COLLEGE STUDENTS AND CREDIT CARD USE: THE EFFECT OF

... potential for profits. Essentially, credit card holders have an open-ended loan up to some specified limit. Open-ended loans allow card holders to borrow money when it is convenient for them, and in varying amounts, without having to go through multiple approval processes. Often, the rates attached ...

... potential for profits. Essentially, credit card holders have an open-ended loan up to some specified limit. Open-ended loans allow card holders to borrow money when it is convenient for them, and in varying amounts, without having to go through multiple approval processes. Often, the rates attached ...

open-end credit under -truth-in- lending

... aformentioned NOTICE was not furnished that customer; then such NOTICE must be mailed or delivered to said customer either before or with the next billing on said account. It follows that creditors must decide whether it would be more economical to mail out the notices to all customers- listed on th ...

... aformentioned NOTICE was not furnished that customer; then such NOTICE must be mailed or delivered to said customer either before or with the next billing on said account. It follows that creditors must decide whether it would be more economical to mail out the notices to all customers- listed on th ...

332 - Consumer credit and payment cards (PDF: 1010.6 Kb)

... lators. Policymakers have focused on the level of interchange fees, paid by the acquiring bank to the issuing bank (see below for more details). Following discussions with the European Commission, Mastercard has recently agreed to reduce interchange fees on cross-border European card transactions. ...

... lators. Policymakers have focused on the level of interchange fees, paid by the acquiring bank to the issuing bank (see below for more details). Following discussions with the European Commission, Mastercard has recently agreed to reduce interchange fees on cross-border European card transactions. ...

Regulating two-sided markets: an empirical investigation

... Second, consumer adoption of payment cards did not significantly decrease over the period because of lower interchange fee revenue for issuers. Consumer preference towards payment cards differ based on a card’s functionality. Adoption for debit cards by consumers may have reached a saturation point ...

... Second, consumer adoption of payment cards did not significantly decrease over the period because of lower interchange fee revenue for issuers. Consumer preference towards payment cards differ based on a card’s functionality. Adoption for debit cards by consumers may have reached a saturation point ...

Purchasing Card Program Policies and Procedures

... them with the charges on Paymentnet or on the P-Card statement. If submitting receipts with a Travel Expense Voucher, which requires original receipts, include copies with the P-Card documentation. Retain all P-Card purchase documentation for audits: retain for seven (7) years, but may be stored in ...

... them with the charges on Paymentnet or on the P-Card statement. If submitting receipts with a Travel Expense Voucher, which requires original receipts, include copies with the P-Card documentation. Retain all P-Card purchase documentation for audits: retain for seven (7) years, but may be stored in ...

Complaint 07/479 - New Zealand Advertising Standards Authority

... generic and not a term specific to banking. The Panel contemplated the use of ‘cards’, generally, in the community. It recognised that there were numerous cards available for use in different ways and for different circumstances. In the Panel’s view, ‘cards’ were an integral part of most peoples’ li ...

... generic and not a term specific to banking. The Panel contemplated the use of ‘cards’, generally, in the community. It recognised that there were numerous cards available for use in different ways and for different circumstances. In the Panel’s view, ‘cards’ were an integral part of most peoples’ li ...

Recent episodes of credit card distress in Asia

... outsourced the recruitment of new cardholders to “credit card brokers” which, for a fee, helped less creditworthy card applicants to “polish up” their applications and simultaneously submit them to several issuers. This effectively bypassed the local credit reporting system. 6 Finally, higher lendin ...

... outsourced the recruitment of new cardholders to “credit card brokers” which, for a fee, helped less creditworthy card applicants to “polish up” their applications and simultaneously submit them to several issuers. This effectively bypassed the local credit reporting system. 6 Finally, higher lendin ...

Credit Card Debt and Consumption

... Kerr and Dunn, 2007). Researchers have also estimated interest rate elasticity of credit card debt (See Gross and Souleles, 2002b; Shen and Giles, 2006). Another strain of the literature has looked at the effect of credit card debt on default and bankruptcy (See Laderman, 1996; Ausubel, 1997; Dunn a ...

... Kerr and Dunn, 2007). Researchers have also estimated interest rate elasticity of credit card debt (See Gross and Souleles, 2002b; Shen and Giles, 2006). Another strain of the literature has looked at the effect of credit card debt on default and bankruptcy (See Laderman, 1996; Ausubel, 1997; Dunn a ...

