Chapter 5 In this chapter we will study how a nation`s standard of

... The traditional approach to calculating real GDP uses base-year prices. The more modern approach, also called the “chained-dollar method,” takes into account what happens when changes in output are evaluated at constant current-year prices. To implement the modern approach, we calculate the value o ...

... The traditional approach to calculating real GDP uses base-year prices. The more modern approach, also called the “chained-dollar method,” takes into account what happens when changes in output are evaluated at constant current-year prices. To implement the modern approach, we calculate the value o ...

Lecture 4 Business Cycles and Aggregate Supply and

... - Remember the GDP equation : Y= C+I+G+ (X-M) ...

... - Remember the GDP equation : Y= C+I+G+ (X-M) ...

Unit 4 Filled In

... the economy. A positive rate of inflation does not mean that every single price increases, nor that all prices increase by the same amount, nor that the price of some goods didn't fall. It represents an average price increase for the goods and services in the economy. ...

... the economy. A positive rate of inflation does not mean that every single price increases, nor that all prices increase by the same amount, nor that the price of some goods didn't fall. It represents an average price increase for the goods and services in the economy. ...

Lecture notes

... supply or demand. For example: many labor contracts fix the nominal wage for a year or longer many magazine publishers change prices only once every 3 to 4 years CHAPTER 1 ...

... supply or demand. For example: many labor contracts fix the nominal wage for a year or longer many magazine publishers change prices only once every 3 to 4 years CHAPTER 1 ...

MICROECONOMICS END OF COURSE REVIEW Part 1 – Ch. 2

... 13. _____ _____ is the ability to produce something more efficiently, thus allowing one party to produce more output than that of their trading partner. 14. T/F – It is possible to have an absolute advantage in both products and a comparative advantage in both products. 15. ____________ leads to inc ...

... 13. _____ _____ is the ability to produce something more efficiently, thus allowing one party to produce more output than that of their trading partner. 14. T/F – It is possible to have an absolute advantage in both products and a comparative advantage in both products. 15. ____________ leads to inc ...

Chapter30

... Question 7 a) If the Bank of Canada does not respond to the negative AS shock, then the economy’s natural adjustment process comes into play. The excess supply for factors occurring because of the recessionary output gap (with Y=Y1) leads factor prices to fall. As factor prices fall, firms’ costs fa ...

... Question 7 a) If the Bank of Canada does not respond to the negative AS shock, then the economy’s natural adjustment process comes into play. The excess supply for factors occurring because of the recessionary output gap (with Y=Y1) leads factor prices to fall. As factor prices fall, firms’ costs fa ...

President’s Report Board Directors

... The weakness in housing market data persisted in October. Sales of both new and existing homes slowed, as did housing starts and the issuance of building permits. In the manufacturing sector, the ISM index continued to fall in November, joined by its employment component. Industrial production rebou ...

... The weakness in housing market data persisted in October. Sales of both new and existing homes slowed, as did housing starts and the issuance of building permits. In the manufacturing sector, the ISM index continued to fall in November, joined by its employment component. Industrial production rebou ...

The Effects of Heterogeneity in Price Setting on Price and Inflation

... might dominate. Also, the nature of shocks to the firms’ optimal prices as well as the degree of competition across sectors might be quite different. We know from the literature on optimal pricing rules that these differences should be translated into heterogeneity in terms of price setting behavior. ...

... might dominate. Also, the nature of shocks to the firms’ optimal prices as well as the degree of competition across sectors might be quite different. We know from the literature on optimal pricing rules that these differences should be translated into heterogeneity in terms of price setting behavior. ...

President’s Report Board Directors

... The housing market showed mixed signs in January. New home sales fell sharply, but existing home sales increased for the second straight month and reached their highest point since June. Housing starts and building permits both decreased in January. In the manufacturing sector, the ISM manufacturing ...

... The housing market showed mixed signs in January. New home sales fell sharply, but existing home sales increased for the second straight month and reached their highest point since June. Housing starts and building permits both decreased in January. In the manufacturing sector, the ISM manufacturing ...

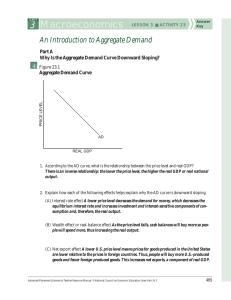

3 Macroeconomics LESSON 3 s ACTIVITY 23

... equilibrium interest rate and increases investment and interest-sensitive components of consumption and, therefore, the real output. (B) Wealth effect or real-balance effect As the price level falls, cash balances will buy more so people will spend more, thus increasing the real output. ...

... equilibrium interest rate and increases investment and interest-sensitive components of consumption and, therefore, the real output. (B) Wealth effect or real-balance effect As the price level falls, cash balances will buy more so people will spend more, thus increasing the real output. ...

Impacts of high and volatile oil prices and policy choices

... Note: Darker red cells = biggest net importer of that commodity , lighter green cells = largest net exporter of that commodity Source: Credit Suisse. 2012. Asia: Winners and losers from commodity price moves. 13 Aug. ...

