Ananda Development: 2Q earnings to be weak with stronger presales

... valuation for ANAN and joint ventures to take into account the company's backlog on hand, which has secured part of our revenue estimates for 2017-2019 period. Our DCF valuation is based on a 2% terminal growth rate and a discount rate of 9.5%9.7%. Risks to our PO are political headwinds, weaker-tha ...

... valuation for ANAN and joint ventures to take into account the company's backlog on hand, which has secured part of our revenue estimates for 2017-2019 period. Our DCF valuation is based on a 2% terminal growth rate and a discount rate of 9.5%9.7%. Risks to our PO are political headwinds, weaker-tha ...

SECURITIES TRADING POLICY

... market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (i.e. a volume that would represent a volume in excess of 10% of the total securities held by the seller prior to the sale, or a volume to be sold that woul ...

... market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (i.e. a volume that would represent a volume in excess of 10% of the total securities held by the seller prior to the sale, or a volume to be sold that woul ...

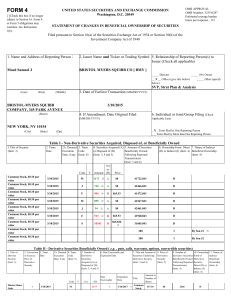

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to ...

... ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to ...

Chapter 2

... visiting or telephoning an OTC dealer or by using a computer-based electronic trading system linked to the OTC dealer. ...

... visiting or telephoning an OTC dealer or by using a computer-based electronic trading system linked to the OTC dealer. ...

Consultation Conclusions on the draft Securities and Futures

... on the application of the draft Notice. The other one was from the Hong Kong Securities Institute attaching the results of a survey to its members on the draft Notice. According to the Hong Kong Securities Institute, the two members who responded to the survey had no comment on the draft Notice. ...

... on the application of the draft Notice. The other one was from the Hong Kong Securities Institute attaching the results of a survey to its members on the draft Notice. According to the Hong Kong Securities Institute, the two members who responded to the survey had no comment on the draft Notice. ...

Creating a Financial Plan

... with the provincial securities commissions and as such our Advisors are entitled to sell mutual funds, stocks, bonds and other securities as permitted under our registration. They may also be able to provide other services or products to you through their own business. As a member of the Investment ...

... with the provincial securities commissions and as such our Advisors are entitled to sell mutual funds, stocks, bonds and other securities as permitted under our registration. They may also be able to provide other services or products to you through their own business. As a member of the Investment ...

Key Issues for Reporters

... Securities Involved in Repurchase and Securities Lending Arrangements • The U.S.-resident security lender should report the foreign security as if no repurchase agreement or security lending arrangement occurred (i.e. a US lender should include the lent security in the lender’s holdings of foreign s ...

... Securities Involved in Repurchase and Securities Lending Arrangements • The U.S.-resident security lender should report the foreign security as if no repurchase agreement or security lending arrangement occurred (i.e. a US lender should include the lent security in the lender’s holdings of foreign s ...

securities trading policy

... Directors and Executives may not engage in hedging arrangements, deal in derivatives or enter into other arrangements which vary economic risk related to the Company's Securities including, for example, dealing in warrants, equity swaps, put and call options, contracts for difference and other contr ...

... Directors and Executives may not engage in hedging arrangements, deal in derivatives or enter into other arrangements which vary economic risk related to the Company's Securities including, for example, dealing in warrants, equity swaps, put and call options, contracts for difference and other contr ...

securities trading policy

... Company securities and possibly the ability of the market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (i.e. a volume that would represent a volume in excess of 10% of the total securities held by the seller ...

... Company securities and possibly the ability of the market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (i.e. a volume that would represent a volume in excess of 10% of the total securities held by the seller ...

Mortgage crisis in the US, economic slowdown in Europe

... And finally, the subprime crisis is instructive for the supervisory authorities. National supervision on its own is insufficient in a global, liberal financial system. Furthermore, the question as to who – besides banks and securities firms – is to be supervised needs to be reviewed. This applies to ...

... And finally, the subprime crisis is instructive for the supervisory authorities. National supervision on its own is insufficient in a global, liberal financial system. Furthermore, the question as to who – besides banks and securities firms – is to be supervised needs to be reviewed. This applies to ...

