Five questions about the Federal Reserve and monetary policy

... interest rates, which supports the economy by inducing businesses to invest more in new capital goods and by leading households to spend more on houses, autos, and other goods and services. Likewise, if the economy is overheating, the Fed can raise interest rates to help cool total demand and constr ...

... interest rates, which supports the economy by inducing businesses to invest more in new capital goods and by leading households to spend more on houses, autos, and other goods and services. Likewise, if the economy is overheating, the Fed can raise interest rates to help cool total demand and constr ...

Exercise Sheet 1

... (a) Derive an expression for the marginal product of labor. How does an increase in the amount of human capital affect the marginal product of labor? Can you give some intuition why this might be the case? (b) Derive an expression for the marginal product of human capital. How does an increase in th ...

... (a) Derive an expression for the marginal product of labor. How does an increase in the amount of human capital affect the marginal product of labor? Can you give some intuition why this might be the case? (b) Derive an expression for the marginal product of human capital. How does an increase in th ...

Interest Rates - Cloudfront.net

... what consumers are really paying) 2. New Products- The CPI market basket may not include the newest consumer products. (Result: CPI measures prices but not the increase in choices) 3. Product Quality- The CPI ignores both improvements and decline in product quality. (Result: CPI may suggest that pri ...

... what consumers are really paying) 2. New Products- The CPI market basket may not include the newest consumer products. (Result: CPI measures prices but not the increase in choices) 3. Product Quality- The CPI ignores both improvements and decline in product quality. (Result: CPI may suggest that pri ...

Document

... b. The government can only set rax rates so high before people prefer not to work. c. Unskilled workers will have a lower turnover rate than skilled workers. d. D. Workers will be paid less than their reservation wage. ...

... b. The government can only set rax rates so high before people prefer not to work. c. Unskilled workers will have a lower turnover rate than skilled workers. d. D. Workers will be paid less than their reservation wage. ...

Short-run Phillips Curve

... changes in the expected rate of inflation. 2. The long-run Phillips curve, which shows the relationship between unemployment and inflation once expectations have had time to adjust, is vertical. It defines the nonaccelerating inflation rate of unemployment, or NAIRU, which is equal to the natural ra ...

... changes in the expected rate of inflation. 2. The long-run Phillips curve, which shows the relationship between unemployment and inflation once expectations have had time to adjust, is vertical. It defines the nonaccelerating inflation rate of unemployment, or NAIRU, which is equal to the natural ra ...

FIN APPRAISAL Agriculture Projects

... lending rate Equal to lending rate Lower than the lending rate ...

... lending rate Equal to lending rate Lower than the lending rate ...

Business Cycles

... since World War II, the federal government has actively tried to use macroeconomic policy measures to end recessions and prolong expansions. • The increased stability of the financial system. During the years after the Great Depression, institutional changes resulted in increased stability in the ...

... since World War II, the federal government has actively tried to use macroeconomic policy measures to end recessions and prolong expansions. • The increased stability of the financial system. During the years after the Great Depression, institutional changes resulted in increased stability in the ...

Getting Back on Track: Macroeconomic Policy Lessons from the Financial Crisis

... the dark line in the figure representing what policy would have been had it followed the principles that worked well for the previous 20 years. That is, interest rates would not have reached such a low level and they would have returned much sooner to the neutral level. So in this sense there was a ...

... the dark line in the figure representing what policy would have been had it followed the principles that worked well for the previous 20 years. That is, interest rates would not have reached such a low level and they would have returned much sooner to the neutral level. So in this sense there was a ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... further in the next few years as the government gradually took over all external debt in the course of sustaining failing financial institutions. In 1980 about half of the external debt was owed by the public sector; by 1985 that share had increased to 82 percent. 1.1.2 From Martinez de Hoz to Alfon ...

... further in the next few years as the government gradually took over all external debt in the course of sustaining failing financial institutions. In 1980 about half of the external debt was owed by the public sector; by 1985 that share had increased to 82 percent. 1.1.2 From Martinez de Hoz to Alfon ...

Monetary policy and asset prices

... related to technology. Basically, equation (2) says that the price level is proportional to money supply or that the rate of inflation is proportional to the rate of money creation. In practical terms, there are some complicating factors: short term supply and demand shocks can cause deviations from ...

... related to technology. Basically, equation (2) says that the price level is proportional to money supply or that the rate of inflation is proportional to the rate of money creation. In practical terms, there are some complicating factors: short term supply and demand shocks can cause deviations from ...

The Demand for Money

... financial assets that mature within six months or less. Long-term interest rates are interest rates on financial assets that mature a number of years in the future. ...

... financial assets that mature within six months or less. Long-term interest rates are interest rates on financial assets that mature a number of years in the future. ...

