Management Fee Evaluation

... the applicable Sub-Adviser (each, an “Interim Sub-Advisory Agreement” and collectively, the “Interim SubAdvisory Agreements”) take effect upon the closing of the Transaction. At the December 8, 2016 meeting, the Board, all of whom are Independent Trustees, unanimously approved an Interim Advisory Ag ...

... the applicable Sub-Adviser (each, an “Interim Sub-Advisory Agreement” and collectively, the “Interim SubAdvisory Agreements”) take effect upon the closing of the Transaction. At the December 8, 2016 meeting, the Board, all of whom are Independent Trustees, unanimously approved an Interim Advisory Ag ...

- Scholar Commons

... When η = YH /YL increases, the model predicts that more effort of the syndicate will be directed to project selection. That is, as high quality projects become relatively superior to low quality ones (i.e. as η increases), the syndicate naturally finds that it is worth expending more effort on proje ...

... When η = YH /YL increases, the model predicts that more effort of the syndicate will be directed to project selection. That is, as high quality projects become relatively superior to low quality ones (i.e. as η increases), the syndicate naturally finds that it is worth expending more effort on proje ...

Intel Capital Presentation

... Intel Capital Summary • Focus on Financial & Strategic success • One of a few credible corporate investors • Very experienced, value add complement VC’s • Investment strategies complement successful teams ...

... Intel Capital Summary • Focus on Financial & Strategic success • One of a few credible corporate investors • Very experienced, value add complement VC’s • Investment strategies complement successful teams ...

The Geography of Angel Investment

... This paper contributes to this literature by systematically examining the implication of geographic distance on the performance of angel investment. To my knowledge, this is the first paper to study this aspect in the angel financing literature. The literature on the angel investment performance is ...

... This paper contributes to this literature by systematically examining the implication of geographic distance on the performance of angel investment. To my knowledge, this is the first paper to study this aspect in the angel financing literature. The literature on the angel investment performance is ...

collective investment schemes in emerging markets

... pool resources of many small savers, generating a large pool of resources which they then invest in a variety of assets like shares, bonds, futures and property with the sole purpose of generating high returns. Consequently, CIS have been instrumental in raising the financial sophistication of the p ...

... pool resources of many small savers, generating a large pool of resources which they then invest in a variety of assets like shares, bonds, futures and property with the sole purpose of generating high returns. Consequently, CIS have been instrumental in raising the financial sophistication of the p ...

Download paper (PDF)

... investors and general probability distributions (not necessarily the normal distribution). Next I elaborate on the economic intuition for my results. First, I find that, if the disclosure friction is sufficiently high, firms making more voluntary disclosures have a lower cost of capital. The rationa ...

... investors and general probability distributions (not necessarily the normal distribution). Next I elaborate on the economic intuition for my results. First, I find that, if the disclosure friction is sufficiently high, firms making more voluntary disclosures have a lower cost of capital. The rationa ...

OECD - Business Angels Netzwerk Deutschland eV

... This publication covers seed and early stage financing for high growth companies in OECD and nonOECD countries with a primary focus on angel investment. Angel investment is the primary source of outside equity financing for start-ups in a number of countries, yet it is frequently overlooked as angel ...

... This publication covers seed and early stage financing for high growth companies in OECD and nonOECD countries with a primary focus on angel investment. Angel investment is the primary source of outside equity financing for start-ups in a number of countries, yet it is frequently overlooked as angel ...

Skill Composition, Technological Change and Firm Performance

... covering the period 2002–2006. The base for the sample is the structural statistics, which are data collected by Statistics Norway. Since 2002 these data comprise information on annual investments in hardware (purchased) and software (both purchased an own account). I use this information for the Th ...

... covering the period 2002–2006. The base for the sample is the structural statistics, which are data collected by Statistics Norway. Since 2002 these data comprise information on annual investments in hardware (purchased) and software (both purchased an own account). I use this information for the Th ...

Sustainable Landscapes: Investor Mapping in Asia

... as non‐DFI investors, ‘Scoping’ includes companies that are currently raising for a fund; “Based in Asia” includes those funds that have a physical presence in Asia, although may be headquartered elsewhere Source: Dalberg analysis; Interviews with investors ...

