CPA PassMaster Questions–Auditing 4 Export Date: 10/30/08

... separate from the role of posting credits to the A/R ledger. Failure to separate the recordkeeping function from the custodial function allows an individual to misappropriate cash and then cover up the theft by posting credits against the related A/R balance. Choice "a" is incorrect. If fictitious t ...

... separate from the role of posting credits to the A/R ledger. Failure to separate the recordkeeping function from the custodial function allows an individual to misappropriate cash and then cover up the theft by posting credits against the related A/R balance. Choice "a" is incorrect. If fictitious t ...

- TestbankU

... 1. Describe cost systems and the flow of costs in job order system. Cost accounting involves the procedures for measuring, recording, and reporting product costs. From the data accumulated, companies determine the total cost and the unit cost of each product. The two basic types of cost accounting s ...

... 1. Describe cost systems and the flow of costs in job order system. Cost accounting involves the procedures for measuring, recording, and reporting product costs. From the data accumulated, companies determine the total cost and the unit cost of each product. The two basic types of cost accounting s ...

Table of Contents - Ontario Energy Board

... System of Accounts (“USoA”). This 2012 revision of the APH recognizes the requirement for most Ontario electricity distributors to adopt International Financial Reporting Standards (“IFRS”) as of January 1, 2012. This updated APH supersedes the previous version. ...

... System of Accounts (“USoA”). This 2012 revision of the APH recognizes the requirement for most Ontario electricity distributors to adopt International Financial Reporting Standards (“IFRS”) as of January 1, 2012. This updated APH supersedes the previous version. ...

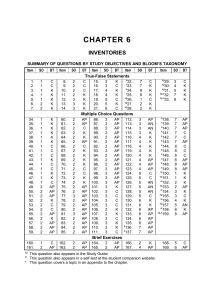

chapter 6

... 1. Describe the steps in determining inventory quantities. The steps are (1) taking a physical inventory of goods on hand and (2) determining the ownership of goods in transit or on consignment. 2. Explain the accounting for inventories, and apply the inventory cost flow methods. The primary basis o ...

... 1. Describe the steps in determining inventory quantities. The steps are (1) taking a physical inventory of goods on hand and (2) determining the ownership of goods in transit or on consignment. 2. Explain the accounting for inventories, and apply the inventory cost flow methods. The primary basis o ...

Guidance Document for Highway Infrastructure Asset Valuation

... by Local Highway Authorities in the UK. The general procedure to be used for asset valuation is described; however, some of the detailed work, such as derivation of Unit Rates and establishing asset service lives, will need to be undertaken by Local Highway Authorities. It is recommended that region ...

... by Local Highway Authorities in the UK. The general procedure to be used for asset valuation is described; however, some of the detailed work, such as derivation of Unit Rates and establishing asset service lives, will need to be undertaken by Local Highway Authorities. It is recommended that region ...

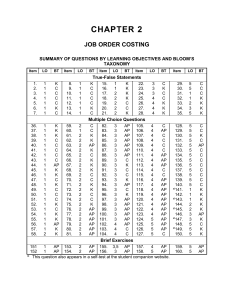

Chapter 02 Job Order Costing and Analysis

... 47. Overapplied or underapplied overhead should be removed from the Factory Overhead account at the end of each accounting period. ...

... 47. Overapplied or underapplied overhead should be removed from the Factory Overhead account at the end of each accounting period. ...

66862 c07 296-365

... THE NATURE OF INVENTORY To this point, we have concentrated on the accounting for businesses that sell services. Banks, hotels, airlines, health clubs, real estate offices, law firms, and accounting firms are all examples of service companies. In this chapter we turn to accounting by companies that ...

... THE NATURE OF INVENTORY To this point, we have concentrated on the accounting for businesses that sell services. Banks, hotels, airlines, health clubs, real estate offices, law firms, and accounting firms are all examples of service companies. In this chapter we turn to accounting by companies that ...

Does the Big-4 Effect Exist when Reputation and

... We find evidence consistent with a Big-4 effect. For partners switching to Big-4 firms, we find higher going-concern reporting accuracy, less earnings management, and higher audit fees after they switch. We observe an immediate increase in the accuracy of the going-concern reports (i.e., in the swi ...

