Cash Flow statement

... Proceeds from disposal of intangible assets Payments to acquire intangible assets Proceeds from disposal of property, plant and equipment Payments to acquire property, plant and equipment Proceeds from disposal of non-current financial assets Payments to acquire non-current financial assets ...

... Proceeds from disposal of intangible assets Payments to acquire intangible assets Proceeds from disposal of property, plant and equipment Payments to acquire property, plant and equipment Proceeds from disposal of non-current financial assets Payments to acquire non-current financial assets ...

The U.S. Current Account Balance

... • In addition, U.S. multinational corporations sometimes over-invoice impart bills or under-report export earnings to reduce their tax obligations – worked to overstate the recorded current account deficit ...

... • In addition, U.S. multinational corporations sometimes over-invoice impart bills or under-report export earnings to reduce their tax obligations – worked to overstate the recorded current account deficit ...

Savings and Investing

... Term deposits offer a lower rate of interest than GIC’s (guaranteed investment certificates) Term deposits can usually be liquidated early Most GIC’s are locked and you would have to pay a penalty to liquidate early Some GIC’s can be redeemed on the anniversary date of their purchase Registe ...

... Term deposits offer a lower rate of interest than GIC’s (guaranteed investment certificates) Term deposits can usually be liquidated early Most GIC’s are locked and you would have to pay a penalty to liquidate early Some GIC’s can be redeemed on the anniversary date of their purchase Registe ...

CHAPTER 2 Financial Statements, Cash Flow, and

... Rates begin at 15% and rise to 35% for corporations with income over $10 million, although corporations with income between $15 million and $18.33 million pay a marginal tax rate of 38%. Also subject to state tax (around 5%). ...

... Rates begin at 15% and rise to 35% for corporations with income over $10 million, although corporations with income between $15 million and $18.33 million pay a marginal tax rate of 38%. Also subject to state tax (around 5%). ...

Chapter 5 Overheads

... You can purchase up to $5,000 worth of I Bonds annually (each calendar year). NOTE: You can purchase up to $5,000 in EE Bonds as well, totaling $10,000 max annually in paper bonds as of January 1, 2008. An individual may also purchase $5,000 in ELECTRONIC EE Bonds as well as an additional $5,000 in ...

... You can purchase up to $5,000 worth of I Bonds annually (each calendar year). NOTE: You can purchase up to $5,000 in EE Bonds as well, totaling $10,000 max annually in paper bonds as of January 1, 2008. An individual may also purchase $5,000 in ELECTRONIC EE Bonds as well as an additional $5,000 in ...

Park Your Cash in a Safe Neighborhood

... with a mutual fund, offer no FDIC safety net. Though touted as safe, there is risk, as was illustrated recently when there was a wave of funds "breaking the buck" and falling below a per-share value of $1. Structured products, such as CDs and money market accounts, are potentially good because they ...

... with a mutual fund, offer no FDIC safety net. Though touted as safe, there is risk, as was illustrated recently when there was a wave of funds "breaking the buck" and falling below a per-share value of $1. Structured products, such as CDs and money market accounts, are potentially good because they ...

Investment Terminology and Concepts

... • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! ...

... • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! ...

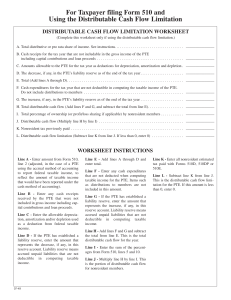

For Taxpayer filing Form 510 and Using the Distributable Cash Flow

... B. Cash receipts for the tax year that are not includable in the gross income of the PTE including capital contributions and loan proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________ C. Amounts allowable to the PTE for the tax year as d ...

... B. Cash receipts for the tax year that are not includable in the gross income of the PTE including capital contributions and loan proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________ C. Amounts allowable to the PTE for the tax year as d ...

Budgets!

... Fixed- This is spending the same amount on a particular thing at a certain time such as every year/month. You MUST pay this!! E.g. Mortgage, Television Licence Irregular- This is spending a varied amount on goods and services. It is called irregular because the amount varies each month, e.g. you ...

... Fixed- This is spending the same amount on a particular thing at a certain time such as every year/month. You MUST pay this!! E.g. Mortgage, Television Licence Irregular- This is spending a varied amount on goods and services. It is called irregular because the amount varies each month, e.g. you ...

A petty cash on hand amount that is more than recorded amount 2

... 1. Cash Over- A petty cash on hand amount that is more than recorded amount 2. Debit Memorandum- A form prepared by the customer showing the price deduction taken by the customer for returns and allowances 3. Corporation- An organization with the legal rights of a person and which many persons may o ...

... 1. Cash Over- A petty cash on hand amount that is more than recorded amount 2. Debit Memorandum- A form prepared by the customer showing the price deduction taken by the customer for returns and allowances 3. Corporation- An organization with the legal rights of a person and which many persons may o ...

