Gold vs Gold Miners

... time to time. However, the characteristics of gold bullion and gold miners are very different. In some ways, those differences are similar to the difference between an insurance policy and shares of an insurance company. It is important to understand the role of gold as money in relation to fiat cur ...

... time to time. However, the characteristics of gold bullion and gold miners are very different. In some ways, those differences are similar to the difference between an insurance policy and shares of an insurance company. It is important to understand the role of gold as money in relation to fiat cur ...

Should inflation-targeting central banks respond to exchange rate

... E-mail address: [email protected] ...

... E-mail address: [email protected] ...

Financial Statility in a Brave New World – Workshops No. 15

... regional exports. Equally notable was the prevalence of wide current account deficits in Southeastern Europe at the time that the financial crisis began to emerge in 2007. These current account deficits largely had their origin in private sector savinginvestment balances, and they were financed to s ...

... regional exports. Equally notable was the prevalence of wide current account deficits in Southeastern Europe at the time that the financial crisis began to emerge in 2007. These current account deficits largely had their origin in private sector savinginvestment balances, and they were financed to s ...

The Euro and the Dollar: Toward a "Finance G-2"?

... in the 21st century than it did in the dollar-dominated world of the 20th century or the sterling-dominated world of the 19th century. Euroland and the United States need to create a new “Group of Two” (G-2) mechanism to manage the dramatic change in their bilateral monetary relationship implied by ...

... in the 21st century than it did in the dollar-dominated world of the 20th century or the sterling-dominated world of the 19th century. Euroland and the United States need to create a new “Group of Two” (G-2) mechanism to manage the dramatic change in their bilateral monetary relationship implied by ...

The Trade Deficit: The Biggest Obstacle to Full Employment

... This means that the deficit in private savings, plus the government budget deficit, summed to $500 billion. Let’s imagine for a moment that private savings is on net zero, meaning that all of the private sector’s saving is devoted to private sector investment. In this case the government budget defi ...

... This means that the deficit in private savings, plus the government budget deficit, summed to $500 billion. Let’s imagine for a moment that private savings is on net zero, meaning that all of the private sector’s saving is devoted to private sector investment. In this case the government budget defi ...

Monetary Policy Statement 20 October 2005

... MONETARY POLICY REVIEW AND NEW MEASURES ............................................................. 10 ...

... MONETARY POLICY REVIEW AND NEW MEASURES ............................................................. 10 ...

The Tale of Two Great Crises

... and France sat in the middle in terms of recession years but differed sharply in terms of the longer run performance over the Thirties, with Germany cumulative per capita real growth exceeding that in the gold standard; more on this in the next section.7 The United States, Germany, and the United Ki ...

... and France sat in the middle in terms of recession years but differed sharply in terms of the longer run performance over the Thirties, with Germany cumulative per capita real growth exceeding that in the gold standard; more on this in the next section.7 The United States, Germany, and the United Ki ...

Complementary currencies and deflationary crisis

... Conclusion: The superneutralisation of our monetary system would change the focus from a abstract and virtual world of financial markets to the economy of reality of goods and services for a human world. Speculative attacks against the Euro zone, as we experience at this time, could be avoided in a ...

... Conclusion: The superneutralisation of our monetary system would change the focus from a abstract and virtual world of financial markets to the economy of reality of goods and services for a human world. Speculative attacks against the Euro zone, as we experience at this time, could be avoided in a ...

Ch10

... – Done by buying forward contract to sell foreign currency at the same time the interest earning asset matures – Covered interest arbitrage: Use of forward market by an interest rate arbitrageur against exchange rate risk Copyright © 2011 Pearson Addison-Wesley. All rights reserved. ...

... – Done by buying forward contract to sell foreign currency at the same time the interest earning asset matures – Covered interest arbitrage: Use of forward market by an interest rate arbitrageur against exchange rate risk Copyright © 2011 Pearson Addison-Wesley. All rights reserved. ...

166 SOME FEATURES OF POSTWAR BUSINESS CYCLES

... towards a relative stability in developing economies, they continue to have a significantly higher volatility of domestic production compared to advanced countries. This is partly due to structural differences, developing countries maintaining agricultural sectors with significant share in total GDP ...

... towards a relative stability in developing economies, they continue to have a significantly higher volatility of domestic production compared to advanced countries. This is partly due to structural differences, developing countries maintaining agricultural sectors with significant share in total GDP ...

Free Full Text ( Final Version , 1mb )

... When we study the international economy, we cannot avoid the question, what is international money? This is because international economic activity, like domestic activity, requires the use of money. For decades, economists, especially, Cohen (1971), McKinnon (1979; 1993), Kindleberger (1981), and K ...

... When we study the international economy, we cannot avoid the question, what is international money? This is because international economic activity, like domestic activity, requires the use of money. For decades, economists, especially, Cohen (1971), McKinnon (1979; 1993), Kindleberger (1981), and K ...

1980s Economic Visions in Retrospect

... habitual macroeconomic imbalances. They bore the seals of a fin de reigne and of the ultimate exhaustion of long-standing societal and economic models. Indeed, Bulgaria and Yugoslavia represented archetypes of the post-war communist extremes. The former was the most orthodox Soviet ally, copying in ...

... habitual macroeconomic imbalances. They bore the seals of a fin de reigne and of the ultimate exhaustion of long-standing societal and economic models. Indeed, Bulgaria and Yugoslavia represented archetypes of the post-war communist extremes. The former was the most orthodox Soviet ally, copying in ...

