Accounts and Notes Receivable

... replace an Accounts Receivable when the customer requests additional time to pay a past-due account. A promissory note is a written promise to pay a specific amount of money, usually including interest, at a future date. If the note is due within a year it is classified as a current asset. If the no ...

... replace an Accounts Receivable when the customer requests additional time to pay a past-due account. A promissory note is a written promise to pay a specific amount of money, usually including interest, at a future date. If the note is due within a year it is classified as a current asset. If the no ...

Deutsche Bundesbank - Annual Report

... To avert that risk, creditors and debtors alike are to be made increasingly accountable in future. They, too, must do their bit towards overcoming crises ± for instance, by means of voluntary rescheduling agreements. The crises in eastern Asia, viewed in isolation, have certainly curbed the growth p ...

... To avert that risk, creditors and debtors alike are to be made increasingly accountable in future. They, too, must do their bit towards overcoming crises ± for instance, by means of voluntary rescheduling agreements. The crises in eastern Asia, viewed in isolation, have certainly curbed the growth p ...

Stock market booms and real economic activity: Is this time different?

... horizon returns only explain a fraction of future production growth rates but this fraction gets larger the longer is the time horizon of returns. In other words, annual returns should be more powerful in forecasting future production growth rates than quarterly returns and quarterly returns more po ...

... horizon returns only explain a fraction of future production growth rates but this fraction gets larger the longer is the time horizon of returns. In other words, annual returns should be more powerful in forecasting future production growth rates than quarterly returns and quarterly returns more po ...

Economics of Money, Banking, and Fin. Markets, 10e (Mishkin

... 10) Compared to interest rates on long-term U.S. government bonds, interest rates on three-month Treasury bills fluctuate ________ and are ________ on average. A) more; lower B) less; lower C) more; higher D) less; higher Answer: A Ques Status: Previous Edition AACSB: Reflective thinking skills 11) ...

... 10) Compared to interest rates on long-term U.S. government bonds, interest rates on three-month Treasury bills fluctuate ________ and are ________ on average. A) more; lower B) less; lower C) more; higher D) less; higher Answer: A Ques Status: Previous Edition AACSB: Reflective thinking skills 11) ...

Volume 71 No. 3, September 2008 Contents Themed issue: Inflation

... Inflation targeting is the best approach New Zealand and many other similar countries have yet found for monetary policy, among a limited number of viable alternatives. The fact remains that the New Zealand economy is subject to powerful forces, and monetary policy can only do so much to buffer the ...

... Inflation targeting is the best approach New Zealand and many other similar countries have yet found for monetary policy, among a limited number of viable alternatives. The fact remains that the New Zealand economy is subject to powerful forces, and monetary policy can only do so much to buffer the ...

Risk Cannot Explain the Muni Puzzle

... critical in the valuation of high-grade municipal bonds. For prime grade municipals they estimate implied default probabilities are between 1.5 and 3%. Furthermore, there are theoretical reasons to believe that default risk will cause the term structure to have a steeper slope. For example, Kim, Ram ...

... critical in the valuation of high-grade municipal bonds. For prime grade municipals they estimate implied default probabilities are between 1.5 and 3%. Furthermore, there are theoretical reasons to believe that default risk will cause the term structure to have a steeper slope. For example, Kim, Ram ...

The Aggregate Demand for Treasury Debt

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

2015-IV

... sum of deposit limits allocated to banks and gold and foreign exchange assets held at the CBRT under the ROM reached a level that more than meets banks’ external debt payments in the upcoming year. Moreover, the CBRT announced that due to the increased volatility in global financial markets, as of 1 ...

... sum of deposit limits allocated to banks and gold and foreign exchange assets held at the CBRT under the ROM reached a level that more than meets banks’ external debt payments in the upcoming year. Moreover, the CBRT announced that due to the increased volatility in global financial markets, as of 1 ...

Real Effects of Inflation through the Redistribution

... episode such as the one experienced during the 1970s. We emphasize the role of money as a unit of account: inflation affects all nominal asset positions, not just cash positions. As a result, we find that even moderate inflation leads to substantial wealth redistribution. Since wealth changes induce ...

... episode such as the one experienced during the 1970s. We emphasize the role of money as a unit of account: inflation affects all nominal asset positions, not just cash positions. As a result, we find that even moderate inflation leads to substantial wealth redistribution. Since wealth changes induce ...

Optimal Reserves in Financially Closed Economies

... in which the private sector cannot insure itself directly because it has little access to foreign assets or external borrowing. This situation was more prevalent under the Bretton Woods system than today, but it remains relevant for developing countries with the lowest levels of international financ ...

... in which the private sector cannot insure itself directly because it has little access to foreign assets or external borrowing. This situation was more prevalent under the Bretton Woods system than today, but it remains relevant for developing countries with the lowest levels of international financ ...

words - Investor Relations Solutions

... statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business , operations, growth strategy and service development efforts. The Private Securities Litigation Reform Act of 1995 pr ...

... statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business , operations, growth strategy and service development efforts. The Private Securities Litigation Reform Act of 1995 pr ...

PDF

... investment behaviour has been incorporated into the GTAP model. In this dynamic version of GTAP, time is included as a variable. This allows investment undertaken during each time period to add to the level of capital stocks available in subsequent time periods; thus in the dynamic model capital acc ...

... investment behaviour has been incorporated into the GTAP model. In this dynamic version of GTAP, time is included as a variable. This allows investment undertaken during each time period to add to the level of capital stocks available in subsequent time periods; thus in the dynamic model capital acc ...

Chapter one: Introduction to Macroeconomics 1) Which of the

... 15) If Congress increases government spending, it is using A) monetary policy. B) supply-side policy. C) fiscal policy. D) incomes policy. 16)If Tomas purchases a share of stock for $150 and one year later sells it for $225, he will realize a A) dividend of $75. B) capital gain of $75. C) dividend o ...

... 15) If Congress increases government spending, it is using A) monetary policy. B) supply-side policy. C) fiscal policy. D) incomes policy. 16)If Tomas purchases a share of stock for $150 and one year later sells it for $225, he will realize a A) dividend of $75. B) capital gain of $75. C) dividend o ...

ECS1601 –SECTION A 1.16 Which of the following statements are

... [2] banks keep their reserves with the reserve bank. [3] banks make loans that result in additional deposits.(ANSWER 3) [4] the government keeps its funds with the reserve bank. 3. Correct. The process whereby demand deposits are created is discussed in Box 15-4 of the textbook. Also see Activity 6( ...

... [2] banks keep their reserves with the reserve bank. [3] banks make loans that result in additional deposits.(ANSWER 3) [4] the government keeps its funds with the reserve bank. 3. Correct. The process whereby demand deposits are created is discussed in Box 15-4 of the textbook. Also see Activity 6( ...

A MACROECONOMETRIC MODEL FOR THE ECONOMY OF

... It is evident from the policy options assessed in this study that fiscal policy remains the main and most potent policy instrument available to policy makers. It is also evident that the effectiveness of fiscal policy is not exclusive as monetary policy can still be used to some extent. A salient ou ...

... It is evident from the policy options assessed in this study that fiscal policy remains the main and most potent policy instrument available to policy makers. It is also evident that the effectiveness of fiscal policy is not exclusive as monetary policy can still be used to some extent. A salient ou ...

Annual Report 2013

... in the drinks industry, has significant experience as a nonexecutive director and will make an important contribution to the international development of the business. I am also delighted to welcome Scott McCroskie to the board in his current role of commercial director. Scott joined Edrington in 20 ...

... in the drinks industry, has significant experience as a nonexecutive director and will make an important contribution to the international development of the business. I am also delighted to welcome Scott McCroskie to the board in his current role of commercial director. Scott joined Edrington in 20 ...

Money In Modern Macro Models: A Review of the Arguments

... control over M1, which is actually not the case. If at all, the central bank is able to indirectly steer the quantity of money by adjusting the monetary base or short-term interest rates. Since the transmission and intermediation process from the monetary base to inside money is complex and time-var ...

... control over M1, which is actually not the case. If at all, the central bank is able to indirectly steer the quantity of money by adjusting the monetary base or short-term interest rates. Since the transmission and intermediation process from the monetary base to inside money is complex and time-var ...

ECO442 - National Open University of Nigeria

... simplest economy made up of only two sector, three sector and four sector economy; the importance of the circular flow of income/spending explain the concepts of consumption and savings; explain the basic consumption and saving function; the consumption hypothesis and the various theories of consump ...

... simplest economy made up of only two sector, three sector and four sector economy; the importance of the circular flow of income/spending explain the concepts of consumption and savings; explain the basic consumption and saving function; the consumption hypothesis and the various theories of consump ...

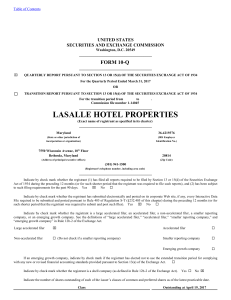

0001053532-17-000022 - Lasalle Hotel Properties

... The consolidated financial statements include the accounts of the Company, the Operating Partnership, LHL and their subsidiaries in which they have a controlling interest, including joint ventures. All significant intercompany balances and transactions have been eliminated. Use of Estimates The prep ...

... The consolidated financial statements include the accounts of the Company, the Operating Partnership, LHL and their subsidiaries in which they have a controlling interest, including joint ventures. All significant intercompany balances and transactions have been eliminated. Use of Estimates The prep ...

Aggregate Supply

... without formal agreements, firms may hold prices steady in order not to annoy their regular customers with frequent price changes. Some prices are sticky because of the way markets are structured: once a firm has printed and distributed its catalog or price list, it is costly to alter prices. To see ...

... without formal agreements, firms may hold prices steady in order not to annoy their regular customers with frequent price changes. Some prices are sticky because of the way markets are structured: once a firm has printed and distributed its catalog or price list, it is costly to alter prices. To see ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.