... as non‐DFI investors, ‘Scoping’ includes companies that are currently raising for a fund; “Based in Asia” includes those funds that have a physical presence in Asia, although may be headquartered elsewhere Source: Dalberg analysis; Interviews with investors ...

Book CHI IPE 141 13628.indb

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

... crowdfunding will arise due to the amplification of information asymmetries. Whereas the asymmetry problem currently concerns the feasibility of and the creator’s ability to deliver the product, in the equity setting the asymmetry problem includes the above as well as the creator’s ability to genera ...

Victory Capital Management Inc ADV Part 2A

... the investment management advice that Victory Capital provides to these clients – and how the investor will be affected by investment decisions – will vary from one client to another. Victory Capital may from time to time, subject to applicable law, discuss with clients or potential clients (upon th ...

... the investment management advice that Victory Capital provides to these clients – and how the investor will be affected by investment decisions – will vary from one client to another. Victory Capital may from time to time, subject to applicable law, discuss with clients or potential clients (upon th ...

Study on German Start-up Eco-System

... This study has been designed to provide an insight into the German start-up eco-system with the specific objective of highlighting innovative incubation and start-up finance models. The study focuses on the institutional embedding of incubation and start-up finance models in Germany, instruments, n ...

... This study has been designed to provide an insight into the German start-up eco-system with the specific objective of highlighting innovative incubation and start-up finance models. The study focuses on the institutional embedding of incubation and start-up finance models in Germany, instruments, n ...

2015 Year-End Dermatology Update

... providers in the market amidst the strong acquisition interest, private equity groups have typically gone below their typical investment size, aggregated several practices into one unified platform, or approached other private equity-backed practices for an acquisition. This strong demand has genera ...

... providers in the market amidst the strong acquisition interest, private equity groups have typically gone below their typical investment size, aggregated several practices into one unified platform, or approached other private equity-backed practices for an acquisition. This strong demand has genera ...

Financing Innovation Working Paper

... area of work will continue strongly for some time into the future. Looking forward through this review, we highlight several recent themes for the financing of innovation that cut across section boundaries. First, there is a growing body of work that documents a role for debt financing related to in ...

... area of work will continue strongly for some time into the future. Looking forward through this review, we highlight several recent themes for the financing of innovation that cut across section boundaries. First, there is a growing body of work that documents a role for debt financing related to in ...

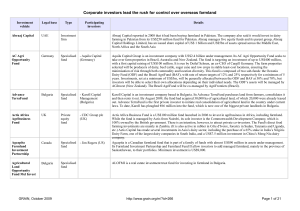

The new farm owners table

... The Altima One World Agricultural Fund is a US$625 million fund created by Altima Partners, a US$3 billion hedge fund, to invest in agricultural land and farming operations in emerging market countries. Altima invests in agribusinesses in Latin America and the Russia/Ukraine/Kazakhstan (RUK) region. ...

... The Altima One World Agricultural Fund is a US$625 million fund created by Altima Partners, a US$3 billion hedge fund, to invest in agricultural land and farming operations in emerging market countries. Altima invests in agribusinesses in Latin America and the Russia/Ukraine/Kazakhstan (RUK) region. ...

Corporate Governance and Investment in the 20th Century Japan: A

... comparing to the late 1960s, although it did not exceed the bond yield as the prewar period. Japanese firms still faced the threat of takeover, given dispersed ownership structure created by the postwar reform and the low stock price comparing to their actual asset value. The estimated Tobin’s q was ...

... comparing to the late 1960s, although it did not exceed the bond yield as the prewar period. Japanese firms still faced the threat of takeover, given dispersed ownership structure created by the postwar reform and the low stock price comparing to their actual asset value. The estimated Tobin’s q was ...

Goodwill Capital

... startup or by a firm’s existing rivals, an event that changes the public’s perception of a product’s quality, and so on.11 Equation (1) implies, of course, that goodwill capital can be negative. When negative, the market’s evaluation of the entire firm is less than the sum of the stocks of existing ...

