Modeling and Forecasting the Malawi Kwacha

... imperative that Malawi should diversify into other foreign exchange earner (for instance tourism) in order to ensure macroeconomic stability, which itself is a pre-requisite for economic growth and therefore poverty reduction. Thus, policies that influence exports and imports of goods and services a ...

... imperative that Malawi should diversify into other foreign exchange earner (for instance tourism) in order to ensure macroeconomic stability, which itself is a pre-requisite for economic growth and therefore poverty reduction. Thus, policies that influence exports and imports of goods and services a ...

LCcarG715_en.pdf

... publications and statements as a float. However, frequent Central Bank interventions, through direct monetary policy instruments such as variations in required reserve ratios or variations in international net reserves and via indirect means such as open market operations, prevent the exchange rate ...

... publications and statements as a float. However, frequent Central Bank interventions, through direct monetary policy instruments such as variations in required reserve ratios or variations in international net reserves and via indirect means such as open market operations, prevent the exchange rate ...

Financial Globalization and Exchange Rates Philip R. Lane Gian Maria Milesi-Ferretti

... Obstfeld and Taylor 2004). In addition to larger gross positions, financial globalization has also allowed a greater dispersion in net foreign asset positions, with a significant number of countries emerging as either large net creditors or net debtors (Lane and Milesi-Ferretti 2002a). In general, f ...

... Obstfeld and Taylor 2004). In addition to larger gross positions, financial globalization has also allowed a greater dispersion in net foreign asset positions, with a significant number of countries emerging as either large net creditors or net debtors (Lane and Milesi-Ferretti 2002a). In general, f ...

When Capital Inflows Come to a Sudden Stop: Consequences and

... unprecedented size. Yet bail-out package notwithstanding, Mexico suffered its largest oneyear output decline in 1995, as GDP shrank by more than six percent. Since Mexico’s crisis, international organizations have brokered several more rescue plans involving vast sums of funds. Yet, as in Mexico, al ...

... unprecedented size. Yet bail-out package notwithstanding, Mexico suffered its largest oneyear output decline in 1995, as GDP shrank by more than six percent. Since Mexico’s crisis, international organizations have brokered several more rescue plans involving vast sums of funds. Yet, as in Mexico, al ...

NBER WORKING. PAPER SERIES EQUILIBRIUM AND EXCHANGE RATES Rudiger Dornbusch

... The paper reviews theoretical develorents in the field of exchange rate theory and assesses the empirical evidence. Since the empirical evidence does not lend support to the nrdels that have been formulated, a number of reasons for that failure are suggested. These include the argument that the curr ...

... The paper reviews theoretical develorents in the field of exchange rate theory and assesses the empirical evidence. Since the empirical evidence does not lend support to the nrdels that have been formulated, a number of reasons for that failure are suggested. These include the argument that the curr ...

The IMF and Poor Countries

... Although this paper touches on the effects of IMF programmes on poverty, its focus is on the Fund’s relationship with low income countries. In discussing this relationship the first challenge is to impose some constraints. After all there is hardly any aspect of the Fund’s operations that could not ...

... Although this paper touches on the effects of IMF programmes on poverty, its focus is on the Fund’s relationship with low income countries. In discussing this relationship the first challenge is to impose some constraints. After all there is hardly any aspect of the Fund’s operations that could not ...

Mizuho Dealer`s Eye

... The euro rose towards the September 17 FOMC meeting before dropping back thereafter now this important event was out of the way. In the end, it failed to break out of ranges it had traded in since May this year (around $1.0800–1.1500 and 133–139 yen). It opened the month trading around $1.1200 and 1 ...

... The euro rose towards the September 17 FOMC meeting before dropping back thereafter now this important event was out of the way. In the end, it failed to break out of ranges it had traded in since May this year (around $1.0800–1.1500 and 133–139 yen). It opened the month trading around $1.1200 and 1 ...

Monetary Policy and Global Banking

... Our work relates most closely to Cetorelli and Goldberg (2012) and Morais, Peydro, and Ruiz (2015), who examine the role of global banks’ internal capital markets on the international transmission of monetary policy. As in these papers, we rely on the use of the global balance sheet as a central cha ...

... Our work relates most closely to Cetorelli and Goldberg (2012) and Morais, Peydro, and Ruiz (2015), who examine the role of global banks’ internal capital markets on the international transmission of monetary policy. As in these papers, we rely on the use of the global balance sheet as a central cha ...

