Appendices to Chapter 8 Capital Mobility, Monetary Policy, and Exchange Rate

... bilateral CPI-based real exchange rates with Kenya’s 8 biggest trading partners. The second measure is a multilateral real exchange rate constructed by ourselves, defined as a simple average of bilateral CPIbased real exchange rates vis-à-vis a group of ‘3rd-party exporters3’ (REER3p). We use the te ...

... bilateral CPI-based real exchange rates with Kenya’s 8 biggest trading partners. The second measure is a multilateral real exchange rate constructed by ourselves, defined as a simple average of bilateral CPIbased real exchange rates vis-à-vis a group of ‘3rd-party exporters3’ (REER3p). We use the te ...

EST RATES AND CURRENCY PRICES IBI A TW@C~UNTRY

... so pooled under all realized paths of the dusturbances .3 Under these circumstances, the world economy becomes virtually identical to ‘that studied in’ Lucas (19%)’ with a single representative consumer consuming half of the endowments of both goods, or (#C&) e&h period, and holding the ‘market port ...

... so pooled under all realized paths of the dusturbances .3 Under these circumstances, the world economy becomes virtually identical to ‘that studied in’ Lucas (19%)’ with a single representative consumer consuming half of the endowments of both goods, or (#C&) e&h period, and holding the ‘market port ...

Document

... money – in the society Monetary policy: policy about money supply and interest rate. Money supply in the short-run affects interest rate and in the long-run affect macro-econ variables such as GDP, price level, etc. The Fed has some ability to manipulate and control the money supply, but the fir ...

... money – in the society Monetary policy: policy about money supply and interest rate. Money supply in the short-run affects interest rate and in the long-run affect macro-econ variables such as GDP, price level, etc. The Fed has some ability to manipulate and control the money supply, but the fir ...

IFM_T1_Key - PESIT South Campus

... is the price that is quoted for immediate (spot) settlement (payment and delivery). The forward price or forward rate is the agreed upon price of an asset in a forward contract. Using the rational pricing assumption, we can express the forward price in terms of the spot price and any dividends etc., ...

... is the price that is quoted for immediate (spot) settlement (payment and delivery). The forward price or forward rate is the agreed upon price of an asset in a forward contract. Using the rational pricing assumption, we can express the forward price in terms of the spot price and any dividends etc., ...

Currency Crisis in Thailand: The Leading Indicators

... economic growth rate soared. During its period of development, Thailand experienced strong economic growth that averaged almost 10% per year from 1987-1995 (Fischer, 1998). Similar to other Southeast Asian countries, Thailand has a lowwage/low-skilled labor force; thus, it successfully attracted sig ...

... economic growth rate soared. During its period of development, Thailand experienced strong economic growth that averaged almost 10% per year from 1987-1995 (Fischer, 1998). Similar to other Southeast Asian countries, Thailand has a lowwage/low-skilled labor force; thus, it successfully attracted sig ...

INSTITUTO TECNOLOGICO AUTONOMO DE MEXICO

... In this course the students will learn: 1) the basic principles of international trade and investment; 2) the global environment in which international firms operate; 3) the financial exchange systems and institutions that measure and facilitate international transactions; 4) the rules and practice ...

... In this course the students will learn: 1) the basic principles of international trade and investment; 2) the global environment in which international firms operate; 3) the financial exchange systems and institutions that measure and facilitate international transactions; 4) the rules and practice ...

From Gold to the Ecu: The International Monetary System in

... Hungary feared an inflationary inflow of silver into their mints and so closed them to the free coinage of silver. For the next thirteen years the gulden remained a paper currency floating in midair at a higher value, in relation to gold currencies, than the silver-bullion content of coins. The acti ...

... Hungary feared an inflationary inflow of silver into their mints and so closed them to the free coinage of silver. For the next thirteen years the gulden remained a paper currency floating in midair at a higher value, in relation to gold currencies, than the silver-bullion content of coins. The acti ...

Internationalization and the Evolution of Corporate Valuation

... Main drivers: domestic investment, resulting from savings rate of about 35% of GDP, and domestic consumption. ...

... Main drivers: domestic investment, resulting from savings rate of about 35% of GDP, and domestic consumption. ...

The Fall of the Rupee Prabhat Patnaik

... In particular, in periods of crisis in the metropolitan capitalist world, there is a tendency for the currency of peripheral economies to depreciate. This is so for two reasons: first, in such periods their current account deficit tends to widen, as has happened in the case of India, since the dema ...

