Local Autonomy in Federal Systems: A Comparison Between

... Indeed, both countries are democratic federated state that came to exist to protect local or regional culture. As Proudhon (1921) would say, this federation were born to protect local diversity in unity. However, both countries also show differences. Switzerland as a cooperative federalist country a ...

... Indeed, both countries are democratic federated state that came to exist to protect local or regional culture. As Proudhon (1921) would say, this federation were born to protect local diversity in unity. However, both countries also show differences. Switzerland as a cooperative federalist country a ...

MURUGU MASTERS THESES - Institute Of Diplomacy and

... decentralized government makes eminent sense, given Kenya‟ s diversity and experience. The Kenya constitution 2010 entrenches devolved government by guaranteeing minimum unconditional transfer of power and resources to the counties under the new dispensation. The devolved units started functioning ...

... decentralized government makes eminent sense, given Kenya‟ s diversity and experience. The Kenya constitution 2010 entrenches devolved government by guaranteeing minimum unconditional transfer of power and resources to the counties under the new dispensation. The devolved units started functioning ...

The Effect of Political and Economic Factors on Corporate Tax Rates

... government as a proxy for transaction costs when examining tax rates. However, transaction costs include many aspects of government structure that may not be correlated with the ability to veto. Buchanan (2008) argues that the rules of government have been neglected in the political literature as th ...

... government as a proxy for transaction costs when examining tax rates. However, transaction costs include many aspects of government structure that may not be correlated with the ability to veto. Buchanan (2008) argues that the rules of government have been neglected in the political literature as th ...

Paying to Drive Freely RFF Surveys Public Attitudes to Congestion Fees

... rationing method provides a given level of road service at lower total cost. Other approaches to rationing roadway use, most notably “high-occupancy-vehicle” (HOV) lanes restricted to cars carrying two, three, or four occupants, are less efficient. Yet it is HOV lanes that have been implemented in m ...

... rationing method provides a given level of road service at lower total cost. Other approaches to rationing roadway use, most notably “high-occupancy-vehicle” (HOV) lanes restricted to cars carrying two, three, or four occupants, are less efficient. Yet it is HOV lanes that have been implemented in m ...

budgetary fund balance

... The General Fund is used to account for and report all financial resources not accounted for and reported in another fund. ...

... The General Fund is used to account for and report all financial resources not accounted for and reported in another fund. ...

8 January 2008

... There will be an impact on parish councils and potentially levying authorities but the Government has yet to indicate how and if this will be mitigated. How will pensioners be protected? The Government will publish advice on the definition of pensioners that are to be protected to fit in with both ...

... There will be an impact on parish councils and potentially levying authorities but the Government has yet to indicate how and if this will be mitigated. How will pensioners be protected? The Government will publish advice on the definition of pensioners that are to be protected to fit in with both ...

The Marginal Cost of Public Funds: Theory and

... needs to raise the same revenues as a 20 percent proportional tax on earnings. The computations indicate that the optimal exemption level can be relatively high (43 percent of earners would not pay the tax) and the optimal marginal tax rate can be over 40 percent even with relatively modest distribu ...

... needs to raise the same revenues as a 20 percent proportional tax on earnings. The computations indicate that the optimal exemption level can be relatively high (43 percent of earners would not pay the tax) and the optimal marginal tax rate can be over 40 percent even with relatively modest distribu ...

Federalism

... with a minimum national standard (example: Congress has mandated that the state provide their low-income citizens with access to some minimal level of health care through the Medicaid program). 2. Restraints forbid state governments to exercise certain powers. a) In 1982, the national government pro ...

... with a minimum national standard (example: Congress has mandated that the state provide their low-income citizens with access to some minimal level of health care through the Medicaid program). 2. Restraints forbid state governments to exercise certain powers. a) In 1982, the national government pro ...

Denmark and Sweden

... • Alberta and Ontario gave “natural person powers” – natural person power do not increase jurisdiction but increase freedom to act within an area of jurisdiction. Organizations that possess natural person powers “can enter into contracts, purchase or sell goods and services, borrow money, provide lo ...

... • Alberta and Ontario gave “natural person powers” – natural person power do not increase jurisdiction but increase freedom to act within an area of jurisdiction. Organizations that possess natural person powers “can enter into contracts, purchase or sell goods and services, borrow money, provide lo ...

What Property Tax Limitation Does to Local Public

... property taxes by increasing other taxes. In practice, few other taxes are as well suited to local government use, and even when local governments increase other taxes after a property tax limitation, they typically do not make up for all of the foregone property tax revenue.i Some local governments ...

... property taxes by increasing other taxes. In practice, few other taxes are as well suited to local government use, and even when local governments increase other taxes after a property tax limitation, they typically do not make up for all of the foregone property tax revenue.i Some local governments ...

