Public Debt and the EU Objectives

... OCA analysis suggests centralised budget - not possible Thus, fiscal policy must be flexible to deal with negative shocks ...

... OCA analysis suggests centralised budget - not possible Thus, fiscal policy must be flexible to deal with negative shocks ...

Lecture Two – Edited for use

... consumers spend more as a result of lower taxes, or if business confidence increases so that firms decide to invest more, the AD curve will shift to the right. ...

... consumers spend more as a result of lower taxes, or if business confidence increases so that firms decide to invest more, the AD curve will shift to the right. ...

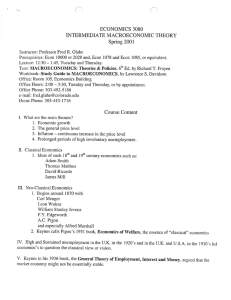

ECON 3080-002 Intermediate Macroeconomic Theory

... Vil. Break down of Keynesian Monopoly on Economic Ideas 1. Starting in the 1950's Milton Friedman challenges the Keynesian view. 2. Friedman produces .a series of theoretical and empirical works which argue against Keynesian ism. These ideas are called Monetarism. 3. Friedman predicts in 1967 that h ...

... Vil. Break down of Keynesian Monopoly on Economic Ideas 1. Starting in the 1950's Milton Friedman challenges the Keynesian view. 2. Friedman produces .a series of theoretical and empirical works which argue against Keynesian ism. These ideas are called Monetarism. 3. Friedman predicts in 1967 that h ...

Investigating Neutrality and Lack of Neutrality of Money in Iranian... Advances in Environmental Biology AENSI Journals

... employment, interest rates and real exchange rates and so on. The only exception related to transaction costs when changing their asset portfolio (between money and other financial assets). Since the changes in nominal interest rates, affect the real demand for money, some are real effects of the ch ...

... employment, interest rates and real exchange rates and so on. The only exception related to transaction costs when changing their asset portfolio (between money and other financial assets). Since the changes in nominal interest rates, affect the real demand for money, some are real effects of the ch ...

Monetary and Fiscal Policy Interact

... crowding-out? The Fed could use expansionary monetary policy; thus the government’s demand for funds would not result in an increase in interest rates. A. Are there certain conditions when the Fed should or should not prevent crowding-out? If the economy were experiencing a recession, the Fed would ...

... crowding-out? The Fed could use expansionary monetary policy; thus the government’s demand for funds would not result in an increase in interest rates. A. Are there certain conditions when the Fed should or should not prevent crowding-out? If the economy were experiencing a recession, the Fed would ...

Scylla and Charybdis: Navigating a Liquidity Trap

... Whereas inflation decreases the real value of money and debt, a deflation enhances the real value of debt and encourages the hoarding of cash. Unexpected inflation favors borrowers, while unexpected deflation favors creditors or lenders. While inflation encourages short-run consumption and commodity ...

... Whereas inflation decreases the real value of money and debt, a deflation enhances the real value of debt and encourages the hoarding of cash. Unexpected inflation favors borrowers, while unexpected deflation favors creditors or lenders. While inflation encourages short-run consumption and commodity ...

money affects real gdp - Choose your book for Principles of

... explained the change in M1 velocity from the 1950s to the 1980s? • Increased use of credit cards during this period allowed people to buy more goods and services with less cash and lower demand deposit balances relative to nominal GDP. ...

... explained the change in M1 velocity from the 1950s to the 1980s? • Increased use of credit cards during this period allowed people to buy more goods and services with less cash and lower demand deposit balances relative to nominal GDP. ...

420 INTERNATIONAL ASPECTS OF STABILIZATION POLICIES

... the laborers in the traditional sector, in fact, Equation (3) conld be replaced by an equality between real wages in the modern sector and the exogenously given traditional average labor share. Equilibrium employment and output would be irresponsive to changes in aggregate demand. A more realistic a ...

... the laborers in the traditional sector, in fact, Equation (3) conld be replaced by an equality between real wages in the modern sector and the exogenously given traditional average labor share. Equilibrium employment and output would be irresponsive to changes in aggregate demand. A more realistic a ...

