NBER WORKING PAPER SERIES THE DOLLAR AND ITS DISCONTENTS Olivier Jeanne

... Treasury securities suggests that there is some truth to the “fiscal Triffin dilemma” view. The global stock of dollar reserves was increasing at a faster pace than the stock of US Treasury securities before the crisis, so that by 2007 the two curves were about to cross each other. This trend was i ...

... Treasury securities suggests that there is some truth to the “fiscal Triffin dilemma” view. The global stock of dollar reserves was increasing at a faster pace than the stock of US Treasury securities before the crisis, so that by 2007 the two curves were about to cross each other. This trend was i ...

Exploring the Relationship between Population Age Structure and Real Exchange Rate in OECD Countries

... growth in Japan on Yen/US dollar bi-lateral real exchange rate. This paper employs an overlapping generations (OLG) model linking the population growth to real exchange rate. However, they do not consider the USA-Japan bi-lateral trade balance, which has been identified as one of the major factors f ...

... growth in Japan on Yen/US dollar bi-lateral real exchange rate. This paper employs an overlapping generations (OLG) model linking the population growth to real exchange rate. However, they do not consider the USA-Japan bi-lateral trade balance, which has been identified as one of the major factors f ...

Foreign Exchange Risk Management Practices

... With this expansion comes a variety of associated risks for the international financial management to deal with. One of these risks is the foreign exchange risk. Because of distortions in the integrated global capital market and changes in exchange- and interest rates, there is a constant need for r ...

... With this expansion comes a variety of associated risks for the international financial management to deal with. One of these risks is the foreign exchange risk. Because of distortions in the integrated global capital market and changes in exchange- and interest rates, there is a constant need for r ...

Monetary policy strategies of the European Central Bank and the

... taking the form of very small adjustments of interest rates (usually 25 to 50 basis points) spread out over periods as long as two or even three years to achieve its ultimate interest rate targets. Ironically, the combination of openness and gradualism can force the central bank to make policy moves ...

... taking the form of very small adjustments of interest rates (usually 25 to 50 basis points) spread out over periods as long as two or even three years to achieve its ultimate interest rate targets. Ironically, the combination of openness and gradualism can force the central bank to make policy moves ...

How do exchange rate movements affect Chinese exports? – A firm

... domestic producers and caused exit of firms and layoff of workers 2 .In particular, the everincreasing trade deficit between the US and China adds further tension between the two largest countries in the world. China’s pegged nominal RMB (Renminbi) has been claimed too low and responsible for the cu ...

... domestic producers and caused exit of firms and layoff of workers 2 .In particular, the everincreasing trade deficit between the US and China adds further tension between the two largest countries in the world. China’s pegged nominal RMB (Renminbi) has been claimed too low and responsible for the cu ...

CHANGES IN THE CHARACTERISTICS OF THE

... fluctuations in the Australian economy. As a mainly commodity-exporting country, the world commodity price cycle dominates large movements in Australia's terms of trade. Prior to the floating of the Australian dollar ($A) in December 1983, income effects generated by these fluctuations contributed t ...

... fluctuations in the Australian economy. As a mainly commodity-exporting country, the world commodity price cycle dominates large movements in Australia's terms of trade. Prior to the floating of the Australian dollar ($A) in December 1983, income effects generated by these fluctuations contributed t ...

PDF Download

... including preemptive capital controls] and institutions [financial stability boards and SWFs, among others]. These developments exemplify a growing trend among emerging markets. The GFC and the resultant quantitative easing [QE] policy by the Fed and other central banks also led to large, hot money ...

... including preemptive capital controls] and institutions [financial stability boards and SWFs, among others]. These developments exemplify a growing trend among emerging markets. The GFC and the resultant quantitative easing [QE] policy by the Fed and other central banks also led to large, hot money ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... macroeconomic legacy-of high inflation and low income, but also of competitive exchange rate, high public tariffs, and sizable international reservesleft by the second administration of Fernando Belaunde. This legacy represents the initial conditions of the period under examination. The section cont ...

