Private Placements of Public Equity in China

... The investors of PEPs are mostly long-term institutional investor (Amihud and Mendelson 1986). Krishnamurthy et al. (2005) examine the relation between stock price performance and the identity of investors buying equity privately. They show that the long-term abnormal returns to the affiliated inves ...

... The investors of PEPs are mostly long-term institutional investor (Amihud and Mendelson 1986). Krishnamurthy et al. (2005) examine the relation between stock price performance and the identity of investors buying equity privately. They show that the long-term abnormal returns to the affiliated inves ...

Kellogg Direct - Morningstar Document Research

... Kellogg Direct is a direct stock purchase and dividend reinvestment plan that provides a convenient and economical method for new investors to make an initial investment in shares of Kellogg Company common stock and for existing investors to increase their holdings of our common stock. As a particip ...

... Kellogg Direct is a direct stock purchase and dividend reinvestment plan that provides a convenient and economical method for new investors to make an initial investment in shares of Kellogg Company common stock and for existing investors to increase their holdings of our common stock. As a particip ...

QLT Affirms Commitment to Return Capital to Shareholders QLT

... Securities Litigation Reform Act of 1995 and constitute "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking statements include, but are not limited to: statements concerning the Company's future plans, including the return of capital through a cas ...

... Securities Litigation Reform Act of 1995 and constitute "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking statements include, but are not limited to: statements concerning the Company's future plans, including the return of capital through a cas ...

Hybrid Securities: A Basic Look at Monthly Income Preferred

... stock with a comparable rating from Standard & Poor’s for both June and December 1996. In June 1996, MIPS offered yields approximately 0.50% higher than comparably rated corporate bonds. In December 1996, the yield spread between MIPS and corporate bonds widened to approximately 1.00%. MIPS offered ...

... stock with a comparable rating from Standard & Poor’s for both June and December 1996. In June 1996, MIPS offered yields approximately 0.50% higher than comparably rated corporate bonds. In December 1996, the yield spread between MIPS and corporate bonds widened to approximately 1.00%. MIPS offered ...

united states securities and exchange commission - corporate

... and with the timing in the formulas above adjusted accordingly. The Management Board can substitute a particular time of day or other measure of “closing sale price” or “bid and asked prices” if appropriate because of exchange or market procedures or can, in its sole discretion, use weighted averag ...

... and with the timing in the formulas above adjusted accordingly. The Management Board can substitute a particular time of day or other measure of “closing sale price” or “bid and asked prices” if appropriate because of exchange or market procedures or can, in its sole discretion, use weighted averag ...

Shelf Offer

... Requests (excluding requests submitted by classified investors that have engaged in prior agreements with the Company as stated in Section 3 of the Offering Report) that include a Unit price equal to the Uniform Unit Price will be accepted in part such that each requesting part will receive, from th ...

... Requests (excluding requests submitted by classified investors that have engaged in prior agreements with the Company as stated in Section 3 of the Offering Report) that include a Unit price equal to the Uniform Unit Price will be accepted in part such that each requesting part will receive, from th ...

DOC - ESW Group

... convertible promissory notes (“Notes”) in the aggregate principal amount of $1,400,000 to Black Family Partners LP, John J. Hannan, Orchard Investments, LLC and Richard Ressler (each individually a “Senior Secured Lender” and collectively the “Senior Secured Lenders”), pursuant to a note subscriptio ...

... convertible promissory notes (“Notes”) in the aggregate principal amount of $1,400,000 to Black Family Partners LP, John J. Hannan, Orchard Investments, LLC and Richard Ressler (each individually a “Senior Secured Lender” and collectively the “Senior Secured Lenders”), pursuant to a note subscriptio ...

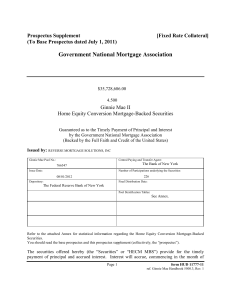

Government National Mortgage Association

... Any payments to be made to securityholders will be paid on the 20th day of the month, or if such day is not a business day, the first business day immediately thereafter. The Final Distribution Date for the Security is set forth on the cover of this prospectus supplement. Although the underlying HEC ...

... Any payments to be made to securityholders will be paid on the 20th day of the month, or if such day is not a business day, the first business day immediately thereafter. The Final Distribution Date for the Security is set forth on the cover of this prospectus supplement. Although the underlying HEC ...

Artemis - launch press release 6

... Melco Resorts Finance Announces Proposed Senior Notes Offering and Redemption of 5.00% Senior Notes due 2021 MACAU, Monday, May 15, 2017 - Melco Resorts Finance Limited, formerly known as MCE Finance Limited (“Melco Resorts Finance”), announces that it proposes to conduct an international offering o ...

... Melco Resorts Finance Announces Proposed Senior Notes Offering and Redemption of 5.00% Senior Notes due 2021 MACAU, Monday, May 15, 2017 - Melco Resorts Finance Limited, formerly known as MCE Finance Limited (“Melco Resorts Finance”), announces that it proposes to conduct an international offering o ...

ING Group Inaugural AT1 Roadshow (PDF 0,4 Mb)

... Except as otherwise indicated, all figures included in this document are presented on the basis of International Financial Reporting Standards (“IFRS”) as adopted by the European Union (“IFRS-EU”). For more information on how IFRS-EU differs from IFRS as issued by the International Accounting Standa ...

... Except as otherwise indicated, all figures included in this document are presented on the basis of International Financial Reporting Standards (“IFRS”) as adopted by the European Union (“IFRS-EU”). For more information on how IFRS-EU differs from IFRS as issued by the International Accounting Standa ...