... In particular, in periods of crisis in the metropolitan capitalist world, there is a tendency for the currency of peripheral economies to depreciate. This is so for two reasons: first, in such periods their current account deficit tends to widen, as has happened in the case of India, since the dema ...

A Model of Currency Exchange Rates

... simulations is presented that is shown to be stable, simple, and fair. Based on foreign holdings of money, the model pegs exchange rates to allow for currency speculation. The effect of international trade, deposits, loans, and investments are discussed. Proof is given that the model is self limitin ...

... simulations is presented that is shown to be stable, simple, and fair. Based on foreign holdings of money, the model pegs exchange rates to allow for currency speculation. The effect of international trade, deposits, loans, and investments are discussed. Proof is given that the model is self limitin ...

Monetary pOLICY - cloudfront.net

... • “Since 2007, the Fed has had its hands full preventing, not inflation, but a global depression. During the banking crisis, the Fed created many innovative programs that quickly pumped trillions of dollar of liquidity into the economy to keep banks solvent. Many were worried that this would create ...

... • “Since 2007, the Fed has had its hands full preventing, not inflation, but a global depression. During the banking crisis, the Fed created many innovative programs that quickly pumped trillions of dollar of liquidity into the economy to keep banks solvent. Many were worried that this would create ...

The evolving international monetary system

... slipped into non-priority status as a focus for reform after the collapse of the Bretton Woods regime in the early 1970s. President Richard Nixon’s decision to end the dollar’s convertibility into gold ushered in a new international monetary system in which international payments would be made by pr ...

... slipped into non-priority status as a focus for reform after the collapse of the Bretton Woods regime in the early 1970s. President Richard Nixon’s decision to end the dollar’s convertibility into gold ushered in a new international monetary system in which international payments would be made by pr ...

The Canadian Dollar is Rising Along with Oil Prices

... in the year, it might profit from higher expectations of monetary tightening in Canada. ff Continued monetary tightening in the United States should bolster the U.S. dollar in coming months. We believe the Federal Reserve will raise its key interest rates in June and then again in September. The mar ...

... in the year, it might profit from higher expectations of monetary tightening in Canada. ff Continued monetary tightening in the United States should bolster the U.S. dollar in coming months. We believe the Federal Reserve will raise its key interest rates in June and then again in September. The mar ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... fixed in nominal terms and so accordingly are prices. In this model, depreciation brings about an equiproportionate gain in competitiveness or loss in the terms of trade. The new direction of research considers explicitly an industrialorganization pricing approach as part of the macroeconomic model. ...

... fixed in nominal terms and so accordingly are prices. In this model, depreciation brings about an equiproportionate gain in competitiveness or loss in the terms of trade. The new direction of research considers explicitly an industrialorganization pricing approach as part of the macroeconomic model. ...

ECON 10020/20020 Principles of Macroeconomics

... looking at costs 115 euros, under which of the following exchange rates would you be willing to purchase the camera? (Assume no taxes or duties are associated with the purchase.) (A) 0.56 euros per dollar (B) 0.89 euros per dollar (C) 0.92 euros per dollar X C (D) You would purchase the new camera a ...

... looking at costs 115 euros, under which of the following exchange rates would you be willing to purchase the camera? (Assume no taxes or duties are associated with the purchase.) (A) 0.56 euros per dollar (B) 0.89 euros per dollar (C) 0.92 euros per dollar X C (D) You would purchase the new camera a ...

chp17_revised_050411

... Sterilized foreign exchange intervention Central banks sometimes carry out equal foreign and domestic asset transactions in opposite directions to nullify the impact of their foreign exchange operations on the domestic money supply. With no sterilization, there is a link between the balance of ...

... Sterilized foreign exchange intervention Central banks sometimes carry out equal foreign and domestic asset transactions in opposite directions to nullify the impact of their foreign exchange operations on the domestic money supply. With no sterilization, there is a link between the balance of ...

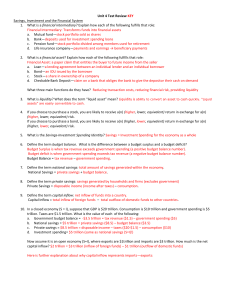

Unit 4 Test Review KEY Savings, Investment and the Financial

... b. If the current interest rate was above equilibrium, what would eventually happen to interest rates? If interest rates rise above equilibrium quantity demanded for money will be less than quantity supplied (surplus); market forces will eventually bring interest rates back down to equilibrium. c. I ...

