Credit Access and Social Welfare in France and America

... The problem with this efficiency-versus-equity argument as it relates to consumer credit markets is that neither American nor French policymakers believed that such a trade-off existed. In the United States, policymakers on the left and right came increasingly to see consumer credit as supporting, r ...

... The problem with this efficiency-versus-equity argument as it relates to consumer credit markets is that neither American nor French policymakers believed that such a trade-off existed. In the United States, policymakers on the left and right came increasingly to see consumer credit as supporting, r ...

I. The Basic Checking Relationship and the Bank`s Right to Pay

... be received by the depositary bank not later than 4pm on the deadline: the fourth business day for nonlocal checks; the second business day for local checks. CC 229.30(a)(2) 2. Reg CC and the UCC midnight deadline a. Whereas the UCC deadline requires the payor bank to put it in the mail by midnight ...

... be received by the depositary bank not later than 4pm on the deadline: the fourth business day for nonlocal checks; the second business day for local checks. CC 229.30(a)(2) 2. Reg CC and the UCC midnight deadline a. Whereas the UCC deadline requires the payor bank to put it in the mail by midnight ...

Report by the Committee on Comprehensive Financial Services for

... IFMR Finance Foundation team - Ms. Deepti George, Mr. Rachit Khaitan, Mr. Dinesh Lodha, Mr. Vishnu Prasad, Dr. Santadarshan Sadhu, and Mr. Anand Sahasranaman who not only provided very useful research and technical support but also worked unstintingly to ensure that this report was completed in such ...

... IFMR Finance Foundation team - Ms. Deepti George, Mr. Rachit Khaitan, Mr. Dinesh Lodha, Mr. Vishnu Prasad, Dr. Santadarshan Sadhu, and Mr. Anand Sahasranaman who not only provided very useful research and technical support but also worked unstintingly to ensure that this report was completed in such ...

Infinity Federal Credit Union

... After submitting images of the front and back of your check, you will receive an onscreen confirmation that the deposit was sent to Infinity FCU. You will also have the option to review all pending deposits in the “Held for Review” section of the menu. When will the funds be available? Remote Check ...

... After submitting images of the front and back of your check, you will receive an onscreen confirmation that the deposit was sent to Infinity FCU. You will also have the option to review all pending deposits in the “Held for Review” section of the menu. When will the funds be available? Remote Check ...

sterling advisors, inc firm brochure

... After an initial meeting with the client and when deemed appropriate, we may recommend the services of an independent investment adviser (“Third Party Adviser”). The recommendation will depend on the client’s circumstances, goals and objectives, strategy desired, account size, risk tolerance, or oth ...

... After an initial meeting with the client and when deemed appropriate, we may recommend the services of an independent investment adviser (“Third Party Adviser”). The recommendation will depend on the client’s circumstances, goals and objectives, strategy desired, account size, risk tolerance, or oth ...

Creating a Sovereign Monetary System

... The payments function would consist of Transaction Accounts held by businesses and members of the public. The funds in these accounts would not be deposits created by the banks (an IOU from the bank to a customer), but electronic sovereign money, created by the central bank. These transaction funds ...

... The payments function would consist of Transaction Accounts held by businesses and members of the public. The funds in these accounts would not be deposits created by the banks (an IOU from the bank to a customer), but electronic sovereign money, created by the central bank. These transaction funds ...

Chart of Accounts

... However, following this strategy makes it more difficult to generate consistent historical comparisons. For example, if the accounting system is set up with a miscellaneous expense account that later is broken into more detailed accounts, it then would be difficult to compare those detailed expenses ...

... However, following this strategy makes it more difficult to generate consistent historical comparisons. For example, if the accounting system is set up with a miscellaneous expense account that later is broken into more detailed accounts, it then would be difficult to compare those detailed expenses ...

Fettered Consumers and Sophisticated Firms: Evidence from

... worker was not necessarily the cheapest for another since total costs depended on the wage to balance ratio of each worker. For example, a family member who was employed in, and planned to leave , the formal labor force to raise children and work within the household could disregard the flow fee and ...

