The Best Interest Contract Exemption

... contains the “best interest contract” (BIC) prohibited transaction exemption (PTE), which will allow otherwise socalled “conflicted compensation” to be paid if the terms of the BIC exemption are met. The BIC exemption, while intended as a way to allow continuation of the broker-dealer/registered rep ...

... contains the “best interest contract” (BIC) prohibited transaction exemption (PTE), which will allow otherwise socalled “conflicted compensation” to be paid if the terms of the BIC exemption are met. The BIC exemption, while intended as a way to allow continuation of the broker-dealer/registered rep ...

C40400 Retirement x 2: Planning Tips for Couples

... For example, some income options provide reduced income for a surviving partner in exchange for higher income while both are living — an arrangement that can work well for some couples, particularly when both are in good health. So look carefully at your budget to see which income options might be m ...

... For example, some income options provide reduced income for a surviving partner in exchange for higher income while both are living — an arrangement that can work well for some couples, particularly when both are in good health. So look carefully at your budget to see which income options might be m ...

Renewal Rates (3-Year) - Brighthouse Financial

... because you agree to absorb all losses that exceed the chosen Shield Rate. Please refer to “Risk Factors” in the contract prospectus for more details. All product guarantees including those associated with the Shield Options are based on the claims-paying ability and financial strength of the issuin ...

... because you agree to absorb all losses that exceed the chosen Shield Rate. Please refer to “Risk Factors” in the contract prospectus for more details. All product guarantees including those associated with the Shield Options are based on the claims-paying ability and financial strength of the issuin ...

A stable option for uncertain times

... nonqualified deferred compensation plan, it’s time to talk details. When you use Principal Executive Variable Universal Life II1 insurance, you get a death benefit that can provide survivor benefits or be used to recover plan costs. Plus, the policy builds cash value. You select how premium payments ...

... nonqualified deferred compensation plan, it’s time to talk details. When you use Principal Executive Variable Universal Life II1 insurance, you get a death benefit that can provide survivor benefits or be used to recover plan costs. Plus, the policy builds cash value. You select how premium payments ...

Open Research Online How Might We Create a Secondary Annuity

... cancelling the policy there would be no ongoing administration and servicing costs to incorporate into the price. Industry experts suggested these costs might amount to 2-4% of the annuity value. If providers were able to buy back policies directly, in part as the likely first place pensioners wanti ...

... cancelling the policy there would be no ongoing administration and servicing costs to incorporate into the price. Industry experts suggested these costs might amount to 2-4% of the annuity value. If providers were able to buy back policies directly, in part as the likely first place pensioners wanti ...

Variable Annuities in Europe after the Crisis: Blockbuster

... insurance companies that do not make VAs a central pillar of their product and advising strategies. It remains doubtful whether companies will succeed in overcoming the forces of inertia in their distribution and sales organizations – above all if they include VAs as just another product among many ...

... insurance companies that do not make VAs a central pillar of their product and advising strategies. It remains doubtful whether companies will succeed in overcoming the forces of inertia in their distribution and sales organizations – above all if they include VAs as just another product among many ...

Variable Insurance and Investment Products

... Mutual Funds are groups of individual stocks, bonds, or other securities managed by investment companies. Mutual funds can offer control over the amount of risk assumed, a variety of investment choices, and opportunity for growth. Today, billions of dollars are invested in mutual funds each year and ...

... Mutual Funds are groups of individual stocks, bonds, or other securities managed by investment companies. Mutual funds can offer control over the amount of risk assumed, a variety of investment choices, and opportunity for growth. Today, billions of dollars are invested in mutual funds each year and ...

working paper / xx/12 - Ministry of Social Development

... policy problems inasmuch as the rules governing the institutions concerned are made or influenced by the government, and the consequences of institutional failure if it occurs are likely to be public policy problems themselves. Although the desired outcome – efficient decumulation – is known, the pr ...

