Review of Basics

... Sellers’ decisions are modeled through a supply function and buyers’ decisions are modeled through a demand function ...

... Sellers’ decisions are modeled through a supply function and buyers’ decisions are modeled through a demand function ...

Economics - cloudfront.net

... iv.Fourth, demonstrate and explain the effects of a third firm in the market, which result in a loss for all firms in the market. Once again be sure to explain the graph in terms of revenues, costs, and profits. v.Explain why firms would be inclined to enter the market in part i and not in part ii. ...

... iv.Fourth, demonstrate and explain the effects of a third firm in the market, which result in a loss for all firms in the market. Once again be sure to explain the graph in terms of revenues, costs, and profits. v.Explain why firms would be inclined to enter the market in part i and not in part ii. ...

Market failure: Monopoly

... exclude rival firms from the market through barriers to entry (things which stop other firms entering a market) A monopoly is strongest when it produces an essential good for which there is no substitutes or when demand is inelastic. .E.g. One firm producing bread/milk. (Unrealistic) ...

... exclude rival firms from the market through barriers to entry (things which stop other firms entering a market) A monopoly is strongest when it produces an essential good for which there is no substitutes or when demand is inelastic. .E.g. One firm producing bread/milk. (Unrealistic) ...

1 Unit 10. Introduction to welfare economics Learning objectives: to

... different from output of the other one. The firms posses initial stocks of factors of production and exchange them to maximize profits (or output). We are going to use Edgeworth box to analyse general economic equilibrium in production (see the figure below). A side of the Edgeworth box is equal to ...

... different from output of the other one. The firms posses initial stocks of factors of production and exchange them to maximize profits (or output). We are going to use Edgeworth box to analyse general economic equilibrium in production (see the figure below). A side of the Edgeworth box is equal to ...

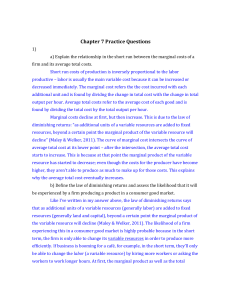

Chapter 7 Practice Questions

... to join the market. Entry of new firms to the industry causes an increase in supply, which then decrease the equilibrium price. This means that firms that were previously making a profit would now be breaking even or making a smaller profit. Entry also causes an increase in competition so that the f ...

... to join the market. Entry of new firms to the industry causes an increase in supply, which then decrease the equilibrium price. This means that firms that were previously making a profit would now be breaking even or making a smaller profit. Entry also causes an increase in competition so that the f ...

File - fortrose biz ed

... or hidden hand of the market operated in a competitive market through the pursuit of self-interest to allocate resources in society’s best interest. This remains the central view of all free-market economists, i.e. those who believe in the virtues of a free-market economy with minimal government Ada ...

... or hidden hand of the market operated in a competitive market through the pursuit of self-interest to allocate resources in society’s best interest. This remains the central view of all free-market economists, i.e. those who believe in the virtues of a free-market economy with minimal government Ada ...

lecture notes - Canvas by Instructure

... The Market System and the Circular Flow determine which industries continue to exist and which individual products survive or fail. b. Consider This … McHits and McMisses In an effort to stimulate demand and respond to market trends and conditions, McDonald’s has introduced a number of new menu ite ...

... The Market System and the Circular Flow determine which industries continue to exist and which individual products survive or fail. b. Consider This … McHits and McMisses In an effort to stimulate demand and respond to market trends and conditions, McDonald’s has introduced a number of new menu ite ...

Regulation of Externalities

... – All goods worth more than they cost to produce get produced (No DWL) – No goods worth less than they cost to produce get produced (No DWL) – Aggregate well-being is maximized ...

... – All goods worth more than they cost to produce get produced (No DWL) – No goods worth less than they cost to produce get produced (No DWL) – Aggregate well-being is maximized ...

Hastings9-Marketsand..

... – In the short run, a firm faces a horizontal demand schedule at the market price. This is their MR, which is equated to their MC to determine the amount of output to be produced. Output is determined by price (which is determined by the market supply and demand). – In the long run, firms can enter ...

... – In the short run, a firm faces a horizontal demand schedule at the market price. This is their MR, which is equated to their MC to determine the amount of output to be produced. Output is determined by price (which is determined by the market supply and demand). – In the long run, firms can enter ...

