Final Exam Study Guide Answer Section

... 33. With _________________________, your checking account information is available to you from your home computer 24 hours a day. 34. The ____________________ is the party who wrote the check and is paying the money. 35. When you deposit a check, write _________________________ as part of the endors ...

... 33. With _________________________, your checking account information is available to you from your home computer 24 hours a day. 34. The ____________________ is the party who wrote the check and is paying the money. 35. When you deposit a check, write _________________________ as part of the endors ...

Personal Financial Planner Preface

... Since this publication is designed to adapt to every personal financial situation, some of the sheets may be appropriate for you at this time, and not at other times in your life. Each of the sheets in the first 11 sections is referenced to specific page numbers of Personal Finance, Seventh Edition, ...

... Since this publication is designed to adapt to every personal financial situation, some of the sheets may be appropriate for you at this time, and not at other times in your life. Each of the sheets in the first 11 sections is referenced to specific page numbers of Personal Finance, Seventh Edition, ...

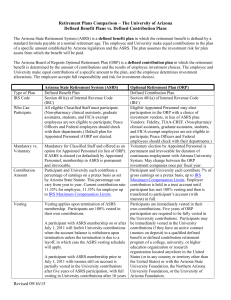

Retirement Plans Comparison - Human Resources

... participant is disabled and unable to work for an extended period of time, generally six months or more. LTD coverage will pay up to 66% of predisability monthly earnings during disability. The current employee contribution is 0.12% of gross earnings. This coverage is required as part of ASRS partic ...

... participant is disabled and unable to work for an extended period of time, generally six months or more. LTD coverage will pay up to 66% of predisability monthly earnings during disability. The current employee contribution is 0.12% of gross earnings. This coverage is required as part of ASRS partic ...

Better Retirement Exit Strategies with Life Insurance

... incurred for the cost of care. Life insurance policies contain exclusions, limitations, reduction of benefits and terms for keeping them in force. Accessing cash values may result in surrender fees and charges, may require additional premium payments to maintain coverage, and will reduce the death b ...

... incurred for the cost of care. Life insurance policies contain exclusions, limitations, reduction of benefits and terms for keeping them in force. Accessing cash values may result in surrender fees and charges, may require additional premium payments to maintain coverage, and will reduce the death b ...

Profiles Mag 2007 - Insurance Brokers Association of Manitoba

... HED offers a profit-sharing pension plan, in-house training program, covers 100 per cent of tuition and books for employees’ jobrelated education and up to 50 per cent of the cost of non-related education. “We like to have well-rounded people,” says Steve Korman, HED’s vice-president human resources ...

... HED offers a profit-sharing pension plan, in-house training program, covers 100 per cent of tuition and books for employees’ jobrelated education and up to 50 per cent of the cost of non-related education. “We like to have well-rounded people,” says Steve Korman, HED’s vice-president human resources ...

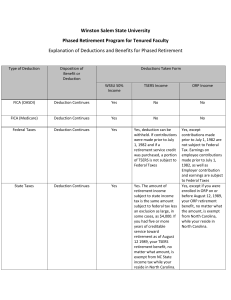

Explanation of Deductions and Benefits for Phased Retirement

... Yes, deduction can be withheld. If contributions were made prior to July 1, 1982 and if a retirement service credit was purchased, a portion of TSERS is not subject to Federal Taxes ...

... Yes, deduction can be withheld. If contributions were made prior to July 1, 1982 and if a retirement service credit was purchased, a portion of TSERS is not subject to Federal Taxes ...

Sample Title Slide

... $1 Million coverage on John and $500k on Cindy. • Because of the length of time available, they are willing to take some risk for better returns, but are afraid of losing their earnings. • Cindy’s grandmother is currently in a Nursing Home facility and both John and Cindy want to consider insuring t ...

... $1 Million coverage on John and $500k on Cindy. • Because of the length of time available, they are willing to take some risk for better returns, but are afraid of losing their earnings. • Cindy’s grandmother is currently in a Nursing Home facility and both John and Cindy want to consider insuring t ...

