Superperformance Stocks

... Growth is a word that has triggered off the purchase of billions of dollars' worth of stock by millions of Americans for many years. As far back as the 1920s the belief was widespread that the way to invest was to buy the stock of a growing company and to hold it. During the 1930s some investors pre ...

... Growth is a word that has triggered off the purchase of billions of dollars' worth of stock by millions of Americans for many years. As far back as the 1920s the belief was widespread that the way to invest was to buy the stock of a growing company and to hold it. During the 1930s some investors pre ...

Limit Orders and the Intraday Behavior of Market Liquidity

... expected gains from trading with liquidity traders exceeded the expected loss from trading with informed traders. However, his model does not endogenize the traders' choice between market and limit orders. Handa and Schwartz (1996) extend Glosten's analysis by examining the investors' rational choic ...

... expected gains from trading with liquidity traders exceeded the expected loss from trading with informed traders. However, his model does not endogenize the traders' choice between market and limit orders. Handa and Schwartz (1996) extend Glosten's analysis by examining the investors' rational choic ...

SP92: The Equivalence of Screen Based Continuous-Auction and Dealer Markets

... the stock, whereas a continuous-auction market has no formally specified intermediary. On the other hand auction markets may feature traders that perform the role of the dealer in that they participate in the market by submitting limit orders and provide liquidity. A dealer market licenses some trad ...

... the stock, whereas a continuous-auction market has no formally specified intermediary. On the other hand auction markets may feature traders that perform the role of the dealer in that they participate in the market by submitting limit orders and provide liquidity. A dealer market licenses some trad ...

SECURITIES AND EXCHANGE COMMISSION Washington, D. C.

... The Company cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Annual Report on Form 10-K (“Report”) or made by management of the Company involve risks and uncertainties and are subject to change based on v ...

... The Company cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Annual Report on Form 10-K (“Report”) or made by management of the Company involve risks and uncertainties and are subject to change based on v ...

Chapter 15: Raising Capital

... Individual venture capitalist - invest their own money Venture capital firms - specialize in pooling funds from various sources and investing them ...

... Individual venture capitalist - invest their own money Venture capital firms - specialize in pooling funds from various sources and investing them ...

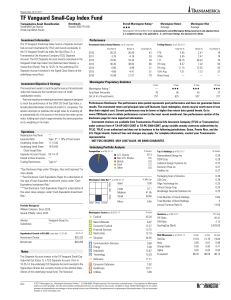

TF Vanguard Small-Cap Index Fund

... investment over the past 10 years (or since inception for investment choices lacking 10-year history). Data assumes reinvestment of dividends and capital gains. Results reflect past performance and do not guarantee future results. Adjusted Historical Returns and Extended Performance Rating: Mornings ...

... investment over the past 10 years (or since inception for investment choices lacking 10-year history). Data assumes reinvestment of dividends and capital gains. Results reflect past performance and do not guarantee future results. Adjusted Historical Returns and Extended Performance Rating: Mornings ...

Difference of Stock Return Distributions and the Cross

... Panel A in Table 1 presents the summary statistics of DD, beta, firm size, book-tomarket ratio, momentum, short-term reversal, illiquidity, idiosyncratic volatility, skewness, kurtosis, and maximum return. The mean of DD is 0.0251. The lowest-percentile (P1) ...

... Panel A in Table 1 presents the summary statistics of DD, beta, firm size, book-tomarket ratio, momentum, short-term reversal, illiquidity, idiosyncratic volatility, skewness, kurtosis, and maximum return. The mean of DD is 0.0251. The lowest-percentile (P1) ...

A Model of Intertemporal Asset Prices Under Asymmetric

... the reaction of uninformed investors. Informed investors take advantage of the errors made by less-informed investors to make profits. The uninformed investors trade based on information extracted from prices and dividends. We find that in some cases, the uninformed investors rationally adopt tradin ...

... the reaction of uninformed investors. Informed investors take advantage of the errors made by less-informed investors to make profits. The uninformed investors trade based on information extracted from prices and dividends. We find that in some cases, the uninformed investors rationally adopt tradin ...

In Millions

... 11-21 In consolidated statements, all the assets and liabilities of the parent and subsidiary are added together in the statements. But the shareholders of the parent do not own all of the combined assets and liabilities, so the interests of the minority owner’s must be subtracted. In contrast, wit ...

