Cost Accounting

... The product cost is the total of cost that is associated with a unit of product. The cost in forming the product viz., direct material, direct labor, factory overhead constitute the product cost. Period cost, on the other hand, are costs that tends to be unaffected by changes in level of activity du ...

... The product cost is the total of cost that is associated with a unit of product. The cost in forming the product viz., direct material, direct labor, factory overhead constitute the product cost. Period cost, on the other hand, are costs that tends to be unaffected by changes in level of activity du ...

PUBLIC SECTOR ACCOUNTING REFORM Tatjana Jovanović

... ESA95 methodology is based on the accrual-based accounting system, thus establishing another link with IPSAS. The fundamental book for national accounts is ESA95 which is in force over the EU through a Council and Parliament Regulation, directly implemented in the Member States without any translati ...

... ESA95 methodology is based on the accrual-based accounting system, thus establishing another link with IPSAS. The fundamental book for national accounts is ESA95 which is in force over the EU through a Council and Parliament Regulation, directly implemented in the Member States without any translati ...

management information

... 3 Cost classification for inventory valuation and profit measurement 4 Cost classification for planning and decision-making 5 Cost classification for control ...

... 3 Cost classification for inventory valuation and profit measurement 4 Cost classification for planning and decision-making 5 Cost classification for control ...

Accounting for Government and Society

... modern economies. The task of such research, however, has been facilitated by the development of well defined models of investor behavior and the widespread availability of large data bases. But capital markets are not ‘society’, and many other needs and concerns may be overlooked with a pursuit of ...

... modern economies. The task of such research, however, has been facilitated by the development of well defined models of investor behavior and the widespread availability of large data bases. But capital markets are not ‘society’, and many other needs and concerns may be overlooked with a pursuit of ...

The Role of Accounting in a Society

... conceptual solutions in order to make them function better (Cooper, 2015). A good illustration of this is the concept of fair value measurement. Although the credibility of the efficient market theory as the foundation of a substantial part of accounting theory (including the fair value measurement) ...

... conceptual solutions in order to make them function better (Cooper, 2015). A good illustration of this is the concept of fair value measurement. Although the credibility of the efficient market theory as the foundation of a substantial part of accounting theory (including the fair value measurement) ...

extract

... the emergence of capitalism, or that accountants invented reading, writing and arithmetic, they would be more likely to be proud of their careers and accomplishments (Hatfield, 1924). We develop our survey by defining “accounting history research” and posing six big picture questions about historica ...

... the emergence of capitalism, or that accountants invented reading, writing and arithmetic, they would be more likely to be proud of their careers and accomplishments (Hatfield, 1924). We develop our survey by defining “accounting history research” and posing six big picture questions about historica ...

CJAR Fundamentalist Perspective on Accounting Jiang

... part of our analysis―to which the reader may take exception― is the statement of “good practice” principles in section III. All policy research must start with normative statements and we choose to make normative statements about practice to resolve accounting issues. These principles of good practi ...

... part of our analysis―to which the reader may take exception― is the statement of “good practice” principles in section III. All policy research must start with normative statements and we choose to make normative statements about practice to resolve accounting issues. These principles of good practi ...

Appendix

... At the end of the fiscal year, entries are processed to recognize expenses when they are incurred (rather than when they are paid) and to recognize revenues when they are earned (rather than when cash is received). For example, the actual cost of an item that is received by June 30th but not paid, w ...

... At the end of the fiscal year, entries are processed to recognize expenses when they are incurred (rather than when they are paid) and to recognize revenues when they are earned (rather than when cash is received). For example, the actual cost of an item that is received by June 30th but not paid, w ...

GAAP

... achieved by a business unit cannot be obtained until it is liquidated, converts its assets into cash and pays off its debts. The final accounts must be prepared on a periodic basis rather than waiting till the business is terminated. ...

... achieved by a business unit cannot be obtained until it is liquidated, converts its assets into cash and pays off its debts. The final accounts must be prepared on a periodic basis rather than waiting till the business is terminated. ...

Determining How Costs Behave

... relationship between the dependent variable and one independent variable. Multiple regression analysis estimates the relationship between the dependent variable and multiple independent variables. ...

... relationship between the dependent variable and one independent variable. Multiple regression analysis estimates the relationship between the dependent variable and multiple independent variables. ...

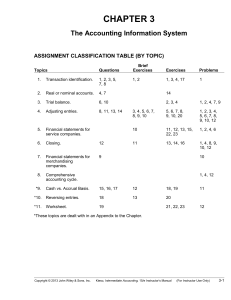

chap.3 - HCC Learning Web

... right side is the credit side. Assets and expenses are increased by debits and decreased by credits. Liabilities, stockholders’ equity, and revenues are decreased by debits and increased by credits. 4. In a double-entry system, for every debit there must be a credit and vice-versa. This leads us to ...

... right side is the credit side. Assets and expenses are increased by debits and decreased by credits. Liabilities, stockholders’ equity, and revenues are decreased by debits and increased by credits. 4. In a double-entry system, for every debit there must be a credit and vice-versa. This leads us to ...

Computerised Accounting System

... of information to various users at the same time on a real time basis (that is spontaneously). Automated Document Production : Most of the computerised accounting systems have standardised, user defined format of accounting reports that are generated automatically. The accounting reports such as Cas ...

... of information to various users at the same time on a real time basis (that is spontaneously). Automated Document Production : Most of the computerised accounting systems have standardised, user defined format of accounting reports that are generated automatically. The accounting reports such as Cas ...