... Note: Darker red cells = biggest net importer of that commodity , lighter green cells = largest net exporter of that commodity Source: Credit Suisse. 2012. Asia: Winners and losers from commodity price moves. 13 Aug. ...

Chapter 01 Lecture Notes Page

... Answers will vary, but all students should obviously include prices paid for consumer goods and the availability of desirable jobs. Managers are affected by inflation because it tends to drive up the wages they must pay, and by unemployment because it affects their ability to find workers. Also, bot ...

... Answers will vary, but all students should obviously include prices paid for consumer goods and the availability of desirable jobs. Managers are affected by inflation because it tends to drive up the wages they must pay, and by unemployment because it affects their ability to find workers. Also, bot ...

2005314134057165

... • The analysis of economies of specialization at the individual level by Yang & Shi (1992) and Yang & Ng (1993) is combined with the Dixit & Stiglitz (1977) analysis of monopolistic-competitive firms to show that, even if both the home and the market sectors have IR and there are no pre-existing tax ...

... • The analysis of economies of specialization at the individual level by Yang & Shi (1992) and Yang & Ng (1993) is combined with the Dixit & Stiglitz (1977) analysis of monopolistic-competitive firms to show that, even if both the home and the market sectors have IR and there are no pre-existing tax ...

Econ 102 Taskin Week of 20 February 2012

... happens to the level output, price and unemployment level? Explain how does the economy adjust back to long-run equilibrium. Compared to the initial equilibrium how have the values for each of the following variables, real GDP, the price level, the unemployment rate, changed? b. Assume that there is ...

... happens to the level output, price and unemployment level? Explain how does the economy adjust back to long-run equilibrium. Compared to the initial equilibrium how have the values for each of the following variables, real GDP, the price level, the unemployment rate, changed? b. Assume that there is ...

Ch02.pps

... For example, if we wanted to compare output in 2002 and output in 2003, we would obtain base-year prices, such as 2002 prices. Real GDP in 2002 would be: (2002 Price of Apples 2002 Quantity of Apples) + (2002 Price of Oranges 2002 Quantity of Oranges). Real GDP in 2003 would be: (2002 Price of A ...

... For example, if we wanted to compare output in 2002 and output in 2003, we would obtain base-year prices, such as 2002 prices. Real GDP in 2002 would be: (2002 Price of Apples 2002 Quantity of Apples) + (2002 Price of Oranges 2002 Quantity of Oranges). Real GDP in 2003 would be: (2002 Price of A ...

chapter two

... For example, if we wanted to compare output in 2002 and output in 2003, we would obtain base-year prices, such as 2002 prices. Real GDP in 2002 would be: (2002 Price of Apples 2002 Quantity of Apples) + (2002 Price of Oranges 2002 Quantity of Oranges). Real GDP in 2003 would be: (2002 Price of A ...

... For example, if we wanted to compare output in 2002 and output in 2003, we would obtain base-year prices, such as 2002 prices. Real GDP in 2002 would be: (2002 Price of Apples 2002 Quantity of Apples) + (2002 Price of Oranges 2002 Quantity of Oranges). Real GDP in 2003 would be: (2002 Price of A ...

Inflation. Unit 1. What is inflation? Reading

... deflation -occurs when price decreases on some goods and services outweigh price increases on all others. Relative Prices vs. the Price Level Because inflation and deflation are measured in terms of average price levels, it is possible for individual prices to rise or fall continuously without chang ...

... deflation -occurs when price decreases on some goods and services outweigh price increases on all others. Relative Prices vs. the Price Level Because inflation and deflation are measured in terms of average price levels, it is possible for individual prices to rise or fall continuously without chang ...

tutorials

... the base year. Verify that the CPI is larger than the GDP deflator. What is the annual rate of inflation for this period? b) Compute current dollar GDP for 2001 and 2002. Compute the constant dollar GDP for 2001 and 2002, using 2001 dollars. Can you state whether consumers are better or worse off in ...

... the base year. Verify that the CPI is larger than the GDP deflator. What is the annual rate of inflation for this period? b) Compute current dollar GDP for 2001 and 2002. Compute the constant dollar GDP for 2001 and 2002, using 2001 dollars. Can you state whether consumers are better or worse off in ...

tutorials

... the base year. Verify that the CPI is larger than the GDP deflator. What is the annual rate of inflation for this period? b) Compute current dollar GDP for 2001 and 2002. Compute the constant dollar GDP for 2001 and 2002, using 2001 dollars. Can you state whether consumers are better or worse off in ...

... the base year. Verify that the CPI is larger than the GDP deflator. What is the annual rate of inflation for this period? b) Compute current dollar GDP for 2001 and 2002. Compute the constant dollar GDP for 2001 and 2002, using 2001 dollars. Can you state whether consumers are better or worse off in ...

PDF

... extremely high oilseed prices, which had just increased the net cost of biodiesel when petroleum prices hit their historical low. In this way, significant state support was not able to compensate for the price difference either. ...

... extremely high oilseed prices, which had just increased the net cost of biodiesel when petroleum prices hit their historical low. In this way, significant state support was not able to compensate for the price difference either. ...