5 - Weber State University

... A) cannot; it excludes non-discretionary spending changes B) can; it includes non-discretionary spending changes C) cannot; it includes non-discretionary spending changes D) can; it excludes automatic stabilization expenditures 31) The actual government budget surplus ____________ be used to determi ...

... A) cannot; it excludes non-discretionary spending changes B) can; it includes non-discretionary spending changes C) cannot; it includes non-discretionary spending changes D) can; it excludes automatic stabilization expenditures 31) The actual government budget surplus ____________ be used to determi ...

Household Debt in Turkey: The Critical Threshold for the

... the increase in indebtedness of the households would imply a transfer of income from the workers to capitalists/rentiers with lower propensity to consume, thus leading to lower output growth rates in the short-run. In the long-run the ultimate effect depends on mainly the relative levels of initial ...

... the increase in indebtedness of the households would imply a transfer of income from the workers to capitalists/rentiers with lower propensity to consume, thus leading to lower output growth rates in the short-run. In the long-run the ultimate effect depends on mainly the relative levels of initial ...

Lecture 4

... (and vice versa) • When the stock market booms, households become wealthier and this stimulates consumer spending. • Rising share prices also make it more attractive for firms to issue new shares and this facilitates increased investment spending. • Central banks can offset these expansionary effect ...

... (and vice versa) • When the stock market booms, households become wealthier and this stimulates consumer spending. • Rising share prices also make it more attractive for firms to issue new shares and this facilitates increased investment spending. • Central banks can offset these expansionary effect ...

The Influence of Monetary and Fiscal Policy on Aggregate

... (and vice versa) • When the stock market booms, households become wealthier and this stimulates consumer spending. • Rising share prices also make it more attractive for firms to issue new shares and this facilitates increased investment spending. • Central banks can offset these expansionary effect ...

... (and vice versa) • When the stock market booms, households become wealthier and this stimulates consumer spending. • Rising share prices also make it more attractive for firms to issue new shares and this facilitates increased investment spending. • Central banks can offset these expansionary effect ...

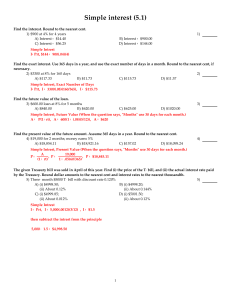

Simple interest (5.1)

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

monetary policy in a cost - push inflation

... exaggerating the degree of certainty about the future. Economists have been thinking about, studying, and trying to measure the social costs of inflation for decades. A central conclusion of this research is that the costs of inflation depend very much on whether it proceeds at a steady, predictable ...

... exaggerating the degree of certainty about the future. Economists have been thinking about, studying, and trying to measure the social costs of inflation for decades. A central conclusion of this research is that the costs of inflation depend very much on whether it proceeds at a steady, predictable ...

Macro Quiz 5.tst

... 23) A decrease in the expected inflation rate shifts the short-run Phillips curve A) downward and shifts the long-run Phillips curve leftward. B) upward and shifts long-run Phillips curve rightward. C) upward and creates a movement upward along the long-run Phillips curve. D) downward and creates a ...

... 23) A decrease in the expected inflation rate shifts the short-run Phillips curve A) downward and shifts the long-run Phillips curve leftward. B) upward and shifts long-run Phillips curve rightward. C) upward and creates a movement upward along the long-run Phillips curve. D) downward and creates a ...

Chapter 16 power point - The College of Business UNR

... Market Confidence Market confidence – One of the Fed’s most powerful tools is its influence over expectations, not its influence over the money supply When there is uncertainty: • People to hold more cash → • Lending falls → M ...

... Market Confidence Market confidence – One of the Fed’s most powerful tools is its influence over expectations, not its influence over the money supply When there is uncertainty: • People to hold more cash → • Lending falls → M ...

Keynes-Wicksell and Neoclassical Models of Money and

... with certain assumptions of the perfectly competitive model,3 we may expect pricesetting by firms even in industries for which the competitive model is adequate for comparative static analysis. Barro analyzes optimal price-setting behavior for a monopolistic firm faced with uncertain demand and a fi ...

... with certain assumptions of the perfectly competitive model,3 we may expect pricesetting by firms even in industries for which the competitive model is adequate for comparative static analysis. Barro analyzes optimal price-setting behavior for a monopolistic firm faced with uncertain demand and a fi ...

The Single Supervisory Mechanism (SSM)

... Notes: Long-term lending rates on loans with a maturity of more than one year. Aggregation is based on new business volumes. ...

... Notes: Long-term lending rates on loans with a maturity of more than one year. Aggregation is based on new business volumes. ...

1 - Whitman People

... output. This in turn increases the amount of money demand. This in turn may cause interest rates to fall by less than they otherwise would had there been no feedback effect from the increased demand for money. Difficulty: E ...

... output. This in turn increases the amount of money demand. This in turn may cause interest rates to fall by less than they otherwise would had there been no feedback effect from the increased demand for money. Difficulty: E ...

CHAPTER - 7 STAGFLATION

... lowered when the rate of inflation is too high. A rise in the rate of monetary expansion above the current rate of inflation raises the rate of inflation, rate exceeds the equilibrium rate, ...

... lowered when the rate of inflation is too high. A rise in the rate of monetary expansion above the current rate of inflation raises the rate of inflation, rate exceeds the equilibrium rate, ...

Why does the investment rate do not increase? Capital

... instrument to control inflation have long-run effects on the level of output, and so on productivity, rather than on prices. This follows from two basic assumptions. On one hand, as in Keynes and Kalecki, we assume that prices are determined by costs, and so, when short-term interest rate rises, it ...

... instrument to control inflation have long-run effects on the level of output, and so on productivity, rather than on prices. This follows from two basic assumptions. On one hand, as in Keynes and Kalecki, we assume that prices are determined by costs, and so, when short-term interest rate rises, it ...

Taking the Nation`s Pluse

... (e.g. the level of unemployment benefits) influence the natural rate of unemployment. The actual rate of unemployment generally rises above the natural rate during a recession and falls below the natural rate during a boom. ...

... (e.g. the level of unemployment benefits) influence the natural rate of unemployment. The actual rate of unemployment generally rises above the natural rate during a recession and falls below the natural rate during a boom. ...

File - MCNEIL ECONOMICS

... tools (techniques or instruments) to control the reserves of banks and the size of the money supply. a. The Federal Reserve can buy or sell government securities in the open market to change the lending ability of the banking system. (1) Buying securities in the open market from either banks or the ...

... tools (techniques or instruments) to control the reserves of banks and the size of the money supply. a. The Federal Reserve can buy or sell government securities in the open market to change the lending ability of the banking system. (1) Buying securities in the open market from either banks or the ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.