Restoring the Pre-WWI Economy

... pound sterling was worth only $3.81, some twenty-five percent less than its pre-World War I parity of $4.86. Why was the gold standard not restored immediately after the end of the war? Because of the enormous debts that had been run up during the war. The chief problem of European governments was d ...

... pound sterling was worth only $3.81, some twenty-five percent less than its pre-World War I parity of $4.86. Why was the gold standard not restored immediately after the end of the war? Because of the enormous debts that had been run up during the war. The chief problem of European governments was d ...

chapter 8. the natural rate of unemployment and the phillips curve

... competition may erode such employment protection in the future. Second, the natural rate of unemployment varies over time. The text argues that the U.S. natural rate fell in the last half of the 1990s as a result of a variety of factors, some of which may have temporary effects on the natural rate a ...

... competition may erode such employment protection in the future. Second, the natural rate of unemployment varies over time. The text argues that the U.S. natural rate fell in the last half of the 1990s as a result of a variety of factors, some of which may have temporary effects on the natural rate a ...

Practice Test Unit IV

... 18. The crowding-out effect of expansionary fiscal policy suggests that: A. tax increases are paid primarily out of saving and therefore are not an effective fiscal device. B. increases in government spending financed through borrowing will increase the interest rate and thereby reduce investment. ...

... 18. The crowding-out effect of expansionary fiscal policy suggests that: A. tax increases are paid primarily out of saving and therefore are not an effective fiscal device. B. increases in government spending financed through borrowing will increase the interest rate and thereby reduce investment. ...

Robert E. Cumby Working POLICY UIDER

... in the long run, and to result in a permanent appreciation of the current account exchange rate. This result is similar in spirit to the findings of Argy and Porter although they focus on output effects rather than price level ...

... in the long run, and to result in a permanent appreciation of the current account exchange rate. This result is similar in spirit to the findings of Argy and Porter although they focus on output effects rather than price level ...

presentation

... A negative economic openness-inflation relation • This result, it is argued, derives from the fact that monetary authorities in more open economies face greater costs for high and variable inflation. • We argue that, within a country, policymakers can also be expected to react to inflationary pressu ...

... A negative economic openness-inflation relation • This result, it is argued, derives from the fact that monetary authorities in more open economies face greater costs for high and variable inflation. • We argue that, within a country, policymakers can also be expected to react to inflationary pressu ...

Quarterly Bulletin April-June 2011

... bank crediting the accounts of the commercial banks and other financial companies from which it bought the assets, thereby creating money electronically. This is done with the hope that the additional money in the economy will promote spending, leading to an increase in economic activity. QE is an e ...

... bank crediting the accounts of the commercial banks and other financial companies from which it bought the assets, thereby creating money electronically. This is done with the hope that the additional money in the economy will promote spending, leading to an increase in economic activity. QE is an e ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... and a series of natural disasters. The buildup of macroeconomic disequilibria was also closely associated with economic policy. In the first years of the revolution, the government adopted an expansionary public expenditure program to improve the poor social record inherited from the Somoza years an ...

... and a series of natural disasters. The buildup of macroeconomic disequilibria was also closely associated with economic policy. In the first years of the revolution, the government adopted an expansionary public expenditure program to improve the poor social record inherited from the Somoza years an ...

Decision regarding the countercyclical buffer rate

... Lending to corporates from monetary financial institutions (MFIs) increased at the same time as the firms’ market funding decreased. FI currently does not see any signs of excessive lending in the business sector. Total lending amounted in Q3 2016 to 145 per cent of GDP. The credit-to-GDP gap, calcu ...

... Lending to corporates from monetary financial institutions (MFIs) increased at the same time as the firms’ market funding decreased. FI currently does not see any signs of excessive lending in the business sector. Total lending amounted in Q3 2016 to 145 per cent of GDP. The credit-to-GDP gap, calcu ...

Chapter 1 - It works!