NBER WORKING PAPER SERIES U.S. BUDGET DEFICITS AND RESOLVING THE POLITICAL ECONOMY PUZZLE

... *professor of Economics, Harvard University and President of the National Bureau of Economic Research. This paper will be presented at the annual meetings of the American Economic Association on December 29, 1985 in the session on The International Dimensions of Fiscal Policies. I am grateful to Rud ...

... *professor of Economics, Harvard University and President of the National Bureau of Economic Research. This paper will be presented at the annual meetings of the American Economic Association on December 29, 1985 in the session on The International Dimensions of Fiscal Policies. I am grateful to Rud ...

Chapter 27 Key Question Solutions

... (Appendix to Chapter 1). MPC and MPS measure changes in consumption and saving as income changes; they are the slopes of the consumption and saving schedules. For straight-line consumption and saving schedules, these slopes do not change as the level of income changes; the slopes and thus the MPC an ...

... (Appendix to Chapter 1). MPC and MPS measure changes in consumption and saving as income changes; they are the slopes of the consumption and saving schedules. For straight-line consumption and saving schedules, these slopes do not change as the level of income changes; the slopes and thus the MPC an ...

feedback-rule policy - Iowa State University Department of Economics

... of the Treasury for International Affairs in the Bush administration, the Taylor rule says Set the federal funds rate equal to the target inflation rate plus 2.5 percent plus one half of the gap between the actual inflation rate and the target inflation rate plus one half of the percentage deviation ...

... of the Treasury for International Affairs in the Bush administration, the Taylor rule says Set the federal funds rate equal to the target inflation rate plus 2.5 percent plus one half of the gap between the actual inflation rate and the target inflation rate plus one half of the percentage deviation ...

Aggregate Demand and Aggregate Supply

... 7. Which of the following statements is true regarding the LRAS curve? The LRAS curve a. shifts left when the natural rate of unemployment falls. b. is vertical because an equal change in all nominal prices and wages leaves output unaffected. c. is positively sloped because price expectations and wa ...

... 7. Which of the following statements is true regarding the LRAS curve? The LRAS curve a. shifts left when the natural rate of unemployment falls. b. is vertical because an equal change in all nominal prices and wages leaves output unaffected. c. is positively sloped because price expectations and wa ...

Explanations

... One can define GDP, a measure of overall economic activity, as the dollar value of final goods and services produced in an economy in a period of time. This is the product approach. Since output produced is also purchased, one could also measure by expenditure. And since revenues that flow into ...

... One can define GDP, a measure of overall economic activity, as the dollar value of final goods and services produced in an economy in a period of time. This is the product approach. Since output produced is also purchased, one could also measure by expenditure. And since revenues that flow into ...

LCcarG640_en.pdf

... industry, which is the most significant sector in most countries. They are, therefore, susceptible to fluctuations in commodity prices on international markets. The Caribbean region is also prone to natural disasters, in particular, hurricanes, which can constrain efforts at increasing output and in ...

... industry, which is the most significant sector in most countries. They are, therefore, susceptible to fluctuations in commodity prices on international markets. The Caribbean region is also prone to natural disasters, in particular, hurricanes, which can constrain efforts at increasing output and in ...

Economic Instability - Federal Reserve Bank of Dallas

... – Too much money chasing too few goods – “Inflation is always and everywhere a monetary ...

... – Too much money chasing too few goods – “Inflation is always and everywhere a monetary ...

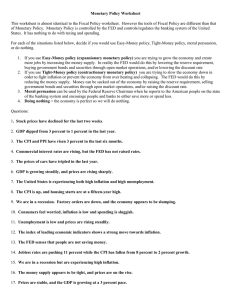

Monetary Policy Worksheet

... In reality the FED would do this by lowering the reserve requirement, buying government bonds and securities through open market operations, and/or lowering the discount rate 2. If you use Tight-Money policy you are trying to slow the economy down in order to fight inflation or prevent the economy f ...

... In reality the FED would do this by lowering the reserve requirement, buying government bonds and securities through open market operations, and/or lowering the discount rate 2. If you use Tight-Money policy you are trying to slow the economy down in order to fight inflation or prevent the economy f ...

www.theallpapers.com

... Some economists, however, consider small stores such as Mr Kojima’s to be rather outdated. They also think the inefficiency of these small stores may be one possible cause of the low level of productivity of Japan’s service sector. (a) Describe two features of a co-operative. ...

... Some economists, however, consider small stores such as Mr Kojima’s to be rather outdated. They also think the inefficiency of these small stores may be one possible cause of the low level of productivity of Japan’s service sector. (a) Describe two features of a co-operative. ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.