... We find evidence consistent with a Big-4 effect. For partners switching to Big-4 firms, we find higher going-concern reporting accuracy, less earnings management, and higher audit fees after they switch. We observe an immediate increase in the accuracy of the going-concern reports (i.e., in the swi ...

Revised Guidance Statement GS 009: Auditing SMSFs

... contain a pension fund and have made an irrevocable election to become regulated in the approved form within the specified time. Approved SMSF auditor is defined in paragraph 13. The SMSF Annual Return (NAT 71226) comprises income tax reporting, regulatory reporting and member contributions reportin ...

... contain a pension fund and have made an irrevocable election to become regulated in the approved form within the specified time. Approved SMSF auditor is defined in paragraph 13. The SMSF Annual Return (NAT 71226) comprises income tax reporting, regulatory reporting and member contributions reportin ...

Defence Audit Guidelines_Final 25 March 2010

... approaches to audit that can be applied by auditors for conducting the audit of government entities in Pakistan. FAM has been implemented in the Department of the Auditor-General of Pakistan (DAG). However, during the course of its implementation, it was found that though it is quite comprehensive f ...

... approaches to audit that can be applied by auditors for conducting the audit of government entities in Pakistan. FAM has been implemented in the Department of the Auditor-General of Pakistan (DAG). However, during the course of its implementation, it was found that though it is quite comprehensive f ...

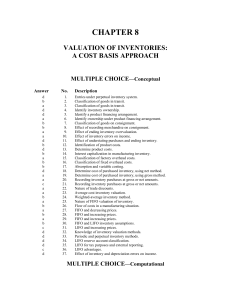

chapter 8 - Csulb.edu

... Solutions to those Multiple Choice questions for which the answer is “none of these.” ...

... Solutions to those Multiple Choice questions for which the answer is “none of these.” ...

Continuous Auditing: Implications for Assurance, Monitoring, and

... auditing and continuous monitoring is ideal. Continuous monitoring encompasses the processes that management puts in place to ensure that the policies, procedures, and business processes are operating effectively. It addresses management’s responsibility to assess the adequacy and effectiveness of c ...

... auditing and continuous monitoring is ideal. Continuous monitoring encompasses the processes that management puts in place to ensure that the policies, procedures, and business processes are operating effectively. It addresses management’s responsibility to assess the adequacy and effectiveness of c ...

Managing Quality: Modeling the Cost of Quality Improvement

... costs as the combination of the price of conformance and the price of nonconformance (Harrington, 1999). Crosby (1984) identifies the price of conformance (POC) represents the costs of making things right, and the price of non-conformance (PONC) represents the cost of doing things wrong. Zairi (1992 ...

... costs as the combination of the price of conformance and the price of nonconformance (Harrington, 1999). Crosby (1984) identifies the price of conformance (POC) represents the costs of making things right, and the price of non-conformance (PONC) represents the cost of doing things wrong. Zairi (1992 ...

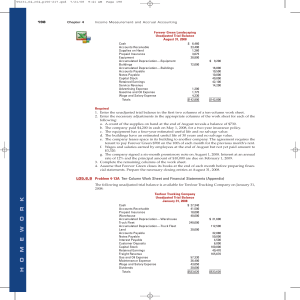

HOMEWORK

... 2. Direct labor consists of the amounts paid to workers to manufacture the product. The hourly wage paid to an assembly line worker is a primary ingredient in the cost to make the shoes. 3. Manufacturing overhead includes all other costs that are related to the manufacturing process but cannot be di ...

... 2. Direct labor consists of the amounts paid to workers to manufacture the product. The hourly wage paid to an assembly line worker is a primary ingredient in the cost to make the shoes. 3. Manufacturing overhead includes all other costs that are related to the manufacturing process but cannot be di ...

FINANCIAL ACCOUNTING : MEANING, NATURE AND ROLE OF

... year) on different items say milk, food, education, entertainment, etc. Similarly she can find the sources of her receipts such as salary of her husband, rent from property, cash gifts from her relatives, etc. Thus, at the end of a period (say a year) she can see for herself about her financial posi ...

