Chapter 13 - University of Alberta

... a negative relationship between the levels of inflation and unemployment holds as long as expected inflation and the natural unemployment rate are approximately ...

... a negative relationship between the levels of inflation and unemployment holds as long as expected inflation and the natural unemployment rate are approximately ...

The Political Business Cycle

... would grow steadily if the money supply grew steadily, was influential for a time but was eventually rejected by many macroeconomists. 4. The natural rate hypothesis became almost universally accepted, limiting the role of macroeconomic policy to stabilizing the economy rather than seeking a permane ...

... would grow steadily if the money supply grew steadily, was influential for a time but was eventually rejected by many macroeconomists. 4. The natural rate hypothesis became almost universally accepted, limiting the role of macroeconomic policy to stabilizing the economy rather than seeking a permane ...

OnePath Diversified Fixed Interest

... The appointment of each new, underlying investment manager becomes effective on or around 1 April 2012. We will conduct a transition of the underlying securities (assets) to each new, underlying investment manager. This transition will be conducted over a period of time such that each new manager’s ...

... The appointment of each new, underlying investment manager becomes effective on or around 1 April 2012. We will conduct a transition of the underlying securities (assets) to each new, underlying investment manager. This transition will be conducted over a period of time such that each new manager’s ...

8 Economic policy_20..

... ─ These tools are used as exceptional and short term: ─ Mandatory structure of assets and liability for commercial banks. ─ Credits, loans limits. One of the most tough direct tool. ─ Obligatory deposits – obligation for state institutions to have account at the central bank (for example revenues au ...

... ─ These tools are used as exceptional and short term: ─ Mandatory structure of assets and liability for commercial banks. ─ Credits, loans limits. One of the most tough direct tool. ─ Obligatory deposits – obligation for state institutions to have account at the central bank (for example revenues au ...

The Aggregate Demand for Housing in the U.S.

... – P-value is probability of rejecting null hypothesis, confidence level of 99.99% ...

... – P-value is probability of rejecting null hypothesis, confidence level of 99.99% ...

The AD-AS Model and Monetary Policy

... Open market operations are the Bank of Canada’s buying and selling of federal government securities. ...

... Open market operations are the Bank of Canada’s buying and selling of federal government securities. ...

homework 2 (chapter 33) eco 11 fall 2006 udayan roy

... 3. Which of the sentences concerning the aggregate demand and aggregate supply model is correct? a. The aggregate demand and supply model is nothing more than a large version of the model of market demand and supply. b. The price level adjusts to bring aggregate demand and supply into balance. c. Th ...

... 3. Which of the sentences concerning the aggregate demand and aggregate supply model is correct? a. The aggregate demand and supply model is nothing more than a large version of the model of market demand and supply. b. The price level adjusts to bring aggregate demand and supply into balance. c. Th ...

Special Focus: Brazil and Argentina - Inter

... Debt Sustainability (required primary surplus in % of GDP, with 70% Haircut on Defaulted Debt, includes redollarization costs under worst case ...

... Debt Sustainability (required primary surplus in % of GDP, with 70% Haircut on Defaulted Debt, includes redollarization costs under worst case ...

effect of government deficit spending on the gdp

... The relationship between government deficit spending and the growth domestic product is of extreme importance for economic policy making, especially in times of economic downturns as has been experienced in the US and around the world in recent years. The literature is mixed on this issue. There are ...

... The relationship between government deficit spending and the growth domestic product is of extreme importance for economic policy making, especially in times of economic downturns as has been experienced in the US and around the world in recent years. The literature is mixed on this issue. There are ...

Chapters 21-25

... knowledge about the way the world behaves. Uncertainty relates to the questions of how to deal with the unprecedented, and whether the world will behave tomorrow the way it behaved in the past. For investors, not being able to distinguish between risk and uncertainty is hazardous to their financial ...

... knowledge about the way the world behaves. Uncertainty relates to the questions of how to deal with the unprecedented, and whether the world will behave tomorrow the way it behaved in the past. For investors, not being able to distinguish between risk and uncertainty is hazardous to their financial ...

Chapter 16—Gaining from International Trade

... 140. Which of the following will make it difficult to institute fiscal policy in a stabilizing manner? a. Politicians will find it more attractive to raise taxes than to increase spending. b. Politicians will find it attractive to increase taxes during a recession, but they will be reluctant to redu ...

... 140. Which of the following will make it difficult to institute fiscal policy in a stabilizing manner? a. Politicians will find it more attractive to raise taxes than to increase spending. b. Politicians will find it attractive to increase taxes during a recession, but they will be reluctant to redu ...

purposeinvest.com purpose tactical investment grade bond fund

... information about the investment fund. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in share/unit value and reinvestment of all distributions and do not take into account sales, redemption, distributio ...

... information about the investment fund. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in share/unit value and reinvestment of all distributions and do not take into account sales, redemption, distributio ...

AP Macro Study Guide - Phoenix Union High School District

... controlling the U.S banking system (and the money supply). The Board of Governors has seven members, appointed by the President with confirmation of the Senate. It directs the activities of the 12 Federal Reserve Banks, which then control the nation’s banks. There are several entities that help the ...

... controlling the U.S banking system (and the money supply). The Board of Governors has seven members, appointed by the President with confirmation of the Senate. It directs the activities of the 12 Federal Reserve Banks, which then control the nation’s banks. There are several entities that help the ...

Fears of Stagflation Return As Price Increases Gain Pace

... inflation-protected Treasury bonds, has jumped since the Fed declared in early January that supporting growth would be a more important focus than holding down inflation. (Fed officials believe technical details in the way the bonds trade may explain some of the jump.) And professional forecasters s ...

... inflation-protected Treasury bonds, has jumped since the Fed declared in early January that supporting growth would be a more important focus than holding down inflation. (Fed officials believe technical details in the way the bonds trade may explain some of the jump.) And professional forecasters s ...

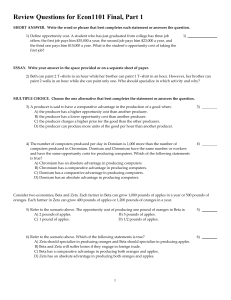

Econ 1101 Practice Questions Final Exam

... ESSAY. Write your answer in the space provided or on a separate sheet of paper. 8) What is meant by the term ʺmarginal analysisʺ? Suppose an individual has to choose between renting four apartments at different distances from his place of work. The individual has to commute to work on five days of ...

... ESSAY. Write your answer in the space provided or on a separate sheet of paper. 8) What is meant by the term ʺmarginal analysisʺ? Suppose an individual has to choose between renting four apartments at different distances from his place of work. The individual has to commute to work on five days of ...

Chapter 1

... • Evidence suggests that money plays an important role in generating business cycles • Recessions (unemployment) and expansions affect all of us • Monetary Theory ties changes in the money supply to changes in aggregate economic activity and the price level ...

... • Evidence suggests that money plays an important role in generating business cycles • Recessions (unemployment) and expansions affect all of us • Monetary Theory ties changes in the money supply to changes in aggregate economic activity and the price level ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.