depreciation of the domestic currency increases ...

... the exchange rate for which the output market is in short-run equilibrium (aggregate demand = aggregate output). • It slopes upward because a rise in the exchange rate (depreciation) causes output, Y, to rise – If P and P* are fixed in the short run, a depreciation of the domestic currency increases ...

Inverted Real Yields vs. Gold

... In the U.K, a weak Pound will increase the price of imports by as much as 10 percent for a nation that imports up to 60 percent of its goods. In the United States, Donald Trump’s fiscal policy is expected to increase wages and spending in the economy - leading to higher wages and inflation. ...

... In the U.K, a weak Pound will increase the price of imports by as much as 10 percent for a nation that imports up to 60 percent of its goods. In the United States, Donald Trump’s fiscal policy is expected to increase wages and spending in the economy - leading to higher wages and inflation. ...

... the global economy and in developed countries, lower international prices for some commodities, including oil, maize and wheat, and increased private consumption, remittances and bank lending. As inflation remained low, the Board brought the base rate down further still at its sessions in both Novem ...

Intermediate Macroeconomics

... The real rental price of capital equals f ’(k). Hence these two countries have identical real rental price of capital. ...

... The real rental price of capital equals f ’(k). Hence these two countries have identical real rental price of capital. ...

Presentation to a Seattle Community Leaders Luncheon Marriott Waterfront, Seattle, Washington

... to a new higher level is likely to have only a transitory effect on output growth. In other words, even if oil prices remained at a high level, real GDP growth would be expected to bounce back. In addition, the economy continues to benefit from substantial monetary policy stimulus and a continuing n ...

... to a new higher level is likely to have only a transitory effect on output growth. In other words, even if oil prices remained at a high level, real GDP growth would be expected to bounce back. In addition, the economy continues to benefit from substantial monetary policy stimulus and a continuing n ...

CFA Outlook, Q315 August Update

... It is amazing that there is a consensus that the U.S. economy is improving and, in fact, getting stronger. Along with the July 30th data on second quarter GDP came revisions to the more recent data. It showed a downward revision in GDP growth from 2011 to 2014 to an even more anemic 2.0% annual grow ...

... It is amazing that there is a consensus that the U.S. economy is improving and, in fact, getting stronger. Along with the July 30th data on second quarter GDP came revisions to the more recent data. It showed a downward revision in GDP growth from 2011 to 2014 to an even more anemic 2.0% annual grow ...

... conjunction with a larger services surplus (8.7% of GDP in 2014 as compared with 8.2% in 2013). These two factors were offset somewhat by an increase in the income account deficit (3.7% of GDP in 2014 versus 2.4% in 2013). Goods trade slowed in 2014 and exports contracted by 3.6% in nominal terms, s ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.