Fund Manager Sector Minimum Investment Fund Size

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

Prudential With

... The value of your policy will be sent out in your annual statement or is available on request. The value will depend on when you actually invested allowing for tax, charges and smoothing. The value could change by more or less than the underlying investment return of the overall fund. Past performan ...

... The value of your policy will be sent out in your annual statement or is available on request. The value will depend on when you actually invested allowing for tax, charges and smoothing. The value could change by more or less than the underlying investment return of the overall fund. Past performan ...

A Prudent Way To Invest - Brown Brothers Harriman

... Essential products and services. Companies that provide “have-to-have” products and services are better positioned to achieve pricing power over time and gain advantages in introducing new products and services. These companies are also less sensitive to inflationary pressures and recessions, as the ...

... Essential products and services. Companies that provide “have-to-have” products and services are better positioned to achieve pricing power over time and gain advantages in introducing new products and services. These companies are also less sensitive to inflationary pressures and recessions, as the ...

The Microfinance Collateralized Debt Obligation: a Modern Robin

... “Although the General Motors episode [of 2005] might not repeat itself, it should nonetheless be a lesson for the future; whether or not the credit environment becomes riskier over the next couple of years, similar sudden changes in CDS spreads most likely will strike the CDS index market from time ...

... “Although the General Motors episode [of 2005] might not repeat itself, it should nonetheless be a lesson for the future; whether or not the credit environment becomes riskier over the next couple of years, similar sudden changes in CDS spreads most likely will strike the CDS index market from time ...

Comments on : “The Greek Pension System

... Test is of the behaviour of asset manager, institutional investor and process of decision-making. Example, whether “due diligence” investigation undertaken in formulating strategic asset allocation, whether coherent/explicit statement of investment principles. ...

... Test is of the behaviour of asset manager, institutional investor and process of decision-making. Example, whether “due diligence” investigation undertaken in formulating strategic asset allocation, whether coherent/explicit statement of investment principles. ...

April 24, 2017 JNL/American Funds Blue Chip

... economy of the United States with respect to issues such as growth of gross national product, reinvestment of capital, resources and balance of payments position. ...

... economy of the United States with respect to issues such as growth of gross national product, reinvestment of capital, resources and balance of payments position. ...

Understanding Volatility/Standard Deviation within investment funds.

... Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: Past performance is not a reliable guide to future performance. Terms and conditions apply. Where relevant life assurance tax applies. This presentat ...

... Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: Past performance is not a reliable guide to future performance. Terms and conditions apply. Where relevant life assurance tax applies. This presentat ...

SIS Performance versus Benchmark to 31 March 2016

... fears of a slowdown in China and collapsing oil prices which hit record lows. Security was also a concern for European markets in the wake of the Brussels terrorist attacks in March. In addition, the European Central Bank (ECB) announced additional stimulus ...

... fears of a slowdown in China and collapsing oil prices which hit record lows. Security was also a concern for European markets in the wake of the Brussels terrorist attacks in March. In addition, the European Central Bank (ECB) announced additional stimulus ...

FL BlackRock Long Term (Aquila C) IE/XE

... managed there may be periods when they have large cash holdings. This can be a deliberate asset allocation decision or while suitable investment opportunities are researched and selected. A fund’s growth potential may be less during this period. L - Reinsured Funds: Where a fund invests in an underl ...

... managed there may be periods when they have large cash holdings. This can be a deliberate asset allocation decision or while suitable investment opportunities are researched and selected. A fund’s growth potential may be less during this period. L - Reinsured Funds: Where a fund invests in an underl ...

Vilar Gave Select Access to IPOs

... At a time when IPOs often soared in their first day of trading, Mr. [Alberto Vilar]'s firm, Amerindo Investment Advisors Inc., channeled most of the IPO shares it received to a small group of wealthy clients investing through an offshore account, the filings say. But until 2002, his mutual fund gear ...

... At a time when IPOs often soared in their first day of trading, Mr. [Alberto Vilar]'s firm, Amerindo Investment Advisors Inc., channeled most of the IPO shares it received to a small group of wealthy clients investing through an offshore account, the filings say. But until 2002, his mutual fund gear ...

fund facts - RBC Global Asset Management

... commissions - can vary among series of a fund and among funds. Higher commissions can influence representatives to recommend one investment over another. Ask about other funds and investments that may be suitable for you at a lower cost. 1. Sales charges Series A mutual fund shares are no load. That ...

... commissions - can vary among series of a fund and among funds. Higher commissions can influence representatives to recommend one investment over another. Ask about other funds and investments that may be suitable for you at a lower cost. 1. Sales charges Series A mutual fund shares are no load. That ...

PDF - Marquette Associates

... throughout 2012. On the minus side, spreads have tightened significantly, and offer average at best value going forward. Exhibit 1 (next page) shows the difference between the level of spreads and their long-term averages for various sectors, as measured by standard deviation. Credit and securitized ...

... throughout 2012. On the minus side, spreads have tightened significantly, and offer average at best value going forward. Exhibit 1 (next page) shows the difference between the level of spreads and their long-term averages for various sectors, as measured by standard deviation. Credit and securitized ...

Chapter 1 PPP

... Move toward less risky investments to preserve capital Transition to higher-quality securities with lower risk ...

... Move toward less risky investments to preserve capital Transition to higher-quality securities with lower risk ...

Download attachment

... • Unique risks in Islamic intermediaries. ¨Specific characteristics of Islamic instruments and the associated mix of risks. ¨Limitations on asset diversification—based on Sharia’a restrictions on investments. ...