... macroeconomic legacy-of high inflation and low income, but also of competitive exchange rate, high public tariffs, and sizable international reservesleft by the second administration of Fernando Belaunde. This legacy represents the initial conditions of the period under examination. The section cont ...

Inter-forecast monetary policy implementation: fixed-instrument versus MCI-based strategies By Ben Hunt

... instrument, then fixing or banding an MCI rather than fixing the instrument can lead to an increase in inflation variability. In the special case where the economy is subjected only to exchange rate shocks, MCI-based inter-forecast strategies reduce inflation and output variability slightly, without ...

... instrument, then fixing or banding an MCI rather than fixing the instrument can lead to an increase in inflation variability. In the special case where the economy is subjected only to exchange rate shocks, MCI-based inter-forecast strategies reduce inflation and output variability slightly, without ...

Leading Indicators of Currency Crises

... crises, and to identify those indicators that have been the most reliable. The results indicate that an effective warning system should, indeed, consider a broad variety of indicators, since currency crises seem to be usually preceded by a broad range of economic problems. Third, the paper compares ...

... crises, and to identify those indicators that have been the most reliable. The results indicate that an effective warning system should, indeed, consider a broad variety of indicators, since currency crises seem to be usually preceded by a broad range of economic problems. Third, the paper compares ...

New perspectives on the Great Depression

... the combination of Roosevelt and Keynes did more than successfully bring about the recovery of the U.S. from the Great Depression: “working in tandem, [Roosevelt and Keynes] effected a revolution in monetary policy that [in addition to bringing] the Great Depression to an end, la ...

... the combination of Roosevelt and Keynes did more than successfully bring about the recovery of the U.S. from the Great Depression: “working in tandem, [Roosevelt and Keynes] effected a revolution in monetary policy that [in addition to bringing] the Great Depression to an end, la ...

The Evolution of Price Dispersion in the European Car Market¤

... While the source of price disparities may be a source of disagreement among auto experts, consensus seems to exist that this is an important issue in the European Community. The Commission of the European Communities also views price di®erentials as a potential threat to the European market integrat ...

... While the source of price disparities may be a source of disagreement among auto experts, consensus seems to exist that this is an important issue in the European Community. The Commission of the European Communities also views price di®erentials as a potential threat to the European market integrat ...

Empirical Exchange Rate Models of the Nineties

... literature are by Meese and Rogoff (1983, 1988), who examined monetary and portfolio balance models. Succeeding works by Mark (1995) and Chinn and Meese (1995) focused on similar models. In this paper we re-assess exchange rate prediction using a wider set of models that have been proposed in the la ...

... literature are by Meese and Rogoff (1983, 1988), who examined monetary and portfolio balance models. Succeeding works by Mark (1995) and Chinn and Meese (1995) focused on similar models. In this paper we re-assess exchange rate prediction using a wider set of models that have been proposed in the la ...

"#$%! DISCUSSION PAPER SERIES !!!"#$%&"'&()

... Over the past decade, the international reserves held by monetary authorities have risen to very high levels relative to national outputs. More rapid reserve accumulation, primarily attributable to relatively poor countries, is thought to have affected the global patterns of exchange rates, of capit ...

... Over the past decade, the international reserves held by monetary authorities have risen to very high levels relative to national outputs. More rapid reserve accumulation, primarily attributable to relatively poor countries, is thought to have affected the global patterns of exchange rates, of capit ...

Final version

... inflation through appropriate variations in the nominal interest rate during the same period they hit the economy, demand shocks do not inflict social losses. The story is different for supply shocks, since they modify the optimal value of both output and inflation. The impact of supply shocks on so ...

... inflation through appropriate variations in the nominal interest rate during the same period they hit the economy, demand shocks do not inflict social losses. The story is different for supply shocks, since they modify the optimal value of both output and inflation. The impact of supply shocks on so ...