Management control systems. Literature

... neoclassical economics (PORPORATO; SANDIN; SHAW, 2003). MCS are the central nervous system of our society, while accounting its language, therefore their study shall be done from the broadest possible perspective but with a clear scope. This literature review place MCS in a large environment, comple ...

... neoclassical economics (PORPORATO; SANDIN; SHAW, 2003). MCS are the central nervous system of our society, while accounting its language, therefore their study shall be done from the broadest possible perspective but with a clear scope. This literature review place MCS in a large environment, comple ...

Unit F011 - Accounting principles - Scheme of work and

... teaching hours are suggestions only. Some or all of it may be applicable to your teaching. The Specification is the document on which assessment is based and specifies what content and skills need to be covered in delivering the course. At all times, therefore, this Support Material booklet should b ...

... teaching hours are suggestions only. Some or all of it may be applicable to your teaching. The Specification is the document on which assessment is based and specifies what content and skills need to be covered in delivering the course. At all times, therefore, this Support Material booklet should b ...

RAILROAD ACCOUNTING: ITS PROBLEMS AND THEIR EFFECT

... as defined in the Uniform System which are not being depreciated. 2. Most railroads have been making provisions for depreciation on depreciable road property only since January 1, 1943. Under generally accepted accounting principles when provision for depreciation is commenced sometime during the li ...

... as defined in the Uniform System which are not being depreciated. 2. Most railroads have been making provisions for depreciation on depreciable road property only since January 1, 1943. Under generally accepted accounting principles when provision for depreciation is commenced sometime during the li ...

5 ACCOUNTING FOR

... main body of the text. In addition, those problems that involve well-known companies introduce elements of the business community with which the student is at least partially familiar. We also encourage instructors to address the many nonquantitative aspects of accounting, such as the information ne ...

... main body of the text. In addition, those problems that involve well-known companies introduce elements of the business community with which the student is at least partially familiar. We also encourage instructors to address the many nonquantitative aspects of accounting, such as the information ne ...

SO 2 Describe the flow of costs in a job order cost accounting system.

... costs. It also applies manufacturing overhead to specific jobs at the same time. For Wallace Manufacturing, overhead applied for January is $22,400 (direct labor cost of $28,000 x 80%). The following entry records this application. Jan. 31 ...

... costs. It also applies manufacturing overhead to specific jobs at the same time. For Wallace Manufacturing, overhead applied for January is $22,400 (direct labor cost of $28,000 x 80%). The following entry records this application. Jan. 31 ...

FREE Sample Here

... The results of the accounting process are expressed in terms of specific units or entities. B-4. Tentativeness. (Related to A-4.) The results of operations for relatively short periods are tentative whenever allocations between past, present, and future periods are required. Group C Imperative Postu ...

... The results of the accounting process are expressed in terms of specific units or entities. B-4. Tentativeness. (Related to A-4.) The results of operations for relatively short periods are tentative whenever allocations between past, present, and future periods are required. Group C Imperative Postu ...

Accounting Principles, 5e

... Distinguish between under- and overapplied manufacturing overhead. Underapplied manufacturing overhead Overhead assigned to work in process is less than the overhead ...

... Distinguish between under- and overapplied manufacturing overhead. Underapplied manufacturing overhead Overhead assigned to work in process is less than the overhead ...

What is Accounting? - masif-emba-fais-s12

... Careers with the IRS, the FBI, the SEC, and in public colleges and universities. ...

... Careers with the IRS, the FBI, the SEC, and in public colleges and universities. ...

The purposes of accounting

... and $4 still buys a Skinny Mocha, but not much more…. • Standards a set of pretty general principles that dictate the ...

... and $4 still buys a Skinny Mocha, but not much more…. • Standards a set of pretty general principles that dictate the ...

Accounting Theory Defined

... After transactions are identified, recorded, and summarized, 4 financial statements are prepared from the summarized accounting data: 1 A balance sheet reports the assets, liabilities, and owner’s equity at a specific date. 2 An income statement presents the revenues and expenses and resulting net i ...

... After transactions are identified, recorded, and summarized, 4 financial statements are prepared from the summarized accounting data: 1 A balance sheet reports the assets, liabilities, and owner’s equity at a specific date. 2 An income statement presents the revenues and expenses and resulting net i ...

Accounting I

... Objective 2: Identify and describe the purpose of permanent/real accounts Objective 3: Identify and describe the purpose of temporary/nominal accounts Objective 4: Use T-accounts to analyze business transactions into debits and credits. a. Identify normal balance, increase and decrease sides of all ...

... Objective 2: Identify and describe the purpose of permanent/real accounts Objective 3: Identify and describe the purpose of temporary/nominal accounts Objective 4: Use T-accounts to analyze business transactions into debits and credits. a. Identify normal balance, increase and decrease sides of all ...

the relevance of auditing in a computerized accounting system

... The introduction of computer technology into accounting systems changed the way data was stored, retrieved and controlled. It is believed that the first use of a computerized accounting system was at general electric in 1954. During the time period of 1954 to the mid -1960s, the auditing profession ...

... The introduction of computer technology into accounting systems changed the way data was stored, retrieved and controlled. It is believed that the first use of a computerized accounting system was at general electric in 1954. During the time period of 1954 to the mid -1960s, the auditing profession ...

James Bray Griffith

James Bray Griffith (1871 - Jan 1, 1937) was an American business theorist, and head of Department of Commerce, Accountancy, and Business Administration at the American School of Correspondence in Chicago, known as early systematizer of management.