... • Interest rates are the price of money • Prior to 1980, the rate of money growth and the interest rate on long-term Treasure bonds were closely tied • Since then, the relationship is less clear but still an important determinant of interest rates Copyright © 2007 Pearson Addison-Wesley. All rights ...

... • Interest rates are the price of money • Prior to 1980, the rate of money growth and the interest rate on long-term Treasure bonds were closely tied • Since then, the relationship is less clear but still an important determinant of interest rates Copyright © 2007 Pearson Addison-Wesley. All rights ...

Answers

... It takes Steve 6 minutes (=60/10) to make one unit of consumption today and 5.88 minutes (=60/10.2) to make one unit of consumption tomorrow. If Steve wants one more unit of consumption today, he must forego 1.02 units of consumption tomorrow (=6/5.88). The interest rate for Steve is 2 percent. It t ...

... It takes Steve 6 minutes (=60/10) to make one unit of consumption today and 5.88 minutes (=60/10.2) to make one unit of consumption tomorrow. If Steve wants one more unit of consumption today, he must forego 1.02 units of consumption tomorrow (=6/5.88). The interest rate for Steve is 2 percent. It t ...

NBER WORKING PAPER SERIES Victor Zarnowitz

... The curve is assumed to have a negative slope that diminishes in absolute value to the right. That is, it is steep in the region of highest inflation and lowest unemployment rates, fiat in the region of lower inflation and higher unemployment. This implies that inflation can rise indefinitely when e ...

... The curve is assumed to have a negative slope that diminishes in absolute value to the right. That is, it is steep in the region of highest inflation and lowest unemployment rates, fiat in the region of lower inflation and higher unemployment. This implies that inflation can rise indefinitely when e ...

Bonds and Their Valuation

... by par to get dollar payment of interest. Maturity date – years until the bond must be repaid. Issue date – when the bond was issued. Yield to maturity - rate of return earned on a bond held until maturity (also called the “promised yield”). ...

... by par to get dollar payment of interest. Maturity date – years until the bond must be repaid. Issue date – when the bond was issued. Yield to maturity - rate of return earned on a bond held until maturity (also called the “promised yield”). ...

Bank of England Inflation Report May 2014 Prospects for inflation

... judgement is that unemployment would lie within the darkest central band on only 30 of those occasions. The fan chart is constructed so that outturns are also expected to lie within each pair of the lighter blue areas on 30 occasions. In any particular quarter of the forecast period, unemployment is ...

... judgement is that unemployment would lie within the darkest central band on only 30 of those occasions. The fan chart is constructed so that outturns are also expected to lie within each pair of the lighter blue areas on 30 occasions. In any particular quarter of the forecast period, unemployment is ...

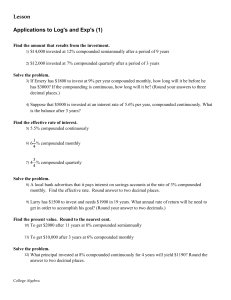

Lesson Applications to Log`s and Exp`s (1)

... bought a diamond ring appraised at $1000 at an antique store. If diamonds have appreciated in value at an annual rate of 11%, what was the value of the ring 6 years ago? (Round your answer to the nearest dollar.) ...

... bought a diamond ring appraised at $1000 at an antique store. If diamonds have appreciated in value at an annual rate of 11%, what was the value of the ring 6 years ago? (Round your answer to the nearest dollar.) ...

THE GEORGE WASHINGTON UNIVERSITY

... 9B. (2) In which year is the country best described as financing its government budget deficit with domestic saving? ...

... 9B. (2) In which year is the country best described as financing its government budget deficit with domestic saving? ...

Exchange-Rate-Variations-And-Inflation-In-The

... more people there are unemployed, the less the public as a whole will spend on goods and services. Central Banks typically have little difficulty adjusting the available money supply to accommodate changes in the demand for money due to business transactions. The speculative demand for money is much ...

... more people there are unemployed, the less the public as a whole will spend on goods and services. Central Banks typically have little difficulty adjusting the available money supply to accommodate changes in the demand for money due to business transactions. The speculative demand for money is much ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.