NBER WORKING PAPER SERIES LIQUIDITY TRAPS: HOW TO AVOID THEM AND

... of monetary policy is the nominal exchange rate. When capital mobility is limited, the short nominal interest rate and the nominal exchange rate both can be instruments of policy, at any rate in the short run. ...

... of monetary policy is the nominal exchange rate. When capital mobility is limited, the short nominal interest rate and the nominal exchange rate both can be instruments of policy, at any rate in the short run. ...

Management & Engineering Empirical Analysis of

... Great numbers of literature have interpreted which factors have decision effect in the process of currency internationalization. There four factors approved by the majority of researchers including economic scale, stability of monetary value, network externality and the developed and open financial ...

... Great numbers of literature have interpreted which factors have decision effect in the process of currency internationalization. There four factors approved by the majority of researchers including economic scale, stability of monetary value, network externality and the developed and open financial ...

The Rationale for Inflation Targeting

... a low-inflation country, say Germany or the United States, or, alternatively, putting the value of the domestic currency on a predetermined path vis-à-vis the foreign currency in a variant of this fixed exchange rate regime known as a crawling peg. The exchange rate anchor has the advantage of avoid ...

... a low-inflation country, say Germany or the United States, or, alternatively, putting the value of the domestic currency on a predetermined path vis-à-vis the foreign currency in a variant of this fixed exchange rate regime known as a crawling peg. The exchange rate anchor has the advantage of avoid ...

Sebastian

... partially open, and there exist some controls to capital movements. Under these circumstances it would be expected that in the short—run the domestic rate of interest will respond both to external factors (i.e.., world interest ...

... partially open, and there exist some controls to capital movements. Under these circumstances it would be expected that in the short—run the domestic rate of interest will respond both to external factors (i.e.., world interest ...

Mankiw 5/e Chapter 5: The Open Economy

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

The Concepts, Consequences, and Determinants of Currency

... use of currency?” In addressing these questions, Strange classified international currencies into four categories: “master currencies,” “top currencies,” “negotiated currencies” and “neutral currencies,” highlighting how both economic and political factors shape currencies’ international uses. A ma ...

... use of currency?” In addressing these questions, Strange classified international currencies into four categories: “master currencies,” “top currencies,” “negotiated currencies” and “neutral currencies,” highlighting how both economic and political factors shape currencies’ international uses. A ma ...

Mankiw 5/e Chapter 5: The Open Economy

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

Mankiw 5/e Chapter 5: The Open Economy

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

JK_26_01_01 - Faculty of Management, Universiti Teknologi

... among interest rate, inflation rate and exchange rate with stock prices in Pakistan for the period from 1990 to 2015. The findings from cointegration test indicated that there was a negative relationship of interest rate, inflation rate and exchange rate with stock prices. Granger causality test res ...

... among interest rate, inflation rate and exchange rate with stock prices in Pakistan for the period from 1990 to 2015. The findings from cointegration test indicated that there was a negative relationship of interest rate, inflation rate and exchange rate with stock prices. Granger causality test res ...

TESTING FOR PURCHASING POWER PARITY FOR

... countries have undergone several phases of economic changes. Economy was depended on heavy industry and monopolistic firms and international trade was formed by state agreements under the socialist model. In the process of transformation there were differences between countries (Fisher and Gelb, 199 ...

... countries have undergone several phases of economic changes. Economy was depended on heavy industry and monopolistic firms and international trade was formed by state agreements under the socialist model. In the process of transformation there were differences between countries (Fisher and Gelb, 199 ...

a comparison of the classical black-scholes model

... $1.5 trillion. This makes it the most volatile and the most liquid of all financial markets. Unlike the stock or bond markets, there is no geographic location where the transactions are bid and cleared. American and European options on foreign currencies are actively traded in both over the counter ( ...

... $1.5 trillion. This makes it the most volatile and the most liquid of all financial markets. Unlike the stock or bond markets, there is no geographic location where the transactions are bid and cleared. American and European options on foreign currencies are actively traded in both over the counter ( ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... per year. The slowdown was also present in the nontraded sector, whose output’s growth was reduced yet remained positive at 3.4% per year. Interestingly, the program was followed initially by a rise in both total factor productivity and labor productivity relative to their levels prior to stabilizat ...

... per year. The slowdown was also present in the nontraded sector, whose output’s growth was reduced yet remained positive at 3.4% per year. Interestingly, the program was followed initially by a rise in both total factor productivity and labor productivity relative to their levels prior to stabilizat ...

Principles of Economics, Case/Fair/Oster, 10e

... to the lenders that purchase the bonds. When interest rates rise, the prices of existing bonds fall. ...

... to the lenders that purchase the bonds. When interest rates rise, the prices of existing bonds fall. ...

what you always wanted to know about gold

... Third, the “Real Bills Doctrine” of Adam Smith should be rehabilitated. Bills of exchange drawn on fast-moving merchandise in most urgent demand by the consumers, which mature into gold coins within 91 days (the length of a quarter), must be allowed to enter into spontaneous monetary circulation. Th ...

... Third, the “Real Bills Doctrine” of Adam Smith should be rehabilitated. Bills of exchange drawn on fast-moving merchandise in most urgent demand by the consumers, which mature into gold coins within 91 days (the length of a quarter), must be allowed to enter into spontaneous monetary circulation. Th ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... by all of the shocks (e.g., preference volatility shocks, fiscal volatility shocks, monetary volatility shocks, animal spirits volatility shocks) buffeting the economy, not just TFP volatility shocks. Granted, under this identification approach, the VAR does deliver a measure of timevarying volatili ...