Credit Cards Can Build Business for Community

... Marketing Opportunities Widen for Smaller Banks and Credit Unions With many institutions continuing to maintain tight constraints on their credit lines and terms, it creates opportunities for other institutions to either enter the credit card market for the first time or to expand their market share ...

... Marketing Opportunities Widen for Smaller Banks and Credit Unions With many institutions continuing to maintain tight constraints on their credit lines and terms, it creates opportunities for other institutions to either enter the credit card market for the first time or to expand their market share ...

Review PowerPoint

... • Know the difference between charge cards, premium cards, limited purpose cards, and prepaid cards • Charge Cards – Can be used all month, but then must be paid in full when monthly bill comes • Premium Cards – Card that comes with special perks like airline miles, cash back or hotel credit, but th ...

... • Know the difference between charge cards, premium cards, limited purpose cards, and prepaid cards • Charge Cards – Can be used all month, but then must be paid in full when monthly bill comes • Premium Cards – Card that comes with special perks like airline miles, cash back or hotel credit, but th ...

Taking charge of your finances

... costs of higher education, many individuals are being forced to have a student loan to get through school. This is one of the only recommended uses for credit because the individual’s future earning power and quality of life increase as a result. ...

... costs of higher education, many individuals are being forced to have a student loan to get through school. This is one of the only recommended uses for credit because the individual’s future earning power and quality of life increase as a result. ...

ConsumerMan Video for LifeSmarts 3: YOUR CREDIT REPORT

... Character- A trait of creditworthiness that shows a responsible attitude toward paying debts Capacity- The ability to repay a loan from present income Collateral- Assets pledged to pay off a debt if payments are not made according to the contract; also called security ...

... Character- A trait of creditworthiness that shows a responsible attitude toward paying debts Capacity- The ability to repay a loan from present income Collateral- Assets pledged to pay off a debt if payments are not made according to the contract; also called security ...

Personal Financial Literacy

... • Finance charges have the effect of increasing the costs of items you purchase with credit. • There are several ways to compute interest. Personal Finance ...

... • Finance charges have the effect of increasing the costs of items you purchase with credit. • There are several ways to compute interest. Personal Finance ...

The Market for Information

... doesn’t work well when consumers have heterogeneous preferences and shop on many margins. So, for instance, credit card solicitations include the Schumer Box, which requires certain important terms to be disclosed prominently in a tabular format. Those terms include things that are obviously importa ...

... doesn’t work well when consumers have heterogeneous preferences and shop on many margins. So, for instance, credit card solicitations include the Schumer Box, which requires certain important terms to be disclosed prominently in a tabular format. Those terms include things that are obviously importa ...

Activate Your Card - Colorado Mesa University

... Returns and/or Exchanges • Make arrangements with merchant before shipping a return • Merchant must credit return to Procard – Do not allow merchants to refund in check or cash • In the case of an exchange merchant must refund original purchase and charge for new transaction • Document details incl ...

... Returns and/or Exchanges • Make arrangements with merchant before shipping a return • Merchant must credit return to Procard – Do not allow merchants to refund in check or cash • In the case of an exchange merchant must refund original purchase and charge for new transaction • Document details incl ...

Job Description

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

Shopaholic Credit Case Study - socialsciences dadeschools net

... Understand that spending is exchanging money for goods and services Compare the price of a good at more than one store. Understand that all consumers have limited budgets and must make choices. Analyze and discuss a person’s use of credit, consumer strategies, and the decision making process ...

... Understand that spending is exchanging money for goods and services Compare the price of a good at more than one store. Understand that all consumers have limited budgets and must make choices. Analyze and discuss a person’s use of credit, consumer strategies, and the decision making process ...

Key Terms and Definitions

... An Acquirer is an organization authorized by the payment schemes to enable merchants to process debit and (or) credit transactions. The acquirer establishes a contractual relationship with the merchant and assigns the relevant fees/discount rates for the merchant and ensures the merchant complies wi ...

... An Acquirer is an organization authorized by the payment schemes to enable merchants to process debit and (or) credit transactions. The acquirer establishes a contractual relationship with the merchant and assigns the relevant fees/discount rates for the merchant and ensures the merchant complies wi ...

