Communiqué of the Thirty-Fifth Meeting of the IMFC

... global uncertainty pose challenges for some emerging market and developing countries. Trade, financial integration, and technological innovation have brought significant benefits, improving living standards, and lifting hundreds of millions out of poverty. However, the prolonged period of low growth ...

... global uncertainty pose challenges for some emerging market and developing countries. Trade, financial integration, and technological innovation have brought significant benefits, improving living standards, and lifting hundreds of millions out of poverty. However, the prolonged period of low growth ...

International Finance

... The Foreign Exchange Market Comments on the graph: The demand for pounds is downward sloping. The higher the dollar price for pounds, the fewer pounds will be demanded; the lower the dollar price for pounds, the more pounds that will be demanded. At $1.90 = £1, there is a surplus of pounds, placing ...

... The Foreign Exchange Market Comments on the graph: The demand for pounds is downward sloping. The higher the dollar price for pounds, the fewer pounds will be demanded; the lower the dollar price for pounds, the more pounds that will be demanded. At $1.90 = £1, there is a surplus of pounds, placing ...

Edward Lazear: Chinese `Currency Manipulation`

... "mass," so to speak, they attract more exports from others. At the same time, other countries tend to import more from larger countries. Thus the growth of trade between China and the rest of the world not only contributed to China's growing size, but the reverse is also true. Rapid economic growth ...

... "mass," so to speak, they attract more exports from others. At the same time, other countries tend to import more from larger countries. Thus the growth of trade between China and the rest of the world not only contributed to China's growing size, but the reverse is also true. Rapid economic growth ...

J.D. Han

... money supply and inflation, and the trade deficit country will have a declining money supply and deflation. The terms of trade changes to the extent to reverse the flow of imports and exports, and thus the international or external balance is to be achieved. In a world with the key currency system, ...

... money supply and inflation, and the trade deficit country will have a declining money supply and deflation. The terms of trade changes to the extent to reverse the flow of imports and exports, and thus the international or external balance is to be achieved. In a world with the key currency system, ...

Evaluating the international monetary system and the availability to

... applying the optimum currency area theory on the one single global currency in the light of the euro experience, and then trying to find out how to convert the international monetary system to a one single global currency guided by the euro experience, and then studying the expected effects of issu ...

... applying the optimum currency area theory on the one single global currency in the light of the euro experience, and then trying to find out how to convert the international monetary system to a one single global currency guided by the euro experience, and then studying the expected effects of issu ...

- Allama Iqbal Open University

... Q.4 What is the relationship between international trade, balance of payments and determination of exchange rate? ...

... Q.4 What is the relationship between international trade, balance of payments and determination of exchange rate? ...

Course: Marketing Theory and Practice (561/5534) Semester:

... Q.4 What is the relationship between international trade, balance of payments and determination of exchange rate? ...

... Q.4 What is the relationship between international trade, balance of payments and determination of exchange rate? ...

Gold`s Role in a Diversified Portfolio

... the individual components. Although a random selection of assets will reduce the overall risk exposure, diversification is more efficient if the assets held are not correlated. Gold as a non-correlated Asset The most effective way to diversify a portfolio and preserve wealth in the financial markets ...

... the individual components. Although a random selection of assets will reduce the overall risk exposure, diversification is more efficient if the assets held are not correlated. Gold as a non-correlated Asset The most effective way to diversify a portfolio and preserve wealth in the financial markets ...

Week 2 - University of Massachusetts Amherst

... • Within a few years, the major nations had eliminated restrictions on flow of capital, and, over time, the flow of capital became more important as a major determinant of short-term currency movements, than trade imbalances. • Although, in principle, the exchange rate was to be determined by the ma ...

... • Within a few years, the major nations had eliminated restrictions on flow of capital, and, over time, the flow of capital became more important as a major determinant of short-term currency movements, than trade imbalances. • Although, in principle, the exchange rate was to be determined by the ma ...

Dollar steady versus euro, yen amid lower US yields

... a sixyear high of 110.09 yen on factors titled Don't buy the dollar, just sell the including expectations for an early rate euro, Juckes said the European outlook hike by the Fed. has taken a turn for the worse, with re However, a recent decline in US cent data confirming that the Ukraine Treasury ...

... a sixyear high of 110.09 yen on factors titled Don't buy the dollar, just sell the including expectations for an early rate euro, Juckes said the European outlook hike by the Fed. has taken a turn for the worse, with re However, a recent decline in US cent data confirming that the Ukraine Treasury ...

Monetary Policy: Goals and Targets

... Currently, the Fed follows an interest rate target. The target interest rate (Fed Funds Rate) is adjusted according to a ‘Taylor Rule” FF = 2% + (Inflation) - 1.25(Unemployment – 5%) + .5(Inflation – 2%) Long Run: When the economy is at full employment ( Unemployment = 5%) and inflation is at its l ...

... Currently, the Fed follows an interest rate target. The target interest rate (Fed Funds Rate) is adjusted according to a ‘Taylor Rule” FF = 2% + (Inflation) - 1.25(Unemployment – 5%) + .5(Inflation – 2%) Long Run: When the economy is at full employment ( Unemployment = 5%) and inflation is at its l ...

powerpoint files for units 4,5, and 6 of IFEL text 1

... and M3 - according to the type and size of account in which the cash and funds are kept. • The Money Supply can be defined as the quantity of money issued by a country's monetary authorities. But why is it important -? • The money supply is important to economists and the public trying to understand ...

... and M3 - according to the type and size of account in which the cash and funds are kept. • The Money Supply can be defined as the quantity of money issued by a country's monetary authorities. But why is it important -? • The money supply is important to economists and the public trying to understand ...