Question Name some good money habits related to managing

... Name some good money habits related to managing checking and savings accounts. ...

... Name some good money habits related to managing checking and savings accounts. ...

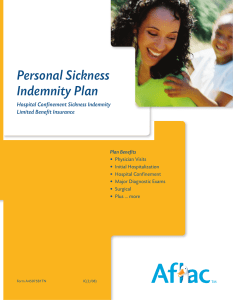

Person Sickness

... covered person. No lifetime maximum. Surgical Benefit Aflac will pay $100–$2,000 when a covered person has surgery performed for a covered sickness in a hospital or ambulatory surgical center based upon the Schedule of Operations in the policy. Only one benefit is payable per 24-hour period for surg ...

... covered person. No lifetime maximum. Surgical Benefit Aflac will pay $100–$2,000 when a covered person has surgery performed for a covered sickness in a hospital or ambulatory surgical center based upon the Schedule of Operations in the policy. Only one benefit is payable per 24-hour period for surg ...

CUBIC 2016 Personal Finance Syllabus

... • Basic concepts and terminology of personal finance; • The planning process--assessing your current financial position, defining financial goals, developing a plan of action, implementing the plan, reviewing and revising the plan; • Retirement planning as a special topic; • Key concepts and practic ...

... • Basic concepts and terminology of personal finance; • The planning process--assessing your current financial position, defining financial goals, developing a plan of action, implementing the plan, reviewing and revising the plan; • Retirement planning as a special topic; • Key concepts and practic ...

CUBIC 2015 Personal Finance Syllabus

... focuses on helping the student understand the key elements of the financial planning process. This includes: • Basic concepts and terminology of personal finance; • The planning process--assessing your current financial position, defining financial goals, developing a plan of action, implementing th ...

... focuses on helping the student understand the key elements of the financial planning process. This includes: • Basic concepts and terminology of personal finance; • The planning process--assessing your current financial position, defining financial goals, developing a plan of action, implementing th ...

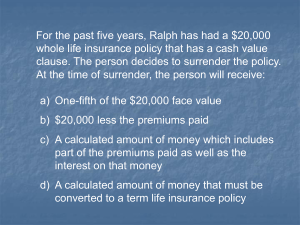

Jumpstart Financial Literacy

... c) A calculated amount of money which includes part of the premiums paid as well as the interest on that money d) A calculated amount of money that must be converted to a term life insurance policy ...

... c) A calculated amount of money which includes part of the premiums paid as well as the interest on that money d) A calculated amount of money that must be converted to a term life insurance policy ...

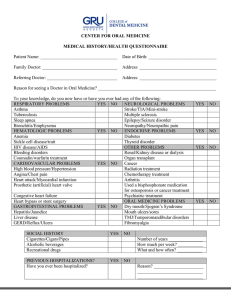

CENTER FOR ORAL MEDICINE MEDICAL HISTORY/HEALTH

... Our office will gladly file health insurance claims on your behalf through the College of Dental Medicine business office. Patient balances remaining after your insurance has processed your claim will be due and payable within thirty (30) days of your insurance company's payment or their notice of n ...

... Our office will gladly file health insurance claims on your behalf through the College of Dental Medicine business office. Patient balances remaining after your insurance has processed your claim will be due and payable within thirty (30) days of your insurance company's payment or their notice of n ...

Drought 2012: Cash Flow Considerations ,

... The situation could call for adjusting the operation in greater ways. For example selling older breeding livestock and keeping younger stock may be a way to generate cash today and reduce the need for finding feed in the year ahead. However, remember that any changes, big or small, will likely chang ...

... The situation could call for adjusting the operation in greater ways. For example selling older breeding livestock and keeping younger stock may be a way to generate cash today and reduce the need for finding feed in the year ahead. However, remember that any changes, big or small, will likely chang ...

Make your next move - Imeriti Financial Network

... under IRC Section 7702B(b). The costs for these riders are deducted monthly from the policy cash value and are federally treated as “distributions” from the policy. Lincoln will not report these distributions as taxable to your client even if their policy is a modified endowment contract (MEC). Inst ...