... by all of the shocks (e.g., preference volatility shocks, fiscal volatility shocks, monetary volatility shocks, animal spirits volatility shocks) buffeting the economy, not just TFP volatility shocks. Granted, under this identification approach, the VAR does deliver a measure of timevarying volatili ...

M o n e t a r y ... Contents 1 August 2000

... that growth slowed very sharply in the June quarter, and may well have been negative. Business confidence has fallen sharply, as indeed has consumer confidence. Changes in labour legislation and other policy announcements have collectively ...

... that growth slowed very sharply in the June quarter, and may well have been negative. Business confidence has fallen sharply, as indeed has consumer confidence. Changes in labour legislation and other policy announcements have collectively ...

NBER WORKING PAPER SERIES COMPOSITIONAL EFFECTS OF GOVERNMENT SPENDING

... Figure 2 illustrates the initial equilibrium. Since it is stationary, the graphs characterize equilibrium in each period. The countries share identical production possibilitiesfrontiers and identicaland homotheticpreferences. Thus, the only difference between the home and foreign country is that pri ...

... Figure 2 illustrates the initial equilibrium. Since it is stationary, the graphs characterize equilibrium in each period. The countries share identical production possibilitiesfrontiers and identicaland homotheticpreferences. Thus, the only difference between the home and foreign country is that pri ...

Empirical Exchange Rate Equations for the Commodity Currencies

... exchange values of the domestic currency, adjusted by the relevant CPIs. An increase in the real rates thus represents a rise in the relative price of home goods or, a real appreciation for the home country. The non-dollar basket is adopted from the Broad Index of the Federal Reserve. It is a compo ...

... exchange values of the domestic currency, adjusted by the relevant CPIs. An increase in the real rates thus represents a rise in the relative price of home goods or, a real appreciation for the home country. The non-dollar basket is adopted from the Broad Index of the Federal Reserve. It is a compo ...

Introducing the Monetary Time Series of Southeastern Europe

... While such a publication is the medium-term aim, the task force set itself as a first goal to provide four key monetary time series for the period until the First World War: exchange-rates to the European core countries of England, France, and Germany; the discount rate of the bank of note issue; go ...

... While such a publication is the medium-term aim, the task force set itself as a first goal to provide four key monetary time series for the period until the First World War: exchange-rates to the European core countries of England, France, and Germany; the discount rate of the bank of note issue; go ...

A Primer on the Euro Breakup

... > The euro is like a modern day gold standard where the burden of adjustment falls on the weaker countries – Like the gold standard, the euro forces adjustment in real prices and wages instead of exchange rates. And much like the gold standard, it has a recessionary bias, where the burden of adjustm ...

... > The euro is like a modern day gold standard where the burden of adjustment falls on the weaker countries – Like the gold standard, the euro forces adjustment in real prices and wages instead of exchange rates. And much like the gold standard, it has a recessionary bias, where the burden of adjustm ...

Real currency appreciation in accession countries

... A model of real exchange rate determination for the EU accession countries should take into account that these countries are small on world goods and capital markets. The model economy should therefore be unable to affect interest rates and prices of tradeable goods on world markets. The only (real) ...

... A model of real exchange rate determination for the EU accession countries should take into account that these countries are small on world goods and capital markets. The model economy should therefore be unable to affect interest rates and prices of tradeable goods on world markets. The only (real) ...

A survey of literature on the equilibrium real exchange rate an

... FEER is usually considered a medium-term approach. In effect, on the one hand, it ignores short-term disturbances and cyclical factors and, on the other hand, it takes into account the existence of capital flows among the different economies. As mentioned in Section 2, the medium-term equilibrium co ...

... FEER is usually considered a medium-term approach. In effect, on the one hand, it ignores short-term disturbances and cyclical factors and, on the other hand, it takes into account the existence of capital flows among the different economies. As mentioned in Section 2, the medium-term equilibrium co ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... up in 1971-73, 1977-78, 1985-87, and 1993-mid-1995 (fig. 13.1).While ameliorating commercial tensions by temporarily making Japanese industry less competitive, these great appreciations imposed relative deflation on Japan without correcting the trade imbalance between the two countries. Why, asymmet ...

... up in 1971-73, 1977-78, 1985-87, and 1993-mid-1995 (fig. 13.1).While ameliorating commercial tensions by temporarily making Japanese industry less competitive, these great appreciations imposed relative deflation on Japan without correcting the trade imbalance between the two countries. Why, asymmet ...

TECHNICAL NOTE PROPOSAL INTERNATIONAL ACCOUNTING

... issuance of circulating money with gold holdings. Paper money was convertible into gold according to a fixed rate. The development of the banking and credit system, as well as the need for circulating money during the First World War led to having amounts of money in circulation that were higher tha ...

... issuance of circulating money with gold holdings. Paper money was convertible into gold according to a fixed rate. The development of the banking and credit system, as well as the need for circulating money during the First World War led to having amounts of money in circulation that were higher tha ...

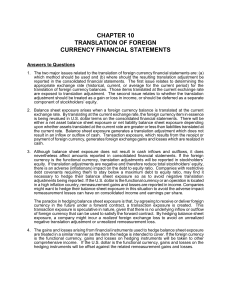

Chapter 10 8e SM

... in a high inflation country, remeasurement gains and losses are reported in income. Companies might want to hedge their balance sheet exposure in this situation to avoid the adverse impact remeasurement losses can have on consolidated income and earnings per share. The paradox in hedging balance she ...

... in a high inflation country, remeasurement gains and losses are reported in income. Companies might want to hedge their balance sheet exposure in this situation to avoid the adverse impact remeasurement losses can have on consolidated income and earnings per share. The paradox in hedging balance she ...