Unit R061 - Different types of business - Activity

... the work done as well as paying any debts if the business folds. However all the profits belong to the owner, who must then pay personal income tax on that money. Partnership The set up of a partnership is similar to that of a sole trader, however, the business is owned by two or more people. In a p ...

... the work done as well as paying any debts if the business folds. However all the profits belong to the owner, who must then pay personal income tax on that money. Partnership The set up of a partnership is similar to that of a sole trader, however, the business is owned by two or more people. In a p ...

Intragroup services caught the attention of the tax authority

... in the Estonian Income Tax Act §8 - parties are deemed to be related if they have common economic interests or if one person has dominant influence over the other. The price of related party transactions - transfer price - must be comparable with the transaction price, which is used in case of trans ...

... in the Estonian Income Tax Act §8 - parties are deemed to be related if they have common economic interests or if one person has dominant influence over the other. The price of related party transactions - transfer price - must be comparable with the transaction price, which is used in case of trans ...

Application of the United Nations Model to payments received under

... LIBOR plus 1/2%, payable quarterly, for 10 years. It then enters into a 10year interest rate swap with its investment bank, pursuant to which it will make "periodic payments" of 6% quarterly with respect to a "notional principal amount" of $100 million to the investment bank, and the investment bank ...

... LIBOR plus 1/2%, payable quarterly, for 10 years. It then enters into a 10year interest rate swap with its investment bank, pursuant to which it will make "periodic payments" of 6% quarterly with respect to a "notional principal amount" of $100 million to the investment bank, and the investment bank ...

Excess Deferred Tax Transition Issues

... Shareholder-owned electric utilities support the goals of tax reform to simplify the U.S. tax code, broaden the tax base, and reduce rates. Reducing federal income tax rates for heavily regulated shareholder-owned electric utilities, however, will create a number of transition issues that Congress s ...

... Shareholder-owned electric utilities support the goals of tax reform to simplify the U.S. tax code, broaden the tax base, and reduce rates. Reducing federal income tax rates for heavily regulated shareholder-owned electric utilities, however, will create a number of transition issues that Congress s ...

Global Stock Options USA, NORTH CAROLINA Womble

... ordinary income the lesser of the excess of the fair market value of the stock on the date of exercise over the adjusted basis in the stock on such date or the excess of the amount realized on the sale or exchange over the adjusted basis in the stock. Any gain realized in excess of the fair market v ...

... ordinary income the lesser of the excess of the fair market value of the stock on the date of exercise over the adjusted basis in the stock on such date or the excess of the amount realized on the sale or exchange over the adjusted basis in the stock. Any gain realized in excess of the fair market v ...

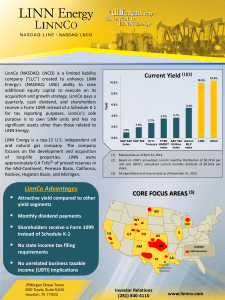

Limited Partnership

... Can be oral or written, but non-idiots put it in writing Terminates with the death of any partner in most states – Can use “Key Man” insurance to provide for the continuation of the partnership Liability is joint and several unless there are limited partners ...

... Can be oral or written, but non-idiots put it in writing Terminates with the death of any partner in most states – Can use “Key Man” insurance to provide for the continuation of the partnership Liability is joint and several unless there are limited partners ...

Shell India - Indian Merchant Chamber

... On 21 May 2012 SEBI introduced guidelines for Alternative Investments Funds (AIFs) which are funds incorporated or established in India for the purpose of pooling of capital from Indian or foreign investors These guidelines have replaced the SEBI Venture Capital Fund guidelines AIFs regulated ...

... On 21 May 2012 SEBI introduced guidelines for Alternative Investments Funds (AIFs) which are funds incorporated or established in India for the purpose of pooling of capital from Indian or foreign investors These guidelines have replaced the SEBI Venture Capital Fund guidelines AIFs regulated ...

Dividend and Payout Policy (for you to read) Dividend Policy (aka

... rather receive the cash than have managers invest it into negative NPV projects. •But note that any increase in value is really caused by a change in investment policy (foregone negative NPV projects) and not by a change of dividend policy. •To see this, note that if managers paid the dividend but r ...

... rather receive the cash than have managers invest it into negative NPV projects. •But note that any increase in value is really caused by a change in investment policy (foregone negative NPV projects) and not by a change of dividend policy. •To see this, note that if managers paid the dividend but r ...

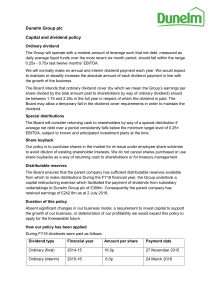

Dunelm Group plc Capital and dividend policy

... The Group will operate with a modest amount of leverage such that net debt, measured as daily average liquid funds over the most recent six month period, should fall within the range 0.25x - 0.75x last twelve months’ EBITDA. We will normally make an annual and interim dividend payment each year. We ...

... The Group will operate with a modest amount of leverage such that net debt, measured as daily average liquid funds over the most recent six month period, should fall within the range 0.25x - 0.75x last twelve months’ EBITDA. We will normally make an annual and interim dividend payment each year. We ...

What is a Property Authorised Investment Fund

... were introduced to avoid foreign companies setting up their own PAIFs and taking advantage of double taxation treaties or UK companies utilising the PAIF regime to pay less tax on their property holdings). To accommodate larger investments, HMRC has endorsed the use of a Unit Trust feeder fund which ...

... were introduced to avoid foreign companies setting up their own PAIFs and taking advantage of double taxation treaties or UK companies utilising the PAIF regime to pay less tax on their property holdings). To accommodate larger investments, HMRC has endorsed the use of a Unit Trust feeder fund which ...

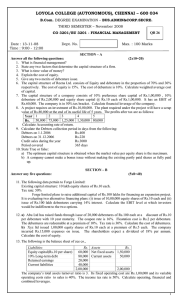

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... Forge limited plans to raise additional capital of Rs.100 lakhs for financing an expansion project. It is evaluating two alternative financing plans: (i) issue of 10,00,000 equity shares of Rs.10 each and (ii) issue of Rs.100 lakh debentures carrying 14% interest. Calculate the EBIT level at which i ...

... Forge limited plans to raise additional capital of Rs.100 lakhs for financing an expansion project. It is evaluating two alternative financing plans: (i) issue of 10,00,000 equity shares of Rs.10 each and (ii) issue of Rs.100 lakh debentures carrying 14% interest. Calculate the EBIT level at which i ...