... year) on different items say milk, food, education, entertainment, etc. Similarly she can find the sources of her receipts such as salary of her husband, rent from property, cash gifts from her relatives, etc. Thus, at the end of a period (say a year) she can see for herself about her financial posi ...

FAP Chapter 19 SM - Test Bank wizard

... 11. A predetermined factory overhead rate must be calculated for at least two reasons: (1) Not all costs are known in advance, yet the costs must be applied to products during the current period. (2) A predetermined rate is used to spread indirect costs to products and/or services throughout an acco ...

... 11. A predetermined factory overhead rate must be calculated for at least two reasons: (1) Not all costs are known in advance, yet the costs must be applied to products during the current period. (2) A predetermined rate is used to spread indirect costs to products and/or services throughout an acco ...

Auditing for Fraud Detection - Professional Education Services

... Auditors. This course is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice and assumes no liability whatsoever in connection with its use. Since tax laws are constantly changing, and are subject to differing interpretations, we ...

... Auditors. This course is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice and assumes no liability whatsoever in connection with its use. Since tax laws are constantly changing, and are subject to differing interpretations, we ...

download

... of thefor gross profit? at athe value of $98,000 property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a Follow Myretail Example 6-1what value should the land be recorded national chain. At in Gallatin Repair Service’s records? ...

... of thefor gross profit? at athe value of $98,000 property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a Follow Myretail Example 6-1what value should the land be recorded national chain. At in Gallatin Repair Service’s records? ...

Internal control and audit

... 8.3 Internal control in government Ministries do not have boards of directors. Government-wide laws and regulations regulate their business affairs. Certain assets such as buildings and infrastructure may be outside the control of those who occupy them. Moreover government entities rarely if ever c ...

... 8.3 Internal control in government Ministries do not have boards of directors. Government-wide laws and regulations regulate their business affairs. Certain assets such as buildings and infrastructure may be outside the control of those who occupy them. Moreover government entities rarely if ever c ...

extract

... institutions are shaped over a long period of time. Knowledge of accounting history allows one to better grasp the deeper function of accounting, which is to enable humans to cooperate far more broadly and intensively than any other species (Wilson, 1975). Accounting promotes economic evaluation tha ...

... institutions are shaped over a long period of time. Knowledge of accounting history allows one to better grasp the deeper function of accounting, which is to enable humans to cooperate far more broadly and intensively than any other species (Wilson, 1975). Accounting promotes economic evaluation tha ...

Merchandising Business

... at a value of $98,000 for property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a Follow Myretail Example 6-1what value should the land be recorded national chain. At in Gallatin Repair Service’s records? ...

... at a value of $98,000 for property tax purposes. On December 4, Gallatin Repair Service was offered $160,000 for the land by a Follow Myretail Example 6-1what value should the land be recorded national chain. At in Gallatin Repair Service’s records? ...

The Role of Accounting in a Society

... that accounting actually “has no virtue outside that which the social, legal and economic frameworks in which it operates allows it... [and that the] relevance of accounting to a society depends upon the aims of that society”. Thus, if society is organized around the principles of competition, the s ...

... that accounting actually “has no virtue outside that which the social, legal and economic frameworks in which it operates allows it... [and that the] relevance of accounting to a society depends upon the aims of that society”. Thus, if society is organized around the principles of competition, the s ...

Quality of Earnings Case Study Collection

... appropriate, (the emphasis here is placed on managing the business); managing earnings as we all agree, is not an acceptable practice to hit earnings targets. The AICPA will continue to provide guidance and education to ensure that our members, and others in the financial reporting community report ...

... appropriate, (the emphasis here is placed on managing the business); managing earnings as we all agree, is not an acceptable practice to hit earnings targets. The AICPA will continue to provide guidance and education to ensure that our members, and others in the financial reporting community report ...

Substantive Tests of Transactions and Balances

... transaction documents, it is important to be specific about the purpose of particular procedures. Dual-purpose tests should be narrowly defined to include only those tests that are specifically planned to provide direct evidence of both controls and substantive matters. In a broad sense, all audit t ...

... transaction documents, it is important to be specific about the purpose of particular procedures. Dual-purpose tests should be narrowly defined to include only those tests that are specifically planned to provide direct evidence of both controls and substantive matters. In a broad sense, all audit t ...