Math 1220 Section 11.1 Notes

... Find Amount of an Annuity Due An annuity in which payments are made at the beginning of each time period is called an annuity due. ...

... Find Amount of an Annuity Due An annuity in which payments are made at the beginning of each time period is called an annuity due. ...

Invest Ver - Virginia Housing Development Authority

... information under false pretenses concerning an applicant or participant may be subject to a misdemeanor and fined not more than $5,000. Any applicant or participant affected by negligent disclosure of information may bring civil action for damages, and seek other relief, as may be appropriate, agai ...

... information under false pretenses concerning an applicant or participant may be subject to a misdemeanor and fined not more than $5,000. Any applicant or participant affected by negligent disclosure of information may bring civil action for damages, and seek other relief, as may be appropriate, agai ...

Growth Control

... Annuities are long-term, tax-deferred vehicles designed for retirement purposes, and are subject to investment risk, including possible loss of principal. Withdrawals of taxable amounts are subject to ordinary income tax and, if taken prior to age 59½, a 10% additional federal tax may apply. Transam ...

... Annuities are long-term, tax-deferred vehicles designed for retirement purposes, and are subject to investment risk, including possible loss of principal. Withdrawals of taxable amounts are subject to ordinary income tax and, if taken prior to age 59½, a 10% additional federal tax may apply. Transam ...

m150cn-jm5

... of September, October and November for Christmas shopping starting in December. The account pays 3.6% compounded monthly. How much will they have saved for Christmas shopping? This is a type of annuity investment. They want to know the future value (FV) of the annuity. We can look at it as 3 differe ...

... of September, October and November for Christmas shopping starting in December. The account pays 3.6% compounded monthly. How much will they have saved for Christmas shopping? This is a type of annuity investment. They want to know the future value (FV) of the annuity. We can look at it as 3 differe ...

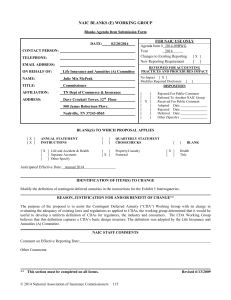

naic blanks (e) working group - National Association of Insurance

... life insurer’s obligation to make periodic payments for the annuitant’s lifetime at the time designated investments, which are not owned or held by the insurer, are depleted to a contractually-defined amount due to contractually-permitted withdrawals, market performance, fees and/or other charges. I ...

... life insurer’s obligation to make periodic payments for the annuitant’s lifetime at the time designated investments, which are not owned or held by the insurer, are depleted to a contractually-defined amount due to contractually-permitted withdrawals, market performance, fees and/or other charges. I ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... crowed-out the private market • Can be in the future much more developed because of the new rules regarding the payout phase of the public system and for the expected growth of the complementary system • Considering the MWR analysis, presents fair prices covering the component due to the cost of adv ...

... crowed-out the private market • Can be in the future much more developed because of the new rules regarding the payout phase of the public system and for the expected growth of the complementary system • Considering the MWR analysis, presents fair prices covering the component due to the cost of adv ...