The Federal Reserve System, Purposes and Functions

... Soon after the creation of the Federal Reserve, it became clear that the act had broader implications for national economic and financial oodrow Wilson signed policy. As time has passed, further the Federal Reserve Act legislation has clarified and supat 6:02 p.m. on plemented the original purposes. ...

... Soon after the creation of the Federal Reserve, it became clear that the act had broader implications for national economic and financial oodrow Wilson signed policy. As time has passed, further the Federal Reserve Act legislation has clarified and supat 6:02 p.m. on plemented the original purposes. ...

Lessons Combined - Federal Reserve Education

... Defining Moments in Federal Reserve System History: 1907–1935 | FRS Centennial Lesson Plan to achieve these objectives without political interference. Central bank independence enables the Fed to focus on the long-run performance of the economy. • Investment banks – Financial intermediaries that h ...

... Defining Moments in Federal Reserve System History: 1907–1935 | FRS Centennial Lesson Plan to achieve these objectives without political interference. Central bank independence enables the Fed to focus on the long-run performance of the economy. • Investment banks – Financial intermediaries that h ...

The Treasury-Fed Accord - Federal Reserve Bank of Richmond

... Riefler and Thomas came to his office to say they felt they had done him a disservice. They feared that war would lead to the continued pegging of the government securities market rather than the development of a free market that would permit an independent monetary policy. In fact, the opposite occ ...

... Riefler and Thomas came to his office to say they felt they had done him a disservice. They feared that war would lead to the continued pegging of the government securities market rather than the development of a free market that would permit an independent monetary policy. In fact, the opposite occ ...

A Historical Assessment of the Rationale and Functions of Reserve

... of the liquidity rationale. The Federal Reserve Act retained, for reserve requirement purposes, the classification of banks under the National Bank Act in what were known as central reserve city, reserve city, and country. bank categories. In addition, the Federal Reserve Act went further and disti ...

... of the liquidity rationale. The Federal Reserve Act retained, for reserve requirement purposes, the classification of banks under the National Bank Act in what were known as central reserve city, reserve city, and country. bank categories. In addition, the Federal Reserve Act went further and disti ...

Navigating Constraints: The Evolution of Federal Reserve Monetary

... reflected special factors affecting measured inflation and output, such as the removal of price controls and conversion of factories from defense to civilian uses after World War II. However, as we discuss below, before the Fed-Treasury Accord of 1951, changes in required reserve ratios were the Fed ...

... reflected special factors affecting measured inflation and output, such as the removal of price controls and conversion of factories from defense to civilian uses after World War II. However, as we discuss below, before the Fed-Treasury Accord of 1951, changes in required reserve ratios were the Fed ...

The Evolution of Federal Reserve Monetary Policy, 1935-59

... Hetzel (2008, pp. 55, 58) contends that in the 1950s, Federal Reserve Chairman William McChesney Martin, Jr., “laid the foundation of modern central banking,” and “had views on monetary policy that foreshadowed those of [Paul] Volcker and [Alan] Greenspan.” Other studies have been more critical of t ...

... Hetzel (2008, pp. 55, 58) contends that in the 1950s, Federal Reserve Chairman William McChesney Martin, Jr., “laid the foundation of modern central banking,” and “had views on monetary policy that foreshadowed those of [Paul] Volcker and [Alan] Greenspan.” Other studies have been more critical of t ...

Reserve Requirements: A Modern Perspective

... that banks hold non-interest-bearing reserves with the Fed amounted to a tax on banks” (“Greenspan sees benefits…” 1992). This statement suggests that if banks do not have to hold as much in non-interestearning reserves, they would likely either lend the excess out or acquire new securities. In eith ...

... that banks hold non-interest-bearing reserves with the Fed amounted to a tax on banks” (“Greenspan sees benefits…” 1992). This statement suggests that if banks do not have to hold as much in non-interestearning reserves, they would likely either lend the excess out or acquire new securities. In eith ...

Changes in the Monetary Base

... The terms on the right-hand side of Eq. (18.1) represent uses of the monetary base— that is, how the base is allocated among Federal Reserve currency held by the nonbank public and banks, bank reserves held at the Fed, and Treasury currency outstanding. Equation (18.1) doesn’t reveal all the potenti ...

... The terms on the right-hand side of Eq. (18.1) represent uses of the monetary base— that is, how the base is allocated among Federal Reserve currency held by the nonbank public and banks, bank reserves held at the Fed, and Treasury currency outstanding. Equation (18.1) doesn’t reveal all the potenti ...

Gold Standards and the Real Bills Doctrine in U.S. Monetary Policy

... amount of bank-held specie in 1860. Currency and bank deposits over the same period increased to about $1,300 million, or roughly two and one-half times their total in 1860 (Friedman and Schwartz 1963, 704; Timberlake 1993, 90, 105). Prices, including the market price of gold, also increased substan ...