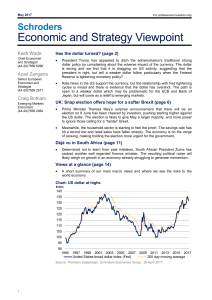

Economic and Strategy Viewpoint

... Has the dollar become a major drag on the US? Looking at the current account deficit the answer would be no: the deficit remains around 1.5% of GDP and has been relatively stable since 2014. If we strip out oil and only look at trade, the deficit is larger at 2.8% of GDP, but again has been relative ...

... Has the dollar become a major drag on the US? Looking at the current account deficit the answer would be no: the deficit remains around 1.5% of GDP and has been relatively stable since 2014. If we strip out oil and only look at trade, the deficit is larger at 2.8% of GDP, but again has been relative ...

Rebalancing the Global Economy

... domestic production, or a higher rate of investment than can be financed by domestic savings, or that owners of wealth claims in surplus countries are willing to hold assets denominated in the currency of the deficit country. These are three aspects of the same phenomenon. Second, the capital balanc ...

... domestic production, or a higher rate of investment than can be financed by domestic savings, or that owners of wealth claims in surplus countries are willing to hold assets denominated in the currency of the deficit country. These are three aspects of the same phenomenon. Second, the capital balanc ...

SP125: Can Central Banking Survive the IT Revolution?

... addressed is how to minimise the loss due to fraud, both to the end consumer and to the issuing commercial bank. When publicly visible (due to media exploitation), e-money fraud occurs consumers may not then be comfortable committing to this technology, and if they do, it may be for small transactio ...

... addressed is how to minimise the loss due to fraud, both to the end consumer and to the issuing commercial bank. When publicly visible (due to media exploitation), e-money fraud occurs consumers may not then be comfortable committing to this technology, and if they do, it may be for small transactio ...

DOLLARS AND DEFICITS – THE US CURRENT ACCOUNT

... demand, albeit temporarily, and raises the world price level. The impact on the Euro Area of a monetary stimulus in the US depends upon the response of the ECB. We presume that the ECB will focus on price stability in the medium term, and hence follow our default policy rule (see for instance Barrel ...

... demand, albeit temporarily, and raises the world price level. The impact on the Euro Area of a monetary stimulus in the US depends upon the response of the ECB. We presume that the ECB will focus on price stability in the medium term, and hence follow our default policy rule (see for instance Barrel ...

Appendix 13A

... • Currency transfer restrictions Wouldn’t it be nice to be able to bring the profits home? • Wars and civil disorders. • Government mandated changes in the ...

... • Currency transfer restrictions Wouldn’t it be nice to be able to bring the profits home? • Wars and civil disorders. • Government mandated changes in the ...

A generation of an internationalised Australian dollar

... dollar bonds into the Australian market; residents issuing Australian dollar bonds into offshore markets; and non-residents issuing Australian dollar bonds into offshore markets. An important precursor to these markets was the development of the domestic Australian government bond market. This mark ...

... dollar bonds into the Australian market; residents issuing Australian dollar bonds into offshore markets; and non-residents issuing Australian dollar bonds into offshore markets. An important precursor to these markets was the development of the domestic Australian government bond market. This mark ...

Introduction: After NAFTA, what`s next

... economic issues. Additionally, until now the Federal Reserve has accomplished its objective of create stability and growth; in that sense there is not reason for the Fed to share its authority with other central banks. (Pintado Rivero 2000, 61) It is highly probable that the American political parti ...

... economic issues. Additionally, until now the Federal Reserve has accomplished its objective of create stability and growth; in that sense there is not reason for the Fed to share its authority with other central banks. (Pintado Rivero 2000, 61) It is highly probable that the American political parti ...

Free Currency Markets, Financial Crises And The Growth Debacle

... and various mistakes. There is valid logic in these attempts in many cases. Milton Friedman, for example, has long maintained that the Great Depression was not caused by the collapse of asset values after October 1929 but by a contraction in the money supply in the early 1930s (Friedman, 1965). Pete ...

... and various mistakes. There is valid logic in these attempts in many cases. Milton Friedman, for example, has long maintained that the Great Depression was not caused by the collapse of asset values after October 1929 but by a contraction in the money supply in the early 1930s (Friedman, 1965). Pete ...

The Overvalued Dollar and the US Slump

... employment. Indeed, the manufacturing sector lost jobs in 1999 and 2000, when the overall economy was still booming. The United States has some of the most efficient manufacturing industry in the world, and for the past decade US manufacturing has posted rapid productivity growth that has lowered un ...

... employment. Indeed, the manufacturing sector lost jobs in 1999 and 2000, when the overall economy was still booming. The United States has some of the most efficient manufacturing industry in the world, and for the past decade US manufacturing has posted rapid productivity growth that has lowered un ...

contents

... changes in the capital account of the balance of payments (including changes in foreign reserves). The flow of funds helps visualize the links between the public and private sector: For a total of credit available to the economy: more credit to the government → less credit available for the privat ...

... changes in the capital account of the balance of payments (including changes in foreign reserves). The flow of funds helps visualize the links between the public and private sector: For a total of credit available to the economy: more credit to the government → less credit available for the privat ...

Document

... D. Selling borrowed currency in the hopes that there will be a large appreciation. 18. The demand for a currency is an example of A. an aggregate demand. B. a derived demand. C. spatial arbitrage. D. a perfectly elastic demand. 19. A depreciation of the Japanese yen relative to the U.S. dollar is il ...

... D. Selling borrowed currency in the hopes that there will be a large appreciation. 18. The demand for a currency is an example of A. an aggregate demand. B. a derived demand. C. spatial arbitrage. D. a perfectly elastic demand. 19. A depreciation of the Japanese yen relative to the U.S. dollar is il ...

Monetary and Economic Integration in Africa

... external arrears. In addition to the above, three categories of macro-economic indicators for multilateral ...

... external arrears. In addition to the above, three categories of macro-economic indicators for multilateral ...