Chapter 12 Investing in Stocks

... A stock split is an increase in the number of outstanding shares of a company’s stock. When a company increases its number of outstanding shares, it lowers the selling price in direct proportion. A stock split lowers the selling price of the stock, making the shares more affordable and encoura ...

... A stock split is an increase in the number of outstanding shares of a company’s stock. When a company increases its number of outstanding shares, it lowers the selling price in direct proportion. A stock split lowers the selling price of the stock, making the shares more affordable and encoura ...

synta pharmaceuticals corp. - corporate

... On October 30, 2015, the Board appointed Scott Morenstein as a director effective November 3, 2015. Mr. Morenstein will serve as a Class II director until the 2018 Annual Meeting of Stockholders and thereafter until his successor is duly elected and qualified. Mr. Morenstein has also been appointed ...

... On October 30, 2015, the Board appointed Scott Morenstein as a director effective November 3, 2015. Mr. Morenstein will serve as a Class II director until the 2018 Annual Meeting of Stockholders and thereafter until his successor is duly elected and qualified. Mr. Morenstein has also been appointed ...

Announcement: Asian Growth Properties Limited

... Stockbrokers, banks and others who deal in relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those clients are aware of the disclosure obligations attaching to associates and other persons under Rule 22 of the Takeovers Code and that those clients ...

... Stockbrokers, banks and others who deal in relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those clients are aware of the disclosure obligations attaching to associates and other persons under Rule 22 of the Takeovers Code and that those clients ...

Grupo Supervielle SA

... Ref: Purchase offer of our subsidiary Cordial Microfinanzas S.A.– RELEVANT MATTER To whom it may concern, I am glad to address this Commission in my capacity as Responsible for Market Relations in order to inform you that the Board of Directors of Grupo Supervielle S.A., together with our subsidiary ...

... Ref: Purchase offer of our subsidiary Cordial Microfinanzas S.A.– RELEVANT MATTER To whom it may concern, I am glad to address this Commission in my capacity as Responsible for Market Relations in order to inform you that the Board of Directors of Grupo Supervielle S.A., together with our subsidiary ...

As filed with the Securities and Exchange Commission

... 10(a)(3) of the Securities Act of 1933; (ii) To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the informati ...

... 10(a)(3) of the Securities Act of 1933; (ii) To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the informati ...

Bancroft - NYU School of Law

... o May not issue a public sales campaign prior to the filing of the registration statement. (ie publicity may have effect of conditioning market – this is an “offer”). o Example 1: Underwriter arranging mining public financing distributes brochure describing in “glowing generalities” the future possi ...

... o May not issue a public sales campaign prior to the filing of the registration statement. (ie publicity may have effect of conditioning market – this is an “offer”). o Example 1: Underwriter arranging mining public financing distributes brochure describing in “glowing generalities” the future possi ...

1. Application for quotation of added securities

... A copy of any trust deed for the new securities. ...

... A copy of any trust deed for the new securities. ...

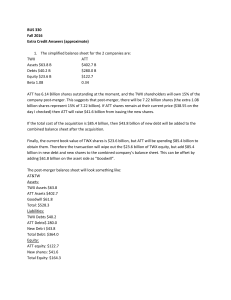

Bonus Assignment solution

... Each dollar of equity of the new company will absorb the risk from 653.4/289.4 = $2.26 of assets, so the resulting beta of the shares should be 2.26 * 0.26 = 0.59 3. If the combined company is able to absorb all the revenues from TWX and eliminate half of the selling, general, and administrative ex ...

... Each dollar of equity of the new company will absorb the risk from 653.4/289.4 = $2.26 of assets, so the resulting beta of the shares should be 2.26 * 0.26 = 0.59 3. If the combined company is able to absorb all the revenues from TWX and eliminate half of the selling, general, and administrative ex ...

brooks automation, inc. - corporate

... Option Exercise Price, as provided in this paragraph (b), that number of full shares of Common Stock reserved for the purpose of the Plan as his or her accumulated payroll deductions on the Offering Termination Date (including any amount carried forward pursuant to Article 8 hereof) will pay for at ...

... Option Exercise Price, as provided in this paragraph (b), that number of full shares of Common Stock reserved for the purpose of the Plan as his or her accumulated payroll deductions on the Offering Termination Date (including any amount carried forward pursuant to Article 8 hereof) will pay for at ...