Working Capital Needs

... A. A common guideline for measuring this working capital ratio is $2 of current assets for each dollar of current liabilities. The need for working capital will be affected by: ...

... A. A common guideline for measuring this working capital ratio is $2 of current assets for each dollar of current liabilities. The need for working capital will be affected by: ...

Venture_Capital_ENG_

... Heavy due diligence Investment memorandum Commitment letter Shareholder’s agreement Grow the company Exit in 4-7 years ...

... Heavy due diligence Investment memorandum Commitment letter Shareholder’s agreement Grow the company Exit in 4-7 years ...

Colbar Completes $7.25 Million Series D Financing Round

... has worked in senior positions at top global companies. For further information, visit: www.vitalifevc.com. ...

... has worked in senior positions at top global companies. For further information, visit: www.vitalifevc.com. ...

read ARTICLE - California Capital Partners

... from limited partners and $130 million from Small Business Administration matching funds. The fund had its first closing last year and is expected to receive government approval during the first half of 2008, said John Nelson, managing partner of California Capital Partners. Nelson said he's seen an ...

... from limited partners and $130 million from Small Business Administration matching funds. The fund had its first closing last year and is expected to receive government approval during the first half of 2008, said John Nelson, managing partner of California Capital Partners. Nelson said he's seen an ...

XENETA RAISES $5.3 MILLION IN SERIES A

... Alliance Venture is a Norwegian venture capital firm investing in early stage technology companies. Total capital under management is 850 MNOK (about € 100 million). Alliance Venture was formed in 2001 by a team of experienced executives with broad business, financial and entrepreneurial backgrou ...

... Alliance Venture is a Norwegian venture capital firm investing in early stage technology companies. Total capital under management is 850 MNOK (about € 100 million). Alliance Venture was formed in 2001 by a team of experienced executives with broad business, financial and entrepreneurial backgrou ...

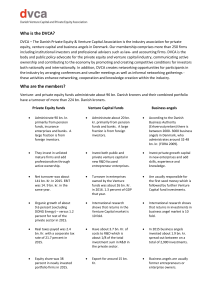

Fact sheet UK

... Turnover for Venture Capital owned enterprises was about 26 bn. kr. In 2015 which was about 1.3 percent of the Danish GDP. There are still plenty of room for more growth. Venture firms invest in newly started enterprises, which helps expanding and introducing the need for new labor. Returns on Ventu ...

... Turnover for Venture Capital owned enterprises was about 26 bn. kr. In 2015 which was about 1.3 percent of the Danish GDP. There are still plenty of room for more growth. Venture firms invest in newly started enterprises, which helps expanding and introducing the need for new labor. Returns on Ventu ...

This publication is intended for general guidance and represents our

... Trusts, who may have favoured buy-out transactions (where they provide an exit to existing shareholders), have been forced to re-focus on growth capital transactions by changes in law that took effect in November 2015. The market for growth capital has been expanded by the creation of the Business G ...

... Trusts, who may have favoured buy-out transactions (where they provide an exit to existing shareholders), have been forced to re-focus on growth capital transactions by changes in law that took effect in November 2015. The market for growth capital has been expanded by the creation of the Business G ...

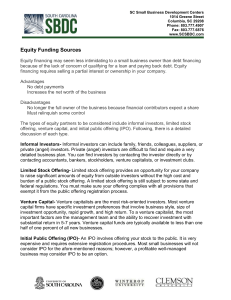

doc - South Carolina Small Business Development Centers

... exempt it from the public offering registration process. Venture Capital- Venture capitalists are the most risk-oriented investors. Most venture capital firms have specific investment preferences that involve business style, size of investment opportunity, rapid growth, and high return. To a venture ...

... exempt it from the public offering registration process. Venture Capital- Venture capitalists are the most risk-oriented investors. Most venture capital firms have specific investment preferences that involve business style, size of investment opportunity, rapid growth, and high return. To a venture ...

Private Equity Funds in Namibia: Venturing Forth

... • Illiquid and long-term investments • Clear exit strategies • Captive vs independent funds • Fees and “carry” ...

... • Illiquid and long-term investments • Clear exit strategies • Captive vs independent funds • Fees and “carry” ...

Hatchtech - Business.gov.au

... Partners, including through funds managed on behalf of the University of Melbourne as well as its funds licensed under two of the Australian Government’s venture capital programmes. Melbourne University continues to be a significant shareholder in the company. Mr Hugh Alsop, CEO of Hatchtech said: “ ...

... Partners, including through funds managed on behalf of the University of Melbourne as well as its funds licensed under two of the Australian Government’s venture capital programmes. Melbourne University continues to be a significant shareholder in the company. Mr Hugh Alsop, CEO of Hatchtech said: “ ...