... 11-21 In consolidated statements, all the assets and liabilities of the parent and subsidiary are added together in the statements. But the shareholders of the parent do not own all of the combined assets and liabilities, so the interests of the minority owner’s must be subtracted. In contrast, wit ...

Multi-market Trading and Liquidity: Evidence from Cross

... As of 2013, there are over 500 non-U.S. firms listed on the New York Stock Exchange (NYSE). When a firm’s shares trade simultaneously on multiple exchanges, however, there may be more than one price for the same stock, i.e. identical financial assets trade at different prices in different markets. F ...

... As of 2013, there are over 500 non-U.S. firms listed on the New York Stock Exchange (NYSE). When a firm’s shares trade simultaneously on multiple exchanges, however, there may be more than one price for the same stock, i.e. identical financial assets trade at different prices in different markets. F ...

SCHEDULE 14A (RULE 14A-101) INFORMATION REQUIRED IN

... Inc., our advisor (Wells Capital), and Wells Management Company, Inc., our property manager (Wells Management), based upon recommendations from Wells Capital, and to set the terms and conditions of such options in accordance with the 2000 Employee Stock Option Plan. During the last fiscal year, the ...

... Inc., our advisor (Wells Capital), and Wells Management Company, Inc., our property manager (Wells Management), based upon recommendations from Wells Capital, and to set the terms and conditions of such options in accordance with the 2000 Employee Stock Option Plan. During the last fiscal year, the ...

Offering and Investor Fees - Handout

... Investor Administration Fees Administration fees are non-contingent fees generally used by the issuer to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, ...

... Investor Administration Fees Administration fees are non-contingent fees generally used by the issuer to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, ...

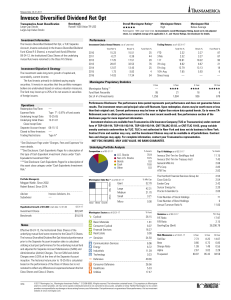

Invesco Diversified Dividend Ret Opt

... investment over the past 10 years (or since inception for investment choices lacking 10-year history). Data assumes reinvestment of dividends and capital gains. Results reflect past performance and do not guarantee future results. Adjusted Historical Returns and Extended Performance Rating: Mornings ...

... investment over the past 10 years (or since inception for investment choices lacking 10-year history). Data assumes reinvestment of dividends and capital gains. Results reflect past performance and do not guarantee future results. Adjusted Historical Returns and Extended Performance Rating: Mornings ...

Chapter 2

... markets and securities are true? • (a) Many common stocks are traded over-the-counter, although the largest corporations usually • have their shares traded at organized stock exchanges such as the New York Stock Exchange. • (b) A corporation acquires new funds only when its securities are first sold ...

... markets and securities are true? • (a) Many common stocks are traded over-the-counter, although the largest corporations usually • have their shares traded at organized stock exchanges such as the New York Stock Exchange. • (b) A corporation acquires new funds only when its securities are first sold ...

The Impact of Serial Correlation on Option Prices in a Non

... better at perfecting the impossible job of constructing perfect hedges than the largest provider of portfolio insurance was back in 1987. After all, market makers make markets on a full range of options for a host of stocks, so they cannot be expected to execute rebalancing trades with perfect, robo ...

... better at perfecting the impossible job of constructing perfect hedges than the largest provider of portfolio insurance was back in 1987. After all, market makers make markets on a full range of options for a host of stocks, so they cannot be expected to execute rebalancing trades with perfect, robo ...

press release

... committed to the intended recommended public offer for all issued and outstanding ordinary shares in the capital of Grontmij On 1 June 2015, Sweco AB (publ) (“Sweco”) and Grontmij N.V. (“Grontmij”) jointly announced the intended recommended public offer by Sweco for all issued and outstanding ordina ...

... committed to the intended recommended public offer for all issued and outstanding ordinary shares in the capital of Grontmij On 1 June 2015, Sweco AB (publ) (“Sweco”) and Grontmij N.V. (“Grontmij”) jointly announced the intended recommended public offer by Sweco for all issued and outstanding ordina ...

stock market overreaction and trading volume

... significant for all holding periods, from 1 to 24 months. Recently, a study by Griffin, Kelly and Nardari (2010) covered 56 stock markets with loser minus winner portfolios constructed based on 1-week holding and formation periods. Argentina, Zimbabwe, Canada and Pakistan recorded some of the highes ...

