ECON-4.13-16.12 Money

... • Total reserves - the sum of a bank’s deposits in in the reserve account at the Fed & Vault cash. • Required reserves - the minimum amount of reserves a bank must hold against its deposits as mandated by the Fed. – Banks can make loans with their excess reserves. • Ex: A bank has excess reserves of ...

... • Total reserves - the sum of a bank’s deposits in in the reserve account at the Fed & Vault cash. • Required reserves - the minimum amount of reserves a bank must hold against its deposits as mandated by the Fed. – Banks can make loans with their excess reserves. • Ex: A bank has excess reserves of ...

PPT

... 1944: A conference held in Bretton Woods, NH established a new Bretton Woods system of exchange rates, under which countries pledged to buy and sell their currencies at a fixed rate against the dollar—and effectively against each others’ currencies. The U.S., in turn, promised to redeem its currency ...

... 1944: A conference held in Bretton Woods, NH established a new Bretton Woods system of exchange rates, under which countries pledged to buy and sell their currencies at a fixed rate against the dollar—and effectively against each others’ currencies. The U.S., in turn, promised to redeem its currency ...

Chapter 19

... be an increase in the demand for dollars. Foreigners will be more interested in purchasing U.S. assets (and less interested in purchasing their own assets) and therefore, at any given exchange rate, they will be more interested in purchasing dollars. The demand curve for dollars will shift to the ri ...

... be an increase in the demand for dollars. Foreigners will be more interested in purchasing U.S. assets (and less interested in purchasing their own assets) and therefore, at any given exchange rate, they will be more interested in purchasing dollars. The demand curve for dollars will shift to the ri ...

BOOK REVIEWS fire me?” The chairman replied, “You didn’t show wherein.”

... Chile, the evidence presented in this study suggests that the liberalization aspects ofthe program increased the openness ofthe Chilean economy. Since the long-run impact of these policies is to increase the tradability and mobility of goods and services produced in the Chilean economy, it follows t ...

... Chile, the evidence presented in this study suggests that the liberalization aspects ofthe program increased the openness ofthe Chilean economy. Since the long-run impact of these policies is to increase the tradability and mobility of goods and services produced in the Chilean economy, it follows t ...

CP World History (Unit 7, #2)

... 1. The domestic trading desk then buys or sells Treasury securities on the open market. “_________________________”-means that the Fed (FOMC) does business with securities dealers who compete on the basis of price. When the Fed (FOMC) wishes to ____________________ reserves, it ________________ secu ...

... 1. The domestic trading desk then buys or sells Treasury securities on the open market. “_________________________”-means that the Fed (FOMC) does business with securities dealers who compete on the basis of price. When the Fed (FOMC) wishes to ____________________ reserves, it ________________ secu ...

Topic H

... • (a) There is the possible marketing advantage by proposing to invoice in the buyer's own currency, when there is competition for the sales contract. • (b) The exporter may also be able to offset payments to his own suppliers in a particular foreign currency against receipts in that currency. • (c) ...

... • (a) There is the possible marketing advantage by proposing to invoice in the buyer's own currency, when there is competition for the sales contract. • (b) The exporter may also be able to offset payments to his own suppliers in a particular foreign currency against receipts in that currency. • (c) ...

Chapter 16

... • A short run model of output market equilibrium • A short run model of asset market equilibrium • A short run model for both output market equilibrium and asset market equilibrium • Effects of temporary and permanent changes in monetary and fiscal policies. • Adjustment of the current account over ...

... • A short run model of output market equilibrium • A short run model of asset market equilibrium • A short run model for both output market equilibrium and asset market equilibrium • Effects of temporary and permanent changes in monetary and fiscal policies. • Adjustment of the current account over ...

Press Statement Malawi Kwacha Depreciation and Near

... dropped to US$366 million or 3 months of imports during the period. In normal circumstances, the Kwacha should have started stabilizing at about K600/US$. Instead the depreciation has continued unabated. This is because the Kwacha exchange rate is also influenced by global developments and the stanc ...

... dropped to US$366 million or 3 months of imports during the period. In normal circumstances, the Kwacha should have started stabilizing at about K600/US$. Instead the depreciation has continued unabated. This is because the Kwacha exchange rate is also influenced by global developments and the stanc ...

Sterilization - Princeton University Press

... countries has often been successful, though whether sterilized intervention can serve as a fully independent policy tool remains controversial. The efficacy of sterilized intervention policies in developing countries has been less widely studied, in large part because governments have been reluctant ...

... countries has often been successful, though whether sterilized intervention can serve as a fully independent policy tool remains controversial. The efficacy of sterilized intervention policies in developing countries has been less widely studied, in large part because governments have been reluctant ...

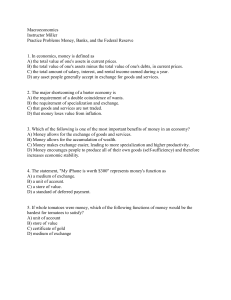

Macroeconomics Instructor Miller Practice Problems

... A) increases reserves, encourages banks to make more loans, and increases the money supply. B) decreases reserves, causes banks to reduce their loans, and decreases the money supply. C) decreases reserves, causes banks to reduce their loans, and increases the money supply. D) increases reserves, cau ...

... A) increases reserves, encourages banks to make more loans, and increases the money supply. B) decreases reserves, causes banks to reduce their loans, and decreases the money supply. C) decreases reserves, causes banks to reduce their loans, and increases the money supply. D) increases reserves, cau ...