Fiscal policy under floating exchange rates

... higher budget deficit). The bliss points of the monetary and fiscal authorities are defined by their objective function and we assume that the two differ. We assume that the monetary authority controls interest rates and the fiscal authority controls fiscal policy. If the two cooperated the resultin ...

... higher budget deficit). The bliss points of the monetary and fiscal authorities are defined by their objective function and we assume that the two differ. We assume that the monetary authority controls interest rates and the fiscal authority controls fiscal policy. If the two cooperated the resultin ...

Monetarist Controversy - Federal Reserve Bank of San Francisco

... to earlier ones. This analysis implied that a fixed money supply far from insuring approximate stability of prices and output, as held by the traditional view, would result in a rather unstable economy, alternating between periods of protracted unemployment and stagnation, and bursts of inflation. T ...

... to earlier ones. This analysis implied that a fixed money supply far from insuring approximate stability of prices and output, as held by the traditional view, would result in a rather unstable economy, alternating between periods of protracted unemployment and stagnation, and bursts of inflation. T ...

- World Bank eLibrary

... There have been two important shifts in Zambia’s external borrowing policy since the debt relief provided by HIPC and MDRI. First is the increased borrowing from donors such as China, India and Kuwait. Second is access to international debt markets. Between 2012 and 2015, Zambia issued Eurobonds tot ...

... There have been two important shifts in Zambia’s external borrowing policy since the debt relief provided by HIPC and MDRI. First is the increased borrowing from donors such as China, India and Kuwait. Second is access to international debt markets. Between 2012 and 2015, Zambia issued Eurobonds tot ...

Uganda Economic Outlook 2016 The Story Behind

... by the central bank to counter the depreciation of the shilling. This increased lending rates to an average of 25% on loans issued by commercial banks, thus increasing the cost of capital and slowing down investment in the period. Inflation rose throughout 2015 and peaked at 8.5% but was eventually ...

... by the central bank to counter the depreciation of the shilling. This increased lending rates to an average of 25% on loans issued by commercial banks, thus increasing the cost of capital and slowing down investment in the period. Inflation rose throughout 2015 and peaked at 8.5% but was eventually ...

Michael Bordo Interview - Federal Reserve Bank of Richmond

... problem of the lender of last resort, so we invented the Fed. And the Fed was designed to be a great improvement — and it did some good things at the beginning — but in a sense it didn’t quite learn from previous mistakes and the Great Depression came along, so it took 25 or 30 years for the Fed to ...

... problem of the lender of last resort, so we invented the Fed. And the Fed was designed to be a great improvement — and it did some good things at the beginning — but in a sense it didn’t quite learn from previous mistakes and the Great Depression came along, so it took 25 or 30 years for the Fed to ...

FRBSF E L

... Figure 1 displays the average ratio of bank lending and public debt to GDP for 17 industrialized economies (Australia, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States). Although ...

... Figure 1 displays the average ratio of bank lending and public debt to GDP for 17 industrialized economies (Australia, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States). Although ...

Bank capital, the state contingency of banks` assets and its role for

... capital. Furthermore, the state contingency of assets is expected to be an important driver for bank capital. While the returns (and prices) on a state-contingent asset depend on the current state of the economy, this is not the case for non-state-contingent assets. From this point of view, it is of ...

... capital. Furthermore, the state contingency of assets is expected to be an important driver for bank capital. While the returns (and prices) on a state-contingent asset depend on the current state of the economy, this is not the case for non-state-contingent assets. From this point of view, it is of ...

cyclically adjusted budget balance

... Two reasons to be concerned when a government runs persistent budget deficits. 1. When the government borrows funds in the financial markets, it is competing with firms that plan to borrow funds for investment spending. As a result, the government’s borrowing may “crowdout” private investment spendi ...

... Two reasons to be concerned when a government runs persistent budget deficits. 1. When the government borrows funds in the financial markets, it is competing with firms that plan to borrow funds for investment spending. As a result, the government’s borrowing may “crowdout” private investment spendi ...