... amount of bank-held specie in 1860. Currency and bank deposits over the same period increased to about $1,300 million, or roughly two and one-half times their total in 1860 (Friedman and Schwartz 1963, 704; Timberlake 1993, 90, 105). Prices, including the market price of gold, also increased substan ...

Money - Meetup

... the term came from Mesopotamia circa 3000 BC. Societies in the Americas, Asia, Africa and Australia used shell money – usually, the shell of the money cowry (Cypraea moneta) were used. According to Herodotus, and most modern scholars, the Lydians were the first people to introduce the use of gold an ...

... the term came from Mesopotamia circa 3000 BC. Societies in the Americas, Asia, Africa and Australia used shell money – usually, the shell of the money cowry (Cypraea moneta) were used. According to Herodotus, and most modern scholars, the Lydians were the first people to introduce the use of gold an ...

Some Historical Reflections on the Governance of the Federal

... current debate over reform of the Federal Reserve. Establishment of the Federal Reserve System A signature aspect of the Federal Reserve System is its federal / regional structure and governance. The Federal Reserve Act of 1913 was passed following a long deliberation over reform of the US financial ...

... current debate over reform of the Federal Reserve. Establishment of the Federal Reserve System A signature aspect of the Federal Reserve System is its federal / regional structure and governance. The Federal Reserve Act of 1913 was passed following a long deliberation over reform of the US financial ...

Introduction: How to think about economies at the macro level?

... GDP per person. The United States came second, with $32500. The G7 and most of the OECD countries ranked in the top 25 positions, together with Singapore, Hong Kong, Taiwan.. Most African countries, on the other hand, fell in the bottom 25 of the distribution. Tanzania was the poorest country, with ...

... GDP per person. The United States came second, with $32500. The G7 and most of the OECD countries ranked in the top 25 positions, together with Singapore, Hong Kong, Taiwan.. Most African countries, on the other hand, fell in the bottom 25 of the distribution. Tanzania was the poorest country, with ...

Money as Simulacrum: The Legal Nature and

... the first volume of the HarvardLaw Review addressed the issue "whether3 Congress has the power to make paper a good tender in payment of debts.", There was also a time when the Supreme Court's rulings on the constitutionality of government-issued money were considered to be among the most important ...

... the first volume of the HarvardLaw Review addressed the issue "whether3 Congress has the power to make paper a good tender in payment of debts.", There was also a time when the Supreme Court's rulings on the constitutionality of government-issued money were considered to be among the most important ...

The Free Banking Era and Online Currencies

... of then have now been replaced by the alternate online currencies. There is, for example, Bitcoin which was created in 2009, as said in the introduction to this paper, by a pseudonymous developer by the name of Satoshi Nakamoto. Bitcoin is, just like privately issued notes of the Free Banking era, a ...

... of then have now been replaced by the alternate online currencies. There is, for example, Bitcoin which was created in 2009, as said in the introduction to this paper, by a pseudonymous developer by the name of Satoshi Nakamoto. Bitcoin is, just like privately issued notes of the Free Banking era, a ...

Chapter 10 - Dr. George Fahmy

... order to minimize inflationary pressures and promote economic stability. The Federal Reserve System, frequently referred to as the Fed, consists of 12 Federal Reserve Banks, a Board of Governors, and a Federal Open Market Committee. The Federal Reserve System is considered independent in that its po ...

... order to minimize inflationary pressures and promote economic stability. The Federal Reserve System, frequently referred to as the Fed, consists of 12 Federal Reserve Banks, a Board of Governors, and a Federal Open Market Committee. The Federal Reserve System is considered independent in that its po ...

Money - Site BU

... guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency (typically notes and coins from a central bank, such as the Federal Reserve System in the U.S.) to be legal tender, m ...

... guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency (typically notes and coins from a central bank, such as the Federal Reserve System in the U.S.) to be legal tender, m ...

Kein Folientitel - Goethe

... as money, were issued by private banks. These bearer notes were claims on gold held by the bank. • In Scotland, banknotes often had a clause that allowed the bank to suspend convertibility. Although banks were legally required to pay the bearer in gold bullion, they could temporarily suspend that co ...

... as money, were issued by private banks. These bearer notes were claims on gold held by the bank. • In Scotland, banknotes often had a clause that allowed the bank to suspend convertibility. Although banks were legally required to pay the bearer in gold bullion, they could temporarily suspend that co ...

A Lesson from the Great Depression that the Fed

... analyze the e¤ect of the operation on the cross section of Treasury yields using an event study methodology. Since there were no announcements, we construct a narrative record of the period preceding and during the operation. Around the dates identi…ed from the narrative record, there were signi…ca ...

... analyze the e¤ect of the operation on the cross section of Treasury yields using an event study methodology. Since there were no announcements, we construct a narrative record of the period preceding and during the operation. Around the dates identi…ed from the narrative record, there were signi…ca ...

Chapters 10 and 15 Banks and Fiscal Policy

... or silver backing. By the end of the war nearly $250 million had been printed and spent. Representative money is money backed by-exchangeable for-some commodity, such as gold or silver. It is not in itself valuable for non-money uses, but it can be exchanged for some valuable item. Like commodity mo ...

