Paul R. Krugman Working DEINDUSTRIALIZATION, REINDUSTRIALIZATION, AND THE REAL

... This rapidly emerging literature is highly suggestive of the importance of thinking about how resources get reallocated in an ...

... This rapidly emerging literature is highly suggestive of the importance of thinking about how resources get reallocated in an ...

A Theory of Development and Long Run Growth

... model will demonstrate that two countries can have the same income level, but due to differences in the composition of their capital stock, they experience different growth rates. The country with the larger endowment of human capital will grow the fastest initially. However, as it accumulates phys ...

... model will demonstrate that two countries can have the same income level, but due to differences in the composition of their capital stock, they experience different growth rates. The country with the larger endowment of human capital will grow the fastest initially. However, as it accumulates phys ...

FORM 6-K - corporate

... has based these assumptions on information currently available, if any one or more of these assumptions turn out to be incorrect, actual market results may differ from those predicted. While NXP does not know what impact any such differences may have on its business, if there are such differences, i ...

... has based these assumptions on information currently available, if any one or more of these assumptions turn out to be incorrect, actual market results may differ from those predicted. While NXP does not know what impact any such differences may have on its business, if there are such differences, i ...

CAPITAL FLOWS AND THEIR IMPLICATION FOR CENTRAL BANK

... Article VIII, Sections 2, 3, and 4 of the IMF Articles of Agreement, with effect from February 1, 19961. The implementations of the current and capital account liberalization have had both negative and positive impacts in the economy. Mongolia was the first country in transition to join the World Tr ...

... Article VIII, Sections 2, 3, and 4 of the IMF Articles of Agreement, with effect from February 1, 19961. The implementations of the current and capital account liberalization have had both negative and positive impacts in the economy. Mongolia was the first country in transition to join the World Tr ...

Accepted Manuscript

... Keywords: Capital controls, capital mobility, contagion, external imbalances, current account deficits, sudden stops, capital flow contractions. * I have benefited from discussions with Ed Leamer. I thank Roberto Alvarez for his comments and Alberto Naudon for his excellent assistance. I am particul ...

... Keywords: Capital controls, capital mobility, contagion, external imbalances, current account deficits, sudden stops, capital flow contractions. * I have benefited from discussions with Ed Leamer. I thank Roberto Alvarez for his comments and Alberto Naudon for his excellent assistance. I am particul ...

Macroprudential Regulation and Macroeconomic Activity

... necessary to derive some intuitive analytical results. Additionally, there is no capital requirement constraint in that model. I will try to explore macroprudential policy in this paper keeping the set up similar to Aiyagari and Gertler (1999) and Gertler and Kiyotaki (2010). I pose the problem a b ...

... necessary to derive some intuitive analytical results. Additionally, there is no capital requirement constraint in that model. I will try to explore macroprudential policy in this paper keeping the set up similar to Aiyagari and Gertler (1999) and Gertler and Kiyotaki (2010). I pose the problem a b ...

PDF

... provides a more extensive explanation of this term and suggests that “social capital refers to the institutions, relationships and norms that shape the quality and quantity of society’s social interactions” and emphasizes that “social capital is not just the sum of the institutions which underpin a ...

... provides a more extensive explanation of this term and suggests that “social capital refers to the institutions, relationships and norms that shape the quality and quantity of society’s social interactions” and emphasizes that “social capital is not just the sum of the institutions which underpin a ...

DOCUMENTOS DE TRABAJO Serie Economía

... markets stand to benefit most from opening up their capital accounts, while the impact of this effect declines as the level of the local capital market’s development improves. Furthermore, it is notable that most of the coefficients associated with our firm- and country-level control variables have ...

... markets stand to benefit most from opening up their capital accounts, while the impact of this effect declines as the level of the local capital market’s development improves. Furthermore, it is notable that most of the coefficients associated with our firm- and country-level control variables have ...

NBER WORKING PAPER SERIES CAPITAL CONTROLS, CAPITAL FLOW CONTRACTIONS, AND MACROECONOMIC VULNERABILITY

... countries that restrict the free flow of international capital are less likely to experiencing an abrupt reduction in net capital inflows. I use three new indexes on the degree of international financial integration and a large multi-country data set for 1970-2004 to estimate a series of random-effe ...

