Major Duties and Responsibilities of Assistant Manager (Audit)

... independent department entrusts to conduct financial and management audit of its Partner Organizations (POs), which are directly implementing PKSF’s programs and projects at field level all over the country. IAD is also responsible for conducting pre-audit of all payments and expenditures of PKSF in ...

... independent department entrusts to conduct financial and management audit of its Partner Organizations (POs), which are directly implementing PKSF’s programs and projects at field level all over the country. IAD is also responsible for conducting pre-audit of all payments and expenditures of PKSF in ...

DOC, 113 Kb

... The Program cannot be used by other departments of the University and other universities without prior permission from the Program authors’ department. ...

... The Program cannot be used by other departments of the University and other universities without prior permission from the Program authors’ department. ...

Syllabus - Institute of Credit Management

... Internal and external auditors. How auditors’ reports can benefit a credit manager. Differences in financial reporting for unincorporated sole traders and ...

... Internal and external auditors. How auditors’ reports can benefit a credit manager. Differences in financial reporting for unincorporated sole traders and ...

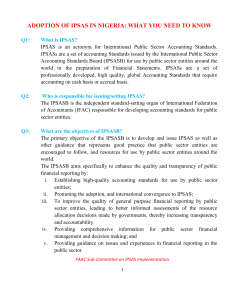

What You Need To Know

... and presenting consolidated financial statements for an economic entity under the accrual basis of accounting. Also addresses how to account for investments in controlled entities, jointly controlled entities and associates in separate financial statements. Prescribes the investor’s accounting for i ...

... and presenting consolidated financial statements for an economic entity under the accrual basis of accounting. Also addresses how to account for investments in controlled entities, jointly controlled entities and associates in separate financial statements. Prescribes the investor’s accounting for i ...

FY2011 Compilation Report from the accountants

... We have compiled the accompanying statements of financial position of Ski for Light, Inc. as of May 31, 2011 and 2010 and the related statements of activities and changes in net assets and cash flows for the years then ended. We have not audited or reviewed the accompanying financial statements and, ...

... We have compiled the accompanying statements of financial position of Ski for Light, Inc. as of May 31, 2011 and 2010 and the related statements of activities and changes in net assets and cash flows for the years then ended. We have not audited or reviewed the accompanying financial statements and, ...

Slide 1

... Full Disclosure Principle 充分揭示 A company is required to report the details behind financial statements that would impact users’ decisions. ...

... Full Disclosure Principle 充分揭示 A company is required to report the details behind financial statements that would impact users’ decisions. ...

internal-auditing-instructional-material

... Standards on reporting 1. Written audit reports are to be submitted to the appropriate of the organization audited & to the appropriate officials of the organization requiring or arranging for the audit unless legal restrictions or ethical consideration prevents it. Copies of the report shall should ...

... Standards on reporting 1. Written audit reports are to be submitted to the appropriate of the organization audited & to the appropriate officials of the organization requiring or arranging for the audit unless legal restrictions or ethical consideration prevents it. Copies of the report shall should ...

2015-230 Presentation of Financial Statements of Not-for

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

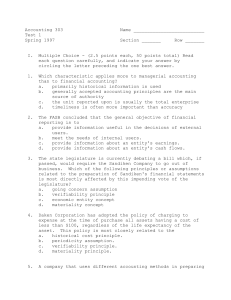

AT1- 1 Achievement Test 1 Achievement Test 1: Chapters 1 and 2

... manner. b. Selecting the economic activities relevant to a particular organization. c. Preparing accounting reports, including financial statements. d. Quantifying events in dollars and cents. ____ 9. The current source of "GAAP" in the private sector is the a. Accounting Principles Board. b. Intern ...

... manner. b. Selecting the economic activities relevant to a particular organization. c. Preparing accounting reports, including financial statements. d. Quantifying events in dollars and cents. ____ 9. The current source of "GAAP" in the private sector is the a. Accounting Principles Board. b. Intern ...

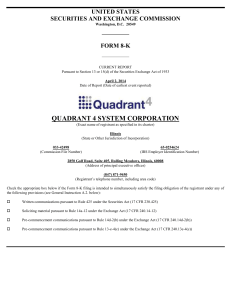

Quadrant 4 System Corp (Form: 8-K, Received: 04/14

... Sassetti is being replaced as the Company’s independent accountant for the fiscal year that commenced on January 1, 2014. The report of Sassetti on the Company’s consolidated financial statements for the year ended December 31, 2013 did not contain an adverse opinion or a disclaimer of opinion and w ...

... Sassetti is being replaced as the Company’s independent accountant for the fiscal year that commenced on January 1, 2014. The report of Sassetti on the Company’s consolidated financial statements for the year ended December 31, 2013 did not contain an adverse opinion or a disclaimer of opinion and w ...

Fund Financial Statements - Minnesota Board of Water and Soil

... Each fiscal year the District develops a work plan that is used as a guide in using resources effectively to provide maximum conservation of all lands within its boundaries. The work plan includes guidelines for employees and technicians to follow in order to achieve the District’s objectives. The D ...

... Each fiscal year the District develops a work plan that is used as a guide in using resources effectively to provide maximum conservation of all lands within its boundaries. The work plan includes guidelines for employees and technicians to follow in order to achieve the District’s objectives. The D ...

Transaction Analysis

... International standards are referred to as International Financial Reporting Standards (IFRS), developed by the International Accounting Standards Board (IASB). ...