T R I A

... high income elasticity of demand for money, even Asian tiger economies could not absorb 30 percent per annum money and credit growth. As a result, symptoms of overheating or inflation began to emerge. The first signs appeared in the securities markets, especially in the listed equity markets. Second ...

... high income elasticity of demand for money, even Asian tiger economies could not absorb 30 percent per annum money and credit growth. As a result, symptoms of overheating or inflation began to emerge. The first signs appeared in the securities markets, especially in the listed equity markets. Second ...

Global Economic Insight The Future of the US Dollar

... Japanese economy combined with the rapid ageing of Japanese society could be distinct negatives in any assessment of the attractiveness of Japanese government securities. Finally, the total outstanding debt of the UK government, though growing rapidly in the past year, amounted to only some $1.5 tri ...

... Japanese economy combined with the rapid ageing of Japanese society could be distinct negatives in any assessment of the attractiveness of Japanese government securities. Finally, the total outstanding debt of the UK government, though growing rapidly in the past year, amounted to only some $1.5 tri ...

A Call for an “Asian Plaza”

... the dollar. Its sizable depreciation over the past six years has been gradual and orderly, and it is approaching an equilibrium level. As often happens in the last stages of a major currency swing, however, like the dollar’s upward overshoot in 1984–85 and downward overshoot in 1995, that decline co ...

... the dollar. Its sizable depreciation over the past six years has been gradual and orderly, and it is approaching an equilibrium level. As often happens in the last stages of a major currency swing, however, like the dollar’s upward overshoot in 1984–85 and downward overshoot in 1995, that decline co ...

Chapter 14 PowerPoint Presentation

... The Discount Rate • The discount rate is the rate of interest charged by the Federal Reserve Banks for lending reserves to private banks. • Sometimes bank reserves run low and they must replenish their reserves temporarily. LO-2 ...

... The Discount Rate • The discount rate is the rate of interest charged by the Federal Reserve Banks for lending reserves to private banks. • Sometimes bank reserves run low and they must replenish their reserves temporarily. LO-2 ...

Manufacturing decline not just a dollar story

... behind New Zealand’s high exchange rate over many years are our low level of savings (relative to our business and residential investment desires), our desire for high levels of consumption, and our dependence on foreign savings to achieve this. I discussed this in a recent presentation to the Cante ...

... behind New Zealand’s high exchange rate over many years are our low level of savings (relative to our business and residential investment desires), our desire for high levels of consumption, and our dependence on foreign savings to achieve this. I discussed this in a recent presentation to the Cante ...

Macro_Chapter_14_study_guide_questions_13e

... 4. If the growth rate of real GDP is 3 percent, velocity is constant, and the money supply grows at 9 percent, the rate of inflation will be approximately a. 3 percent. b. 6 percent. c. 9 percent. d. 12 percent. 5. When the Fed unexpectedly increases the money supply, it will cause an increase in ag ...

... 4. If the growth rate of real GDP is 3 percent, velocity is constant, and the money supply grows at 9 percent, the rate of inflation will be approximately a. 3 percent. b. 6 percent. c. 9 percent. d. 12 percent. 5. When the Fed unexpectedly increases the money supply, it will cause an increase in ag ...

Sudamericana S.R.L.- case(Word)

... Importados Gouveia Limitada retails a broad line of national and imported computers and peripherals throughout the city of Rio de Janeiro. Founded in early 1995, it experienced rapid growth, growing from an initial one-store operation to a chain of 9 stores by late 2001. Sales for Importados Gouveia ...

... Importados Gouveia Limitada retails a broad line of national and imported computers and peripherals throughout the city of Rio de Janeiro. Founded in early 1995, it experienced rapid growth, growing from an initial one-store operation to a chain of 9 stores by late 2001. Sales for Importados Gouveia ...

class11

... – Central bank makes a €1000 deposit into their Bank of Ireland Reserve Account at the central bank. – Bank of Ireland’s reserves goes up Bank of Ireland make more loans that means the people (borrowers) will have more money in their checking accounts (borrowed) M1 goes up MS goes up ...

... – Central bank makes a €1000 deposit into their Bank of Ireland Reserve Account at the central bank. – Bank of Ireland’s reserves goes up Bank of Ireland make more loans that means the people (borrowers) will have more money in their checking accounts (borrowed) M1 goes up MS goes up ...

Unit II Macroeconomics FRQ Release Practice

... (c) Using a correctly labeled graph of the foreign exchange market for the United States dollar, show how a decrease in the United States financial investment in Argentina affects each of the following. (i) The supply of United States dollars (ii) The value of the United States dollar relative to th ...

... (c) Using a correctly labeled graph of the foreign exchange market for the United States dollar, show how a decrease in the United States financial investment in Argentina affects each of the following. (i) The supply of United States dollars (ii) The value of the United States dollar relative to th ...

Int'l Monetary Crisis - University of Texas at Austin

... No, govt’s intervened to manipulate markets for their currencies Intervention ¢ subverted mechanism ¢ demonstrated failure to finesse ¢ political management ...

... No, govt’s intervened to manipulate markets for their currencies Intervention ¢ subverted mechanism ¢ demonstrated failure to finesse ¢ political management ...

International Monetary Crisis

... No, govt’s intervened to manipulate markets for their currencies Intervention ¢ subverted mechanism ¢ demonstrated failure to finesse ¢ political management ...

... No, govt’s intervened to manipulate markets for their currencies Intervention ¢ subverted mechanism ¢ demonstrated failure to finesse ¢ political management ...

Interest Rates and Monetary Policy

... operations to achieve the target • Demand curve for Federal funds • Supply curve for Federal funds ...

... operations to achieve the target • Demand curve for Federal funds • Supply curve for Federal funds ...