... countries that restrict the free flow of international capital are less likely to experiencing an abrupt reduction in net capital inflows. I use three new indexes on the degree of international financial integration and a large multi-country data set for 1970-2004 to estimate a series of random-effe ...

The New Theory of Foreign Direct Investment: Merging micro

... signal it observes. The size of this interval is known and identical across firms. At this point, the original owner can hold onto the firm or sell it to a domestic or foreign investor. Any owner intending to produce in the following period must decide whether to pay a screening cost to find out the ...

... signal it observes. The size of this interval is known and identical across firms. At this point, the original owner can hold onto the firm or sell it to a domestic or foreign investor. Any owner intending to produce in the following period must decide whether to pay a screening cost to find out the ...

Liquidity Traps, Capital Flows and Currency Wars

... in a small open economy involves devaluing the currency, and temporarily adopting a peg and a price-level target. Jeanne (2009), Haberis and Lipinska (2012) and Fujiwara et al. (2013) study two-country models in which a large shock in one country can lead to a worldwide liquidity trap. In a similar ...

... in a small open economy involves devaluing the currency, and temporarily adopting a peg and a price-level target. Jeanne (2009), Haberis and Lipinska (2012) and Fujiwara et al. (2013) study two-country models in which a large shock in one country can lead to a worldwide liquidity trap. In a similar ...

OCASSIONAL POLICY PAPER MEASURES FOR FINANCIAL

... lead to excessive expansion of domestic demand, which is likely to be reflected in inflationary pressures, real exchange rate appreciation and a widening of the current account deficit. Capital inflows also typically lead to an expansion of domestic bank credit and an unsustainable increase in asset ...

... lead to excessive expansion of domestic demand, which is likely to be reflected in inflationary pressures, real exchange rate appreciation and a widening of the current account deficit. Capital inflows also typically lead to an expansion of domestic bank credit and an unsustainable increase in asset ...

Capital Flight and the Hollowing Out of the Philippine Economy in

... neoliberal policies—indeed the Philippines is a good example of a country that closely followed neoliberal prescriptions (see Pritchett 2003; Bello et al. 2004)—we find that capital flight and external borrowing have increased with deregulation and financial liberalization. Such felicitous outcomes ...

... neoliberal policies—indeed the Philippines is a good example of a country that closely followed neoliberal prescriptions (see Pritchett 2003; Bello et al. 2004)—we find that capital flight and external borrowing have increased with deregulation and financial liberalization. Such felicitous outcomes ...

Role of the IMF in the Global Financial Crisis Miranda Xafa

... The failure of regulation to address the buildup of risks in the shadow banking system has amply demonstrated the need to expand the perimeter of regulation to a wider range of systemically important institutions and markets, including off–balance sheet derivatives that turned out to be so important ...

... The failure of regulation to address the buildup of risks in the shadow banking system has amply demonstrated the need to expand the perimeter of regulation to a wider range of systemically important institutions and markets, including off–balance sheet derivatives that turned out to be so important ...

When Capital Inflows Come to a Sudden Stop: Consequences and

... most notably the Scandinavian group, were also experiencing systemic banking sector problems. Confronted with the incompatible goals of defending the exchange rate peg (which would entail maintaining high interest rates) and acting as a lender of last resort to the banks, several countries succumbed ...

... most notably the Scandinavian group, were also experiencing systemic banking sector problems. Confronted with the incompatible goals of defending the exchange rate peg (which would entail maintaining high interest rates) and acting as a lender of last resort to the banks, several countries succumbed ...

Joint Discussion Paper Series in Economics No. 21

... contrast to other studies, Forbes and Warnock (2012) find that liquidity conditions and global interest rates are insignificant explanatory variables. Among the pull factors domestic growth has the strongest impact on surges and stops. Finally, Zalduendo et al. (2012) identify “surges” of net capita ...

... contrast to other studies, Forbes and Warnock (2012) find that liquidity conditions and global interest rates are insignificant explanatory variables. Among the pull factors domestic growth has the strongest impact on surges and stops. Finally, Zalduendo et al. (2012) identify “surges” of net capita ...

Real Exchange Rate Dynamics in Sticky-Price Models with Capital

... simplifying assumption is arguably reasonable, as in the short run capital does not move very much. When analyzing real exchange rate (RER) dynamics, however, this assumption is arguably less palatable. The “consensus view”in the empirical literature summarized by Rogo¤ (1996) is that departures of ...