Balance of Payments

... • If we devalue or depreciate the domestic currency, the domestic price of imports rises immediately, the price of exports will rise with a lag as our products attract a higher demand because they are cheaper in terms of the foreign currency. The physical quantity of exports will not increase immedi ...

... • If we devalue or depreciate the domestic currency, the domestic price of imports rises immediately, the price of exports will rise with a lag as our products attract a higher demand because they are cheaper in terms of the foreign currency. The physical quantity of exports will not increase immedi ...

Slide 1

... • The structure of the economies in the EU’s economic and monetary union is important for determining how members respond to aggregate demand shocks. – The economies of EU members are similar in the sense that there is a high volume of intra-industry trade relative to the total volume. – They are di ...

... • The structure of the economies in the EU’s economic and monetary union is important for determining how members respond to aggregate demand shocks. – The economies of EU members are similar in the sense that there is a high volume of intra-industry trade relative to the total volume. – They are di ...

Viewpoint: Understanding the Great Depression

... portfolio capital; hence, funds flowed to Paris from other financial centres. But high real interest rates also made consumption and investment less attractive, strengthening the French current account. Lower nominal rates, for their part, stimulated the demand for money, which could be met only by ...

... portfolio capital; hence, funds flowed to Paris from other financial centres. But high real interest rates also made consumption and investment less attractive, strengthening the French current account. Lower nominal rates, for their part, stimulated the demand for money, which could be met only by ...

A Strong US Dollar Changes Everything

... commodities as an asset class. Since most globally traded commodities are traded in U.S. dollars, a stronger dollar tends to send the prices of commodities lower, all else being equal. Let’s look at an example: Crude oil is globally traded and priced in U.S. dollars, which means if a company in Fran ...

... commodities as an asset class. Since most globally traded commodities are traded in U.S. dollars, a stronger dollar tends to send the prices of commodities lower, all else being equal. Let’s look at an example: Crude oil is globally traded and priced in U.S. dollars, which means if a company in Fran ...

Answer Key - University of Colorado Boulder

... A rise in the average value of transactions carried out by a household or a firm causes its demand for money to fall. B. A reduction in the average value of transactions carried out by a household or a firm causes its demand for money to rise. C. A rise in the average value of transactions carried o ...

... A rise in the average value of transactions carried out by a household or a firm causes its demand for money to fall. B. A reduction in the average value of transactions carried out by a household or a firm causes its demand for money to rise. C. A rise in the average value of transactions carried o ...

10 THE EXCHANGE RATE AND THE BALANCE OF PAYMENTS**

... The government sector balance is equal to net taxes (£217 billion) minus government expenditures on goods and services (£230 billion), or −£13 billion. Net exports equals the private sector balance (−£19 billion) plus the government sector balance (−£13 billion), or −£32 billion. The U.K. had a net ...

... The government sector balance is equal to net taxes (£217 billion) minus government expenditures on goods and services (£230 billion), or −£13 billion. Net exports equals the private sector balance (−£19 billion) plus the government sector balance (−£13 billion), or −£32 billion. The U.K. had a net ...

Houston Investors Association Monthly SIG

... Fed has promised to keep rates at zero all this coming year also. Great call ...

... Fed has promised to keep rates at zero all this coming year also. Great call ...

PDF Download

... Why does the balance of payments matter? One disadvantage of a balance of payments deficit, for any country, is that the central bank is running down its reserves. If this process continues indefinitely, it will eventually have to adjust course. Under conditions of open capital markets, if reserves ...

... Why does the balance of payments matter? One disadvantage of a balance of payments deficit, for any country, is that the central bank is running down its reserves. If this process continues indefinitely, it will eventually have to adjust course. Under conditions of open capital markets, if reserves ...

Muhammed Yesilhark – Head of European Equities team at

... My conclusion would be the jury is still out there of whether these unconventional monetary policies are good or bad and we as market participants should be careful what we wish for. ...

... My conclusion would be the jury is still out there of whether these unconventional monetary policies are good or bad and we as market participants should be careful what we wish for. ...

Lecture 21: Exchange Rates and International Trade

... i. At eight to the dollar, the yuan is currently overvalued. ii. To defend the currency, the government buys yuan with their international reserves (causing them to shrink). iii. In effect, the government simulates additional demand for a currency people are losing interest in. e. Now suppose China ...

... i. At eight to the dollar, the yuan is currently overvalued. ii. To defend the currency, the government buys yuan with their international reserves (causing them to shrink). iii. In effect, the government simulates additional demand for a currency people are losing interest in. e. Now suppose China ...

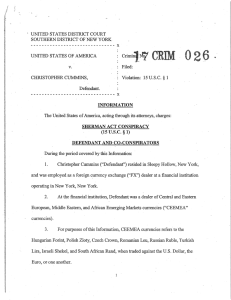

` UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF

... customers who contacted their respective financial institutions looking to trade. Defendant and his co-conspirators acted as market makers principally in spot transactions, although on certain occasions, and with respect to certain currencies, they quoted prices for forward transactions as well. ...

... customers who contacted their respective financial institutions looking to trade. Defendant and his co-conspirators acted as market makers principally in spot transactions, although on certain occasions, and with respect to certain currencies, they quoted prices for forward transactions as well. ...

global political economy

... Agriculture-based economies, gold standard C. Objectives of Mercantilism—gold, silver, wealth and treasure of the monarchy through trade, exploration, conquest, war, royal intermarriages, taxation. The power of a kingdom/empire is partly measured in terms of the king’s treasure. Gold and silver were ...

... Agriculture-based economies, gold standard C. Objectives of Mercantilism—gold, silver, wealth and treasure of the monarchy through trade, exploration, conquest, war, royal intermarriages, taxation. The power of a kingdom/empire is partly measured in terms of the king’s treasure. Gold and silver were ...