Telefónica, SA

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

Invesco Core Plus Bond Fund investment philosophy and process

... issuer’s credit rating. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic ...

... issuer’s credit rating. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic ...

NEW STANDARD ENERGY LIMITED SECURITIES TRADING

... The prohibition does not apply to acquisitions of shares or options by employees made under employee share or option schemes, nor does it apply to the acquisition of shares as a result of the exercise of options under an employee option scheme. However, the prohibition does apply to the sale of shar ...

... The prohibition does not apply to acquisitions of shares or options by employees made under employee share or option schemes, nor does it apply to the acquisition of shares as a result of the exercise of options under an employee option scheme. However, the prohibition does apply to the sale of shar ...

All findings, interpretations, and conclusions of this presentation

... by the Papers • Moving from pay-as-you-go pensions to funded pensions ...

... by the Papers • Moving from pay-as-you-go pensions to funded pensions ...

... A U.S. federal agency established by the Commodity Futures Trading Commission Act of 1974. It ensures the open and efficient operation of the futures market. The CFTC protects investors from abusive trade practices, manipulation, and fraud. The CFTC ensures that the markets are liquid and that both ...

Treasury Terminology

... ‘Society for Worldwide Interbank Financial Telecommunication’ is a cooperative society created under Belgian law and having its Corporate Office at Brussels. The Society, which has been in operation since May 1977 and covers most of Western Europe and North America, operates a computer-guided commun ...

... ‘Society for Worldwide Interbank Financial Telecommunication’ is a cooperative society created under Belgian law and having its Corporate Office at Brussels. The Society, which has been in operation since May 1977 and covers most of Western Europe and North America, operates a computer-guided commun ...

Short-Term Income Fund - Investor Fact Sheet

... The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some form of government or private insurance, there is no assurance that private guarantors or insurers will meet their obligatio ...

... The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some form of government or private insurance, there is no assurance that private guarantors or insurers will meet their obligatio ...

12. Dealing in Tasmines`Securities

... Individuals who contravene the insider trading provisions of the Corporations Act are liable to prosecution or a civil penalty action by the Australian Securities and Investments Commission (ASIC). If you engage in insider trading, you may be sued by Tasmines or another party in a civil action for a ...

... Individuals who contravene the insider trading provisions of the Corporations Act are liable to prosecution or a civil penalty action by the Australian Securities and Investments Commission (ASIC). If you engage in insider trading, you may be sued by Tasmines or another party in a civil action for a ...

Mirae Asset Securities (USA) Inc.

... the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the n ...

... the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the n ...

Guidelines for Transfers of Registered Plans

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

investing

... Shares are traded like stocks on securities exchanges Shares are bought and sold through investment brokers, not through an investment company ...

... Shares are traded like stocks on securities exchanges Shares are bought and sold through investment brokers, not through an investment company ...

General Information

... On 31 December 2003, the amount of publicly traded shares at a face value constituted 499.8 million lats, compared to 495.5 million lats on 30 September 2003. In the reporting period, pursuant to decisions of the shareholders’ meetings, 5,159,962 ordinary voting shares of the JSC Latvijas Krājbanka ...

... On 31 December 2003, the amount of publicly traded shares at a face value constituted 499.8 million lats, compared to 495.5 million lats on 30 September 2003. In the reporting period, pursuant to decisions of the shareholders’ meetings, 5,159,962 ordinary voting shares of the JSC Latvijas Krājbanka ...

Petrosea 1st Quarter Newsletter

... This announcement is not an offer to purchase or sell, or a solicitation of an offer to purchase or sell, securities in the United States. The sec urities referred to herein have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United State ...

... This announcement is not an offer to purchase or sell, or a solicitation of an offer to purchase or sell, securities in the United States. The sec urities referred to herein have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United State ...

The Potential for Tax-Advantaged Income From Preferred Securities

... securities income is taxed at the respective qualified dividend income rate and marginal tax rate on a 50/50 blended basis. All other securities reflect full taxation at the respective marginal rates based on income. Risks of Investing in Preferred Securities Investing in any market exposes investor ...

... securities income is taxed at the respective qualified dividend income rate and marginal tax rate on a 50/50 blended basis. All other securities reflect full taxation at the respective marginal rates based on income. Risks of Investing in Preferred Securities Investing in any market exposes investor ...