Western Hemisphere - Adjusting Under Pressure

... in both the near and medium term. The recovery in advanced economies is becoming more firm, though it is weaker than previously anticipated. After a slow start this year, the U.S. economy regained momentum on the back of resilient consumption, while a gradual recovery in the euro area continues and ...

... in both the near and medium term. The recovery in advanced economies is becoming more firm, though it is weaker than previously anticipated. After a slow start this year, the U.S. economy regained momentum on the back of resilient consumption, while a gradual recovery in the euro area continues and ...

Our Rationale for Investing in Physical Gold

... confiscation was complete, FDR promptly changed the conversion price to 35 dollars, an act of taxation by inflation that effectively transferred 40% of the gold held by the Fed for American citizens to the US government. However, the US dollar was still not completely severed from gold. While Americ ...

... confiscation was complete, FDR promptly changed the conversion price to 35 dollars, an act of taxation by inflation that effectively transferred 40% of the gold held by the Fed for American citizens to the US government. However, the US dollar was still not completely severed from gold. While Americ ...

01.07 - Study Center Gerzensee

... flexibility, we first consider a constant real wage. In that case country size plays a role separate from market share. In the last step we allow for real wage volatility. While country size and real wage volatility can theoretically play a role, we argue that empirically they are not very relevant. ...

... flexibility, we first consider a constant real wage. In that case country size plays a role separate from market share. In the last step we allow for real wage volatility. While country size and real wage volatility can theoretically play a role, we argue that empirically they are not very relevant. ...

EMP – A Note on Empiricism and Foreign Exchange Markets

... tariffs, identical goods sold in different countries must sell for the same price where their prices are expressed in terms of the same currency – this is the law of one price. A study by Isard (1977) compared the movements of dollar prices of West German goods relative to their US equivalents for s ...

... tariffs, identical goods sold in different countries must sell for the same price where their prices are expressed in terms of the same currency – this is the law of one price. A study by Isard (1977) compared the movements of dollar prices of West German goods relative to their US equivalents for s ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... macroeconomic policy choices by a simple and stable (over time and across countries) reaction function that holds for both participating and nonparticipating countries. We extend this standard model by introducing currency or balance-of-payments crisis as an additional factor influencing the evoluti ...

... macroeconomic policy choices by a simple and stable (over time and across countries) reaction function that holds for both participating and nonparticipating countries. We extend this standard model by introducing currency or balance-of-payments crisis as an additional factor influencing the evoluti ...

NBER WORKING PAPER SERIES THE U.S. CURRENT ACCOUNT AND THE DOLLAR

... deficit to GDP of 1% requires a decrease in the real exchange rate somewhere between 7% and 10%—thus, a smaller depreciation than implied by ...

... deficit to GDP of 1% requires a decrease in the real exchange rate somewhere between 7% and 10%—thus, a smaller depreciation than implied by ...

RMB as an Anchor Currency in ASEAN, China, Japan

... ($467 billion), and accounted for 8.4 percent of total trade settlement, a rise from 6.6 and 2.2 percent in 2011 and 2010 respectively. RMB settlement in direct investment reached RMB 284 billion ($45 billion), more than doubled that of 2011. By the end of 2012 a total of 206 countries and regions ...

... ($467 billion), and accounted for 8.4 percent of total trade settlement, a rise from 6.6 and 2.2 percent in 2011 and 2010 respectively. RMB settlement in direct investment reached RMB 284 billion ($45 billion), more than doubled that of 2011. By the end of 2012 a total of 206 countries and regions ...

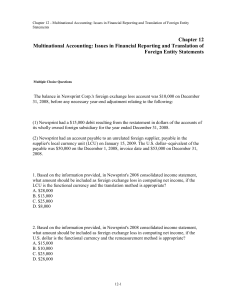

Ch12 – Financial Reporting and Translation of Foreign

... 5. Simon Company has two foreign subsidiaries. One is located in France, the other in England. Simon has determined the U.S. dollar is the functional currency for the French subsidiary, while the British pound is the functional currency for the English subsidiary. Both subsidiaries maintain their bo ...

... 5. Simon Company has two foreign subsidiaries. One is located in France, the other in England. Simon has determined the U.S. dollar is the functional currency for the French subsidiary, while the British pound is the functional currency for the English subsidiary. Both subsidiaries maintain their bo ...

The Welfare effects of an East Africa Community Currency Area

... the member states, which may spur international trade and investment. An important benefit that has dominated recent literature is the credibility argument. Monetary unions create the potential for some countries to “import monetary credibility” (Herrendorf 1997) from other member countries with rep ...