... under IRC Section 7702B(b). The costs for these riders are deducted monthly from the policy cash value and are federally treated as “distributions” from the policy. Lincoln will not report these distributions as taxable to your client even if their policy is a modified endowment contract (MEC). Inst ...

Which Type of Insurance is Best for You? ( 97k)

... future income upon the death of the insured person. The death benefit for term life insurance is only paid out if the insured person dies during the period the policy is valid, which may be defined in years (e.g., 1, 5, 10 or 20 years) or set to a specific age (e.g., up to the age of 65). The insura ...

... future income upon the death of the insured person. The death benefit for term life insurance is only paid out if the insured person dies during the period the policy is valid, which may be defined in years (e.g., 1, 5, 10 or 20 years) or set to a specific age (e.g., up to the age of 65). The insura ...

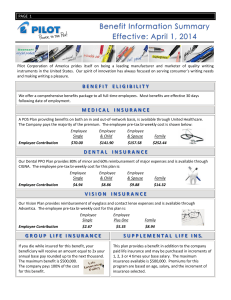

Pilot Corporation of America prides itself on being a

... GROUP LIFE INSURANCE If you die while insured for this benefit, your beneficiary will receive an amount equal to 2x your annual base pay rounded up to the next thousand. The maximum benefit is $500,000. The company pays 100% of the cost for this benefit. ...

... GROUP LIFE INSURANCE If you die while insured for this benefit, your beneficiary will receive an amount equal to 2x your annual base pay rounded up to the next thousand. The maximum benefit is $500,000. The company pays 100% of the cost for this benefit. ...

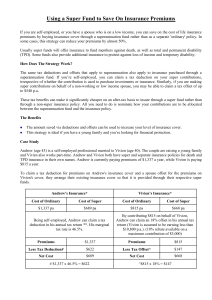

Using a Super Fund to Save On Insurance

... Using a Super Fund to Save On Insurance Premiums If you are self-employed, or you have a spouse who is on a low income, you can save on the cost of life insurance premiums by buying insurance cover through a superannuation fund rather than as a separate 'ordinary' policy. In some cases, this strateg ...

... Using a Super Fund to Save On Insurance Premiums If you are self-employed, or you have a spouse who is on a low income, you can save on the cost of life insurance premiums by buying insurance cover through a superannuation fund rather than as a separate 'ordinary' policy. In some cases, this strateg ...

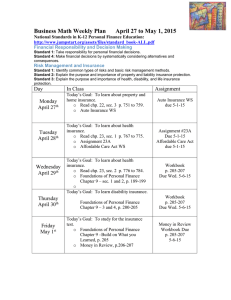

Math 9 Weekly Plan

... National Standards in K-12 Personal Finance Education: http://www.jumpstart.org/assets/files/standard_book-ALL.pdf Financial Responsibility and Decision Making Standard 1: Take responsibility for personal financial decisions. Standard 4: Make financial decisions by systematically considering alterna ...

... National Standards in K-12 Personal Finance Education: http://www.jumpstart.org/assets/files/standard_book-ALL.pdf Financial Responsibility and Decision Making Standard 1: Take responsibility for personal financial decisions. Standard 4: Make financial decisions by systematically considering alterna ...

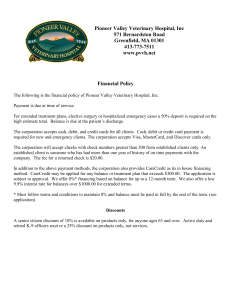

Financial Policy - Pioneer Valley Veterinary Hospital, Inc

... The corporation will accept checks with check numbers greater than 300 from established clients only. An established client is someone who has had more than one year of history of on time payments with the company. The fee for a returned check is $20.00. In addition to the above payment methods, the ...

... The corporation will accept checks with check numbers greater than 300 from established clients only. An established client is someone who has had more than one year of history of on time payments with the company. The fee for a returned check is $20.00. In addition to the above payment methods, the ...