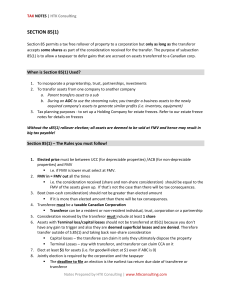

Section 85 (1)

... i.e. the consideration received (share and non-share consideration) should be equal to the FMV of the assets given up. If that’s not the case than there will be tax consequences. 3. Boot (non-cash consideration) should not be greater than elected amount If it is more than elected amount than the ...

... i.e. the consideration received (share and non-share consideration) should be equal to the FMV of the assets given up. If that’s not the case than there will be tax consequences. 3. Boot (non-cash consideration) should not be greater than elected amount If it is more than elected amount than the ...

financing of the local government capital investments

... governments to be transparent and leads to lenders exerting a certain control function on local government finances.1 Local governments rarely maintain cash surpluses large enough to pay for the entire cost of big capital projects. They can either finance a capital project from own resources, by acc ...

... governments to be transparent and leads to lenders exerting a certain control function on local government finances.1 Local governments rarely maintain cash surpluses large enough to pay for the entire cost of big capital projects. They can either finance a capital project from own resources, by acc ...

city of shawnee ordinance no. 3086 an ordinance calling for a

... qualified electors of the City the question of levying a Special Purpose Retailers’ Sales Tax to be collected by the Kansas Department of Revenue with revenue therefrom returned to the City ; and WHEREAS, pursuant to Ordinance No. 2754, passed on January 24, 2005, as approved by a majority of the el ...

... qualified electors of the City the question of levying a Special Purpose Retailers’ Sales Tax to be collected by the Kansas Department of Revenue with revenue therefrom returned to the City ; and WHEREAS, pursuant to Ordinance No. 2754, passed on January 24, 2005, as approved by a majority of the el ...

The Great Depression - National Conference of State Legislatures

... almost unimaginably small before the Great Depression. Federal spending was only 1.6 percent of gross domestic product in 1929, as compared to more than 20 percent in 2006. State and local government spending was much larger than federal spending before the Depression. In 1927, local governments spe ...

... almost unimaginably small before the Great Depression. Federal spending was only 1.6 percent of gross domestic product in 1929, as compared to more than 20 percent in 2006. State and local government spending was much larger than federal spending before the Depression. In 1927, local governments spe ...

Percent of a Number ( C )

... • A tip is money paid to workers to show satisfaction for their service. • Another word for tip is gratuity. Tips are paid to people who provide services such as cutting hair or serving meals. • A tip is usually a percent of the cost of the service. Many people consider 15% of the cost of the servic ...

... • A tip is money paid to workers to show satisfaction for their service. • Another word for tip is gratuity. Tips are paid to people who provide services such as cutting hair or serving meals. • A tip is usually a percent of the cost of the service. Many people consider 15% of the cost of the servic ...

The Tiebout Model

... The Commonwealth Government controls the major highyielding taxes: personal income tax, customs and excise duties, company income tax, and sales tax. It left only low-yielding smaller revenue sources for state and municipal governments. Australia espouses the principal of complete separation of the ...

... The Commonwealth Government controls the major highyielding taxes: personal income tax, customs and excise duties, company income tax, and sales tax. It left only low-yielding smaller revenue sources for state and municipal governments. Australia espouses the principal of complete separation of the ...

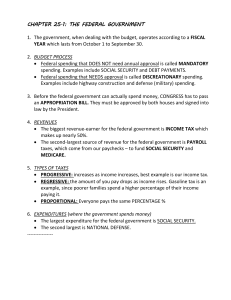

CHAPTER 24

... counting passing money down to local government), is ENTITLEMENT PROGRAMS... or what you refer to as "welfare." Another major expenditure is college and universities. States spend a significant amount of money on SUBSIDIZING (paying part of) the college tuition costs for their citizens. Without th ...

... counting passing money down to local government), is ENTITLEMENT PROGRAMS... or what you refer to as "welfare." Another major expenditure is college and universities. States spend a significant amount of money on SUBSIDIZING (paying part of) the college tuition costs for their citizens. Without th ...

TIME TO ACT IS NOW - Nigeria Labour Congress

... activities in Nigeria, especially in the oil sector is “humongus and ravenous”. The need for action is underscored by the increasing poverty and social discontent in the land. Congress is concerned that little or no progress has been made with regard to the implementation of the recommendations in t ...

... activities in Nigeria, especially in the oil sector is “humongus and ravenous”. The need for action is underscored by the increasing poverty and social discontent in the land. Congress is concerned that little or no progress has been made with regard to the implementation of the recommendations in t ...