... startup or by a firm’s existing rivals, an event that changes the public’s perception of a product’s quality, and so on.11 Equation (1) implies, of course, that goodwill capital can be negative. When negative, the market’s evaluation of the entire firm is less than the sum of the stocks of existing ...

AEC-54

... A cooperative is organized to benefit its members as patrons and not as investors. A co-op patron's return on investment is reckoned in terms of how he improved his farm income by using the coop's services, not in terms of returns on capital furnished. Member-patrons are those primarily interested ...

... A cooperative is organized to benefit its members as patrons and not as investors. A co-op patron's return on investment is reckoned in terms of how he improved his farm income by using the coop's services, not in terms of returns on capital furnished. Member-patrons are those primarily interested ...

Extending the Resource-Based View to Explain Venture Capital

... Capital Association (NVCA) member venture capital firm networks’ human-based factors to the performance of initial public offerings are examined. Second, the substantive domain—venture capital—lacks articulation and quantification regarding the impact of venture capital firms on the start-up firms t ...

... Capital Association (NVCA) member venture capital firm networks’ human-based factors to the performance of initial public offerings are examined. Second, the substantive domain—venture capital—lacks articulation and quantification regarding the impact of venture capital firms on the start-up firms t ...

SBICs: More Popular Than Ever Should You Form One?

... The SBA also issued the following guidance to BDC applicants: SBICs may apply for leverage commitments a maximum of two times per calendar year (per SBIC TechNote 13) BDC applicants are encouraged to carefully consider the appropriate Regulatory Capital amount in light of their investment strate ...

... The SBA also issued the following guidance to BDC applicants: SBICs may apply for leverage commitments a maximum of two times per calendar year (per SBIC TechNote 13) BDC applicants are encouraged to carefully consider the appropriate Regulatory Capital amount in light of their investment strate ...

Co-investments in funds of funds and separate accounts

... After formal commitment to a co-investment, the final step before funding is the completion of all of the legal documents. These include documents used to acquire the subject company, as well as the documents governing the terms between the equity sponsor and co-investor(s). The legal documents used ...

... After formal commitment to a co-investment, the final step before funding is the completion of all of the legal documents. These include documents used to acquire the subject company, as well as the documents governing the terms between the equity sponsor and co-investor(s). The legal documents used ...

Intertemporal capital budgeting

... changes in customer demand. Those changes do not necessarily warrant an immediate response entailing capital investment, but, if they turn out to be permanent or become more pronounced, do so in the future. Division managers are also likely to be better informed than headquarters about the probabili ...

... changes in customer demand. Those changes do not necessarily warrant an immediate response entailing capital investment, but, if they turn out to be permanent or become more pronounced, do so in the future. Division managers are also likely to be better informed than headquarters about the probabili ...

Does Financial Constraint Affect Shareholder Taxes and the Cost of

... To capture different tax sensitivity of investor ownership to shareholder taxes, we construct proxies for the percentage of investor ownership of a stock (individual investors and institutional investors) using data on shares outstanding and shares owned by different types of institutional investors ...

... To capture different tax sensitivity of investor ownership to shareholder taxes, we construct proxies for the percentage of investor ownership of a stock (individual investors and institutional investors) using data on shares outstanding and shares owned by different types of institutional investors ...

SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the

... Mr. Sethi graduated summa cum laude from the University of Pennsylvania in 1995. He earned both a B.S.E. from the Wharton School and a B.A. from the College of Arts and Sciences. Mr. Sethi received an honors distinction from the Economics Department, which named him the top student in the graduatin ...

... Mr. Sethi graduated summa cum laude from the University of Pennsylvania in 1995. He earned both a B.S.E. from the Wharton School and a B.A. from the College of Arts and Sciences. Mr. Sethi received an honors distinction from the Economics Department, which named him the top student in the graduatin ...

19.1 Financing Your Business

... If your company has established a successful track record, there are other types of financing available, including: venture capital (VC) companies private placements initial public offerings (IPOs) ...

... If your company has established a successful track record, there are other types of financing available, including: venture capital (VC) companies private placements initial public offerings (IPOs) ...