... simplifying assumption is arguably reasonable, as in the short run capital does not move very much. When analyzing real exchange rate (RER) dynamics, however, this assumption is arguably less palatable. The “consensus view”in the empirical literature summarized by Rogo¤ (1996) is that departures of ...

Capital Management Techniques In Developing Countries:

... Kaplan and Rodrik, 2001; Rajamaran, 2001].3 Several findings emerge from these analyses. Capital controls can reduce the vulnerability of developing countries to financial crises. Controls over capital inflows can be effective (at least in the short run) in changing the composition and maturity stru ...

... Kaplan and Rodrik, 2001; Rajamaran, 2001].3 Several findings emerge from these analyses. Capital controls can reduce the vulnerability of developing countries to financial crises. Controls over capital inflows can be effective (at least in the short run) in changing the composition and maturity stru ...

SAVINGS, INVESTMENT AND CAPITAL FLOWS: AN EMPIRICAL

... proposed by Feldstein and Horioka only works on small open economies. For a large open economy like United Stated, domestic savings and investment might move together even if the international capital market functioned perfectly. This is due to the fact that a large economy could affect the world re ...

... proposed by Feldstein and Horioka only works on small open economies. For a large open economy like United Stated, domestic savings and investment might move together even if the international capital market functioned perfectly. This is due to the fact that a large economy could affect the world re ...

Capital Flows to Emerging Markets

... values, but changes in underlying and/or future fundamentals still drive investor decisions. The only potential source of fundamentals-unrelated decision is investors “risk appetite”, which has however received little attention, but is found to have a very important impact on capital flows (e.g. Bra ...

... values, but changes in underlying and/or future fundamentals still drive investor decisions. The only potential source of fundamentals-unrelated decision is investors “risk appetite”, which has however received little attention, but is found to have a very important impact on capital flows (e.g. Bra ...

Steady State Investment per worker

... With decreasing returns to capital, there are limits to this process An economy can become “too capital intensive” There is no evidence that this has happened ...

... With decreasing returns to capital, there are limits to this process An economy can become “too capital intensive” There is no evidence that this has happened ...

Frequently Asked Questions on ESM paid-in capital

... The ESM’s paid-in capital supports the financial strength and high creditworthiness of the ESM as an issuer. It serves as a security buffer for the bonds issued by the ESM. The money raised by selling these bonds enables the ESM to finance loans provided to beneficiary Member States. In the unlikely ...

... The ESM’s paid-in capital supports the financial strength and high creditworthiness of the ESM as an issuer. It serves as a security buffer for the bonds issued by the ESM. The money raised by selling these bonds enables the ESM to finance loans provided to beneficiary Member States. In the unlikely ...

capital flows, exchange rates and growth: evidence from

... Additionally, as suggested by Calvo (1998) and Calvo et al (2004), RER depreciation that usually accompanies a Sudden Stop causes bankruptcies in the real sector. This in turn, causes further credit contraction and uncertainty about the solvency of the banking system, leading to bunk runs, bank ban ...

... Additionally, as suggested by Calvo (1998) and Calvo et al (2004), RER depreciation that usually accompanies a Sudden Stop causes bankruptcies in the real sector. This in turn, causes further credit contraction and uncertainty about the solvency of the banking system, leading to bunk runs, bank ban ...

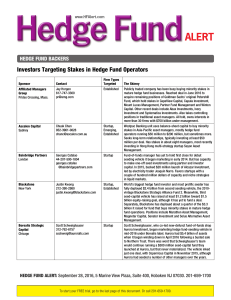

Hedge Fund Backers

... hedge fund-seeding vehicle, but the firm has no plans to move ahead until the returns of its first seed-capital fund improve. For now, Reservoir has capacity to make additional seed investments via its flagship fund. One recent seed, Silver Ridge Asset Management, had to delay its launch until Janua ...

... hedge fund-seeding vehicle, but the firm has no plans to move ahead until the returns of its first seed-capital fund improve. For now, Reservoir has capacity to make additional seed investments via its flagship fund. One recent seed, Silver Ridge Asset Management, had to delay its launch until Janua ...