... b. If the current interest rate was above equilibrium, what would eventually happen to interest rates? If interest rates rise above equilibrium quantity demanded for money will be less than quantity supplied (surplus); market forces will eventually bring interest rates back down to equilibrium. c. I ...

Effects of a unified GCC currency

... commodity will end up paying less than should have been paid. This means that the countries have to look for techniques to avoid the exchange rate volatility so as to enhance international trade. An experiment of the European Union indicated that had previously maintained low exchange rate volatilit ...

... commodity will end up paying less than should have been paid. This means that the countries have to look for techniques to avoid the exchange rate volatility so as to enhance international trade. An experiment of the European Union indicated that had previously maintained low exchange rate volatilit ...

chapt 13 Exchange rate

... in Y causes desired saving to rise, with no direct effect on desired investment. So the S-I curve shifts to the right. An increase in Y decreases net exports, shifting the NX curve to the left. ...

... in Y causes desired saving to rise, with no direct effect on desired investment. So the S-I curve shifts to the right. An increase in Y decreases net exports, shifting the NX curve to the left. ...

Lecture #8

... proportionally. Yet, E went up faster than P/Pf •Canada- inflation differentials between U.S. and Canada could not fully explain the changes in the nominal FX. •This suggests that a substantial part of FOREX fluctuations between Canada and US is caused by ‘real factors’. •What have caused the real F ...

... proportionally. Yet, E went up faster than P/Pf •Canada- inflation differentials between U.S. and Canada could not fully explain the changes in the nominal FX. •This suggests that a substantial part of FOREX fluctuations between Canada and US is caused by ‘real factors’. •What have caused the real F ...

XII. Keynesian stabilization in an open economy

... pressure towards appreciation, at the same excess demand for money and pressure towards interest increase → Central Bank must intervene, buying foreign assets to increase money supply (and to keep fix) → shift of AA → further increase of output, ExR remains at fix • Fiscal policy has an impact on ou ...

... pressure towards appreciation, at the same excess demand for money and pressure towards interest increase → Central Bank must intervene, buying foreign assets to increase money supply (and to keep fix) → shift of AA → further increase of output, ExR remains at fix • Fiscal policy has an impact on ou ...

XII. Keynesian stabilization in an open economy

... pressure towards appreciation, at the same excess demand for money and pressure towards interest increase → Central Bank must intervene, buying foreign assets to increase money supply (and to keep fix) → shift of AA → further increase of output, ExR remains at fix • Fiscal policy has an impact on ou ...

... pressure towards appreciation, at the same excess demand for money and pressure towards interest increase → Central Bank must intervene, buying foreign assets to increase money supply (and to keep fix) → shift of AA → further increase of output, ExR remains at fix • Fiscal policy has an impact on ou ...

3rd Trimester, 2015

... for most Israeli exporters. In the event the depreciation is maintained, it will likely support a slight increase in inflation, via a rise in the prices of tradable. Looking forward, it can be said that the potential for depreciation of the shekel is limited, this due to the underlying background co ...

... for most Israeli exporters. In the event the depreciation is maintained, it will likely support a slight increase in inflation, via a rise in the prices of tradable. Looking forward, it can be said that the potential for depreciation of the shekel is limited, this due to the underlying background co ...

85051058I_en.pdf

... stemming from cumulative United States deficits, but also by the fact that central banks kept most of their reserves in dollars. In 1971, with its reserves shrinking rapidly and the alternative solution of deflating the economy ruled out, the United States abandoned its commitment to the unlimited s ...

... stemming from cumulative United States deficits, but also by the fact that central banks kept most of their reserves in dollars. In 1971, with its reserves shrinking rapidly and the alternative solution of deflating the economy ruled out, the United States abandoned its commitment to the unlimited s ...

Topic6 - Booth School of Business

... Japanese cars are more expensive than US ones. Substitution effect can take time to kick in … On Impact: Americans import the same amount of Japanese cars, but they are more expensive. Then, the nominal value of import increases and NX decreases Later: American stop importing Japanese cars and NX in ...

... Japanese cars are more expensive than US ones. Substitution effect can take time to kick in … On Impact: Americans import the same amount of Japanese cars, but they are more expensive. Then, the nominal value of import increases and NX decreases Later: American stop importing Japanese cars and NX in ...