CHAPTER 16, CREDIT IN AMERICA CREDIT

... Open-Ended – The lender places a limit on how much a customer can borrow during a given period. Thirty-Day Accounts Promises to pay the full amount in 30 days. American Express and Diner’s Club/ Accepted widely accepted nationwide and have high or no credit limits. ...

... Open-Ended – The lender places a limit on how much a customer can borrow during a given period. Thirty-Day Accounts Promises to pay the full amount in 30 days. American Express and Diner’s Club/ Accepted widely accepted nationwide and have high or no credit limits. ...

HERE - Augustana College

... Meredith A. Whitney, a banking analyst, said recently. By her projections, consumers could lose access to $2 trillion in credit in the next 18 months. This would force many Americans to radically change their behavior — saving for what they can afford rather than financing what they covet. Already, ...

... Meredith A. Whitney, a banking analyst, said recently. By her projections, consumers could lose access to $2 trillion in credit in the next 18 months. This would force many Americans to radically change their behavior — saving for what they can afford rather than financing what they covet. Already, ...

Law for Business

... 6. After One Year, Apply for Unsecured Card The unsecured card will likely offer a higher credit limit and better pricing Eventually add a card from a retailer Continue to pay in full each month ...

... 6. After One Year, Apply for Unsecured Card The unsecured card will likely offer a higher credit limit and better pricing Eventually add a card from a retailer Continue to pay in full each month ...

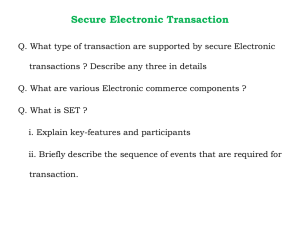

Secure Electronic Transactions

... account number reduces incedence of fraudand overall cost of payment processing ; Digital signature and certificates are used to verify that cardholder is legitimate user of a valid account. ...

... account number reduces incedence of fraudand overall cost of payment processing ; Digital signature and certificates are used to verify that cardholder is legitimate user of a valid account. ...

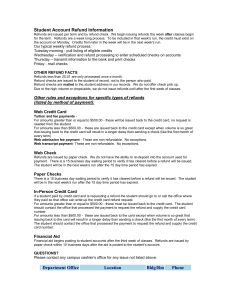

Student Refunds - Montgomery College

... Refunds less than 25.01 are only processed once a month. Refund checks are issued to the student of record, not to the person who paid. Refund checks are mailed to the student address in our records. We do not offer check pick up. Due to the high volume or drops/adds, we do not issue refunds until a ...

... Refunds less than 25.01 are only processed once a month. Refund checks are issued to the student of record, not to the person who paid. Refund checks are mailed to the student address in our records. We do not offer check pick up. Due to the high volume or drops/adds, we do not issue refunds until a ...

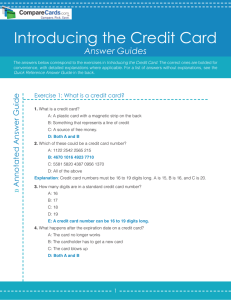

Introduction to Credit Card Answer Guide | CompareCards.com

... Exercise 3: Do credit cards have fees? 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

... Exercise 3: Do credit cards have fees? 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

Credit card

A credit card is a payment card issued to users (cardholders) as a method of payment. It allows the cardholder to pay for goods and services based on the holder's promise to pay for them. The issuer of the card (usually a bank) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.A credit card is different from a charge card: a charge card requires the balance to be repaid in full each month. In contrast, credit cards allow the consumers a continuing balance of debt, subject to interest being charged. A credit card also differs from a cash card, which can be used like currency by the owner of the card. A credit card differs from a charge card also in that a credit card typically involves a third-party entity that pays the seller and is reimbursed by the buyer, whereas a charge card simply defers payment by the buyer until a later date.The size of most credit cards is 3 3⁄8 in × 2 1⁄8 in (85.7 mm × 54.0 mm), conforming to the ISO/IEC 7810 ID-1 standard. Credit cards have a printed or embossed bank card number complying with the ISO/IEC 7812 numbering standard. Both of these standards are maintained and further developed by ISO/IEC JTC 1/SC 17/WG 1. Before magnetic stripe readers came into widespread use, plastic credit cards issued by many department stores were produced on stock (""Princess"" or ""CR-50"") slightly longer and narrower than 7810. Many modern credit cards have a computer chip embedded in them for security reasons.