... significant for all holding periods, from 1 to 24 months. Recently, a study by Griffin, Kelly and Nardari (2010) covered 56 stock markets with loser minus winner portfolios constructed based on 1-week holding and formation periods. Argentina, Zimbabwe, Canada and Pakistan recorded some of the highes ...

contracts 9,899,780,283 traded

... firmly to that spot for the last three years. Predecessors of today’s Euronext group participated in the top five list all six years. Monep, which became part of Paris Bourse, was in fifth place in 1999; Paris Bourse was in third and fourth place in 2000 and 2001 respectively. Euronext appeared firs ...

... firmly to that spot for the last three years. Predecessors of today’s Euronext group participated in the top five list all six years. Monep, which became part of Paris Bourse, was in fifth place in 1999; Paris Bourse was in third and fourth place in 2000 and 2001 respectively. Euronext appeared firs ...

Statutory Regulation of Insider Trading in Impersonal Markets

... These goals are not all feasible, or even appropriate, in all circumstances. For example, the goal of rapid public disclosure of material information is irrelevant when the corporation has a legitimate business purpose for secrecy. Nor is compensation an appropriate regulatory goal under such circum ...

... These goals are not all feasible, or even appropriate, in all circumstances. For example, the goal of rapid public disclosure of material information is irrelevant when the corporation has a legitimate business purpose for secrecy. Nor is compensation an appropriate regulatory goal under such circum ...

Rules concerning Price Limits on Bids and Offers

... 2. The provisions in the preceding paragraph shall not apply to issues enumerated in each of the following items: (1) In cases of a newly listed issue out of stocks (excluding issues designated by the Exchange on a case by case basis; hereinafter referred to as the "directly listed issue"), the dire ...

... 2. The provisions in the preceding paragraph shall not apply to issues enumerated in each of the following items: (1) In cases of a newly listed issue out of stocks (excluding issues designated by the Exchange on a case by case basis; hereinafter referred to as the "directly listed issue"), the dire ...

FSB Securities Lending and Repos: Market Overview and Financial

... intended for investment in equity or bond markets into the money markets, creating additional demand for wholesale “money-like” assets (the first driver described above). In addition, market participants told the Workstream that some pension funds use repos to finance part of their bond holdings. Th ...

... intended for investment in equity or bond markets into the money markets, creating additional demand for wholesale “money-like” assets (the first driver described above). In addition, market participants told the Workstream that some pension funds use repos to finance part of their bond holdings. Th ...

INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... The Investment Policy Statement was adopted by the Board of Trustees of the Florida Chamber Foundation, Inc. (the "Board of Trustees") to direct the prudent investment of its investment portfolio (the "Foundation") in a manner consistent with the investment objectives stated herein. The Foundation, ...

... The Investment Policy Statement was adopted by the Board of Trustees of the Florida Chamber Foundation, Inc. (the "Board of Trustees") to direct the prudent investment of its investment portfolio (the "Foundation") in a manner consistent with the investment objectives stated herein. The Foundation, ...

Efficient market hypothesis: is the Croatian stock market as (in

... more persistent in emerging markets. Jagric et al. (2005) tested five Central European markets (Slovenia, Hungary, Poland, Slovakia and the Czech Republic) and Russia on the effect the transition process had on the market efficiency. They tested these markets with a technical trading system comprised ...

... more persistent in emerging markets. Jagric et al. (2005) tested five Central European markets (Slovenia, Hungary, Poland, Slovakia and the Czech Republic) and Russia on the effect the transition process had on the market efficiency. They tested these markets with a technical trading system comprised ...

Reporting Guidance for All Loan-Backed and Structured Finance

... financial assets. Asset-backed securitization is a financing technique in which financial assets, in many cases themselves less liquid, are pooled and converted into instruments that may be offered and sold more freely in the capital markets. In a basic securitization structure, an entity, often a f ...

... financial assets. Asset-backed securitization is a financing technique in which financial assets, in many cases themselves less liquid, are pooled and converted into instruments that may be offered and sold more freely in the capital markets. In a basic securitization structure, an entity, often a f ...

Towards a General Theory of the Stock Market

... EMH. Nevertheless, not all adherents of the EMH have been persuaded. For most of the above anomalies, explanations have been put forward which are compatible with the EMH. For example, large increases in stock prices can be explained by a big improvement in fundamentals or by a significant fall in t ...

... EMH. Nevertheless, not all adherents of the EMH have been persuaded. For most of the above anomalies, explanations have been put forward which are compatible with the EMH. For example, large increases in stock prices can be explained by a big improvement in fundamentals or by a significant fall in t ...