Measuring Dividend Quality

... its selection and weighting process. Non-dividend payers are eliminated from the universe of large cap equities, as are the lowest 20 percent of companies in the DQS ranking. The DQS score evaluates dividend-paying equities across all these lenses and ranks companies on a sector basis. (For internat ...

... its selection and weighting process. Non-dividend payers are eliminated from the universe of large cap equities, as are the lowest 20 percent of companies in the DQS ranking. The DQS score evaluates dividend-paying equities across all these lenses and ranks companies on a sector basis. (For internat ...

SOLE PROPRIETORSHIP The sole proprietorship is

... limited partner, but on the other hand it is still susceptible to the disadvantages of the general partnership. C-CORPORATION Corporations differ from proprietorships and partnerships largely in that they are themselves their own entity, independent and separate from the owners. Corporations have l ...

... limited partner, but on the other hand it is still susceptible to the disadvantages of the general partnership. C-CORPORATION Corporations differ from proprietorships and partnerships largely in that they are themselves their own entity, independent and separate from the owners. Corporations have l ...

U.S. Federal Income Tax Issues in Acquisitions and Amalgamations

... including a U.S. subsidiary that is a USRPHC, a “forward” amalgamation transaction likely will be treated as ...

... including a U.S. subsidiary that is a USRPHC, a “forward” amalgamation transaction likely will be treated as ...

1 THE DIVIDEND DEBATE: GROWTH VERSUS YIELD Introduction

... Amidst the low interest rate environment of recent years, dividend paying stocks have gained increased mindshare among investors and asset allocators in an effort to supplement the suboptimal yield currently offered by fixed income. One need look no further than Canada’s TSX Exchange for evidence of ...

... Amidst the low interest rate environment of recent years, dividend paying stocks have gained increased mindshare among investors and asset allocators in an effort to supplement the suboptimal yield currently offered by fixed income. One need look no further than Canada’s TSX Exchange for evidence of ...

TATA MOTORS LIMITED DIVIDEND DISTRIBUTION POLICY

... Regulations, 2015 together with the circulars issued thereunder; as amended from time to time and such other act, rules or regulations which deals with the distribution of dividend. 3. “Board” or “Board of Directors” shall mean Board of Directors of the Company. 4. “Company” shall mean “Tata Motors ...

... Regulations, 2015 together with the circulars issued thereunder; as amended from time to time and such other act, rules or regulations which deals with the distribution of dividend. 3. “Board” or “Board of Directors” shall mean Board of Directors of the Company. 4. “Company” shall mean “Tata Motors ...

Syngene International Limited Dividend Distribution Policy Version. No

... Syngene, being a listed Company, is obligated to comply with the requirements under Securities and Exchange Board of India (Listing Obligations and Disclosure Requirement) Regulations, 2015 (‘Listing Regulations’) and any amendment thereof. This Dividend Distribution Policy (‘’the Policy’’) is being ...

... Syngene, being a listed Company, is obligated to comply with the requirements under Securities and Exchange Board of India (Listing Obligations and Disclosure Requirement) Regulations, 2015 (‘Listing Regulations’) and any amendment thereof. This Dividend Distribution Policy (‘’the Policy’’) is being ...

mining tax avoidance schemes - International Association of

... Fenced) to respective mines – Where separate and distinct mining operations are carried on by a mining company in mines which are not contiguous – Exception when mine qualifies to be an “existing mine” (even when mining operations are separate, distinct and not contiguous) • Interest Restriction (Th ...

... Fenced) to respective mines – Where separate and distinct mining operations are carried on by a mining company in mines which are not contiguous – Exception when mine qualifies to be an “existing mine” (even when mining operations are separate, distinct and not contiguous) • Interest Restriction (Th ...

DOING BUSINESS IN AZERBAIJAN

... Liability to taxation is decided by the residency of companies or individuals, by the location of assets and source of income. Residents of Azerbaijan are liable to pay income tax on income earned within the territory of Azerbaijan and outside. Non-residents are liable only for Azerbaijan sourced in ...

... Liability to taxation is decided by the residency of companies or individuals, by the location of assets and source of income. Residents of Azerbaijan are liable to pay income tax on income earned within the territory of Azerbaijan and outside. Non-residents are liable only for Azerbaijan sourced in ...

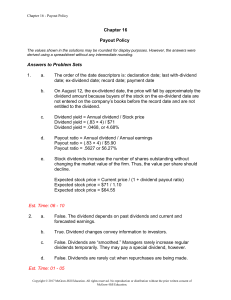

chapter 14

... The investor can then sell the stock when she chooses and pay capital gains taxes at that time. This results in tax deferral, and historically has provided the additional benefit of capital gains being taxed at a lower rate than dividends. Of course, this is all subject to the current (ever-changing ...

... The investor can then sell the stock when she chooses and pay capital gains taxes at that time. This results in tax deferral, and historically has provided the additional benefit of capital gains being taxed at a lower rate than dividends. Of course, this is all subject to the current (ever-changing ...

DIVIDEND DISTRIBUTION POLICY Preamble Dividend is

... and long term capital appreciation for all shareholders of the Company. The Company would ensure to strike the right balance between the quantum of dividend paid and amount of profits retained in the business for various purposes. The Board of Directors (Board) will refer to the policy while declari ...

... and long term capital appreciation for all shareholders of the Company. The Company would ensure to strike the right balance between the quantum of dividend paid and amount of profits retained in the business for various purposes. The Board of Directors (Board) will refer to the policy while declari ...