... worker was not necessarily the cheapest for another since total costs depended on the wage to balance ratio of each worker. For example, a family member who was employed in, and planned to leave , the formal labor force to raise children and work within the household could disregard the flow fee and ...

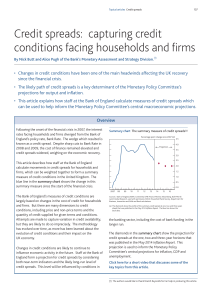

Credit spreads - Bank of England

... Savers: the gap between savings rates and reference rates is not strictly a ‘credit spread’. Nevertheless, for households with sufficient savings, the opportunity cost of additional spending may be the deposit rate they could have earned had they continued to save rather than spend. It therefore mak ...

... Savers: the gap between savings rates and reference rates is not strictly a ‘credit spread’. Nevertheless, for households with sufficient savings, the opportunity cost of additional spending may be the deposit rate they could have earned had they continued to save rather than spend. It therefore mak ...

Current Liabilities and payroll

... • Entity buys goods from a supplier with the agreement to pay at a later date – Accounts Payable (trade payable) usually due within 30 days ...

... • Entity buys goods from a supplier with the agreement to pay at a later date – Accounts Payable (trade payable) usually due within 30 days ...

Assessing payments systems in Latin America

... that electronic payments systems would ultimately lead to a “cashless society”, people around the world continue to use currency. In fact, plastic cards are playing a growing role in the cash economy through ATMs and cash-back terminals, which enable consumers to carry smaller amounts. This chapter ...

... that electronic payments systems would ultimately lead to a “cashless society”, people around the world continue to use currency. In fact, plastic cards are playing a growing role in the cash economy through ATMs and cash-back terminals, which enable consumers to carry smaller amounts. This chapter ...

Strategies to Control Defined Contribution Plan Fees

... sharing with a wrap fee, (2) revenue sharing with a fixed per participant fee, and (3) a fixed per participant fee with a wrap fee. In a revenue sharing with a wrap fee model, an additional wrap charge is applied to the funds in the plan by dividing the revenue shortfall by the total plan assets. Fo ...

... sharing with a wrap fee, (2) revenue sharing with a fixed per participant fee, and (3) a fixed per participant fee with a wrap fee. In a revenue sharing with a wrap fee model, an additional wrap charge is applied to the funds in the plan by dividing the revenue shortfall by the total plan assets. Fo ...

0538479736_265849

... Trade receivables, generally most significant category of receivables, result from the normal activities of a business. Trade receivables may be evidenced by a formal written promise to pay and classified as notes receivables. In its broadest sense, the term receivable is applicable to all claims ag ...

... Trade receivables, generally most significant category of receivables, result from the normal activities of a business. Trade receivables may be evidenced by a formal written promise to pay and classified as notes receivables. In its broadest sense, the term receivable is applicable to all claims ag ...

Banks credit assessment to small businesses

... 10 allocated banks operating with corporate services was executed. ...

... 10 allocated banks operating with corporate services was executed. ...

Which banks are more risky? The impact of loan growth

... risks, which would only materialize in the long-term or in the event of a shock. While the literature consistently finds that excessive rates of loan growth lead to greater risktaking (see e.g. Foos et al., 2010 and Jimenez and Saurina, 2007), there is less consensus among academics about the impact ...

... risks, which would only materialize in the long-term or in the event of a shock. While the literature consistently finds that excessive rates of loan growth lead to greater risktaking (see e.g. Foos et al., 2010 and Jimenez and Saurina, 2007), there is less consensus among academics about the impact ...

FCSAmerica 2017 Patronage Program / Cash

... capital to fund future growth and to develop new products and services that help you, our customer-owner, succeed. Who is eligible for the 2017 patronage program? Generally, all customers whose loans are capitalized by stock with the exceptions noted below. This includes customers who pay off their ...