... policy problems inasmuch as the rules governing the institutions concerned are made or influenced by the government, and the consequences of institutional failure if it occurs are likely to be public policy problems themselves. Although the desired outcome – efficient decumulation – is known, the pr ...

Documento de Trabajo N° 14: Las Pensiones en el nuevo Sistema

... Payouts, like investments, are tightly circumscribed. Lump sum withdrawals are not permitted except under narrowly specified circumstances—the remaining accumulation must be large enough to produce a pension that is at least 120% of the MPG (gradually raised to 150% starting in 2004) and 70% of the ...

... Payouts, like investments, are tightly circumscribed. Lump sum withdrawals are not permitted except under narrowly specified circumstances—the remaining accumulation must be large enough to produce a pension that is at least 120% of the MPG (gradually raised to 150% starting in 2004) and 70% of the ...

Now you can get real world financial education

... Tuition Financing, Inc. for a child, grandchild, yourself or other loved one. ...

... Tuition Financing, Inc. for a child, grandchild, yourself or other loved one. ...

topics in retirement income

... minimum income guarantee (the floor) or the income generated by the current annuity purchase rates applied to the market value of the account. Once the annuity is purchased, generally there is no liquidity. The participant may choose not to annuitize and withdraw the market value of his or her accou ...

... minimum income guarantee (the floor) or the income generated by the current annuity purchase rates applied to the market value of the account. Once the annuity is purchased, generally there is no liquidity. The participant may choose not to annuitize and withdraw the market value of his or her accou ...

Allianz MasterDex 5 PlusSM Annuity

... The Barclays Capital U.S. Aggregate Bond Index is comprised ofU.S. investment-grade, fixed-rate bond market securities, including government agency, corporate, and mortgage-backed securities. Barclays Capital and Barclays Capital U.S. Aggregate Bond Index are trademarks of Barclays Capital Inc. (“Ba ...

... The Barclays Capital U.S. Aggregate Bond Index is comprised ofU.S. investment-grade, fixed-rate bond market securities, including government agency, corporate, and mortgage-backed securities. Barclays Capital and Barclays Capital U.S. Aggregate Bond Index are trademarks of Barclays Capital Inc. (“Ba ...

Pension Pay-Out Products - Financial Services Commission

... Countries permitting PWs have prescribed specific rules and restrictions aimed at stretching or preserving the payments to the pensioner over a longer period. Additionally, these countries tend to have adequate social safety networks. ...

... Countries permitting PWs have prescribed specific rules and restrictions aimed at stretching or preserving the payments to the pensioner over a longer period. Additionally, these countries tend to have adequate social safety networks. ...

Life Insurance Product Taxation

... Insurance Company Taxation Income Taxation – can be made equitable and neutral but usually not simple I-E or variations (I-E+U) – combined insurer and insured tax on investment income. Indirect Taxation – not equitable or neutral but usually simple Premium taxation Parafiscal taxes such as a t ...

... Insurance Company Taxation Income Taxation – can be made equitable and neutral but usually not simple I-E or variations (I-E+U) – combined insurer and insured tax on investment income. Indirect Taxation – not equitable or neutral but usually simple Premium taxation Parafiscal taxes such as a t ...

Derivatives Market Risk Related to Certain Variable

... liabilities. Our derivatives primarily include swaps, futures, options and forward contracts that are exchange-traded or contracted in the over-the-counter market. Our derivatives also include interest rate guarantees we provide on our synthetic GIC products. Synthetic GICs simulate the performance ...

... liabilities. Our derivatives primarily include swaps, futures, options and forward contracts that are exchange-traded or contracted in the over-the-counter market. Our derivatives also include interest rate guarantees we provide on our synthetic GIC products. Synthetic GICs simulate the performance ...

life insurance: it`s more than death insurance

... Although life insurance acquisitions made solely for death benefit and estate planning needs can be designed to achieve the minimum required sustainable premium, in many cases it makes more sense than ever in our high and rising income tax climate to deposit more than the bare minimum into this valu ...

