Fiscal Policy, Incentives, and Secondary Effects

... • An increase in government borrowing to finance an enlarged budget deficit places upward pressure on real interest rates. • This retards private investment and aggregate demand. • In an open economy, high interest rates attract foreign capital. • As foreigners buy more dollars to buy U.S. bonds and ...

... • An increase in government borrowing to finance an enlarged budget deficit places upward pressure on real interest rates. • This retards private investment and aggregate demand. • In an open economy, high interest rates attract foreign capital. • As foreigners buy more dollars to buy U.S. bonds and ...

Coyote Economist Panel Discussion on The Recession News.from.the.Department.of.Economics,.CSUSB

... anyway. But, in a context of considerable unemployment, government borrowing will be financed by the excess saving that’s not being absorbed by the private sector. Rather than displacing private borrowing, government borrowing will take up the slack left by the decline in private borrowing. The impa ...

... anyway. But, in a context of considerable unemployment, government borrowing will be financed by the excess saving that’s not being absorbed by the private sector. Rather than displacing private borrowing, government borrowing will take up the slack left by the decline in private borrowing. The impa ...

Medium Term Debt Management Strategy 2015-2017

... medium-term to ensure debt sustainability while minimizing costs and risks embedded in the debt portfolio. The 2015 – 2017 MTDS reaffirms the Government’s commitment to reducing the Debt to GDP ratio and debt service payments. Through the establishment of indicative targets, the Strategy also consid ...

... medium-term to ensure debt sustainability while minimizing costs and risks embedded in the debt portfolio. The 2015 – 2017 MTDS reaffirms the Government’s commitment to reducing the Debt to GDP ratio and debt service payments. Through the establishment of indicative targets, the Strategy also consid ...

Debt Sustainability- Medium term Outlook

... Debt reduction should be the guiding principle of fiscal adjustment. ...

... Debt reduction should be the guiding principle of fiscal adjustment. ...

foreign reserves and international adjustments under the bretton

... production and the need for reserves. Both Keynes and Cassel views led to the conclusions that there was a gold shortage. This was highly influential at the times of the Bretton Woods conference, when it was decided to create a fund out of which credit could be granted to member countries (in additi ...

... production and the need for reserves. Both Keynes and Cassel views led to the conclusions that there was a gold shortage. This was highly influential at the times of the Bretton Woods conference, when it was decided to create a fund out of which credit could be granted to member countries (in additi ...

Lecture 4 - The Digital Economist

... (after-tax) income, household wealth, savings needs and plans, confidence in the future direction of the economy, and interest rates (in the case of durable-goods purchases). Investment Expenditure Investment expenditure I represents a smaller share of the total but tends to be the most volatile com ...

... (after-tax) income, household wealth, savings needs and plans, confidence in the future direction of the economy, and interest rates (in the case of durable-goods purchases). Investment Expenditure Investment expenditure I represents a smaller share of the total but tends to be the most volatile com ...

Impact of Macroprudential Policy Measures on Economic Dynamics: Simulation Using

... In addition, financial innovations can occur to promote credit expansions in the bubble period. For example, investment trusts and leveraged financial products that repackage such investment trusts appeared in the period leading up to the Great Depression in the United States, and they accelerated c ...

... In addition, financial innovations can occur to promote credit expansions in the bubble period. For example, investment trusts and leveraged financial products that repackage such investment trusts appeared in the period leading up to the Great Depression in the United States, and they accelerated c ...

Lectures 12 to 14

... From GNE to GDP: Accounting for Trade in Goods and Services ■ Personal consumption expenditures (usually called “consumption”) equal total spending by private households on final goods and services, including nondurable goods such as food, durable goods, and services. ■ Gross private domestic invest ...

... From GNE to GDP: Accounting for Trade in Goods and Services ■ Personal consumption expenditures (usually called “consumption”) equal total spending by private households on final goods and services, including nondurable goods such as food, durable goods, and services. ■ Gross private domestic invest ...

Monetary and Fiscal Policy in a Liquidity Trap:

... this way, even if short-term rates come up against the lower bound, the Bank can still “borrow” from the effect of the future low rates” (Fukui (2003)). 4 The BOJ terminated this commitment in August 2000, and made a new commitment of maintaining quantitative easing policy until “the core CPI registe ...

... this way, even if short-term rates come up against the lower bound, the Bank can still “borrow” from the effect of the future low rates” (Fukui (2003)). 4 The BOJ terminated this commitment in August 2000, and made a new commitment of maintaining quantitative easing policy until “the core CPI registe ...

The Czech National Bank`s Role Since the Global Crisis

... recession driven by very weak domestic demand. The central bank cut the interest rates further and hit the “technically zero” level in November 2012. To achieve further monetary policy easing, the CNB used forward guidance on the nominal interest rates, and established an exchange rate commitment at ...

... recession driven by very weak domestic demand. The central bank cut the interest rates further and hit the “technically zero” level in November 2012. To achieve further monetary policy easing, the CNB used forward guidance on the nominal interest rates, and established an exchange rate commitment at ...

16 September, 2010

... industrial base. The region’s petrochemical sector is a lead candidate for a development push. Admittedly, as an industry whose end-products are derivates of oil and natural gas, it might not contribute much to diversification of the GCC economy. But it will enable local economies to add more value ...

... industrial base. The region’s petrochemical sector is a lead candidate for a development push. Admittedly, as an industry whose end-products are derivates of oil and natural gas, it might not contribute much to diversification of the GCC economy. But it will enable local economies to add more value ...

in Ahmet Kose, Fikret Senses and Erinc Yeldan (eds) Neoliberal

... sufficiently low that households and businesses do not have to take it into account in making every day decisions”. For Feldstein (1997), however, price stability meant a long-run inflation rate of zero. In addition, inflation targeting is usually associated with appropriate changes in the central b ...