... or silver backing. By the end of the war nearly $250 million had been printed and spent. Representative money is money backed by-exchangeable for-some commodity, such as gold or silver. It is not in itself valuable for non-money uses, but it can be exchanged for some valuable item. Like commodity mo ...

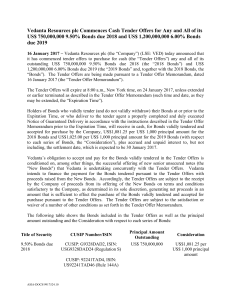

Vedanta - Tender Offer Launch Press Release

... it has commenced tender offers to purchase for cash (the “Tender Offers”) any and all of its outstanding US$ 750,000,000 9.50% Bonds due 2018 (the “2018 Bonds”) and US$ 1,200,000,000 6.00% Bonds due 2019 (the “2019 Bonds” and, together with the 2018 Bonds, the “Bonds”). The Tender Offers are being m ...

... it has commenced tender offers to purchase for cash (the “Tender Offers”) any and all of its outstanding US$ 750,000,000 9.50% Bonds due 2018 (the “2018 Bonds”) and US$ 1,200,000,000 6.00% Bonds due 2019 (the “2019 Bonds” and, together with the 2018 Bonds, the “Bonds”). The Tender Offers are being m ...

Chapter 3. Money Of Love, Money, and Transactional Efficiency

... coincidence of wants problem and reduce the number of prices, ideally to one per good. It does the former by acting as a medium of exchange, something that people acquire not for its own sake but to trade away to another person for something of use. The latter it does by serving as a unit of account ...

... coincidence of wants problem and reduce the number of prices, ideally to one per good. It does the former by acting as a medium of exchange, something that people acquire not for its own sake but to trade away to another person for something of use. The latter it does by serving as a unit of account ...

Board of Governors of the Federal Reserve System IFDP 1058

... that underreporting is more likely for outbound travels. Second, even if all travelers were to report accurately, the CMIRs require no reporting for sums below $10,000; in aggregate, these sums could be considerable. As noted above, 151 million passengers arrived and departed on international fligh ...

... that underreporting is more likely for outbound travels. Second, even if all travelers were to report accurately, the CMIRs require no reporting for sums below $10,000; in aggregate, these sums could be considerable. As noted above, 151 million passengers arrived and departed on international fligh ...

Open resource

... and 844 state-chartered Federal Reserve member banks. While these member banks represented only about 34% of all federally insured U.S. banks, they held about 80% of all insured bank assets.10 The 12 Reserve Banks are “owned” by their member banks. The stock of the Federal Reserve Banks is held enti ...

... and 844 state-chartered Federal Reserve member banks. While these member banks represented only about 34% of all federally insured U.S. banks, they held about 80% of all insured bank assets.10 The 12 Reserve Banks are “owned” by their member banks. The stock of the Federal Reserve Banks is held enti ...

bank-created money, monetary sovereignty, and the federal deficit

... Chairman of the Federal Reserve, Alan Greenspan, for example, has explained: “[A] government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims [as those created against the government when it creates mon ...

... Chairman of the Federal Reserve, Alan Greenspan, for example, has explained: “[A] government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims [as those created against the government when it creates mon ...

The History of Money - Dr. Francisco J. Collazo

... written order to pay the amount to whoever had it in their possession. These notes can be seen as a predecessor to regular banknotes. The first European banknotes were issued by Stockholm’s Banco, a predecessor of the Bank of Sweden in 1661. These replaced the copperplates being used instead as a me ...

... written order to pay the amount to whoever had it in their possession. These notes can be seen as a predecessor to regular banknotes. The first European banknotes were issued by Stockholm’s Banco, a predecessor of the Bank of Sweden in 1661. These replaced the copperplates being used instead as a me ...

United States Note

A United States Note, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the U.S. Having been current for over 100 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as ""greenbacks"" in their heyday, a name inherited from the earlier greenbacks, the Demand Notes, that they replaced in 1862. Often called Legal Tender Notes, they were called United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency. During the 1860s the so-called second obligation on the reverse of the notes stated:This Note is Legal Tender for All Debts Public and Private Except Duties On Imports And Interest On The Public Debt; And Is Redeemable In Payment Of All Loans Made To The United States.They were originally issued directly into circulation by the U.S. Treasury to pay expenses incurred by the Union during the American Civil War. Over the next century, the legislation governing these notes was modified many times and numerous versions were issued by the Treasury.United States Notes that were issued in the large-size format, before 1929, differ dramatically in appearance when compared to modern American currency, but those issued in the small-size format, starting in 1929, are very similar to contemporary Federal Reserve Notes with the highly visible distinction of having red U.S. Treasury Seals and serial numbers in place of green ones.Existing United States Notes remain valid currency in the United States; however, as no United States Notes have been issued since January 1971, they are increasingly rare in circulation.