The Savings Plan Formula The savings plan formula

... certain amount of years), what regular payments are needed to reach the goal? Ex.3 College savings plan at 7%. You want to build a $100, 000 college fund in 18 years by making a regular, end-of-month deposits. Assuming an AP R of 7%, calculate how much you should deposit monthly. How much of the fin ...

... certain amount of years), what regular payments are needed to reach the goal? Ex.3 College savings plan at 7%. You want to build a $100, 000 college fund in 18 years by making a regular, end-of-month deposits. Assuming an AP R of 7%, calculate how much you should deposit monthly. How much of the fin ...

Midterm Exam 1 Answers

... e) cannot be determined with the information given. 6. Which of the following $1,000 face-value securities has the highest yield to maturity? a) A 5 percent coupon bond selling for $1,000 b) A 10 percent coupon bond selling for $1,000 c) A 12 percent coupon bond selling for $1,000 d) A 12 percent co ...

... e) cannot be determined with the information given. 6. Which of the following $1,000 face-value securities has the highest yield to maturity? a) A 5 percent coupon bond selling for $1,000 b) A 10 percent coupon bond selling for $1,000 c) A 12 percent coupon bond selling for $1,000 d) A 12 percent co ...

c21

... B) a desired level of trade or capital flows. C) where the IS and BP curve intersect. D) a domestic rate of growth consistent with a low unemployment rate. Answer: D 16) Many economists argue that the sharp reduction in U.S. net exports in the mid 1980s was due to A) expansionary U.S. monetary polic ...

... B) a desired level of trade or capital flows. C) where the IS and BP curve intersect. D) a domestic rate of growth consistent with a low unemployment rate. Answer: D 16) Many economists argue that the sharp reduction in U.S. net exports in the mid 1980s was due to A) expansionary U.S. monetary polic ...

Chapter 23 Transmission Mechanisms of Monetary Policy

... with a fall or a rise in short-term nominal interest rates • Other asset prices besides those on shortterm debt instruments contain important information about the stance of monetary policy because they are important elements in various monetary policy transmission mechanisms Copyright © 2010 Pearso ...

... with a fall or a rise in short-term nominal interest rates • Other asset prices besides those on shortterm debt instruments contain important information about the stance of monetary policy because they are important elements in various monetary policy transmission mechanisms Copyright © 2010 Pearso ...

SU14_2630_Study Guid..

... 37. What is the difference between gross and net public debt? Gross public debt includes the total amount owed to all holders of government securities. Net public debt is equal to gross public debt minus intragovernmental debt (the amount owed to holders of public securities outside of the governmen ...

... 37. What is the difference between gross and net public debt? Gross public debt includes the total amount owed to all holders of government securities. Net public debt is equal to gross public debt minus intragovernmental debt (the amount owed to holders of public securities outside of the governmen ...

Policy - QC Economics

... • Changes in velocity are not likely to offset changes in the money supply. • Changes in the money supply will largely determine changes in aggregate demand, and therefore changes in Real GDP and the price level. • An increase in the money supply will raise aggregate demand and increase both Real GD ...

... • Changes in velocity are not likely to offset changes in the money supply. • Changes in the money supply will largely determine changes in aggregate demand, and therefore changes in Real GDP and the price level. • An increase in the money supply will raise aggregate demand and increase both Real GD ...

The Determination of Exchange Rate

... Political instability negatively affects a currency Confidence and faith in the currency is importantdespite a huge budget deficit, trade deficit and debt the mighty U.S. Dollar prevails-do you know ...

... Political instability negatively affects a currency Confidence and faith in the currency is importantdespite a huge budget deficit, trade deficit and debt the mighty U.S. Dollar prevails-do you know ...

View/Open

... of the foregoing, these authors assumed that the world was made up of economies producing differentiated goods (that is to say, goods that were not perfect substitutes) but which were subject to a high level of mobility in their capital flows. These authors proceeded to analyze the effects derived f ...

... of the foregoing, these authors assumed that the world was made up of economies producing differentiated goods (that is to say, goods that were not perfect substitutes) but which were subject to a high level of mobility in their capital flows. These authors proceeded to analyze the effects derived f ...

MARKET COMMENTARY – 1st Quarter, 2013 The first quarter of

... markets strongly outperformed all other asset classes. Investors have become acutely aware of the developed world’s coordinated central bank policies targeting inflation (U.S., Europe and Japan); as a result, there has been a powerful psychological shift in investor sentiment, pivoting from a stance ...

... markets strongly outperformed all other asset classes. Investors have become acutely aware of the developed world’s coordinated central bank policies targeting inflation (U.S., Europe and Japan); as a result, there has been a powerful psychological shift in investor sentiment, pivoting from a stance ...