... sufficiently low that households and businesses do not have to take it into account in making every day decisions”. For Feldstein (1997), however, price stability meant a long-run inflation rate of zero. In addition, inflation targeting is usually associated with appropriate changes in the central b ...

Epstein, Gerald and Erinc Yeldan: "Inflation Targeting, Employment

... sufficiently low that households and businesses do not have to take it into account in making every day decisions”. For Feldstein (1997), however, price stability meant a long-run inflation rate of zero. In addition, inflation targeting is usually associated with appropriate changes in the central b ...

... sufficiently low that households and businesses do not have to take it into account in making every day decisions”. For Feldstein (1997), however, price stability meant a long-run inflation rate of zero. In addition, inflation targeting is usually associated with appropriate changes in the central b ...

money market

... Other Determinants of Planned Investment The assumption that planned investment depends only on the interest rate is obviously a simplification, just as is the assumption that consumption depends only on income. In practice, the decision of a firm on how much to invest depends on, among other things ...

... Other Determinants of Planned Investment The assumption that planned investment depends only on the interest rate is obviously a simplification, just as is the assumption that consumption depends only on income. In practice, the decision of a firm on how much to invest depends on, among other things ...

Chapter 1 U G F

... Revenue receipts exceeded the budget estimates marginally by 0.82 per cent mainly due to an increase in non-tax revenue receipts by 4.47 per cent which compensated the marginal shortfall in tax collections and resulted in overall better realization of revenue receipts during the year. However, an in ...

... Revenue receipts exceeded the budget estimates marginally by 0.82 per cent mainly due to an increase in non-tax revenue receipts by 4.47 per cent which compensated the marginal shortfall in tax collections and resulted in overall better realization of revenue receipts during the year. However, an in ...

Separating the Debt Limit From the Deficit Problem

... have loaned the federal government money to finance deficits. Debt held by the public stood at $11.6 trillion on December 31. The gross federal debt — and its close cousin, debt subject to limit — consist of debt held by the public plus debt that one part of the federal government owes another part. ...

... have loaned the federal government money to finance deficits. Debt held by the public stood at $11.6 trillion on December 31. The gross federal debt — and its close cousin, debt subject to limit — consist of debt held by the public plus debt that one part of the federal government owes another part. ...

File

... A major change in monetary policy allowed the Bank of England to be free to pursue its policy goals without direct political control. An economist studied how the British bond market reacted to the policy change by comparing the interest rates changes on two types of long-term bonds: bonds that are ...

... A major change in monetary policy allowed the Bank of England to be free to pursue its policy goals without direct political control. An economist studied how the British bond market reacted to the policy change by comparing the interest rates changes on two types of long-term bonds: bonds that are ...

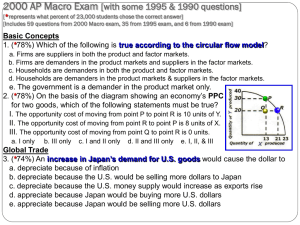

increase

... d. a smaller money supply increases private sector investment 49. (41%) If, at FE, the G wants to increase its spending by $100 billion without increasing inflation in the short run, it must do which of the following? a. raise taxes by more than $100 billion c. raise taxes by less than $100 b. raise ...

... d. a smaller money supply increases private sector investment 49. (41%) If, at FE, the G wants to increase its spending by $100 billion without increasing inflation in the short run, it must do which of the following? a. raise taxes by more than $100 billion c. raise taxes by less than $100 b. raise ...

The Transmission of Monetary Policy Operations through

... Suppose the central bank wishes to sell a risky asset (an asset with lower return in a bad state); one would think the private sector would be in principle only willing to buy it at a lower price. However, in the frictionless settings analyzed by Woodford (2012), even if the central bank keeps the r ...

... Suppose the central bank wishes to sell a risky asset (an asset with lower return in a bad state); one would think the private sector would be in principle only willing to buy it at a lower price. However, in the frictionless settings analyzed by Woodford (2012), even if the central bank keeps the r ...

2013-2017 - Sierra Leone Country Strategy Paper

... by the decade long conflict. The country has successfully implemented two medium term development strategies that invested in peace and state-building mainly through consolidation and infrastructure enhancement and strengthening macroeconomic foundations by qualifying for debt relief under Highly In ...

... by the decade long conflict. The country has successfully implemented two medium term development strategies that invested in peace and state-building mainly through consolidation and infrastructure enhancement and strengthening macroeconomic foundations by qualifying for debt relief under Highly In ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... depending solely on the domestic deficit. Now suppose external creditors suspend voluntary lending so that the capitalization coefficient falls to zero, as occurred in 1982. It is immediately apparent that reduced access to automatic capitalization of interest payments increases the portion of the d ...

... depending solely on the domestic deficit. Now suppose external creditors suspend voluntary lending so that the capitalization coefficient falls to zero, as occurred in 1982. It is immediately apparent that reduced access to automatic capitalization of interest payments increases the portion of the d ...

NBER WORKING PAPER SERIES STABILIZATION POLICIES IN OPEN ECONOMIES Richard C. Marston

... trade balance (B), all measured in units of domestic output. Expenditure by residents (2.2) is a function of income (Y), the interest rate (r), and the real wealth of domestic residents; real wealth is the sum (A) of money and ...

... trade balance (B), all measured in units of domestic output. Expenditure by residents (2.2) is a function of income (Y), the interest rate (r), and the real wealth of domestic residents; real wealth is the sum (A) of money and ...