Celebdaq Academy Lesson Plan

... • Every day BBC editors count the amount of press coverage (in column inches) that the each celebrity gets • On Friday the shares you own pay out a ‘dividend’. The more press coverage a celeb gets, the bigger the dividend • Just like in the real world, the more people want (demand) the share the hig ...

... • Every day BBC editors count the amount of press coverage (in column inches) that the each celebrity gets • On Friday the shares you own pay out a ‘dividend’. The more press coverage a celeb gets, the bigger the dividend • Just like in the real world, the more people want (demand) the share the hig ...

True Value and the Great I Am

... months later, oil had plunged to $90 as these emerging economies didn't seem so impervious to the economic cycle. Similarly in recent weeks, the price of cash on hand has soared to unprecedented levels and folks have been willing to sell anything and everything else for a taste of the only thing tha ...

... months later, oil had plunged to $90 as these emerging economies didn't seem so impervious to the economic cycle. Similarly in recent weeks, the price of cash on hand has soared to unprecedented levels and folks have been willing to sell anything and everything else for a taste of the only thing tha ...

9 Ways to Increase Available Cash - Multi-SWAC

... the funds, sending statements, adding interest (see 3 above) and other ways to ensure the funds are received in terms of the credit terms applied. 5. Sell off obsolete stock at any price Obsolete stock takes up space that could be better utilised for higher margin and higher moving stock. The invent ...

... the funds, sending statements, adding interest (see 3 above) and other ways to ensure the funds are received in terms of the credit terms applied. 5. Sell off obsolete stock at any price Obsolete stock takes up space that could be better utilised for higher margin and higher moving stock. The invent ...

Cash Flow Statement for the year ended 31st March, 2016

... of the Non-Engineering Business of Wimco Limited was transferred to and vested in the Company, from 1st April, 2013, which is included in financial year 2014-15 at the values stated below: (i) Loan Funds (ii) Other Liabilities (iii) Fixed Assets (Net) (iv) Investments (v) Other Assets ...

... of the Non-Engineering Business of Wimco Limited was transferred to and vested in the Company, from 1st April, 2013, which is included in financial year 2014-15 at the values stated below: (i) Loan Funds (ii) Other Liabilities (iii) Fixed Assets (Net) (iv) Investments (v) Other Assets ...

Personal Financial Literacy: Managing Financial Well

... between checking and savings accounts, so individuals usually go in and move the money to a savings account once they are paid. Many banks penalize individuals who draw money out of accounts too often. Typically do offer low interest payments to help individuals save money more quickly. ...

... between checking and savings accounts, so individuals usually go in and move the money to a savings account once they are paid. Many banks penalize individuals who draw money out of accounts too often. Typically do offer low interest payments to help individuals save money more quickly. ...

What Is Diversification?

... diversifying. The value of stocks, bonds, and mutual funds fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. ...

... diversifying. The value of stocks, bonds, and mutual funds fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. ...

Collective Investments

... each time a share is sold and another purchased CGT may be incurred. With collectives, however, gains crystallised on the sale of investments within the fund are exempt from CGT. This allows the underlying investments within the fund to be actively managed without being restricted by CGT constraints ...

... each time a share is sold and another purchased CGT may be incurred. With collectives, however, gains crystallised on the sale of investments within the fund are exempt from CGT. This allows the underlying investments within the fund to be actively managed without being restricted by CGT constraints ...

Smart LPG metering in Europe

... is, you quickly find out that main reason is due to the innovation ecosystem. For long time world-class engineering, marketing and sales talent from all over the globe are attracted to that environment where academics, investors, lawyers, public relation specialists and many others who understand th ...

... is, you quickly find out that main reason is due to the innovation ecosystem. For long time world-class engineering, marketing and sales talent from all over the globe are attracted to that environment where academics, investors, lawyers, public relation specialists and many others who understand th ...

Is a Cash Balance Plan Right for Your Business?

... Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice and are not “fiduciaries” (under ERISA, the Internal Revenue Code or otherwise) with respect to the services or activities described herein except as otherwise agreed to in writing by Morgan Stanley. Thi ...

... Morgan Stanley Financial Advisors and Private Wealth Advisors do not provide tax or legal advice and are not “fiduciaries” (under ERISA, the Internal Revenue Code or otherwise) with respect to the services or activities described herein except as otherwise agreed to in writing by Morgan Stanley. Thi ...

Saving

... Account – an account at a banking institution in which you may deposit money, earn interest, and withdraw your funds at any time Certificate of Deposit (CD) – a deposit in a savings institution that earns a fixed interest rate for a specific period of time Money Market Account – a deposit for wh ...

... Account – an account at a banking institution in which you may deposit money, earn interest, and withdraw your funds at any time Certificate of Deposit (CD) – a deposit in a savings institution that earns a fixed interest rate for a specific period of time Money Market Account – a deposit for wh ...

UNIT 6: THE FINANCIAL PLAN When the company has more

... sign of the leasing contract and is always less than the market value of the property. If fees are not paid the leasing company would remain with good. ...

... sign of the leasing contract and is always less than the market value of the property. If fees are not paid the leasing company would remain with good. ...