Demand Side Fiscal Policy

... Second part of first question: explain reasons for changes in the distribution of government expenditure, e.g. changing economic circumstances, brought about by changing domestic or international conditions, which in addition to changing the level of spending, may cause governments to have to re- ...

... Second part of first question: explain reasons for changes in the distribution of government expenditure, e.g. changing economic circumstances, brought about by changing domestic or international conditions, which in addition to changing the level of spending, may cause governments to have to re- ...

Economics The Public Debt of Romania between 2008-2013

... inflation rate reached in December 2010 to 7.96% as a result of the increase of VAT rate on the 1st of July the 1st, the excise duty and the problems on the domestic and international food markets. In 2011 the policies adopted by the government aimed to maintain inflation in the range-to-target, red ...

... inflation rate reached in December 2010 to 7.96% as a result of the increase of VAT rate on the 1st of July the 1st, the excise duty and the problems on the domestic and international food markets. In 2011 the policies adopted by the government aimed to maintain inflation in the range-to-target, red ...

Chapter 15 Deficit and Debt 2 It is the Flow

... The government finances its deficits by selling bonds to private individuals and to the central bank Bonds are promises to pay back the money in the future The central bank can print an unlimited amount of money to buy bonds, but printing too much money can cause serious inflation ...

... The government finances its deficits by selling bonds to private individuals and to the central bank Bonds are promises to pay back the money in the future The central bank can print an unlimited amount of money to buy bonds, but printing too much money can cause serious inflation ...

United States then, Europe now Thomas J. Sargent December 12, 2011

... 1789, they rearranged fiscal affairs first and only then approached monetary arrangements as an afterthought. The fiscal institutions of the EU today remind me of those in my own country under the Articles of Confederation. The power to tax lies with the member states. Unanimous consent by member s ...

... 1789, they rearranged fiscal affairs first and only then approached monetary arrangements as an afterthought. The fiscal institutions of the EU today remind me of those in my own country under the Articles of Confederation. The power to tax lies with the member states. Unanimous consent by member s ...

Slide - Department of Economics Sciences Po

... Policy Options in an Open Economy § Maintaining Internal Balance • Both P* and E are fixed. • Internal balance: Yf = C(Yf – T) + I + G + NX(EP*/P, Yd ,Yd*) – Policy tools that affect aggregate demand in the short run: fiscal policy (T, G), devaluation/revaluation E – If E depreciates, can run ...

... Policy Options in an Open Economy § Maintaining Internal Balance • Both P* and E are fixed. • Internal balance: Yf = C(Yf – T) + I + G + NX(EP*/P, Yd ,Yd*) – Policy tools that affect aggregate demand in the short run: fiscal policy (T, G), devaluation/revaluation E – If E depreciates, can run ...

1990s - Bank i Kredyt

... inflation targeting approach is best suited to the needs of the Ukrainian economy. Some important “pros” support this statement. Under a flexible exchange rate regime the central bank should be able carry out a more independent monetary policy, which helps mitigate the negative influence of foreign ...

... inflation targeting approach is best suited to the needs of the Ukrainian economy. Some important “pros” support this statement. Under a flexible exchange rate regime the central bank should be able carry out a more independent monetary policy, which helps mitigate the negative influence of foreign ...

Document

... 30. The assertion that large budget deficits have an adverse impact on the economy is rooted in the idea that deficits would: a. raise interest rates and therefore lower investment. b. eliminate the balance of payments deficit. c. impose a burden on present generations. d. reduce inflation. ANSWER: ...

... 30. The assertion that large budget deficits have an adverse impact on the economy is rooted in the idea that deficits would: a. raise interest rates and therefore lower investment. b. eliminate the balance of payments deficit. c. impose a burden on present generations. d. reduce inflation. ANSWER: ...

The Fiscal and Monetary History of Colombia: 1963-2012 1 Introduction

... a centralized government where local governments finance their expenses mostly with transfers from the central government. Since 1968 the central government is required by law to transfer resources from value added tax and social security to local governments and with the new Constitution of 2001 tr ...

... a centralized government where local governments finance their expenses mostly with transfers from the central government. Since 1968 the central government is required by law to transfer resources from value added tax and social security to local governments and with the new Constitution of 2001 tr ...