... International standards are referred to as International Financial Reporting Standards (IFRS), developed by the International Accounting Standards Board (IASB). ...

Approved form - Australian Prudential Regulation Authority

... of .………………………………………………………………. [insert name of the superannuation entity]. My audit has been conducted in accordance with Australian Auditing Standards5. These Standards require that I comply with relevant ethical requirements relating to audit engagements and plan and perform the audit to obtain rea ...

... of .………………………………………………………………. [insert name of the superannuation entity]. My audit has been conducted in accordance with Australian Auditing Standards5. These Standards require that I comply with relevant ethical requirements relating to audit engagements and plan and perform the audit to obtain rea ...

FINANCIAL STATEMENTS DECEMBER 31, 2015 toge

... Management considers the likelihood of changes by taxing authorities in its filed income tax returns and recognizes a liability for or discloses potential significant changes that management believes are more likely than not to occur, including changes to Predisan's status as a not-for-profit entity ...

... Management considers the likelihood of changes by taxing authorities in its filed income tax returns and recognizes a liability for or discloses potential significant changes that management believes are more likely than not to occur, including changes to Predisan's status as a not-for-profit entity ...

BERRIEN COUNTY BUILDING AUTHORITY

... America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of ma ...

... America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of ma ...

chapter_1-guidedoutlinestud

... (1) Describe the nature of a business, the role of accounting, and ethics in business; (2) Summarize the development of accounting principles and relate them to practice; (3) State the accounting equation and define each element of the equation; (4) Describe and illustrate how business transactions ...

... (1) Describe the nature of a business, the role of accounting, and ethics in business; (2) Summarize the development of accounting principles and relate them to practice; (3) State the accounting equation and define each element of the equation; (4) Describe and illustrate how business transactions ...

FAR Change Alerts - I Pass the CPA Exam!

... Prior to this standard, a reporting entity with a fiscal year-end that did not match a month-end might incur more costs than other entities when measuring the fair value of plan assets of benefit plans. This was because third-party service provider information about the fair value of plan assets is ...

... Prior to this standard, a reporting entity with a fiscal year-end that did not match a month-end might incur more costs than other entities when measuring the fair value of plan assets of benefit plans. This was because third-party service provider information about the fair value of plan assets is ...

Role of a Board Member in Financial Oversight

... – Are we overly dependent on a single funding source? – Is revenue increasing at least as fast as expenses? – Did our bottom line meet expectations? ...

... – Are we overly dependent on a single funding source? – Is revenue increasing at least as fast as expenses? – Did our bottom line meet expectations? ...

APES 205 Conformity with Accounting Standards

... Activities are provided by a Member in Public Practice in respect of Engagements of either a recurring or demand nature. Code means APES 110 Code of Ethics for Professional Accountants. Compliance Framework means: (a) a financial reporting framework that requires compliance with the requirements of ...

... Activities are provided by a Member in Public Practice in respect of Engagements of either a recurring or demand nature. Code means APES 110 Code of Ethics for Professional Accountants. Compliance Framework means: (a) a financial reporting framework that requires compliance with the requirements of ...

LESSON ONE

... All other liabilities would be classified as non-current liabilities. Income Statement IAS 1 considers the issue of the presentation of the income statement, which in other national published accounting standards is referred to as the profit and loss account. The standard distinguishes the function ...

... All other liabilities would be classified as non-current liabilities. Income Statement IAS 1 considers the issue of the presentation of the income statement, which in other national published accounting standards is referred to as the profit and loss account. The standard distinguishes the function ...

November 12, 2014 International Ethics Standards Board for

... The consensus of the AAA Auditing Standards Committee (we) is that there is a need to improve the balance between the familiarity treat that comes by long association with the client and the need to maintain appropriate knowledge and experience to support audit quality. As a basis for the proposal, ...

... The consensus of the AAA Auditing Standards Committee (we) is that there is a need to improve the balance between the familiarity treat that comes by long association with the client and the need to maintain appropriate knowledge and experience to support audit quality. As a basis for the proposal, ...

topic 1 - WordPress.com

... Illustration: Are the following events recorded in the accounting records? Owner withdraws cash Supplies are An employee for personal Event purchased on is hired. use. account. ...

... Illustration: Are the following events recorded in the accounting records? Owner withdraws cash Supplies are An employee for personal Event purchased on is hired. use. account. ...

Audited Financial Statements

... A summary of the significant accounting policies applied in the preparation of the accompanying financial statements follows: Basis of Accounting The financial statements of the Organization have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting p ...

... A summary of the significant accounting policies applied in the preparation of the accompanying financial statements follows: Basis of Accounting The financial statements of the Organization have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting p ...

1. Accountants refer to an economic event as a a. purchase. b. sale

... b. journalizing and posting adjusting entries. c. preparing a post-closing trial balance. d. posting to ledger accounts. ...

... b. journalizing and posting adjusting entries. c. preparing a post-closing trial balance. d. posting to ledger accounts. ...

Test 1, Spring 1997 - College of Business Administration

... 8. A prepaid expense is a. payment received by the company in advance for the future sale of inventory or performance of services. b. an item of goods or services purchased by the company for use in its operations but not fully consumed by the end of the accounting period. c. an expense that has bee ...

... 8. A prepaid expense is a. payment received by the company in advance for the future sale of inventory or performance of services. b. an item of goods or services purchased by the company for use in its operations but not fully consumed by the end of the accounting period. c. an expense that has bee ...