... capital to fund future growth and to develop new products and services that help you, our customer-owner, succeed. Who is eligible for the 2017 patronage program? Generally, all customers whose loans are capitalized by stock with the exceptions noted below. This includes customers who pay off their ...

here - Empirical Legal Studies

... governing unfair or deceptive practices by national banks,9 it is not permitted to define what is unfair or deceptive, and it has done virtually nothing to use this authority for the protection of consumers.10 Requirements to ensure the safety and soundness of national banks may overlap with protect ...

... governing unfair or deceptive practices by national banks,9 it is not permitted to define what is unfair or deceptive, and it has done virtually nothing to use this authority for the protection of consumers.10 Requirements to ensure the safety and soundness of national banks may overlap with protect ...

The Real Effects of the Bank Lending Channel

... securitization at the firm aggregate level may be significantly lower due to “crowding out” of the credit at the firm level. Crowding out may occur for several reasons: First, some firms may not be credit constrained and, hence, may not want to increase their net borrowing. If a bank offers to incre ...

... securitization at the firm aggregate level may be significantly lower due to “crowding out” of the credit at the firm level. Crowding out may occur for several reasons: First, some firms may not be credit constrained and, hence, may not want to increase their net borrowing. If a bank offers to incre ...

11.1 Subsidiary Ledger Systems

... each sales invoice and credits a customer’s account for each item on the cash receipts daily summary 17. Describe the work done by the general ledger clerk. They make complete, balanced accounting entry for every source document 18. Why is the accounts receivable ledger updated daily? Because it is ...

... each sales invoice and credits a customer’s account for each item on the cash receipts daily summary 17. Describe the work done by the general ledger clerk. They make complete, balanced accounting entry for every source document 18. Why is the accounts receivable ledger updated daily? Because it is ...

Four Fund Accounting Essentials

... unusually large infusion of assets, allowing the spendable amount to also increase immediately, yet not greatly impacting other funds having more conventional growth. Take for example the hypothetical XYZ Family Fund that had a typical $26,000 fund balance until the grandmother passed away and a lar ...

... unusually large infusion of assets, allowing the spendable amount to also increase immediately, yet not greatly impacting other funds having more conventional growth. Take for example the hypothetical XYZ Family Fund that had a typical $26,000 fund balance until the grandmother passed away and a lar ...

DollarsDirect - Treasury.gov.au

... i. The Proposed Caps on Establishment Fees are Detrimental to Consumers and the Australian Public and would result in depriving consumers access to legitimate and responsible credit options and encourage illegal lending activities. 1. A 20% establishment fee with monthly fees that can be a maximum o ...

... i. The Proposed Caps on Establishment Fees are Detrimental to Consumers and the Australian Public and would result in depriving consumers access to legitimate and responsible credit options and encourage illegal lending activities. 1. A 20% establishment fee with monthly fees that can be a maximum o ...

- PuneICAI

... Outstanding Balance in account based on the DP calculated from stock statements older than 3 months would be deemed as irregular & if such irregular drawings are permitted for a period of 90 days, account needs to be classified as NPA. (TD) ...

... Outstanding Balance in account based on the DP calculated from stock statements older than 3 months would be deemed as irregular & if such irregular drawings are permitted for a period of 90 days, account needs to be classified as NPA. (TD) ...

1.1. Necessity of the research problem

... From 2008 to 2012, loan activities developed strongly in Vietnamese commercial banks. In a short period of time, there was a considerable increase in the loan balance at credit institutions by means of credit products, services and channels. After just 1-2 years, bad debts at various levels occurred ...

... From 2008 to 2012, loan activities developed strongly in Vietnamese commercial banks. In a short period of time, there was a considerable increase in the loan balance at credit institutions by means of credit products, services and channels. After just 1-2 years, bad debts at various levels occurred ...

Overdraft

An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation the account is said to be ""overdrawn"". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.