Lecture 1

... • How financial markets affect our daily life? • How financial markets affect our economy? • The effect on other economies? • The importance of Money in the economy. ...

... • How financial markets affect our daily life? • How financial markets affect our economy? • The effect on other economies? • The importance of Money in the economy. ...

Brazil`s 1998-1999 BOP Crisis

... 1999- Brazil devaluates Real by 8% Real’s value continues to loose value down to 40%. Recession occurs due to the government’s attempt to correct the fall of the currency. ...

... 1999- Brazil devaluates Real by 8% Real’s value continues to loose value down to 40%. Recession occurs due to the government’s attempt to correct the fall of the currency. ...

SOL 11d

... The Federal Reserve Bank, also known as the _____________________, is our nation’s ___________________________ bank. The Fed’s responsibilities are to maintain the ________________________ of our ____________________________; regulate banks to ensure the soundness of the banking system and the _____ ...

... The Federal Reserve Bank, also known as the _____________________, is our nation’s ___________________________ bank. The Fed’s responsibilities are to maintain the ________________________ of our ____________________________; regulate banks to ensure the soundness of the banking system and the _____ ...

Bank One

... of M1 in the form of currency, and the required reserve ratio is 20%. 1. Estimate how much the money supply will increase in response to a new cash deposit of $500 by completing the accompanying table. (Hint: The first row shows that the bank must hold $100 in minimum reserves—20% of the $500 deposi ...

... of M1 in the form of currency, and the required reserve ratio is 20%. 1. Estimate how much the money supply will increase in response to a new cash deposit of $500 by completing the accompanying table. (Hint: The first row shows that the bank must hold $100 in minimum reserves—20% of the $500 deposi ...

Home Economics - Green Economist

... abnegation of this power • Many countries have abdicated in favour of private banks • The power of seignorage • The ability to eradicate debts, viz. recent IMF report on the Chicago Plan ...

... abnegation of this power • Many countries have abdicated in favour of private banks • The power of seignorage • The ability to eradicate debts, viz. recent IMF report on the Chicago Plan ...

Budget Deficits and the National Debt

... Balanced Budget: a budget in which revenues are equal to spending. Budget Surplus: a situation in which the government takes in more than it spends. Budget Deficit: a situation in which the government spends more than it takes in. Responding to Budget Deficits 1) The government could create more mon ...

... Balanced Budget: a budget in which revenues are equal to spending. Budget Surplus: a situation in which the government takes in more than it spends. Budget Deficit: a situation in which the government spends more than it takes in. Responding to Budget Deficits 1) The government could create more mon ...

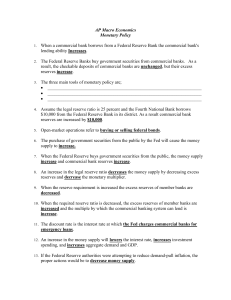

AP Macro Economics Monetary Policy When a commercial bank

... The three main tools of monetary policy are; ____________________________________________________________________ ____________________________________________________________________ ____________________________________________________________________ ...

... The three main tools of monetary policy are; ____________________________________________________________________ ____________________________________________________________________ ____________________________________________________________________ ...

BD104_fme_lnt_006_Ma..

... Tools of Monetary Control • There are 3 tools of monetary control it can use to alter the reserves of commercial banks: (a) Open-market operations. (b) The reserve ratio. (c) The discount rate. ...

... Tools of Monetary Control • There are 3 tools of monetary control it can use to alter the reserves of commercial banks: (a) Open-market operations. (b) The reserve ratio. (c) The discount rate. ...

Eco 200 – Principles of Macroeconomics

... Sterilization – open market operations to offset the domestic money supply effect of foreign exchange market intervention ...

... Sterilization – open market operations to offset the domestic money supply effect of foreign exchange market intervention ...

Macroeconomics - Econproph on Macro

... • Industrial and financial capitalism tends to be unstable • Financial and banking crises are an inherent feature of capitalism • Government fiscal policy and strict financial regulation is needed • Fiat money systems as actually practiced Rx: • Aggressive fiscal policy to assure full employment ...

... • Industrial and financial capitalism tends to be unstable • Financial and banking crises are an inherent feature of capitalism • Government fiscal policy and strict financial regulation is needed • Fiat money systems as actually practiced Rx: • Aggressive fiscal policy to assure full employment ...

May 2013 Update - Goodwin Securities, Inc.

... Economic Update: There is much recent hullabaloo over the famous Rogoff and Reinhart finding that high levels of govt debt severely impact a country’s growth. I’ve cited their work before and I will stick to their findings: at some point when govt debt is greater than 90% of total country GDP, priva ...