Monetary Policy and Aggregate Demand

... in which the Fed has convened between its regularly scheduled meetings to adjust key monetary policy tools. This was especially true in 2001, when the Fed met and reduced the federal funds rate 10 times in an effort to circumvent a recession. • Money supply aggregate supply. Students may mistakenly ...

... in which the Fed has convened between its regularly scheduled meetings to adjust key monetary policy tools. This was especially true in 2001, when the Fed met and reduced the federal funds rate 10 times in an effort to circumvent a recession. • Money supply aggregate supply. Students may mistakenly ...

Chapter 15 Monetary Policy

... people don’t have jobs. Does not account for Velocity of money; During inflation, when the Fed restrains the money supply, velocity may increase. During a recession, when the Fed increases the money supply, the public may hold more money due to lower interest rates & fear. Less Control by the Fed in ...

... people don’t have jobs. Does not account for Velocity of money; During inflation, when the Fed restrains the money supply, velocity may increase. During a recession, when the Fed increases the money supply, the public may hold more money due to lower interest rates & fear. Less Control by the Fed in ...

Nominal - Phoenix Union High School District

... At the Movies: Real v. Nominal Movie Box Office Sales ...

... At the Movies: Real v. Nominal Movie Box Office Sales ...

1 Danger of Deflation and Stagflation by Gustav A. Horn Düsseldorf

... and then fiscal policy should enter a smoother consolidation path. Monetary policy should then take back all the quantitative easing immediately by starting appropriate open market operations. Interest rates then should be increased only slowly as long as the upturn is not steady. Wages will then po ...

... and then fiscal policy should enter a smoother consolidation path. Monetary policy should then take back all the quantitative easing immediately by starting appropriate open market operations. Interest rates then should be increased only slowly as long as the upturn is not steady. Wages will then po ...

Name 1 In The General Theory of Employment, Interest, and Money

... A. falling prices redistribute income from creditors to debtors, which leads to a decline in the APC. B. falling prices redistribute income from debtors to creditors, which leads to a decline in the APC. C. a rise in the saving rate leads to a lower amount of real debt in the economy, depressing con ...

... A. falling prices redistribute income from creditors to debtors, which leads to a decline in the APC. B. falling prices redistribute income from debtors to creditors, which leads to a decline in the APC. C. a rise in the saving rate leads to a lower amount of real debt in the economy, depressing con ...

1. "Income Inequality and Human Wellbeing"

... The author seeks to investigate the relationship between the various factors which affect the well being and Gini Coefficient - a measure of statistical income distribution of a country. It is the author’s hypothesis that large income disparity causes social tensions and problems. This in turn leads ...

... The author seeks to investigate the relationship between the various factors which affect the well being and Gini Coefficient - a measure of statistical income distribution of a country. It is the author’s hypothesis that large income disparity causes social tensions and problems. This in turn leads ...

Quiz 1 Solution Set 14.02 Macroeconomics March 8, 2006

... b. “All the central bank can do by increasing the money supply is to decrease the interest rate down to zero, but no further.” Do you agree or disagree? Ans: The interest rate cannot be negative, because individuals will not be willing to hold any bonds if the rate is below zero. c. Look at the figu ...

... b. “All the central bank can do by increasing the money supply is to decrease the interest rate down to zero, but no further.” Do you agree or disagree? Ans: The interest rate cannot be negative, because individuals will not be willing to hold any bonds if the rate is below zero. c. Look at the figu ...

Quarterly market and economic review

... In contrast, inflation-linked bonds (ILBs) still seem to ...

... In contrast, inflation-linked bonds (ILBs) still seem to ...

The Role of Macro-Economic Policies in an Era

... applied vigorously, and in a coordinated way in 2009, to deal successfully with the collapse in global demand. But since 2011, this policy paradigm has not been successful in restoring growth to its previous long-run path, despite ultra-low policy interest rates and the implementation of unconventio ...

... applied vigorously, and in a coordinated way in 2009, to deal successfully with the collapse in global demand. But since 2011, this policy paradigm has not been successful in restoring growth to its previous long-run path, despite ultra-low policy interest rates and the implementation of unconventio ...

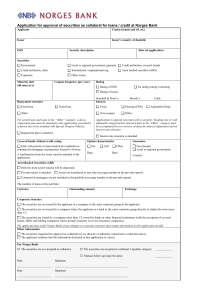

Søknadsskjema for godkjenning av obligasjoner og

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

... The securities are not issued by the applicant or a company in the same corporate group as the applicant. The securities are not issued by a company where the applicant or a bank in the same corporate group directly or indirectly owns more than 1/3. The securities are issued by a company more than 1 ...

Economics Paper-II

... which may disclose in any way your identity, you will render yourself liable to disqualification. Do not tamper or fold the OMR Sheet in anyway. If you do so your OMR Sheet will not be ...

... which may disclose in any way your identity, you will render yourself liable to disqualification. Do not tamper or fold the OMR Sheet in anyway. If you do so your OMR Sheet will not be ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.