Taxes and Welfare

... We saw that the presence of monopoly, for example, could justify government interference because monopolies don’t produce output levels where MSB = MSC. But even competitive markets may fail under some circumstances. ...

... We saw that the presence of monopoly, for example, could justify government interference because monopolies don’t produce output levels where MSB = MSC. But even competitive markets may fail under some circumstances. ...

ECO228W_Ch02

... • Sellers’ decisions are modeled with a supply function • Buyers’ decisions are modeled with a demand function ...

... • Sellers’ decisions are modeled with a supply function • Buyers’ decisions are modeled with a demand function ...

Chapter 10: Monopoly and Monopsony • Objectives – By the end of

... o Explain how the problems facing monopolistically competitive firms change between the short and long run both verbally and graphically. You should also be able to compare monopolistic competition with the outcomes of perfectly competitive markets. o Graph the deadweight loss that can be associated ...

... o Explain how the problems facing monopolistically competitive firms change between the short and long run both verbally and graphically. You should also be able to compare monopolistic competition with the outcomes of perfectly competitive markets. o Graph the deadweight loss that can be associated ...

Lecture 3

... MWTP = Willingness to Pay for last unit • Public Goods MB = Sum of Marginal WTP = MC (WTP = willingness to pay) Why? Because everyone can enjoy resource without detracting from anyone else. ...

... MWTP = Willingness to Pay for last unit • Public Goods MB = Sum of Marginal WTP = MC (WTP = willingness to pay) Why? Because everyone can enjoy resource without detracting from anyone else. ...

Answers to Extra Practice Quiz

... The value of total surplus in a perfectly competitive market is the sum of consumer plus producer surplus. In this example, CS = $500 and PS = $250. Total surplus is therefore equal to $750. 3. (1 point) In the class we have talked about how a firm profit maximizes by producing that level of output ...

... The value of total surplus in a perfectly competitive market is the sum of consumer plus producer surplus. In this example, CS = $500 and PS = $250. Total surplus is therefore equal to $750. 3. (1 point) In the class we have talked about how a firm profit maximizes by producing that level of output ...

Volvo Scania Merger - Personal Homepages

... price, after sale networks, second hand value, power of the engine and comfort level. The consumer’s preference for buses is more concentrated on local service network, reliabilitty and life-time costs Change in customer’s profile For trucks we see seven big producers on European market within which ...

... price, after sale networks, second hand value, power of the engine and comfort level. The consumer’s preference for buses is more concentrated on local service network, reliabilitty and life-time costs Change in customer’s profile For trucks we see seven big producers on European market within which ...

Document

... Chapters Three and Four: Questions and Problems from the text. Review of Market Allocation Mechanisms ...

... Chapters Three and Four: Questions and Problems from the text. Review of Market Allocation Mechanisms ...

2017 General externally set task Unit 3 content

... This unit explores the theory that markets are an efficient way to allocate scarce resources, using real world markets with an emphasis on the Australian economy. When the forces of demand and supply do not allocate and price resources in a way that society would regard as efficient, equitable or ...

... This unit explores the theory that markets are an efficient way to allocate scarce resources, using real world markets with an emphasis on the Australian economy. When the forces of demand and supply do not allocate and price resources in a way that society would regard as efficient, equitable or ...

PrinciplesChapter7_2..

... Nearly 120 years ago Alfred Marshall defined the periods of production and sale – in the market period, output could not change (since it had already been produced and was sent to market). During the market period the price could change, but not output, if there were a sudden change in demand. In th ...

... Nearly 120 years ago Alfred Marshall defined the periods of production and sale – in the market period, output could not change (since it had already been produced and was sent to market). During the market period the price could change, but not output, if there were a sudden change in demand. In th ...

WORD - College of Micronesia

... To build on the understanding of how the economy works, the study of maximation and optimization of scarce resources, and how the production and distribution choices ar3 made in an economic system. The function of the market and consumer behavior, the market process in the real world and externaliti ...

... To build on the understanding of how the economy works, the study of maximation and optimization of scarce resources, and how the production and distribution choices ar3 made in an economic system. The function of the market and consumer behavior, the market process in the real world and externaliti ...