... Economic Update: There is much recent hullabaloo over the famous Rogoff and Reinhart finding that high levels of govt debt severely impact a country’s growth. I’ve cited their work before and I will stick to their findings: at some point when govt debt is greater than 90% of total country GDP, priva ...

New Keynesian Economics

... The demand for money L = kPYe-αi, where P = the domestic price level, Y = real output i = the nominal interest rate, α = the interest elasticity of money demand, and k is a constant = 1/V, V = money velocity The assumption of a constant money velocity is a keystone to monetarism ...

... The demand for money L = kPYe-αi, where P = the domestic price level, Y = real output i = the nominal interest rate, α = the interest elasticity of money demand, and k is a constant = 1/V, V = money velocity The assumption of a constant money velocity is a keystone to monetarism ...

Slide 1

... • Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of ...

... • Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of ...

Ch 18 Milton Friedman

... • Transitory changes in income do not affect consumption spending, only permanent changes do • This implies a small marginal propensity to consume and, therefore, a small multiplier. • This makes Keynesian fiscal policy ineffective ...

... • Transitory changes in income do not affect consumption spending, only permanent changes do • This implies a small marginal propensity to consume and, therefore, a small multiplier. • This makes Keynesian fiscal policy ineffective ...

Multiple Choice: Circle the answer the best completes each question

... 23. One way the Fed can try to combat inflation would be to sell bonds. 24. The most powerful monetary tool is the reserve requirement. 25. One necessary characteristic of money is that it must be unlimited in supply. 26. Commercial banks like Wells Fargo and Washington Mutual make a profit by loani ...

... 23. One way the Fed can try to combat inflation would be to sell bonds. 24. The most powerful monetary tool is the reserve requirement. 25. One necessary characteristic of money is that it must be unlimited in supply. 26. Commercial banks like Wells Fargo and Washington Mutual make a profit by loani ...

The Federal Reserve

... • If the “FED” buys government securities from banks then a banks total reserves increase allowing the bank to loan out more money (Expansionary) • If the “FED” sells government securities from banks then a banks total reserves decrease forcing the bank to loan out less money (Contractionary) ...

... • If the “FED” buys government securities from banks then a banks total reserves increase allowing the bank to loan out more money (Expansionary) • If the “FED” sells government securities from banks then a banks total reserves decrease forcing the bank to loan out less money (Contractionary) ...

Banking and Money Creation

... European plan, led on by England, is that capital shall control labor by controlling wages. The great debt that the capitalists will see to it is made out of the war, must be used as a means to control the volume of money. To accomplish this the bonds must be used as a banking basis. We are now wait ...

... European plan, led on by England, is that capital shall control labor by controlling wages. The great debt that the capitalists will see to it is made out of the war, must be used as a means to control the volume of money. To accomplish this the bonds must be used as a banking basis. We are now wait ...

Macroeconomics I Final exam: sample questions

... A. bank deposits divided by bank reserves B. bank deposits divided by high-powered money C. money supply divided by high-powered money D. the currency divided by bank reserves 4. A nation's balance of payments can be affected by changes in A. foreign income B. the differential between domestic and f ...

... A. bank deposits divided by bank reserves B. bank deposits divided by high-powered money C. money supply divided by high-powered money D. the currency divided by bank reserves 4. A nation's balance of payments can be affected by changes in A. foreign income B. the differential between domestic and f ...

Monetary Policy Practice

... If the Fed believes there is too much money in the economy, they can try to reduce lending activity by banks. In order to do this, they should _________________ the discount rate. This would cause banks to _______________ their interest rates. As interest rates increase, money becomes ______________ ...

... If the Fed believes there is too much money in the economy, they can try to reduce lending activity by banks. In order to do this, they should _________________ the discount rate. This would cause banks to _______________ their interest rates. As interest rates increase, money becomes ______________ ...

CENTRAL BANKING

... government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity. QE targets commercial bank ...

... government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity. QE targets commercial bank ...

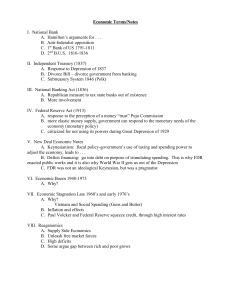

Economic Terms/Notes

... A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for not using its powers during Great Depression of 1929 V. New Deal Economic Notes A. Keynesianism: fiscal polic ...

... A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for not using its powers during Great Depression of 1929 V. New Deal Economic Notes A. Keynesianism: fiscal polic ...