... • Unique risks in Islamic intermediaries. ¨Specific characteristics of Islamic instruments and the associated mix of risks. ¨Limitations on asset diversification—based on Sharia’a restrictions on investments. ...

award from institutional investor magazine

... ceremony, to be held this year at the Mandarin Oriental in NYC.” Awards referenced do not reflect the experiences of any Neuberger Berman client and readers should not view such information as representative of any particular client’s experience or assume that they will have a similar investment exp ...

... ceremony, to be held this year at the Mandarin Oriental in NYC.” Awards referenced do not reflect the experiences of any Neuberger Berman client and readers should not view such information as representative of any particular client’s experience or assume that they will have a similar investment exp ...

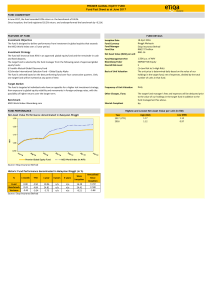

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... The fund is selected based on the best performing fund over four consecutive quarters. Only one target fund will be invested at any point of time. Target Market The fund is targeted at individuals who have an appetite for a higher risk investment strategy, from exposure to global equity volatility a ...

... The fund is selected based on the best performing fund over four consecutive quarters. Only one target fund will be invested at any point of time. Target Market The fund is targeted at individuals who have an appetite for a higher risk investment strategy, from exposure to global equity volatility a ...

coronation global managed fund

... slightly more sanguine approach to what US President Donald Trump can or may do over the next few years. Global equities were amongst the global asset classes that did well, rising 6.9%, and thereby continuing its outperformance of bonds (as has been the case since the global low point in yields see ...

... slightly more sanguine approach to what US President Donald Trump can or may do over the next few years. Global equities were amongst the global asset classes that did well, rising 6.9%, and thereby continuing its outperformance of bonds (as has been the case since the global low point in yields see ...

Facile.it is Italy`s #1 destination for consumers to make informed

... helps 1.5 million Italians a month compare prices on key elements of their household expenditure. The business has demonstrated a strong growth trajectory and had revenues of €28.6 million and EBITDA of €4.7 million for the year ended 31 December 2013 (up from €19.3 million and €0.4 million respecti ...

... helps 1.5 million Italians a month compare prices on key elements of their household expenditure. The business has demonstrated a strong growth trajectory and had revenues of €28.6 million and EBITDA of €4.7 million for the year ended 31 December 2013 (up from €19.3 million and €0.4 million respecti ...

quarterly report

... provide 77% of personal banking accounts and 90% of business accounts. Lloyds itself has 27% of the retail market (31% if you include TSB, which is still majority owned by Lloyds but was recently floated on the stockmarket). ...

... provide 77% of personal banking accounts and 90% of business accounts. Lloyds itself has 27% of the retail market (31% if you include TSB, which is still majority owned by Lloyds but was recently floated on the stockmarket). ...

Expansion of investor base must for capital market

... economic development. To a question about growth of the capital market, Naqvi said, "I think the single most important thing is expansion of the investor base which stands at just around 250,000 since 1948. This is too small when compared to Bangladesh's over one million and Iran's and Turkey's six ...

... economic development. To a question about growth of the capital market, Naqvi said, "I think the single most important thing is expansion of the investor base which stands at just around 250,000 since 1948. This is too small when compared to Bangladesh's over one million and Iran's and Turkey's six ...

About Our Private Investment Benchmarks

... year in which the first capital is invested. Vintage year statistics are critical to assessing an individual fund’s performance because they provide a similar universe for comparison. 8. The Cambridge Associates commentaries talk a lot about comparative size vintages. Why is this important? Because ...

... year in which the first capital is invested. Vintage year statistics are critical to assessing an individual fund’s performance because they provide a similar universe for comparison. 8. The Cambridge Associates commentaries talk a lot about comparative size vintages. Why is this important? Because ...

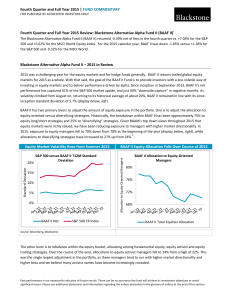

Fourth Quarter and Full Year 2015

... All returns include dividend and capital gain distributions. All investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your fi ...

... All returns include dividend and capital gain distributions. All investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your fi ...

Capital Market Review - Allegheny Financial Group

... The major market averages were mixed during the fourth quarter. The S&P 500, an index of large company stocks, was up 3.8%, while the Dow Jones Industrial Average climbed 8.7%. The Russell 2000, an index of small-company stocks, gained an 8.8% return for the quarter. The MSCI EAFE, an index represen ...

... The major market averages were mixed during the fourth quarter. The S&P 500, an index of large company stocks, was up 3.8%, while the Dow Jones Industrial Average climbed 8.7%. The Russell 2000, an index of small-company stocks, gained an 8.8% return for the quarter. The MSCI EAFE, an index represen ...

Illusions of Precision, Completeness and Control

... concentrating on what I call “conventional” investing that emphasizes portfolios that are simple, transparent and focused. This approach includes limiting investment to asset classes such as global equities and investment grade fixed income (with an addition of some private investments such as real ...

... concentrating on what I call “conventional” investing that emphasizes portfolios that are simple, transparent and focused. This approach includes limiting investment to asset classes such as global equities and investment grade fixed income (with an addition of some private investments such as real ...