Responding to the Monetary Superpower

... Between 2002 and 2006, the United States Federal Reserve set interest rates significantly below the rates suggested by well-known monetary policy rules. There is a growing body of research suggesting that this helped fuel an excess of liquidity in the U.S. that contributed to the 2008 worldwide fina ...

... Between 2002 and 2006, the United States Federal Reserve set interest rates significantly below the rates suggested by well-known monetary policy rules. There is a growing body of research suggesting that this helped fuel an excess of liquidity in the U.S. that contributed to the 2008 worldwide fina ...

Mankiw 5/e Chapter 5: The Open Economy

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

Mankiw 5/e Chapter 5: The Open Economy

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

... a country’s output (Y ) and its spending (C + I + G) 2. Net capital outflow equals purchases of foreign assets ...

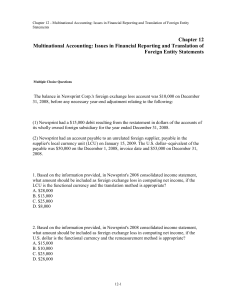

Ch12 – Financial Reporting and Translation of Foreign

... functional currency indicators, Leo determined that the British pound was the functional currency. On December 31, 2008, the British subsidiary's adjusted trial balance, translated into U.S. dollars, contained $17,000 more debits than credits. The British subsidiary reported income of 33,000 pounds ...

... functional currency indicators, Leo determined that the British pound was the functional currency. On December 31, 2008, the British subsidiary's adjusted trial balance, translated into U.S. dollars, contained $17,000 more debits than credits. The British subsidiary reported income of 33,000 pounds ...

L = money demand funtion relating money demand to real income

... 2. Higher real incomes, Y, increase the number of transactions agents make. More transactions mean that people will demand more money. 3. An increase in the nominal interest rate on nonmonetary assets means that these alternative assets become more attractive. People will reduce their demand for mon ...

... 2. Higher real incomes, Y, increase the number of transactions agents make. More transactions mean that people will demand more money. 3. An increase in the nominal interest rate on nonmonetary assets means that these alternative assets become more attractive. People will reduce their demand for mon ...

Chapter 11 The Monetary Approach To The Alan Barrett

... changes in domestic money demand and D.C.E. is to say nothing. However, this point is refuted by pointing out that the monetary approach goes further than this in postulating a stable demand for money function. By postulating this, the tautology becomes a theory. According to Frenkel and J ohnson, a ...

... changes in domestic money demand and D.C.E. is to say nothing. However, this point is refuted by pointing out that the monetary approach goes further than this in postulating a stable demand for money function. By postulating this, the tautology becomes a theory. According to Frenkel and J ohnson, a ...

Exchange-Rate Stabilization in Mid-1930s

... holdings of gold and foreign exchange increased by more than one-half.2 Since a substantial proportion of this reserve gain reflected dollar accumulations in, and gold purchases from, the United States, the American authorities were fully convinced that the EEA, while ostensibly established merely t ...

... holdings of gold and foreign exchange increased by more than one-half.2 Since a substantial proportion of this reserve gain reflected dollar accumulations in, and gold purchases from, the United States, the American authorities were fully convinced that the EEA, while ostensibly established merely t ...

Do High Interest Rates Defend Currencies During Speculative

... During the last thirty years, both developed and developing countries with fixed exchange-rate regimes have suffered significantly from speculative attacks against their currencies. To prevent such attacks from developing into currency crises, academics and policymakers around the world have been inves ...

... During the last thirty years, both developed and developing countries with fixed exchange-rate regimes have suffered significantly from speculative attacks against their currencies. To prevent such attacks from developing into currency crises, academics and policymakers around the world have been inves ...

The Open Economy

... exchange market with little or no intervention by central banks; Managed exchange rate – e is managed by central banks according to some rule; Fixed exchange rate – central bank(s) set a price and enter the market to support the price as required; Currency Board/Common currency - strong types ...

... exchange market with little or no intervention by central banks; Managed exchange rate – e is managed by central banks according to some rule; Fixed exchange rate – central bank(s) set a price and enter the market to support the price as required; Currency Board/Common currency - strong types ...