... Although life insurance acquisitions made solely for death benefit and estate planning needs can be designed to achieve the minimum required sustainable premium, in many cases it makes more sense than ever in our high and rising income tax climate to deposit more than the bare minimum into this valu ...

American Equity Investment Life

... This is not an illustration on how indexed annuities will perform, but it does demonstrate the powerful benefits of Indexed Annuities with the annual reset interest crediting design. All of our current products offer annual reset design. ...

... This is not an illustration on how indexed annuities will perform, but it does demonstrate the powerful benefits of Indexed Annuities with the annual reset interest crediting design. All of our current products offer annual reset design. ...

The Policy Implications of Decumulation in Retirement in New Zealand

... are offering these as noted below and fewer again of these pensions provide protection from the erosion of inflation. The second major risk faced by a retiree is the possibility of needing to meet the cost of catastrophic healthcare including expensive end of life, long-term care. While New Zealand ...

... are offering these as noted below and fewer again of these pensions provide protection from the erosion of inflation. The second major risk faced by a retiree is the possibility of needing to meet the cost of catastrophic healthcare including expensive end of life, long-term care. While New Zealand ...

IMPORTANT FINANCIAL DOCUMENTS CHECKLIST

... IMPORTANT FINANCIAL DOCUMENTS CHECKLIST When you meet with a financial planner, they will probably ask you to bring the following types of documents. These documents, along with the Personal Data Organizer will be used to tailor a financial plan to meet your life goals. Retirement Planning Documents ...

... IMPORTANT FINANCIAL DOCUMENTS CHECKLIST When you meet with a financial planner, they will probably ask you to bring the following types of documents. These documents, along with the Personal Data Organizer will be used to tailor a financial plan to meet your life goals. Retirement Planning Documents ...

Qualified Default Investment Alternatives

... charge or a liquidation, exchange or redemption fee. After the 90-day period, the normal restrictions, fees and expenses of the plan will also apply to a QDIA. For those plan sponsors who chose stable value products as the plan’s default investment prior to December 24, 2007, these arrangements are ...

... charge or a liquidation, exchange or redemption fee. After the 90-day period, the normal restrictions, fees and expenses of the plan will also apply to a QDIA. For those plan sponsors who chose stable value products as the plan’s default investment prior to December 24, 2007, these arrangements are ...

Important Financial Documents Checklist Retirement Planning

... Please bring as many of the following documents to your initial consultation as are easily accessible to you. We will use this information to begin developing a comprehensive strategy that addresses your goals and concerns. If you cannot easily locate some of these items, please bring what you can a ...

... Please bring as many of the following documents to your initial consultation as are easily accessible to you. We will use this information to begin developing a comprehensive strategy that addresses your goals and concerns. If you cannot easily locate some of these items, please bring what you can a ...

Receipts from Germany and the Young Plan

... army costs claims explained below, a postponement rather than a diminution of the total sums to be paid. The ultimate liquidation of both accounts will necessarily .be postponed, but since the claims in the one account are those of individuals to whom the time element is necessarily very important, ...

... army costs claims explained below, a postponement rather than a diminution of the total sums to be paid. The ultimate liquidation of both accounts will necessarily .be postponed, but since the claims in the one account are those of individuals to whom the time element is necessarily very important, ...

CashReady Option – Guaranteed Payments

... guaranteed… providing peace of mind especially in times of investment volatility and uncertainty. But what if your retirement years don’t go exactly as planned, or opportunities arise that you just have to take advantage of? All qualifying income annuities1 from BMO® Insurance automatically include ...

... guaranteed… providing peace of mind especially in times of investment volatility and uncertainty. But what if your retirement years don’t go exactly as planned, or opportunities arise that you just have to take advantage of? All qualifying income annuities1 from BMO® Insurance automatically include ...

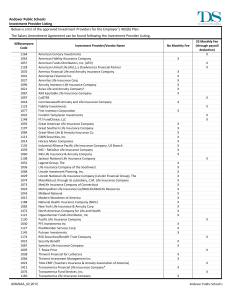

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...