... the member states, which may spur international trade and investment. An important benefit that has dominated recent literature is the credibility argument. Monetary unions create the potential for some countries to “import monetary credibility” (Herrendorf 1997) from other member countries with rep ...

Do High Interest Rates Defend Currencies During Speculative

... During the last thirty years, both developed and developing countries with fixed exchange-rate regimes have suffered significantly from speculative attacks against their currencies. To prevent such attacks from developing into currency crises, academics and policymakers around the world have been inves ...

... During the last thirty years, both developed and developing countries with fixed exchange-rate regimes have suffered significantly from speculative attacks against their currencies. To prevent such attacks from developing into currency crises, academics and policymakers around the world have been inves ...

The Output Composition Puzzle - compositional response of GDP to

... study finds that investment is most sensitive (followed by net exports) to unanticipated increases in the cash rate, and also contributes the most to output deviation. However, this study also finds that net exports are a key driver of output reduction in the first year, and then play a role in damp ...

... study finds that investment is most sensitive (followed by net exports) to unanticipated increases in the cash rate, and also contributes the most to output deviation. However, this study also finds that net exports are a key driver of output reduction in the first year, and then play a role in damp ...

External Wealth, the Trade Balance, and the Real Exchange

... -6balance and the real exchange rate. However, our focus in this paper is on the long-run relation between these variables. For countries with market power in international markets, trade imbalances may also affect the structure of international relative prices. For instance, a trade deficit may be ...

... -6balance and the real exchange rate. However, our focus in this paper is on the long-run relation between these variables. For countries with market power in international markets, trade imbalances may also affect the structure of international relative prices. For instance, a trade deficit may be ...

Information Asymmetry and Foreign Currency Borrowing by Small

... may be particularly relevant regarding small firms in transition and developing countries. Banks may not necessarily know the currency in which (small) firms have contracted their sales, and/or the firms' actual or prospective revenue levels, when they evaluate the firms’ loan applications. Though a ...

... may be particularly relevant regarding small firms in transition and developing countries. Banks may not necessarily know the currency in which (small) firms have contracted their sales, and/or the firms' actual or prospective revenue levels, when they evaluate the firms’ loan applications. Though a ...

70 Working Paper The benefits and costs of monetary union in Southern Africa:

... Africa, Lesotho, Namibia, and Swaziland.6 The CMA originated as an informal arrangement during the colonial period in the early twentieth century. A currency union was formally established with the signing of the Rand Monetary Area Agreement (RMA) in 1974 by South Africa, Botswana, Namibia, and Swaz ...

... Africa, Lesotho, Namibia, and Swaziland.6 The CMA originated as an informal arrangement during the colonial period in the early twentieth century. A currency union was formally established with the signing of the Rand Monetary Area Agreement (RMA) in 1974 by South Africa, Botswana, Namibia, and Swaz ...

Why Trade Forex

... Technical analysis works very well and the market trends well. Forex offers up to 100:1 leverage but it is wise avoid very high leverage if you can afford it. Stocks offer 1:1 or 2:1.Futures offers 15:1 leverage The forex market is the most liquid in the world. Traders can almost always open or clos ...

... Technical analysis works very well and the market trends well. Forex offers up to 100:1 leverage but it is wise avoid very high leverage if you can afford it. Stocks offer 1:1 or 2:1.Futures offers 15:1 leverage The forex market is the most liquid in the world. Traders can almost always open or clos ...

Economics R. Glenn Hubbard, Anthony Patrick O`Brien, 2e.

... Growth rate of velocity − Growth rate of real output If the velocity is constant: Inflation rate = Growth rate of the money supply − Growth rate of real output In the long run, inflation results from the money supply growing at a faster rate than real GDP. Hyperinflation and how it comes. ...

... Growth rate of velocity − Growth rate of real output If the velocity is constant: Inflation rate = Growth rate of the money supply − Growth rate of real output In the long run, inflation results from the money supply growing at a faster rate than real GDP. Hyperinflation and how it comes. ...

Download attachment

... Proceedings of Applied International Business Conference 2008 interest rate by RBF gave rise to speculations about the currency devaluation (Narayan, 2006; Narayan and Narayan, 2007). The next section undertakes a quantitative analysis of real exchange rate. 3. Review of empirical research on real ...

... Proceedings of Applied International Business Conference 2008 interest rate by RBF gave rise to speculations about the currency devaluation (Narayan, 2006; Narayan and Narayan, 2007). The next section undertakes a quantitative analysis of real exchange rate. 3. Review of empirical research on real ...